Winner’s Column: A tech firm, a goldie and a cannabis company dominate January’s Top 50

Pic: Stevica Mrdja / EyeEm / EyeEm via Getty Images

Following a 30 per cent gain in 2019, the S&P/ASX Emerging Companies index – which measures overall performance of the ASX microcap sector — moved another 3 per cent higher in January. Of the sub-$400m market cap companies on our list, 692 went up, 700 went down, and 196 stayed the same over the month.

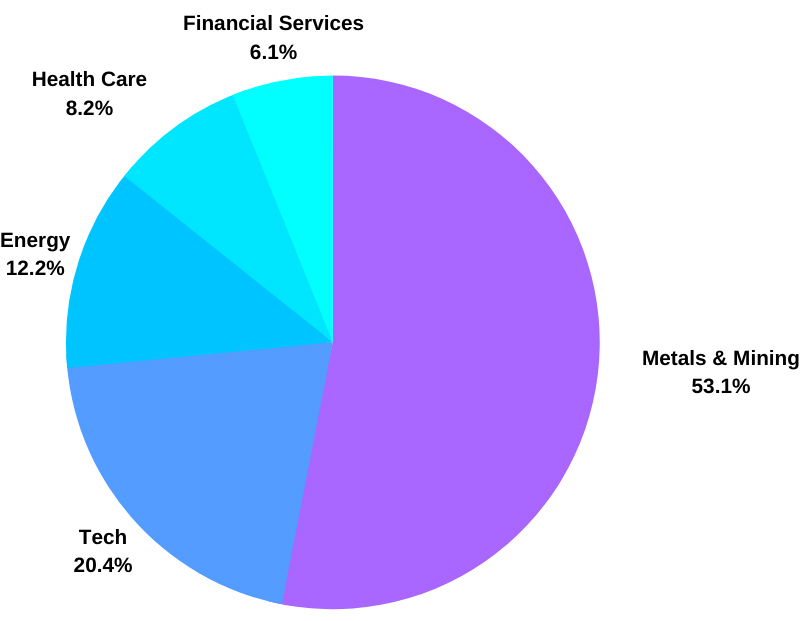

Mineral explorers dominated the winner’s column (not surprising, as they also make up the lion’s share of microcaps on the ASX):

Here’s the top 50 small caps for the month of January>>>

Scroll or swipe to reveal table. Click headings to sort. Best viewed on a laptop

| CODE | NAME | % RETURN | PRICE 01 JAN | PRICE 31 JAN | MARKET CAP $AU |

|---|---|---|---|---|---|

| NCL | NETCCENTRIC | 300 | 0.005 | 0.020 | 5.25M |

| AUT | AUTECO MINERALS | 167 | 0.009 | 0.024 | 24.06M |

| ADD | ADAVALE RESOURCES | 144 | 0.016 | 0.039 | 6.21M |

| FRX | FLEXIROAM | 137 | 0.016 | 0.038 | 11.60M |

| KZR | KALAMAZOO RESOURCES | 133 | 0.275 | 0.640 | 78.31M |

| CAN | CANN GROUP | 105 | 0.630 | 1.290 | 183.72M |

| EER | EAST ENERGY RESOURCES | 100 | 0.003 | 0.006 | 19.21M |

| CAD | CAENEUS MINERALS | 100 | 0.001 | 0.002 | 5.30M |

| PSZ | PS&C | 98 | 0.015 | 0.030 | 10.53M |

| GBZ | GBM RESOURCES | 94 | 0.036 | 0.070 | 13.50M |

| GBP | GLOBAL PETROLEUM | 90 | 0.020 | 0.038 | 7.70M |

| MHI | MERCHANT HOUSE INTL | 89 | 0.061 | 0.115 | 10.84M |

| EHX | EHR RESOURCES | 87 | 0.064 | 0.120 | 15.20M |

| CXX | CRADLE RESOURCES | 83 | 0.030 | 0.055 | 10.43M |

| SGO | STREAM GROUP | 82 | 0.011 | 0.020 | 4.39M |

| GTG | GENETIC TECHNOLOGIES | 82 | 0.005 | 0.010 | 40.63M |

| LKE | LAKE RESOURCES | 81 | 0.026 | 0.047 | 24.89M |

| TMK | TAMASKA OIL & GAS | 80 | 0.005 | 0.009 | 8.01M |

| TSL | TITANIUM SANDS | 78 | 0.018 | 0.032 | 24.92M |

| MAG | MAGMATIC RESOURCES | 77 | 0.220 | 0.390 | 60.64M |

| 8IH | 8I HOLDINGS | 75 | 0.080 | 0.140 | 50.73M |

| CFE | CAPE LAMBERT RESOURCES | 75 | 0.004 | 0.007 | 7.82M |

| MEU | MARMOTA | 72 | 0.025 | 0.043 | 36.31M |

| WZR | WISR | 68 | 0.157 | 0.265 | 247.73M |

| SKN | SKIN ELEMENTS | 67 | 0.009 | 0.015 | 2.94M |

| CEL | CHALLENGER EXPLORATION | 67 | 0.105 | 0.175 | 91.43M |

| DDD | 3D RESOURCES | 67 | 0.002 | 0.002 | 2.89M |

| RXH | REWARDLE HOLDINGS | 67 | 0.003 | 0.005 | 2.63M |

| PRO | PROPHECY INTERNATIONAL | 64 | 0.420 | 0.690 | 44.17M |

| OKU | OKLO RESOURCES | 64 | 0.140 | 0.230 | 94.94M |

| CSE | COPPER STRIKE | 62 | 0.037 | 0.060 | 6.41M |

| AXE | ARCHER MATERIALS | 61 | 0.155 | 0.250 | 53.10M |

| CZN | CORAZON MINING | 60 | 0.002 | 0.004 | 8.35M |

| STN | SATURN METALS | 57 | 0.300 | 0.470 | 34.40M |

| SND | SAUNDERS INTERNATIONAL | 56 | 0.320 | 0.500 | 52.36M |

| TGO | TRIMANTIUM GROWTHOPS | 56 | 0.090 | 0.140 | 19.45M |

| WJA | WAMEJA | 55 | 0.084 | 0.130 | 157.41M |

| SYA | SAYONA MINING | 55 | 0.011 | 0.017 | 36.41M |

| TNT | TESSERENT | 55 | 0.044 | 0.068 | 29.16M |

| GLN | GALAN LITHIUM | 54 | 0.130 | 0.200 | 32.33M |

| BIT | BIOTRON | 54 | 0.052 | 0.080 | 56.15M |

| 8VI | 8VIC HOLDINGS | 53 | 0.170 | 0.260 | 10.54M |

| RIE | RIEDEL RESOURCES | 50 | 0.010 | 0.015 | 6.27M |

| HHM | HAMPTON HILL MINING | 50 | 0.020 | 0.030 | 8.84M |

| EPM | ECLIPSE METALS | 50 | 0.004 | 0.006 | 7.41M |

| KTE | K2 ENERGY | 50 | 0.004 | 0.006 | 1.80M |

| GLV | GLOBAL OIL & GAS | 50 | 0.001 | 0.002 | 4.69M |

| AOA | AUSMON RESOURCES | 50 | 0.002 | 0.003 | 1.90M |

| ROG | RED SKY ENERGY | 50 | 0.002 | 0.003 | 4.88M |

| LSA | LACHLAN STAR | 50 | 0.004 | 0.006 | 4.52M |

Netccentric (ASX:NCL) +300%

Market Cap: ~$5m

Shares in Singapore-based ‘bottom of the sock drawer’ minnow Netccentric (ASX:NCL) rose strongly after Ernst & Young’s Technology Entrepreneur of the Year Malaysia 2012 Ganesh Kumar Bangah acquired an 84 per cent interest in the company.

Ganesh founded his first internet business at 20 years old which then, through a series of acquisitions, became South East Asia’s first NASDAQ-listed internet firm in 2014.

He’s done other stuff as well. Overall, it’s a pretty impressive resume which the Netccentric board says, “will add value to the company”.

Auteco Minerals (ASX:AUT) +167%

Market Cap: ~$24m

Vanadium-titanium explorer Auteco caught a rocket after buying a historic gold project, something every small cap explorer seems to be doing at the moment.

The project in question is Pickle Crow, one of Canada’s highest-grade historical gold mines which produced 1.5 million ounces of gold at a grade of 16g/t until 1966.

It remains underexplored, Auteco says, with little modern exploration since it closed.

Adavale Resources (ASX:ADD) +144%

Market Cap: ~$6m

Former uranium play/shell company Adavale submitted an application for ground neighbouring the government owned Kabanga project in Tanzania — one of the largest undeveloped nickel sulphide projects in the world.

In a show of considerable ambition, Adavale also said that it was assessing whether to tender for the big prize – Kabanga – itself.

Major miners Glencore and Barrick previously spent hundreds of millions on exploration and predevelopment at Kabanga. The project was delayed due to low nickel prices. Then the Tanzanian government decided to change the rules and take it back, because that’s definitely the right way to attract foreign investment.

Kalamazoo Resources (ASX:KZR) +133%

Market Cap: ~$80m

Kalamazoo Resources has a couple of new cornerstone shareholders — Canadian billionaire investor Eric Sprott and $US460m ($681.5m) market cap goldie Novo Resources.

The $8m investment from Sprott and Novo came after Kalamazoo reported really high gold grades early in maiden drilling at its Castlemaine gold project, near the world class Fosterville mine in Victoria’s goldfields.

“High-grade epizonal mineralisation forms at shallow depths and is usually eroded away during the mountain-building processes associated with the formation of such deposits,” Novo’s president and chairman Dr Quinton Hennigh says.

“It is extremely rare to find these systems preserved.

“Kalamazoo’s recent results display many of the right geologic indicators of this special type of high-grade deposit, remarkable given these recent results are at such an early stage.”

Cann Group (ASX:CAN) +105%

Market Cap: ~$180m

In early January, Cann Group said its manufacturer had started making cannabis resin from the company’s plants, and it should be ready for sale by March.

IDT Australia (ASX:IDT), a $33m pharmaceuticals manufacturer based in eastern Melbourne, had been posting videos on LinkedIn of its cannabis operations, which led to a 37 per cent spike in the price of Cann shares before it went into a trading halt.

This was a big step towards commercialisation, Cann’s Peter Crock says.

“This facilitates the manufacture of finished product formulations and puts us a step closer to launching our own locally sourced and produced range of medicinal cannabis treatments to satisfy both domestic demand and to help develop valuable export pathways.”

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.