Weekly Small Cap and IPO Wrap: Local markets thriving, Japanese Yen dying, AQC flying

News

News

Australian markets are ahead this week.

The ASX Emerging Companies (XEC) index climbed circa 1.5%, while the benchmark gained about 0.6% since the Monday open.

The Utilities Sector (XUJ) flies largely under the radar, but after providing the main drag this week (down 3.6%), it’s been worth a few minutes of my life to see that the home of AGL (ASX:AGL) et al is up an impressive 23% year-to-date, eclipsed by only the trauma-causing behaviour of the black sheep Energy Sector (XEJ) which is up 44% this calendar year and down 0.6% this week.

I know I speak for every Australian when I say ‘gosh, weren’t we thrilled this week with the packed schedule of market moving economic data and events’.

We had the RBA Board meet, where as foretold, the little guy got royally screwed.

Again.

The official cash rate (OCR) was hoisted once more unto the breach, up by 50 basis points to 2.35%.

Doing the math (me, I’m doing the math) reveals the RBA has needed just 16 weeks to heap some 225 basis points onto the economy and indirectly via your salivating financial institutions onto you and your family.

By my calculations, whacking on a further 0.50% to a 30 year loan of $500,000, (at a previous ballpark interest rate of 4.50%) your monthly repayments will rise by an extra $151.

The OCR is 160bps above its pre-COVID level. The unflappable Doctor of Doom, RBA Governor Philip Lowe, delivered a cracker of a speech on Thursday powerfully intimating that this rapid pace of tightening may at some stage, I kid you not, slow. It’s possible.

That was Thursday arvo and markets, lonely and dispirited, jumped on the inferences and slight concessions of philology.

Meanwhile, at the ABS, the country’s current account surplus widened happily on the back of those insanely high commodity prices. The peak looks to have peaked, if I can put it that way (I can’t) as the trade balance almost halved (to $8.7 billion) in July alone, as the insane value of coal, energy and resources (like iron ore) began to un-peak (that’s a word).

The latest (Q2 22) national accounts described an Australia growing by 0.9% over the three months to June.

Harry Ottley at the Commonwealth Bank says it was our insatiable house eating (or household consumption) and overseas fish trap sales (or net exports) which drove the growth.

“The headline result indicated that the economy had significant momentum when the RBA commenced its tightening cycle,” Mr Ottley said.

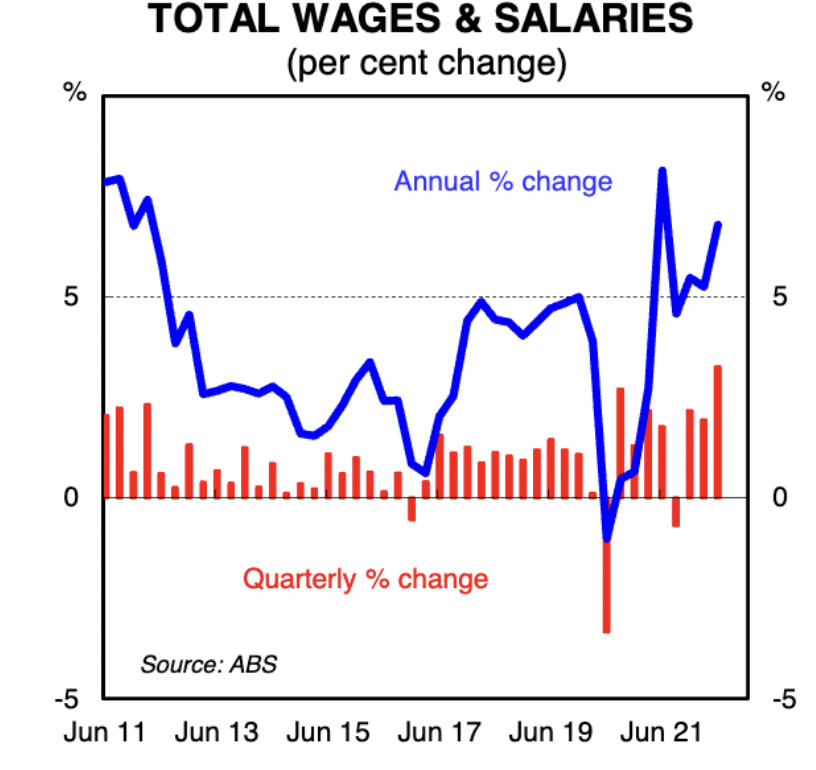

Total wages and salaries increased by 3.3 % in the quarter to be 6.8 % higher over the year.

This was the strongest lift since Q2 2008 when everything was great because China still liked us and it was the height of the mining boom.

CBA says the significant large lift “reflects both changes in hours worked (more people in jobs), as well as changes in the rate of pay and bonuses.

The ABS reports company profits also rose by 8.6%/qtr, after adjusting for inventories.

The rest of the world might be weighed down by the rising cost of things, but not our mates in Japan, and not their mates at the Bank of Japan.

They’re more transfixed by the currency that all too often can’t (that’d be the Yen), which has already made 2022 a standout shocker amongst a tight 30 or so years of absolute Yenish shockers.

XM’s CEO Peter McGuire, not one for mincing words:

The Japanese yen has resumed its terrifying downtrend, crushed under the boot of a central bank that refuses to follow other economies in raising interest rates. With inflation dynamics still subdued, traders are betting the Bank of Japan won’t lift a finger to stop the yen’s bleeding when it meets in two weeks and that the government won’t dare intervene in the FX market.

The currency fell a lot this week after economic indicators provided more encouragement for an already over-confident USD which tore a bit of USD shaped hole through our neck of the woods, hurting Asian currencies, but none more so than the Yen.

Japan’s Minister for Finance Shunichi Suzuki told reporters the government will intervene when the time requires.

“My impression is that currency market volatility has become somewhat high recently,” Suzuki said in thrilling understatement of the Yen’s fabulous slide to what was (even on Friday) just a 24-year low against the USD.

It has been an excruciating year for the Japanese currency, which has lost 25% of its value against the US dollar, tormented by one of the greatest episodes of monetary policy divergence in modern history. Central banks across the world are raising interest rates with incredible speed to fight sky-high inflation, but the Bank of Japan refuses to participate.

That’s because the BoJ is convinced there isn’t any inflation to fight, it’s just all a bit of a shock.

Excluding food and energy, inflation in Japan is running at only 1.2%, far from the danger zone. Most importantly, wage growth and inflation expectations remain suppressed, so it doesn’t seem like inflation is becoming entrenched. Ergo, the BoJ is convinced this is a global supply shock that will dissipate soon.

With interest rates going nuts everywhere except for Japan, Pete says “rate differentials have widened, devastating the yen.”

Capital is flowing out of Japan, looking for stronger offshore returns.

This has turned the yen into a pure play for global interest rates, trading in lockstep with bets around what the Fed will do next, instead of behaving like a safe haven asset.

At least Tokyo is trying to reopen to a post-COVID world, providing mercenary Australians the chance to snap up some wildly cheaper Japanese holidays.

Over this side of things, we’re having our own ‘Sakura’ in Australia

But if you save now, Sakura – or the blooming of the cherry blossom trees – kicks off in Japan between March and May and only goes a week or two.

For the Japanese sakura symbolises human life, transience and nobleness. Around the country people like to celebrate and cherish the cherry blossoms trees during the limited flowering period and many people hold ‘flower watching’ parties known as ‘hanami.’

Next week will be a lot more zen. We’ll be getting a read on consumer and business confidence as well as an update on the labour market.

The Westpac /MI Consumer confidence index is at really, really ordinary levels. Levels one associates with full-on economic dramas. There’s some tea-leaving on US inflation via the August CPI release. CBA forecasts a dip in the headline due to a large decrease in gasoline prices, but another sizable rise when excluding nosh and energy.

In China, there’s a few indicators, but they don’t really matter until they start looking at activity during these latest zero-COVID lockdowns.

Perhaps most importantly, the Bank of England (BoE) meet with CBA expecting the BoE to raise the key interest rate by 50 bas is points to 2.25%.

In some reassuring news, the UK is getting absolutely smashed by inflation much worse than ours.

UK GDP is also in the post, a fabulously weak number looming as the EU’s energy crisis “continues to pour fuel on inflation” amid rapid monetary policy tightening.

It must be just a terrific relief to British citizens that Brexit.

And just finally, it’s forecast that well over 50% of the divvies for the ASX blue cap companies will be paid out in the final fortnight of this month. CBA says as much as $8 billion is being shared out this earnings season.

Terra Uranium (ASX:T92) arrived at club ASX early on Thursday morning, putting on quite the defiant launch party for the ages.

With an IPO targeting $7.5m at $0.20, T92 holds some 775sqkm of the Athabasca Basin in Canada, which three projects – the HawkRock, Parker Lake and Pasfield Lake – containing what the blurb calls the world’s largest and highest-grade uranium deposits.

“We are targeting greenfield discovery and brownfield developments close to existing production infrastructure to play a role in a clean carbon free economy,” executive chairman Andrew Vigar said

Terra’s plan is to explore and develop the projects as well as seek out further complementary mineral exploration and resource opportunities.

T92 opened some 60% higher from the moment it entered the club.

Here are the best performing ASX small cap stocks for September 5 – September 9:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Company | Price | % Week | Market Cap |

|---|---|---|---|---|

| AJL | AJ Lucas Group | 0.18 | 80% | $227,294,461 |

| MCM | Mc Mining Ltd | 0.5 | 67% | $98,827,435 |

| TYX | Tyranna Res Ltd | 0.045 | 50% | $117,793,033 |

| IVX | Invion Ltd | 0.014 | 40% | $76,998,164 |

| ROG | Red Sky Energy. | 0.007 | 40% | $37,115,590 |

| HIO | Hawsons Iron Ltd | 0.51 | 36% | $366,821,210 |

| IR1 | Irismetals | 1.56 | 36% | $85,218,000 |

| CAU | Cronos Australia | 0.58 | 35% | $307,675,740 |

| TON | Triton Min Ltd | 0.035 | 35% | $42,798,662 |

| DNK | Danakali Limited | 0.295 | 34% | $97,608,602 |

| PNN | Power Minerals Ltd | 0.6625 | 34% | $38,171,956 |

| DUB | Dubber Corp Ltd | 0.74 | 32% | $216,649,928 |

| FBR | FBR Ltd | 0.055 | 31% | $138,910,262 |

| ABX | ABX Group Limited | 0.16 | 31% | $38,010,438 |

| FMS | Flinders Mines Ltd | 0.65 | 30% | $110,595,818 |

| VRC | Volt Resources Ltd | 0.026 | 30% | $76,375,267 |

| WR1 | Winsome Resources | 0.335 | 29% | $43,236,478 |

| CZR | CZR Resources Ltd | 0.018 | 29% | $59,267,496 |

| HHR | Hartshead Resources | 0.045 | 29% | $93,975,013 |

| IHL | Incannex Healthcare | 0.295 | 28% | $411,370,298 |

| AMA | AMA Group Limited | 0.215 | 26% | $225,344,746 |

| TYR | Tyro Payments | 1.365 | 26% | $652,592,809 |

| HE8 | Helios Energy Ltd | 0.089 | 25% | $213,532,054 |

| NXL | Nuix Limited | 0.83 | 25% | $218,947,208 |

| MYR | Myer Holdings Ltd | 0.635 | 25% | $476,341,713 |

| BKT | Black Rock Mining | 0.18 | 24% | $141,711,279 |

| CTT | Cettire | 0.855 | 24% | $312,615,340 |

| ACB | A-Cap Energy Ltd | 0.11 | 24% | $110,919,158 |

| OKR | Okapi Resources | 0.315 | 24% | $39,422,266 |

| KKO | Kinetiko Energy Ltd | 0.09 | 23% | $59,856,472 |

| QGL | Quantum Graphite | 0.4 | 23% | $119,392,650 |

| CKA | Cokal Ltd | 0.24 | 23% | $230,165,000 |

| ACR | Acrux Limited | 0.0775 | 23% | $19,409,595 |

| 92E | 92Energy | 0.7 | 23% | $50,764,792 |

| GL1 | Globallith | 2.16 | 23% | $309,461,599 |

| FEG | Far East Gold | 0.545 | 22% | $58,577,861 |

| HTG | Harvest Tech Grp Ltd | 0.094 | 22% | $56,536,948 |

| AGY | Argosy Minerals Ltd | 0.475 | 22% | $628,292,724 |

| ASN | Anson Resources Ltd | 0.395 | 22% | $431,789,862 |

| PPK | PPK Group Limited | 1.82 | 21% | $157,595,602 |

| OPY | Openpay Group | 0.23 | 21% | $51,020,260 |

| EM2 | Eagle Mountain | 0.26 | 21% | $59,018,314 |

| VRS | Veris Ltd | 0.087 | 21% | $40,852,458 |

| DEG | De Grey Mining | 1.105 | 21% | $1,368,347,772 |

| IVR | Investigator Res Ltd | 0.048 | 20% | $61,286,428 |

| ESS | Essential Metals Ltd | 0.52 | 20% | $126,216,042 |

| CXM | Centrex Limited | 0.185 | 19% | $109,881,626 |

| ARU | Arafura Resource Ltd | 0.37 | 19% | $620,845,763 |

| HCH | Hot Chili Ltd | 1.06 | 18% | $111,084,042 |

| MP1 | Megaport Limited | 8.27 | 18% | $1,317,515,408 |

Australian Pacific Coal (ASX:AQC) is up 600% over the past month.

This what Reuben is saying:

Former coal baron Nathan Tinkler via his company PPC has now upped his bid for control of AQC and its mothballed Dartbrook operation to $1 per share.

That dwarfs the 36c per share offered by M Resources — – largest shareholder in Bowen Coal (ASX:BCB) and significant shareholder in Stanmore Resources (ASX:SMR) – which also wants to acquire the formerly producing operation.

For Tinkler’s deal to go though, AQC’s largest shareholder Trepang would need to agree to convert the debt it is owed into a direct 40% interest in Dartbrook “on terms acceptable to PPC”.

Should such an agreement not be forthcoming from Trepang, then PPC would repay all outstanding debts to the Trepang parties, although there is no detail provided as to how this would occur, AQC says.

“Given the non-binding proposal needs the support of Trepang to proceed, either by Trepang agreeing to convert the Trepang Debt or by Trepang agreeing to the debt being repaid by PPC (with the consequence that Trepang would need to agree to a forbearance until their debt is repaid by PPC), AQC requested urgent advice from Trepang as to whether Trepang is willing to support the NBIO and satisfy the pre-condition,” the company says.

“Trepang has advised the company that they are seeking advice on the proposal. A further response is awaited from Trepang.”

This is what I say:

Here are the least performing ASX small cap stocks for September 5 – September 9:

Swipe or scroll to reveal full table. Click headings to sort: