Indiana Resources is punching back over Tanzanian government’s ‘inappropriate seizure’ of Ntaka Hill

Mining

Mining

Once considered investment-friendly, the east-African nation of Tanzania stunned ASX resource plays in July 2017 with sweeping changes to its Mining Act.

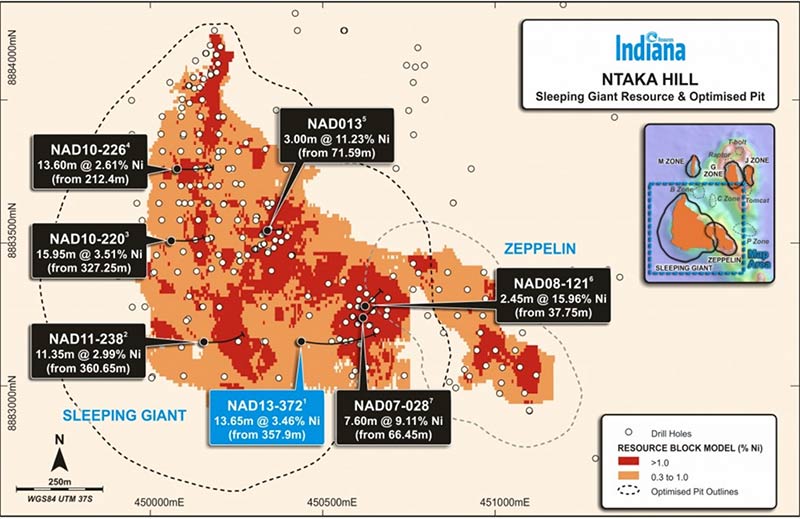

As part of these changes, minnow Indiana Resources (ASX:IDA) had the retention licence for its advanced Ntaka Hill nickel sulphide project – a ‘holding title’ that gives a company more time to develop the resource and secure financing – unilaterally revoked.

That means the project was taken back by the Tanzanian government.

Indiana has been progressing discussions to get it back ever since, but last week — without warning — the government advertised an open tender/sales process for 10 of the former retention licenses, including Ntaka Hill.

Indiana now intends to pursue a claim to arbitration and “all feasible legal avenues to protect the rights of shareholders”.

We had a quick chat with Indiana chair Bronwyn Barnes who says this is not an approach by a government that encourages foreign investment “and is a clear signal that funds invested into Tanzania are at risk of sudden and inappropriate seizure”.

“In 2017, the Tanzanian government changed the Mining Code,” Barnes says.

“That also meant ownership of these retention licenses — which included Indiana’s advanced Ntaka Hill project — reverted to the state.

“Since then, we have progressed discussions, seeking to justify that we had met all the criteria for a retention license.

“We paid our taxes, had behaved well, and complied with all regulatory requirements.

“We thought that we were progressing toward a resolution.

“But in December 2019, the government advertised all 10 former retention licenses in a tender process on their website.”

“No, that was never an argument.

“We’ve complied with the conditions of the license at all times. In fact, it was only two months before the cancellation of the retention license that we had completed a desktop scoping study on a smaller high-grade, early stage development.

“So, we were absolutely actively working that project.”

“I know there were 10 licenses that were current at the time the code was changed.

“Between Indiana, Canadian explorers Winshear Gold Corp (TSX-V:WINS) and Montero Mining (TSX.V:MON), and [major miner] Glencore you have 7 licenses accounted for. I’m not sure who holds the other three.

“Winshear held four of those retention licenses. They served their Notice of Intent to the government on Friday of last week.

“Montero Mining has rare earths project, but I don’t know what they are doing.

“Glencore held the Kabanga nickel project [in 50-50 joint venture with Barrick Gold]; I’m not sure what their plans are either.”

“This was the flagship asset of the company, but when the government changed the Mining Code and subsequently advised that ownership was reverting back to the state, we made the decision to find another asset that we could continue to work.

“That’s why we acquired the ground in Mali. We think they are an interesting group of standalone projects, but Ntaka Hill is a substantial asset.

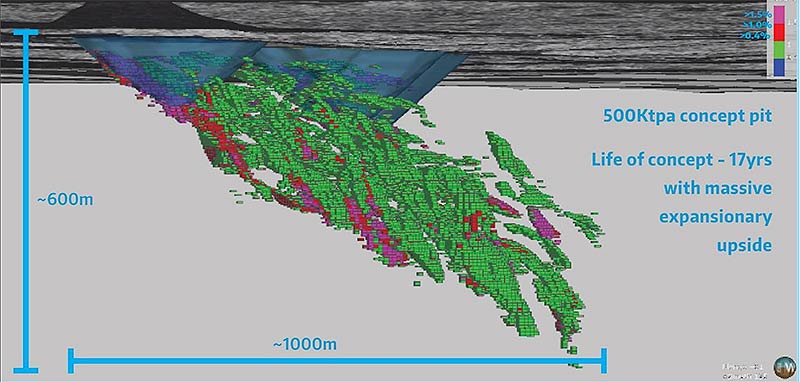

“We have already spent $US60m ($87m) on an asset that was at development stage, with multiple scoping studies and feasibility studies clearly outlining a NPV value for the project.

“I am not walking away from the value and investment that shareholders have sunk historically into the Ntaka Hill project.”