You might be interested in

News

Sydney, Melbourne house prices to weaken; Units surge as living crisis goes nuclear family

News

Westpac: It's a two-speed house market! AMP: It's simpler. There's more Australians than homes

Uncategorized

News

Australia’s monthly rate of rental growth eased in June, but ongoing demand pressures and chronic undersupply have ensured that life as a tenant – particularly in a Sydney or Melbourne unit – simple bites, and bites deep.

Aussie rental growth according to the latest work by real estate data firms PropTrack and CoreLogic might differ in the detail, but the general message is clear – renting costs continue to climb well above their long-term averages.

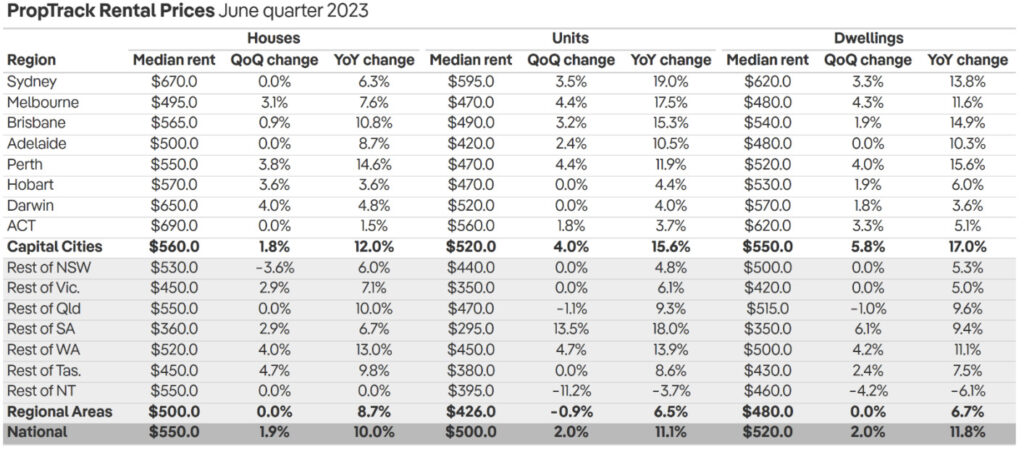

According to PropTrack data released on Wednesday, median advertised rents around Australia climbed 2% over the June quarter to $520 a week.

That brings rents up 11.8% compared to the June quarter of 2022 (when rents were a wee $465 nationally).

Rent prices across Australia’s combined capital cities continued to surge, up 5.8% in the June quarter to $550 per week – an even brisker pace of growth than in the March quarter.

That one brings rents up a gobsmacking 17% compared to a year earlier.

The Greens, who are great, but also pretty nuts, have floated freezing rents.

That’d mean landlords can’t lift rents on an existing tenant. That kind of legislation might even see landlords disallowed from increasing rents between tenants.

The other option lawmakers could be looking at if they just take a moment and stop counting the rising value of their own home are rent caps which would still allow landlords and homeowners to lift what they charge tenants, but it’d limit the amount and frequency so a landlord can’t start gouging.

As a matter of fact, the pot smoking, weed growing public servant Royuame we call the Australian Capital Territory actually introduced cap controls before the pandemic in 2019.

These laws limit rent increases to 110% of inflation a year.

So with inflation at around 4%, a renter paying $500 a week would have to wear at most a circa $20 a week rise.

Now if your average Canberran landlord wants to beat that, then they have to go the ACT government and justify it.

PropTrack economist Angus Moore says Sydney and Melbourne units have copped the sharpest rises, up 19% and 17.5% over the past year (respectively).

Angus says that some of this growth reflects catch up after unit rents fell during the pandemic, but not all. Median unit rents are now 19% higher than pre-pandemic in Sydney and 10.6% higher in Melbourne.

In contrast, regional rental markets look to be moderating. Rents were flat across regional areas in the June quarter; and while they are still 6.7% higher than a year ago, it was the slowest pace of annual growth since early 2021.

“Rental markets continue to be extremely challenging for renters, with rents surging across much of the country amid strong demand and very limited availability. This is especially true in Sydney and Melbourne, where weekly rents have increased significantly after falling in these cities during 2020 and 2021,“ Angus says.

“There are signs rent growth may be slowing in some of the other capitals. Rents in Adelaide were flat in the June quarter. Rents in Brisbane grew 1.9%; while still quick, it was the slowest pace of quarterly growth since mid-2021.

“The good news for regional renters is rent growth looks to be moderating after three years of brisk growth. Median rents were flat in the June quarter, with rents for units even declining modestly. That slowing in rent growth is consistent with improving rental availability in regional markets.

“Rents are likely to continue growing in capitals over the coming months. But, with rental vacancy rates looking to have stabilised, and growth easing in some capitals, national rent growth may start to slow.”

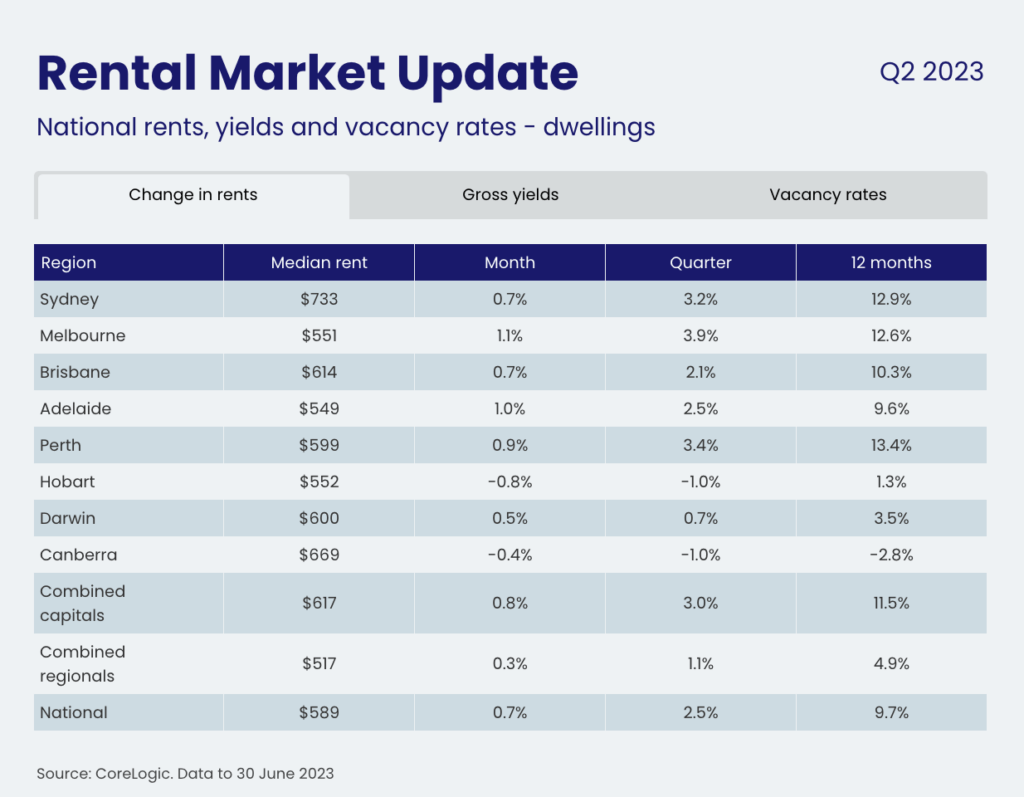

However, according to CoreLogic’s Quarterly Rental Review for Q2 2023 the country’s quarterly rental growth trend was higher at 2.5% but in line with the previous March quarter increase.

The quarterly results are down 30 basis points from the 2.8% increase seen over the three months to May. This is the first slowdown in quarterly rent growth since November last year.

CoreLogic’s Kaytlin Ezzy says while a slowdown in the pace of national rental growth is now evident across the monthly, quarterly and annual trends, rental growth remains well above average.

The slowdown in national rental appreciation can also be seen in the annual trend, with national rents rising 9.7%, over the 2022-23 financial year, down from the record 10.2% lift seen over the 2022 calendar year.

“The softening in rental growth occurred in spite of an ongoing surge in overseas migration and a continued shortage in rental supply, suggesting an increasing portion of tenants are reaching their affordability ceiling,” Ezzy sezzy.

“While rental demand from overseas migrants is likely to remain strong for some time yet, particularly across the largest capitals, we’ve already seen a reduction in domestic rental demand via an increase in the average household size.”

With national rents 27.4% higher since the onset of COVID, equivalent to a $127 per week increase on the median dwelling rent in Australia, Kaytlin says it’s likely group houses are about to get a whole lot more groupie.

“There’ll be an increase in average household sizes as more renters re-form share houses as a means of sharing the increased rental burden.”