Vanguard’s four key investing principles for long-term success

Pic:Getty Images

- Investors favour diversity and Aussie bonds amidst global market volatility in 2022

- Vanguard has four key principles for investors to follow for long-term success

- Vanguard removes $9 brokerage fee from platform to reduce costs for investors

As high inflation, interest rate rises, supply chain shortages, and geopolitical tensions weigh on global markets throughout 2022, diversity is proving popular with investors in Australia’s ETF sector.

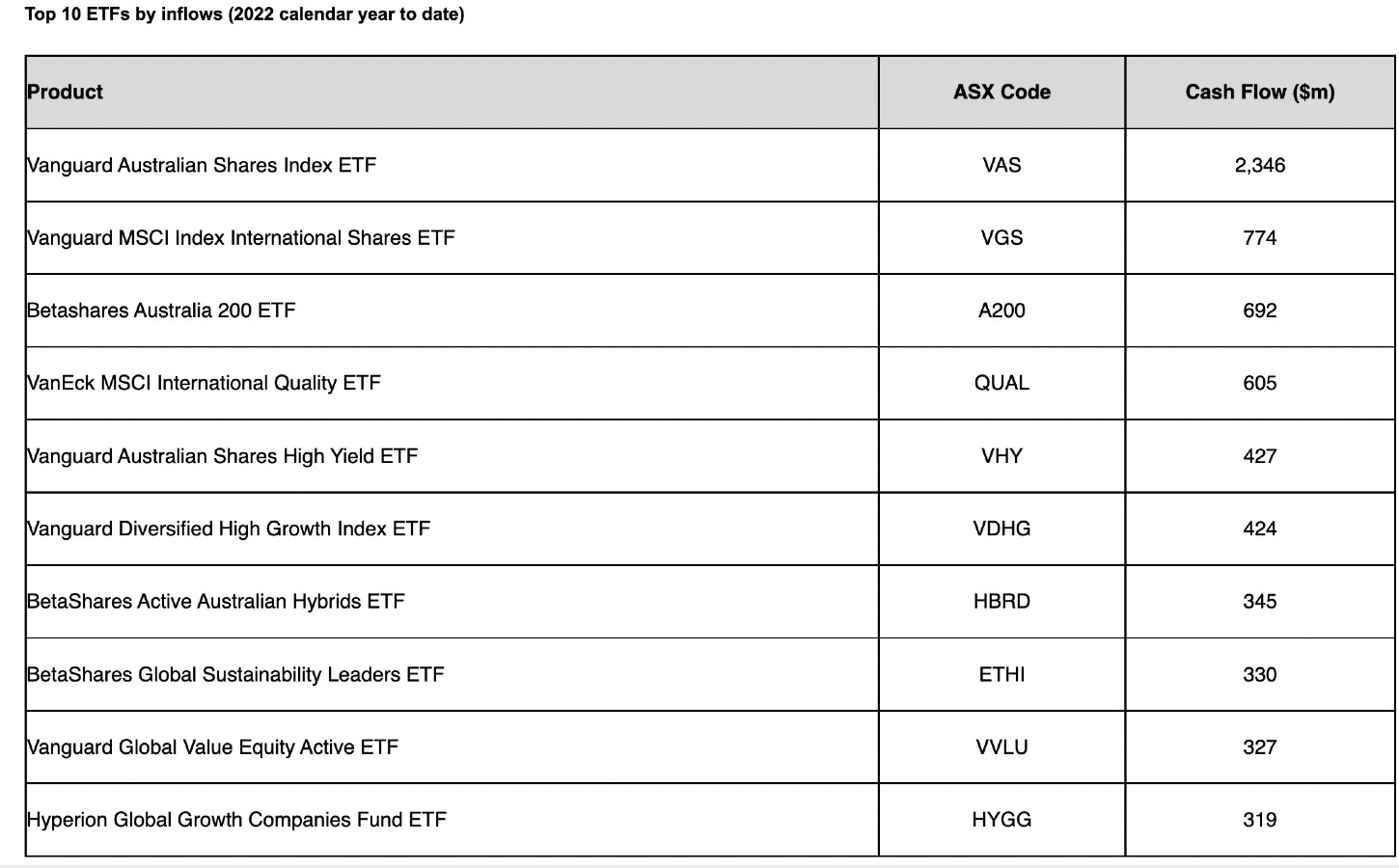

Looking at the Top 10 ETFs for the 2022 calendar year so far by inflows, the three leaders are all diversified. Vanguard Australian Shares Index ETF (ASX:VAS) is the most popular followed by the Vanguard MSCI Index International Shares ETF (ASX:VGS) and Betashares Australia 200 ETF (ASX:A200).

Domestic bonds prove popular

Vanguard’s Head of Personal Investor Balaji Gopal said Australian bonds have proven popular during the market turbulence of 2022.

Unusually, both bonds and equities have both seen falls in 2022 rewriting the economic textbooks. When bonds go down, stock prices tend to rise. The opposite also happens – when bond prices rise, stock prices tend to fall.

However, Gopal said there is an indication the lockstep is ending and bonds are proving popular.

“Australian bonds have been a popular asset class with all the volatility and we see them receive the strongest inflows of any asset class, particularly in third quarter of 2022,” Gopal said.

“We have seen increasing interest rates, rising inflation, weakening economic growth and investors are allocating more of their funds to safe havens like bonds.

“We fundamentally believe bonds continue to be an effective portfolio diversifier over the long-term and will continue to play their role as long-term source of income given the rise in interest rates.”

Vanguard Australia’s largest ETF provider

Vanguard continues to be the largest ETF provider in Australia recording $2.07 billion of inflows in Q3 2022.

“Our market share for ETFs in Australia has grown consistently, VAS is the biggest ETF and we continue to attract a lot of flows into our categories of ETFs,” Gopal said.

“We try to do the simple things really well with a strong focus on cost and diversification.

Vanguard’s four principles for investing in ETFs

Gopal said investing should be for the long-term and Vanguard focuses on four key investment principles including:

1) Set clear goals and 2) stay well-balanced and diversify.

Gopal said principles one and two tie in together and essentially investors should create clear investment goals with a long-term focus and then construct a portfolio with the right mix of growth and defensive assets that suits their risk profile, time frame, and goals.

3. Focus on costs

“Cost is one thing within people’s control and our view is the lower fees you pay the more of your money is working for you and investing should be low-cost,” Gopal said.

4. Staying the course

Gopal said investors should have the discipline to not be influenced or affected by shorter-term market movements or trends or fads which might be playing out.

“In the current market environment, where markets are quite volatile we continue to remind investors to take a longer-term perspective,” he said.

“Over the long-term equity markets generally tend upwards.”

Vanguard removes $9 brokerage fee from platform

As part of ensuring minimal costs for investors, Vanguard will remove the $9 brokerage fee for ETF purchases from 27 October 2022 on the Vanguard Personal Investor platform.

“We built the Vanguard Personal Investor platform with the aim of changing the way Australians invest, by providing access to our high-quality, low-cost investment products and promoting smart investing strategies,” Gopal said.

“Small changes in fees can make a big difference over time, and the removal of the current $9 brokerage fee for all Vanguard ETF purchases is another step in improving the investing experience with Vanguard, and demonstrating our commitment to delivering the best value we can.”

He said the reason ETFs are growing in popularity is they have become a true representation of low-cost investing.

“Most ETFs attract large market cap indices and you don’t have someone actively picking stocks, which means these products are offered at a very low cost,” he said.

“Our VAS which is the biggest ETF in Australia with about 9% of all assets under management is offered at 10 basis points, so for $10,000 you are paying $10 to get access to it.”

Vanguard also outlined its plans to introduce further new features in the coming months, with work underway to extend the Auto Invest capability to ETFs, introduce Vanguard Personal Investor Kids Accounts, and add Automatic Reinvestment for ETFs to the platform service.

“Analysis shows that Vanguard investors who have adopted that automated feature are more resilient to market volatility, having made the conscious decision to contribute regularly to their investments despite the market’s spikes or dips,” Gopal said.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.