What the ETF? Falling markets? Last month new money pumped the value of Aussie ETF assets to a huge record high

Pic: Getty Images

- Australia’s ETF industry has set a record high ending February with $139.7 billion in funds under management

- Not withstanding falling sharemarkets ASX ETF trading value was 28% higher in February than January

- February saw considerable interest in broad market Australian equities ETFs followed by fixed income

A little ray of sunshine among the clouds which is global share markets at present with investors continuing to allocate to ETFs with net inflows causing the Aussie industry to once again set a new all-time high in funds under management (FuM).

According to the latest BetaShares monthly Australian ETF industry report, FUM ended February at $139.7 billion with growth positive, albeit slow, at 0.9% month-on-month, for a total monthly market cap increase of $1.3B.

Unlike January, in February, the majority of the industry’s growth came from net flows (net new money) which contributed ~70% of the monthly growth with total net flows to $900 million.

The Aussie share market had its best start to a year ever with the S&P ASX 200 rising 6.2% in January. But the rally was not to last with the benchmark dropping 2.5% in February, reducing YTD gains to 3.6%.

ASX ETF trading value increased significantly in February and was 28% higher than January – for total value of $9 billion.

Over the past 12 months the industry has grown in size, but at a slower rate low to previous years given market declines, with an increase of 7.4% year on year or $9.7B.

Four new products launched

In February four new products were launched in February including three covered call ETFs from Global X and a new Global

Transition Active ETF from Platinum.

The launched ETFS include:

- Global X S&P/ASX 200 Covered Call ETF (ASX:AYLD)

- Global X Nasdaq 100 Covered Call ETF (ASX:QYLD)

- Global X S&P 500 Covered Call ETF (ASX:UYLD)

- Platinum Global Transition Fund (Quoted Managed Hedge Fund) (ASX:PGTX)

There are now 325 Exchange Traded Products trading on the ASX.

Broad market Aussie ETFs in favour

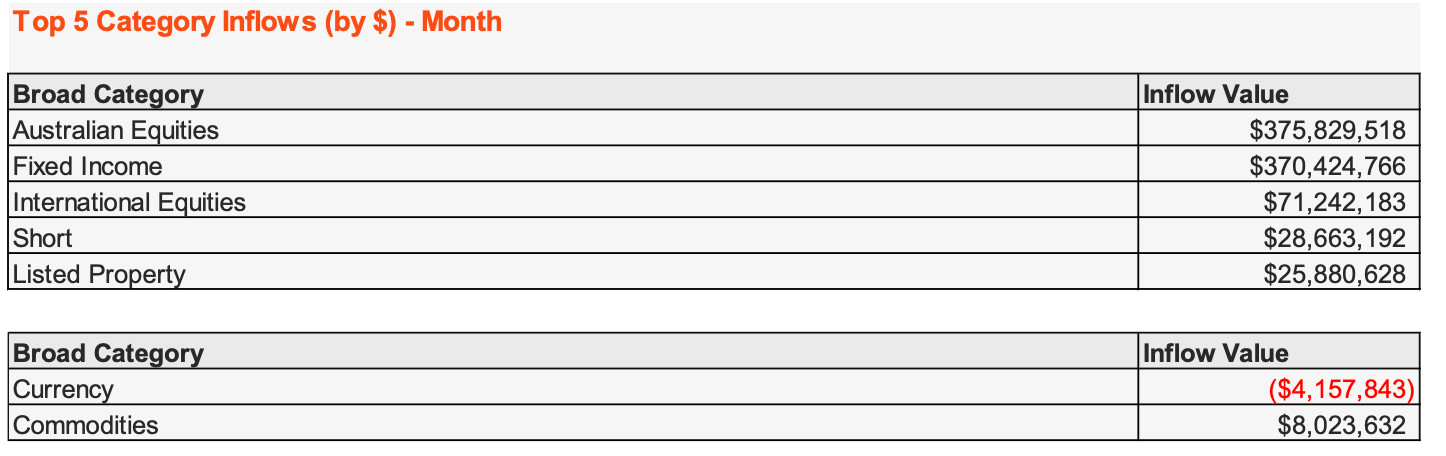

February saw considerable interest in broad market Australian equities ETFs with $375m inflows. The BetaShares report said investors seemingly took the view that the ‘lucky country’ remains in a better position economically than other developed global markets.

Fixed income exposures also continued to remain popular receiving $370m of net flows.

The report said it was notable that although inflows remain relatively muted compared to previous years, as yet there are not any major outflows across the industry.

“The exception to this has been Active ETFs, where ~$300m of outflows have been recorded to date this year,” the report said.

Top February ETF performers

As both global and Australian sharemarkets declined, the US dollar rallied, with the BetaShares Strong US Dollar Fund (ASX:YANK) topping the performance tables, with ~11% return for the month.

Carbon credits exposures also performed strongly rising ~9% for the month.

VAS has rare month of outflows

Topping inflows for February was iShares Core S&P/ASX 200 ETF (ASX:IOZ). The Vanguard Australian Shares Index ETF (ASX:VAS) had a rare month of outflows while the bleeding also continues at Magellan.

BetaShares chief commercial officer Ilan Israelstam said that investors are continuing to allocate to ETFs in their portfolio during times of market volatility is a positive sign.

“The new record for the ETF industry came despite a sell off on markets, highlighting that our investors continue to take a long-term view on their portfolio,” he said.

“For the month of February, Aussie equities returned to top place on the leaderboard with strong interest in exposures like our Australia 200 ETF (A200).”

BetaShares dropped the management fee on its A200 ETF from 0.07% to 0.04% per annum while iShares dropped the price of ishares Core S&P IOZ (ASX:IOZ) from 0.09% to 0.05% in February.

“The strong start to 2023 for the ETF industry demonstrates the growing adoption of the convenient and cost effective investment vehicle in investor portfolios,” Israelstam said.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.