You might be interested in

Experts

MoneyTalks: Canary Capital’s Paul Hart reckons these are the biotech stocks to pop in the basket

Experts

MoneyTalks: Tony Locantro's 3 contrarian biotech picks in a time of market volatility

Health & Biotech

Experts

MoneyTalks is Stockhead’s regular recap of the ASX stocks, sectors and trends that fund managers and analysts are looking at right now.

Today, we hear from Paul Hart, executive director of Canary Capital.

During the past 12 months biotechnology shares in the US have entered a bear market which has seen the biotech index on the NASDAQ fall by more than 22%.

This negative sentiment has spilled over to the Australian market with heavy selling evident in the sector, particularly across smaller biotechnology stocks.

With the June tax loss selling now upon us, it is likely that there will be more selling by people who want to offset losses against their profits.

Canary Capital’s Paul Hart believes that amidst all of the selling lies a great opportunity for astute investors.

“Our philosophy has always been to find really good companies, run by good people with a proven track record and buy them for the long term,” he said.

“If you want to make large profits this is the best way to do it.

“There is no better time to buy shares in a company than when they are on sale. Biotechnology shares are deeply discounted at the moment due to poor market sentiment.

“One thing we are sure about, is that the market will eventually turn up for the sector.”

Hart said three stocks which Canary Capital are currently closely following and have invested into are Incannex Healthcare Limited, Nyrada and Biome Australia.

Canary has been following Incannex Healthcare for the last two years and the story just keeps getting better.

“Incannex is a clinical stage pharmaceutical company focused on developing unique medicines combining medical cannabis with off patent drugs as well as psychedelic medicine therapies.

“The company has a multitude of projects aimed at developing new medicines for conditions with an unmet need,” he said.

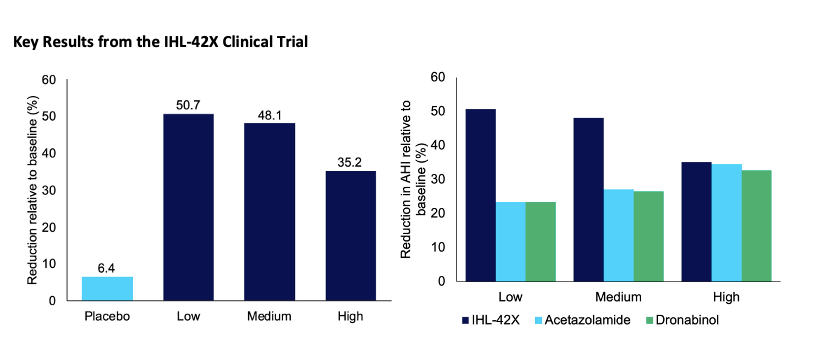

Last Friday, Incannex announced positive results from its Phase 2 proof of concept clinical trial investigating the effect of IHL-42X for the treatment of obstructive sleep apnoea (OSA). IHL-42X is a combination drug made up of 2.5mg of dronabinol (a synthetic form of tetrahydrocannabinol) and 125mg Acetazolamide at the lowest dose.

“The results significantly exceeded the company’s expectations,” Hart added.

“The trial has shown substantial clinical benefit to people with obstructive sleep apnoea at the lowest dose given.

“This not only means people can get the full benefit with a reduced risk of side effects, but also, during the low dose treatment period, every patient was substantially below the legal driving limits for THC in their blood the morning after dosing.

“It removes a significant hurdle for IHL-42X’s widespread use.”

The chart of the left shows that low dose IHL-42X reduced the Apnoea Hypopnea Index (AHI) by 50.7% versus baseline and the chart on the right highlights the combined synergistic benefits of IHL-42X relative to the two components used as a monotherapy.

“If these results are replicated in a larger pivotal Phase 2 trial to be conducted in the United States under an Investigational New Drug application (IND), we think it is likely that the company will start to attract a substantial level of interest from large pharmaceutical companies,” Hart said.

“ResMED (ASX: RMD), which sells the current standard of care Continuous Positive Airway Pressure (CPAP) machines used by OSA sufferers, is a US$30bn company.

“I’m sure that they will be watching the Phase 2 pivotal trial closely because it is highly likely that a simple pill, which is effective at reducing symptoms, will be preferred by OSA sufferers far more than the alternative of using an uncomfortable noisy machine to help their breathing when sleeping.”

The current stock price of 40.5 cents is well off its high of 75.5 cents reached in March this year.

This is despite significant progress made during the past few months with the OSA clinical trial results and the acquisition of APIRx, which added 22 active and pre-clinical projects to the company targeting the treatment of pain, dementia, Parkinsons disease and many other conditions.

Nyrada specialises in the discovery and development of small molecule drugs to address unmet medical needs in cardiovascular disease and stroke and traumatic brain injury.

“The company is about to enter a very interesting phase with two trials expected to commence during the second half of 2022,” Hart said.

“Nyrada has an exceptional board and management team including two American directors who have been directly involved in negotiating substantial deals with large pharmaceutical companies.

“The first trial aims to demonstrate that the company’s small molecule PCSK9i inhibitor lowers cholesterol. According to the World Health Organisation (WHO), cardiovascular disease is the largest cause of death globally, taking the lives of an estimated 17.9m people every year.”

One of the major causes of the disease is a build-up of LDL cholesterol in arteries which can cause heart attack and stroke. Nyrada is aiming to prove that its PCSK9i inhibitor, which is taken orally, lowers LDL cholesterol levels. The drug would be an ideal solution for patients who respond poorly to statins.

“Results from a second preclinical trial in a specialised transgenic mouse model have shown cholesterol levels reduced by 46% and reduced by 65% when given in combination with the statin Lipitor – which alone only achieved a 27% reduction,” he said.

“This mouse model is seen as a reliable indicator of what happens in humans so the company is optimistic about achieving success in the upcoming trial.”

Lipitor, which is the leading cholesterol drug owned by global giant Pfizer, has been the best-selling drug of all time having generated more than US$160 billion in sales since its launch in 1997.

“Despite being off patent, it still generates annual sales of around US$2 billion. There is no doubt that this new cholesterol drug has the potential to generate significant global sales if the clinical trial is successful,” Hart added.

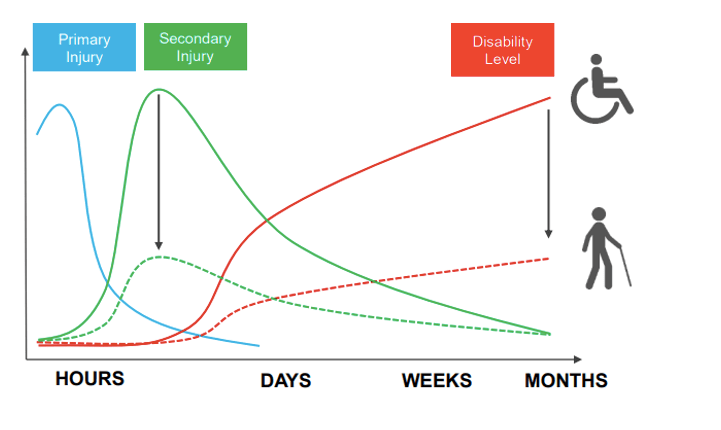

“The second drug development program involves the development of a neuroprotectant drug to reduce the impact of secondary brain injury in patients following a stroke or traumatic brain injury.

“Traumatic brain injury is a global problem affecting millions of people. It is the secondary brain injury that leads to long term permanent brain damage and disability.

“There is currently no FDA approved drug available meaning treatment options are limited. Every year there are 4.1 million TBIs in the United States, United Kingdom, Europe and Japan.”

As shown from the green dashed line in diagram above, Hart said the aim with the company’s new drug is to reduce the secondary injury and therefore reduce the level of disability (red dashed line) caused by TBI delivering better outcomes for patients.

A Phase 1 first in human study is anticipated to commence during the second half of 2022.

Nyrada’s share price has more than halved from 35 cents to 16 cents during the last 12 months. This is despite the progress which has been made in selecting the drug candidates for the two upcoming clinical trials.

With a current market capitalisation of $25m, success in either trial will provide investors with significant upside.

Biome Australia is focused on becoming a global leader in targeted probiotics (live-biotheraputics) by developing and marketing a range of probiotics.

The company’s flagship brand is Activated Probiotics.

Hart said what sets them apart from others in the space is the level of clinical evidence behind many of the products backed up by data from clinical trials.

“Biome works in partnership with some of the world’s leading organisations in microbiome research and development.

“It also develops, licenses and distributes a scientifically formulated organic nutraceutical range called Activated Nutrients and a sports performance and recovery range targeting professional athletes under the brand Activated X Performance.”

The company recently released a FY22 trading update showing an acceleration in sales occurring during Q4. With six weeks to go, sales to mid-May were ~$3.57m, up 57% on the FY21 figures.

Hart said key factors driving the growth are expanded distribution points with Biome products soon to be available in over 2,500 pharmacies and retail stores and new product launches of Biome Eczema, Biome Her, Biome Advanced 10 pack and Biome Acne.

A new distribution agreement announced with Priceline to sell Biome’s Activated Probiotics as a core range in their 370 pharmacies across Australia should help maintain sales momentum.

Biome listed its 20 cent shares in late November 2021 and the price has ranged between 12 and 7 cents since then.

At 10 cents the current market capitalisation is around $20m so provided sales growth continues, Canary Capital doesn’t see prices staying around this level for long.

Stockhead does not provide, endorse or otherwise assume responsibility for any financial product advice contained in this article.