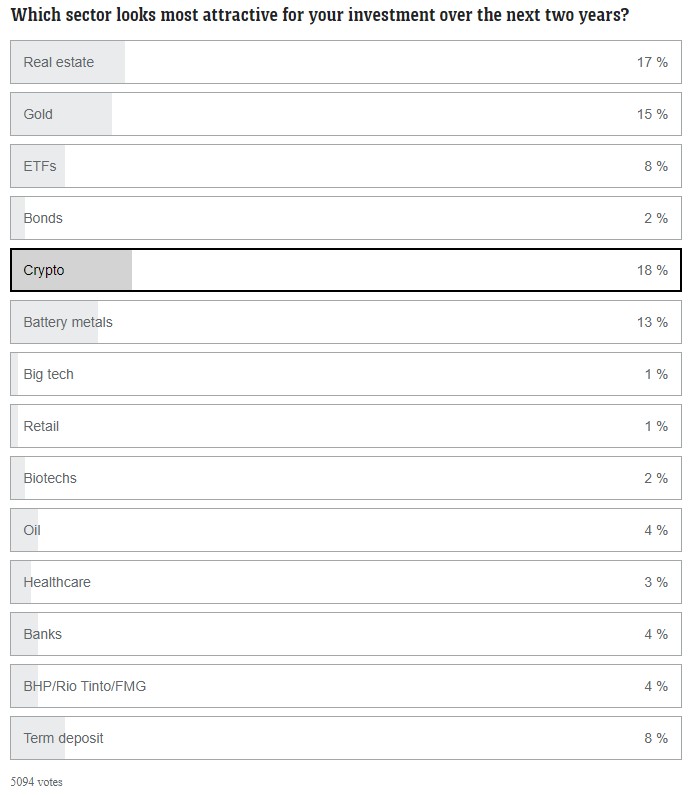

We asked 5,000 Aussies where they’ll stash cash over the next 2 years and it got weird

Via Getty

And now for some real time All Australian, unfiltered in-house, fair dinkum, quasi-shocking financial decision making in its rawest graphic form. (Here at Stockhead we call it a table – not quite a chart, better than a Chez Lounge.)

To get things rolling, I asked the nearest quality craft apple cider creator, Stockhead Editor Peter Farquhar, what he took from the broad division of interests. I also leant heavily on my comrades, particularly Eddy S and Josh C.

But first, Peter:

“…It is excellent cider. We’ll put that as an option in the next one.”

“Honestly mate, that’s a shock result.

“I’m shocked. Not appalled-shocked, just shocked. There’s a difference.

“So, 5000 plus votes is a good sample and the split says a fair bit about where we’re at as a nation of spendthrifts.”

(Ed: My recollection was “nation of bad gamblers”)

REAL ESTATE: 17%

Real Estate. Up there as is to be expected – there’s a large chunk of the demographic that was old enough to cut its teeth on the benefits our parents’ generation enjoyed from property. That kind of validates the sample, it clearly it wasn’t just millennials rolling the dice on crypto and future metals.

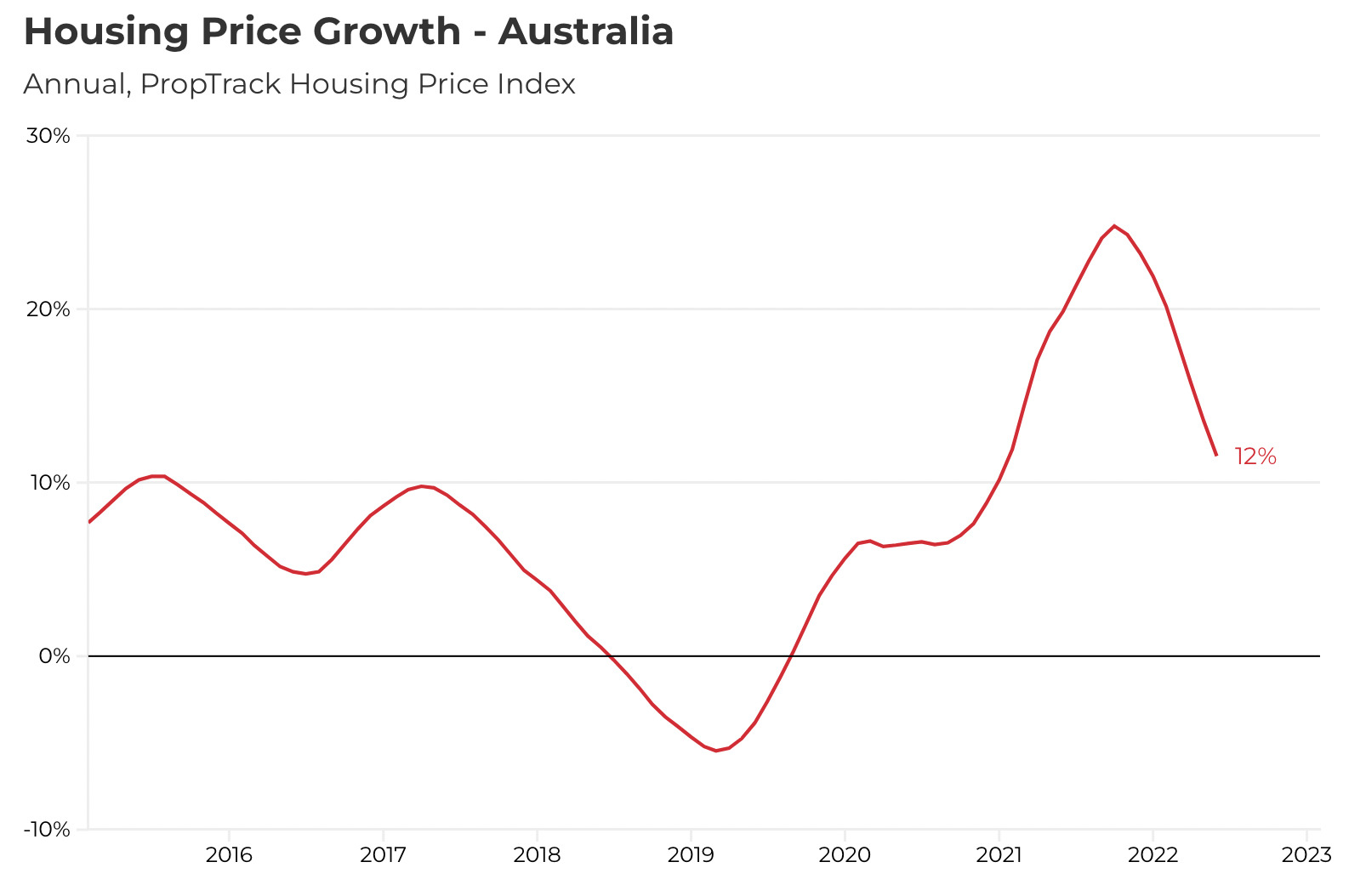

Interest rates continue to rise and Australian house values are falling. The value of the average Aussie home is down 0.25% since May, which in context is a shirtload indeed.

Suddenly, more than half of the capital cities have seen price declines in the past month, Sydney and Melbourne got out in front of those falls and they’re now down 0.4% for Sydney, and 0.61% in the other one as per the very latest numbers out of the PropTrack Home Price Index.

PropTrack’s senior economist Elanor Creagh says while June’s new listing numbers came in at more than decade highs (in fact more homes have come onto the market so far in 2022 than at any time for the same period since 2015) housing stock just isn’t moving as quickly any more, particularly in Sydney and Melbourne.

Higher volumes plus lower turnover means more houses on the market for longer. And that, is a buyer’s opportunity.

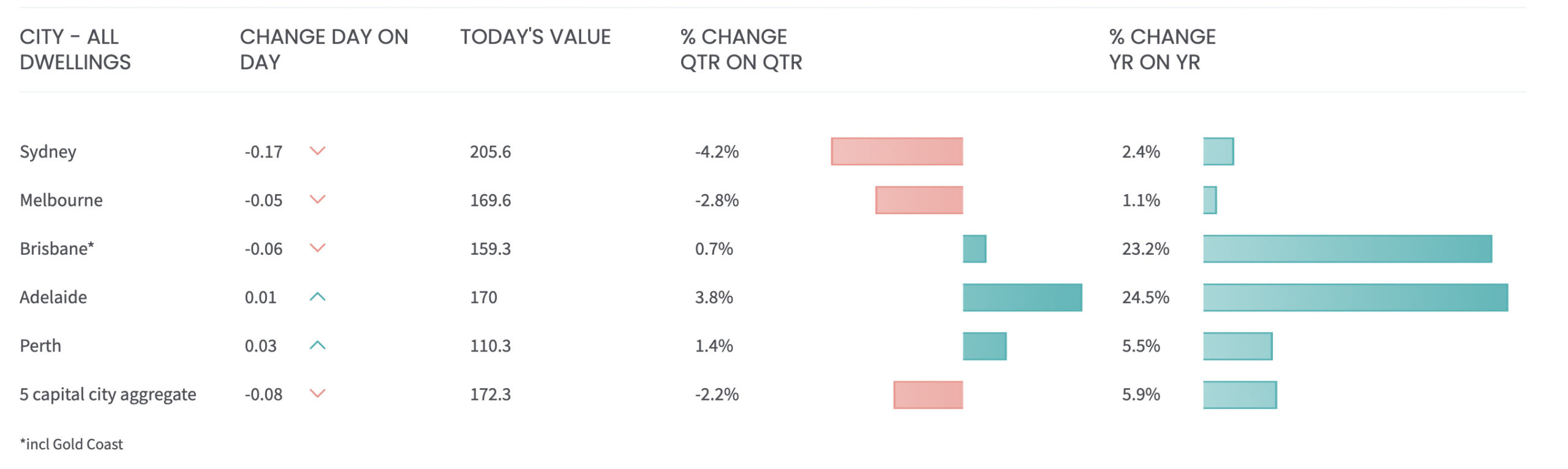

This is the CoreLogic daily home value index week, starting July 25:

Luke Winchester from Merewether Capital says, meh, real estate is tricky.

“If the question is purely an investment I’d be pretty cautious.”

“Just look at rates and rental yields. Yes, yields are climbing but nowhere near as fast as rates and for most investors you are locking in a negative return (4-5% rates and 3-4% rental yields).

“That is a winning strategy when capital prices were going up and you were getting leverage to that, but prices are rolling over in Sydney and Melbourne and I expect other cities to follow as the RBA keeps ploughing on,” Luke says.

“If people are answering about ‘investing’ in owning a home I am more open to that, even if we see jitters over the next few years as long as people aren’t stretched on serviceability house prices will recover.

“If the question is for commercial real estate I don’t think the equation changes a big deal.

“I think it’s very risky owning any asset with leverage into a rising rate environment,” he adds.

BIOTECH: 2%

“Honestly, I’m ashamed,” Pete says, possibly talking about biotech. “We haven’t been doing our jobs properly if people aren’t all over the revolution in biotechnology in Aussie. I think the slim pickings for biotech exposes a poor national knowledge base on where that space is and where it’s going.”

In the words of (our ageless expert in the realm of bio-science and genetics) Eddy Sunarto:

“Historical data shows that biotech is one the best sectors to put your money in over the long term,” Eddy says pulling out the historical data.

“Since 2007, the S&P Biotech Index is up by 500%, beating the benchmark S&P 500 return of 150%.”

During the past 12 months biotechnology shares in the US have entered a bear market which has seen the biotech index on the NASDAQ fall by more than 22%.

This negative sentiment has spilled over to the Australian market with heavy selling evident in the sector, and Canary Capital’s Paul Hart believes that therein lies a great opportunity.

“Our philosophy has always been to find really good companies, run by good people with a proven track record and buy them for the long term,” he said.

“If you want to make large profits this is the best way to do it.

“There is no better time to buy shares in a company than when they are on sale. Biotechnology shares are deeply discounted at the moment due to poor market sentiment.

“One thing we are sure about, is that the market will eventually turn up for the sector.”

GOLD: 15%

“Good to see gold there,” Pete says. “It doesn’t hurt being sensible.”

“However, not that many people know how to buy gold, and it doesn’t give moonshot returns.”

Luke Winchester reckons gold is “no surprise”.

“Common investing adage is to own gold during inflationary periods. Hasn’t worked so far but has been relatively stable compared to other assets – so arguably doing its job.

“Most long-term indicators are showing that the market doesn’t think inflation is sticking around longer term which is probably why the gold price isn’t reacting to 8% prints right now, but it’s not a bad hedge if that changes.”

I asked Mark Pey, director of Rush Gold on his take and why he reckons gold will be “last man standing”.

“Put this down in dot points, I have a lot of them,” he said.

- In comparison to the rest of the market experiencing downfalls, at the end of the June quarter gold is up 5% for the year and 11% year on year. Gold is doing its job.

- The RBA’s predicted inflation rate rise to 7% by year-end may be wishful thinking, and inflation could be much higher. Globally we are seeing countries such as the UK already at 11%, and Estonia and Latvia sitting at a massive 20% annualised inflation.

- These rises playing out globally reinstate Rush Gold’s opinion that investing is always a forward-looking exercise and gold fits the criteria of a top performing inflation hedge.

- Gold bullion has the advantage in volatile times of not only being a hedge, but also a currency.

- History shows that gold performs well in times of a crisis.

Oil: 4%

This is just about as complex a one word question as can be asked of investors at the moment and frankly, the response is complicated.

Pete texted me this: Oil, wtf?

First – if we’d done the same survey this week – we’d be talking all them fossil fuels. Coal stocks have risen literally from their own ashes and the gas squeeze has become a gas crisis.

That being said, and this is where it gets tricksy – next time you receive your ESG-themed fund statement, take a closer look at the stocks in your portfolio – because even the green fundies are warming up to it.

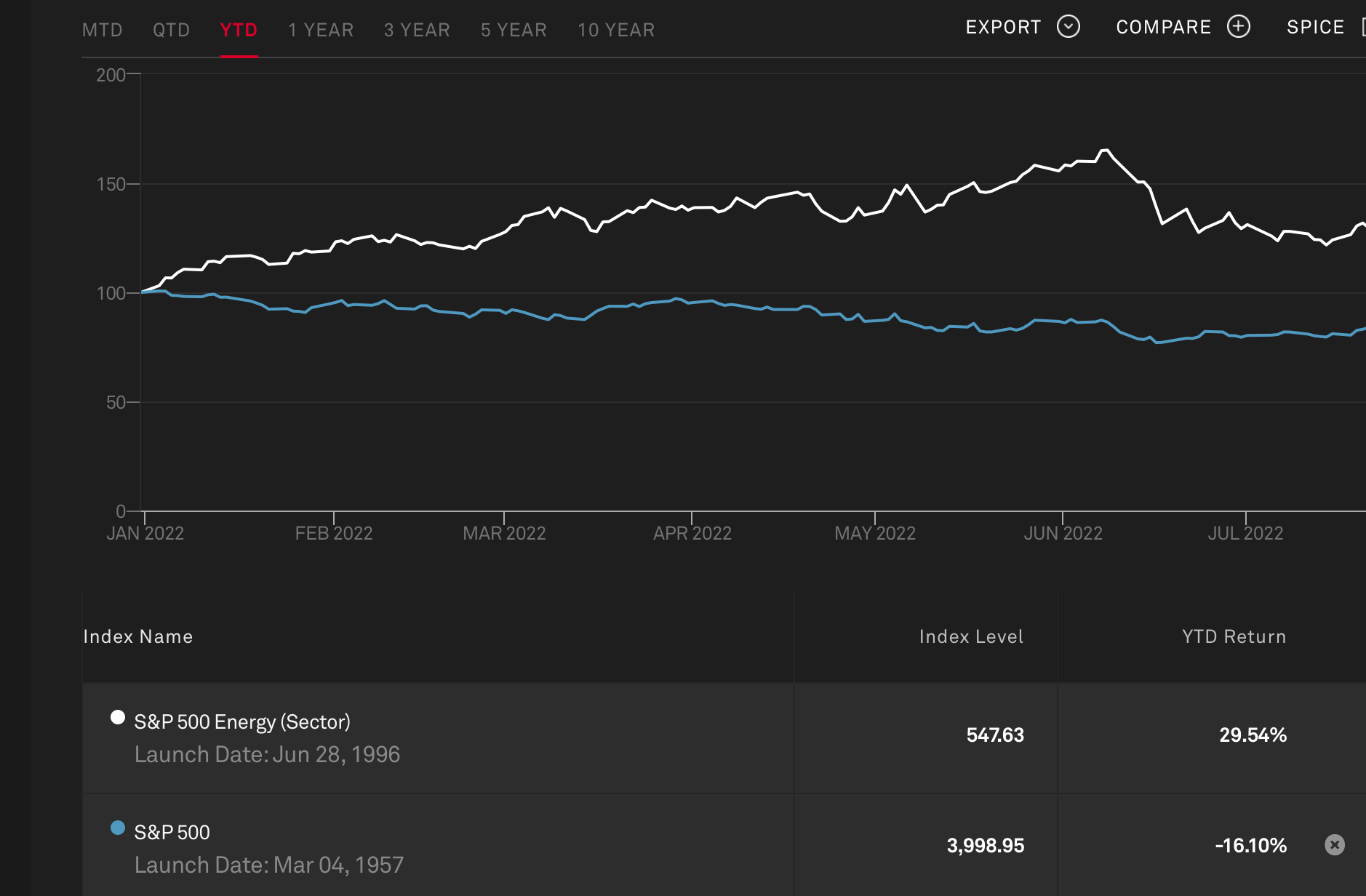

According to Eddy, new analysis shows ESG portfolios are jumping into oil and gas sector.

“An unimaginable thing to do just a couple of years ago,” he says.

“It’s an opportunistic yet astute move because due to the recent turmoil, the energy sector is the only sector to have made gains in the S&P 500 index this year.

The Top 5 of the Bank of America’s ESG Meter – that’s a list of stocks the BofA deems top environmental performers – is now pretty much dominated by giant, terrifying oil companies (in alphabetical order):

- Chevron

- ConocoPhillips

- Devon Energy (Luke: I prefer their meat)

- ExxonMobil

- Halliburton (oil field services)

BANKS: 4%, IRON ORE BIGGIES: 4%, BONDS: 2%

Pete says this is the big surprise – the major banks, the monster iron ore miners, happy, happy bonds and do-nothing term deposits. These are all the regular alt-income streams of our parents.

“Dividends and yields were just such a huge deal.

“Frankly, I suspect the rise of retail meme-stonkers means something around a 7% a year is looking on paper like just too poor a return for the modern investor who’s been accustomed to the interventionist price action of the last decade,” Farquhar told me, over Zoom, over strong scrumpy.

Honestly, WTF do people have against solid returns these days?

Mark Pey puts it in this context: The 1970s oil shocks saw prices and uncertainty spike – as did the GFC and then COVID.

“So your traditional asset class in volatile and/or bear markets has been bonds, especially government bonds.

“But the 30-year bull market in bonds has ended like the Dodo as global central banks push up interest rates to curb inflation. Bonds are literally inverted now.

“It means bonds are currently destroying capital, not protecting it,” Pey says

“With inflation at 7% and maybe much higher, cash and terms deposits are no answer either. Although rates are rising, the return on capital is still well below the rate of inflation,” he adds.

TERM DEPOSITS: 8%

This is usually the sensible, ‘let’s go out to meet the cycle’ thinking and worth breaking down a bit.

On the Monday before the RBA’s July rates decision, the bloody CommBank increased their term deposit rates by up to 60 basis points.

Take a minimum deposit balance of $5,000:

- 13 months, paid annually: 60bps increase to 1.20% p.a.

- 24 months, paid annually: 50bps increase to 1.50% p.a.

- 36 months, paid annually: 25bps increase to 1.75% p.a.

And that’s largely how the Big Four are playing it and while they play it well, it’s probably Australia’s ‘challenger banks’ which are worth checking over.

Side note/hustle: Making money out of the challenger banks

The RBA’s most recent data has the average 12-month term deposit interest rate at 0.70% p.a. Just last week AMP, ING Macquarie, the takeover target in the sunshine state Suncorp and neo-bank Judo all increased term deposit rates by up to 125bps.

On Friday last, AMP increased its 12-month rate by 20 basis points to 3.05% p.a. with a minimum deposit of $5K, interest payable at the end of term.

ING lifted its 12-month rate by 25 basis points to 3.25% p.a. The minimum deposit here is $10K, likewise, end of term.

Judo Bank increased its 12-month term deposit by 10bps to 3.45%, with a minimum deposit of $1K, end of term. There’ s a 10bps cut if you opt for monthly payments.

Following ANZ’s takeover bid, subject to reg approval and good manners, Suncorp lifted the rates on most of its term deposit products by between 30 and 55bps.

The 12-month rate was increased by 35 basis points to 2.65%, on $5K to collect at the end of term.

I add Macquarie because it’s a little blood out of stone – with a wee 10bps increase on only the two year rate (now 3.40%), on a minimum $5K with interest paid annually.

So all in all: there’s money there, no doubt.

CRYPTO: 18%

Luke Winchester always has a few choice words which I’m delighted to share, although it should be noted The Badman has landed in Sydney and will most certainly have armed himself by now.

“Disgraceful that crypto is number one. Honestly I think the biggest reason why is because advice around crypto is unregulated,” Luke says.

“Blokes have to tiptoe around advising people to buy the ASX 200 ETF, meanwhile crypto guys can jump on YouTube and tell everyone CumRocket Coin is going to ten bags in the next year!”

Also shocking in the context of how far crypto has fallen that so many people would still select it, he adds.

“Maybe the ‘buy the dip’ mentality is stronger than we think.”

Funny you should mention that Lukey:

Because crypto investors appear to be regaining their mojo according to the latest chunky data from eToro, which notes the number of newly opened crypto positions is up about 80% since in the week before Wednesday last week.

On Wednesday last the average trade value for a newly opened position was the highest it has been since April 8 this year bringing the total value of newly opened positions up some 130% over the same period.

Over the last few days, the average daily value of newly opened positions is 180% higher than the rest of July.

The little uplift in sentiment follows a wee price rally last week for the two biggest crypto assets – with Bitcoin now trading at around the $23K mark and Ether trading at around $1.5K – which is over 30% higher than a month ago.

“Crypto asset prices have rallied off their June lows, following equities higher as investors become more comfortable with the economic growth outlook. But markets are not yet out of the woods and need to see a clear fall in US inflation for this bear market rally to become sustainable,” says eToro’s Man in Sydney, Joshua Gilbert.

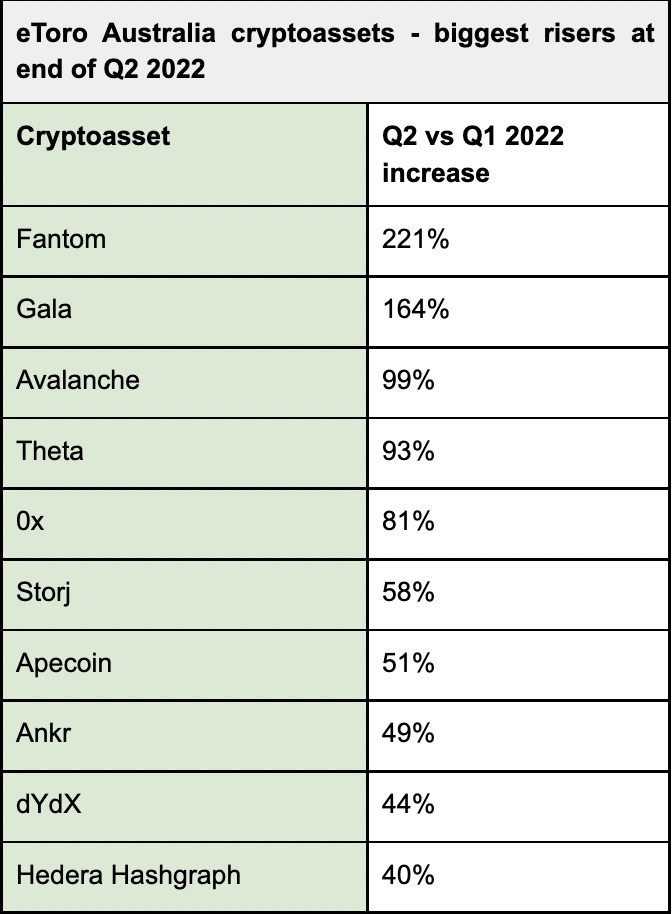

For your Aussie crypto-investing edification:

“Interesting,” Luke says. “Nonetheless I wouldn’t touch it with a ten foot pole.”

“A new exchange/finance platform is going under daily in the crypto space, I suspect we will see a washout over the next few months and long required regulation will finally come in (ironically probably driven by crypto guys themselves).

Healthcare: 3% Vs Big Tech: 1%

There’s not a heap of time for the social media end of Big Tech, that’s certain. Last Friday week, for example, Snap posted a net loss of US$422 million on revenue of $1.11 billion.

Analysts were expecting a loss of half that based on heaps more revenue of $1.14 billion.

The results were attributed to various factors, including challenging economic conditions, slowing demand for its online advertising platform, Apple’s iOS privacy changes and competition from rivals like TikTok. But the feeling is the worm is turning on a lot of these names. This week will be the best high watermark for the FAANG stocks.

Most of them started reporting last weeek, with Apple and Amazon kicking off on Tuesday.

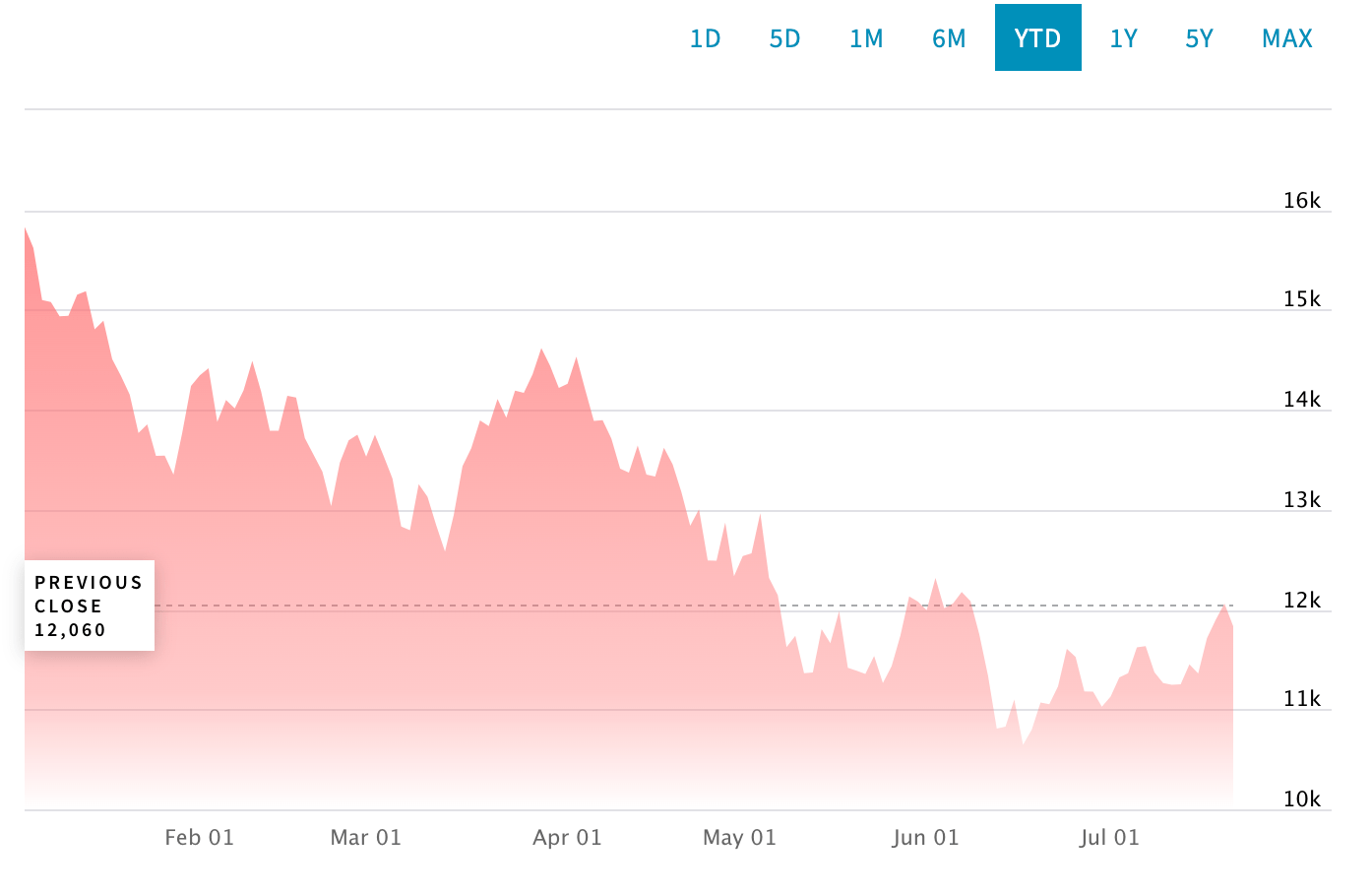

Here’s the Nasdaq Composite Year-To-Date:

Either way, it’s welcome back to the defensive end of town, which really does continue to outperform, Market Matters’ James Gerrish told me last week, and they’ve been watching the high valuation growth stocks since mid-June.

“And some of our holdings have illustrated the point perfectly over the last five weeks,” he reckons.

Healthcare biggies like CSL (ASX:CSL) and ResMed (ASX:RMD) have surged +16.1% and +17% respectively, while tech heavyweight Xero (ASX:XRO) has only bounced +6.5% (although they’ve all left the miners in their wake).

“As central banks undertake the enormous transition from QE to QT we are witnessing a market whose concerns are gyrating between rising bond yields and a potential recession causing some dramatic sector rotation – e.g. at the moment it’s all about sell the resources and buy defensives such as healthcare – but tech hasn’t yet fully embraced the pullback in bond yields.

The Healthcare Sector is looking at six-month highs, while the Tech Sector cannot even regain the losses endured through June.

Fortunately for the ASX 200 the Healthcare Sector is well over twice as large as the Technology Sector, although the latter does exert a noticeable sentiment influence on the market.

Battery metals: 13%

Battery metals are interesting. Lithium equities have rolled over but the commodity price is still elevated and many, like Luke, believe it will stay there given long term tailwinds.

“Still for me, in the short-term it is a high beta asset, so it’s interesting to me that people are still so enamoured by it.”

On that note, Stockhead’s Josh Chiat has been tracking lithium prices against other battery metals during China’s economic adventures of late and noted lithium has come out looking pretty good.

Josh notes the experts still say the market will remain in short supply due to strong demand and long lead times, nixing the celebrated Goldman Sachs’ oversupply call.

Last week, the human headline running Tesla called producing lithium a licence to print money, while Shaw and Partners’ Adam Dawes reckons big lithium stocks should be favoured in tough market conditions after a major sell-off across the sector.

There’s no two ways about it, battery metals have been hammered by China’s economic slowdown, with Covid lockdowns hitting downstream demand from property, infrastructure or whatever manufacturing industry you like.

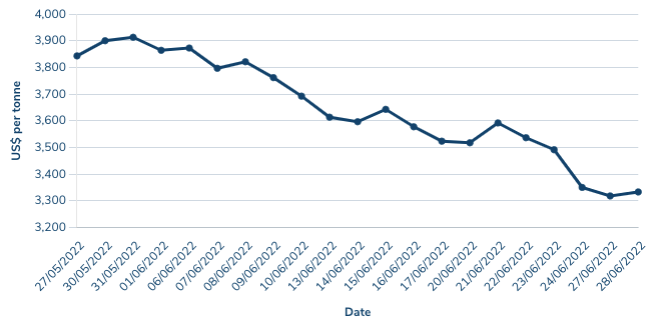

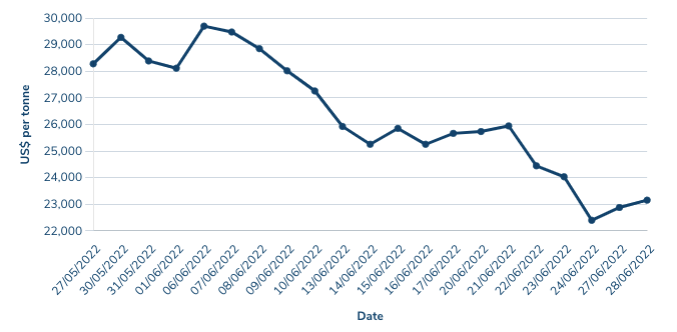

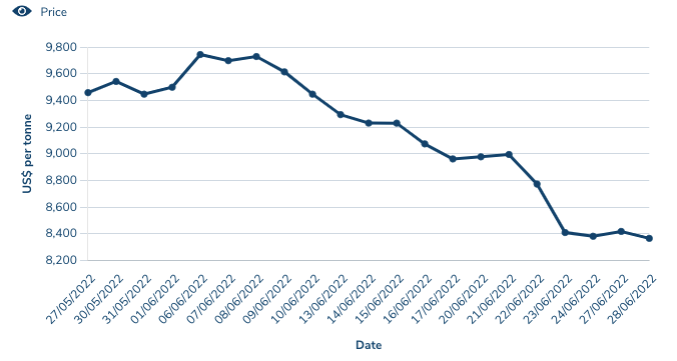

Take a look at these price charts for some key battery metals.

That’s zinc, nickel and copper by the way, three previously flying commodities whose wings have been clipped by China’s struggles.

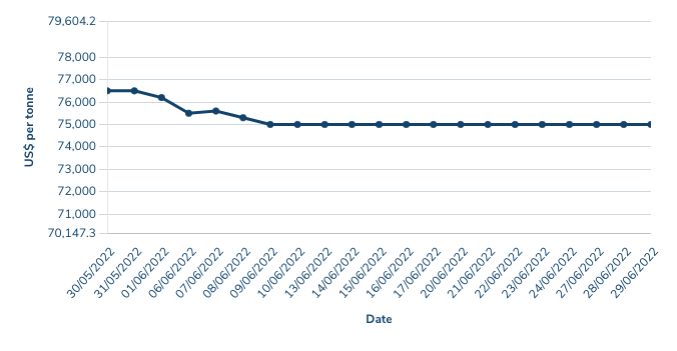

You may be forgiven for thinking one of those charts is lithium given the pain befalling companies exploring and mining the key input in lithium ion batteries. Until the recent rallies, Global X Lithium & Battery Tech ETF had shed almost 10% year to date, but even that was mild given the performances of large Chinese lithium stocks have tempered the losses.

This is what’s actually happened to lithium hydroxide prices in Asia from May to July: no big moves, so the recent sell-off in local stocks has had little to do with structural demand out of Asia.

It’s what Josh calls cognitive dissonance in action.

Just a wee note as well about all those Rare Earth Elelments which are standing up too, if Victory Goldfields’ (ASX:1VG) recent discovery in its Mafeking and North Stanmore Projects, about 15km from the Cue township in Western Australia, show anything.

Those hits took Victory’s share price on a near vertical tear – up about 60% and not showing any signs of slowing down.

Highlights of Victory’s Total Rare Earth Oxides (TREO) and Heavy Rare Earth Oxides (HREO) find include average HREO of 419ppm, average TREO of 1020ppm, highest TREO concentration of 3,872ppm, intersections of up to 16m (and remain open), highest gold intersection of 0.5g/t and current strike length extending more than 1km at a width of 200m. You can read more about it here.

Luke’s last word

“Excellent. I come for the cruelty, but I stay for the last word.”

“I take two things from this survey; first is that people are in two camps about how to play the markets right now.

“First camp are people who expect further pain and want to hide in safe assets (real estate, gold, term deposits) and second camp are those who likely think this is Covid crash 2.0, after the initial shock a huge rip higher in risk assets (although does that need central banks to play along?) so owning crypto and battery metals.

“The second thing I take is very often being contrarian to surveys like this is the winning strategy,” he says. “Just look at the two lowest responses, retail and tech. The two sectors that have fallen the furthest and burnt people the most.

“I’ve found people in general tend to just extrapolate short-term trends into the future – but come on Australia – they’re probably two sectors I think will offer the best opportunities given they have fallen so far and are unloved by general sentiment.”

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.