Trading Places: Which fund managers want gold, buy-now-pay-later and chocolate stocks?

US Olympic Gold medalists Red Gerard and Jessie Diggins visiting Hershey's Chocolate World (Pic: Getty)

In this weekly column, Stockhead overviews all substantial holder filings of ASX small caps.

Substantial shareholders are those holding 5 per cent or more. These could be company directors, individual investors or major institutions.

Companies are required to announce when new substantial holders have come on board, when they have ceased to be shareholders or when they change their holdings.

Entrances

Right as Yowie (ASX: YOW) face a takeover offer from disgruntled shareholder Keybridge Capital (ASX: KBC), Wilson Asset Management came onboard with a 13% stake, costing nearly $2.5 million.

It is unclear whether it is looking for a quick gain (it would gain over $150,000 if the 9.2 cent per share takeover offer went ahead) or seeking to make a counter-offer. Either way, we are bound to find out soon.

UPDATE: While Wilson have not commented, the mere purchase was enough to get Keybridge suspicious. It has submitted an order to the Takeovers panel to prevent it from exercising shareholders rights (including voting) and buying more shares.

Fresh from acquiring Explarum, Rameulis Resources (ASX: RMS) have welcomed Van Eck as a shareholder, after it bought a 6.5 per cent stake for $10.9 million. Van Eck also bought a 5.57% stake in Perseus Mining (ASX: PRU) for $3.5m.

But rather than owning outright, the stake lies in Van Eck’s US$19b Junior Gold Miners ETF (NYSE: GDXJ), so while forking out over $14 million may seem big for Australian observers, the purchase is essentially loose change for them.

On Monday, Smiles Inclusive (ASX: SIL) director David Herlihy took a 17.7 per cent stake in the dental practice company and within 24 hours requested an EGM to overthrow two current board members.

Under law the company have to hold it within three weeks and it has confirmed it will. While we are yet to hear more from either party, this comes only three weeks after Smiles Inclusive’s anticipated 2019FY profit of $2m fell to a $1m loss.

- Subscribe to our daily newsletter

- Join our small cap Facebook group

- Follow us on Facebook or Twitter

Zenith Energy (ASX: ZEN) welcomed Moelis as a substantial holder with 5.10 per cent after 4 months of building its stake. Moelis is the investment bank established in 2007 by billionaire banker Ken Moelis and in Australia it’s run by Sydney Swans chairman Andrew Pridham.

New Zealand’s Accident Compensation Corporation bought a 5.16 per cent stake in Sky Network Television (ASX: SKT) – the NZ Sky Network, unrelated to the Australian or UK channels. This cost NZ$7.7m (A$7.4m) and was done through the NZX – Sky is dual listed.

| Company | Code | Market Cap | Holder | Stake |

|---|---|---|---|---|

| Food Revolution Group | FOD | $48.8M | SG Hiscock | 0.0569 |

| Perseus Mining | PRU | $498.0M | Van Eck | 0.0557 |

| Ramelius Resources | RMS | $514.1M | Van Eck | 0.0654 |

| Nexopharm | NOX | $51.9N | Goodridge Nominees | 0.0795 |

| Zenith Energy | ZEN | $63.2M | Moelis | 0.0509 |

| Benjamin Hornigold | BHD | Suspended | GM Holdings | 0.0724 |

| FlexiGroup | FXL | $520.3M | Tamorer - trustee for Wylie Family Trust | 0.0518 |

| Sky Network Television | SKT | $509.7M | Accident Compensation Corporation | 0.0516 |

| Yowie Group | YOW | $19.4M | Wilson Asset Mgmt | 0.13 |

| Managed Accounts Holdings | MGP | $40.1M | Starmay Superannuation | 0.0501 |

| Uniti Wireless | UWL | $52.4M | Cornish Group Investments | 0.0763 |

| Base Resources | BSE | $379.2M | Fidelity | 0.0519 |

| Metro Performance Glass | MPP | $83.4M | NAB/BNZ | 0.0501 |

| MCS Services | MSG | $2.4M | Peter Johns | 0.0501 |

| Smiles Inclusive | SIL | $9.6M | David Herlihy | 0.1768 |

| Petrel Energy | PRL | $13.2M | Dennis Donald | 0.1999 |

| Petrel Energy | PRL | $13.2M | Duncan MacNiven | 0.1999 |

| AIC Resources | A1C | $13.5M | Intrepid Mines | 0.387 |

Exits

Fidelity completely sold out of Yowie (ASX: YOW), holding 9.24 per cent immediately before its exit. The stake was accumulated between April 2016 and May 2017.

Considering Yowie’s share price was no lower than 60 cents and as high as $1 during this time, this would be represent a hefty loss.

National Veterinary Care (ASX: NVL) saw small cap fund managers Pengana Capital and Washington H Soul Pattinson depart, selling over $5 million worth of shares between them.

NZ fund manager Fisher Funds Management sold its 9.94 per cent stake in Michael Hill (ASX: MHJ), reaping $23.8 million. Bank of America Merrill Lynch halved its 7 per cent stake in pharmaceutical IDT Australia (ASX: IDT).

Resource Capital Funds sold a $3m stake in Geopacific Resources (ASX: GPR) which would have been around 17.7 per cent stake in the gold-copper explorer. Curiously, the company is currently in a trading halt pending the announcement of a capital raise.

| Company | Code | Market Cap | Holder | Stake |

|---|---|---|---|---|

| Celsius Resources | CLA | $15.0M | Gecko Namibia | 0.05 |

| Food Revolution Group | FOD | $48.8M | Bill Nikolovski | 0.077 |

| ImpediMed | IPD | $85.4M | Fidelity | 0.055 |

| Liquified Natural Gas | LNG | $271.6M | Valinor Management | 0.0735 |

| National Veterinary Care | NVL | $123.0M | Pengana Capital | 0.0642 |

| Bell Financial Group | BFG | $248.6M | Ahmed Fahour/Equitas Nominee | 0.0679 |

| Infomedia | IFM | $512.1M | Yarra | 0.0572 |

| Michael Hill | MHJ | $265.4M | Fisher Funds Mgmt | 0.0994 |

| National Veterinary Care | NVL | $123.0M | Pengana Capital Management | 0.065 |

| Quickstep Holdings | QHL | $57.2M | Deakin | 0.0484 |

| Atomos | AMS | $185.4M | Common Sense Computing | 0.0845 |

| Eclipx Group | ECX | $238.1M | Pendal Group | 0.067 |

| Geopacific Resource | GPR | $22.9M | Resource Capital Funds | 0.177 |

| IDT Australia | IDT | $35.5M | Bank of America Merill Lynch | 0.07 |

| KYCKR Ltd | KYK | $7.7M | IOOF Holdings | 0.0719 |

| Immutep Ltd | IMM | $115.0M | Altium Growth GP | 0.074 |

Increasing

Pura Vida Energy (ASX: PVD) and its associates have continued to accumulate stock in Factor Therapeutics (ASX: FTT).

Factor was worth $60 million before being wiped out in a second following a clinical trial that showed no commercial benefit compared to existing treatment methods.

Pura Vida now holds 19.97% in the company and it looks it will launch a takeover bid, reaching the 20% threshold. But it took no action at yesterday’s EGM.

The ASX has been addicted to buy-now-pay-later stocks, with investors buying en-masse despite none of the stocks being profitable and at risk of legal regulation. But users have been signing up at a frenetic pace and seemingly that’s good enough.

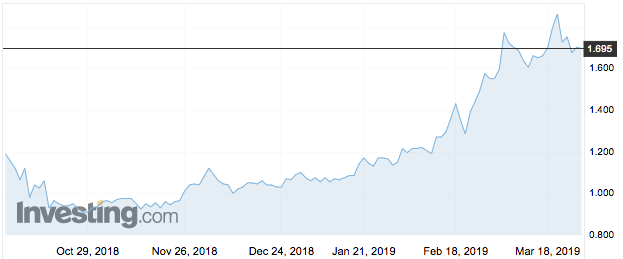

Regal Funds Management bought another 1 per cent in one of these companies Zip (ASX: Z1P), taking its holdings to 7.79 per cent.

Its most recent purchasing spree last December, which made it substantial holders, saw it buy 9.6 million shares for $10.2m. Since then the share price has spiked from $1.06 to $1.70, making that purchase now $16.3m. Clearly it wants more.

Heron Resources (ASX: HRR) saw Minneapolis-based mining fund manager Castlelake increase its 22.31 per cent stake to 25.31 per cent. This was conducted off-market between Castlelake and fellow mining investor Pala.

IOOF increased its 6.09 per cent stake in KYCKR (ASX: KYK) to 7.19 per cent and the Commonwealth Bank hiked its 10.71 per cent stake in GR Engineering Services (ASX: GNG) to 11.97 per cent.

| Listed Company | Code | Market Cap | Purchaser | Past Stake | Present Stake |

|---|---|---|---|---|---|

| Blackstone Minerals | BSX | $9.8M | Deutsche Balaton Aktiengesellschaft | 0.1018 | 0.1192 |

| Eildon Capital | EDC | $46.5M | Joseph Ross | 0.0652 | 0.0753 |

| Mach7 Technologies | M7T | $25.9M | JM Financial | 0.0849 | 0.1058 |

| Mareterram | MTM | $37.9M | Sea Harvest International | 0.6349 | 0.6567 |

| MaxiTrans Industries | MXI | $60.2M | Spheria Asset Mgmt | 0.0516 | 0.066 |

| Myer | MYR | $468.1M | Wilson Asset Mgmt | 0.0546 | 0.0669 |

| CML Group | CGR | $100.6M | Naos Asset Mgmt | 0.1849 | 0.1953 |

| Cokal | CKA | $52.6M | Aahana | 0.0656 | 0.1597 |

| Factor Therapeutics | FTT | $4.1M | Pura Vida & associates | 0.1944 | 0.1997 |

| Integral Diagnostics | IDX | $403.7M | Vibumum Funds | 0.0614 | 0.0743 |

| Mareterram | MTM | $37.9M | Sea Harvest | 0.6567 | 0.6783 |

| Mercantile Invesment Company | MVT | $43.5M | Geoff Wilson | 0.096 | 0.126 |

| Spectrum Metals | SPX | $25.2M | Anthony Barton | 0.075 | 0.086 |

| Tambla Ltd | TBL | $9.9M | Kestrel Growth | 0.3041 | 0.3132 |

| TerraCom | TER | $250.1M | OCP | 0.1873 | 0.1892 |

| UsCom | UCM | $22.0M | Smart Top Overseas | 0.1688 | 0.1788 |

| White Cliff Minerals | WCN | $2.4M | Denman Income | 0.0657 | 0.1071 |

| Chant West Holdings | CWL | $7.2M | Carnethy Evergreen | 0.1975 | 0.1985 |

| Great Southern Mining | GSN | $8.3M | Terpu Group | 0.3804 | 0.3885 |

| Heron Resources | HRR | $163.1M | Castlelake LP | 0.2231 | 0.2531 |

| Middle Island Resources | MDI | $7.3M | Twynam Investments | 0.0647 | 0.0931 |

| Mercantile Investment Company | MVT | $43.5M | Phoenix Portfolios | 0.0627 | 0.0764 |

| Thorn Group | TGA | $71.7M | Somers | 0.081 | 0.106 |

| TPI Enterprises | TPE | $85.9M | Thorney Opportunities | 0.14 | 0.1701 |

| Angel SeaFood | AS1 | $23.7M | Bonafide Wealth Mgmt | 0.147 | 0.16 |

| Bass Metals | BSM | $30.7M | Rookharp Investments | 0.0599 | 0.0654 |

| ERM Power | EPW | $502.1M | Trevor Charles St Baker | 0.2584 | 0.269 |

| Metro Performance Glass | MPP | $83.4M | Accident Compensation Corporation | 0.0504 | 0.0652 |

| Marreterram | MTM | $38.6M | Sea Harvest | 0.6783 | 0.7079 |

| Virtus Health | VRT | $327.2M | Allan Gray | 0.0509 | 0.0611 |

| White Cliff Minerals | WCN | $2.8M | Denman Income Ltd | 0.1071 | 0.1215 |

| Angel SeaFood | AS1 | $23.7M | Bonafide Wealth Mgmt | 0.147 | 0.16 |

| Bass Metals | BSM | $30.7M | Rookharp Investments | 0.0599 | 0.0654 |

| ERM Power | EPW | $502.1M | Trevor Charles St Baker | 0.2584 | 0.269 |

| Metro Performance Glass | MPP | $83.4M | Accident Compensation Corporation | 0.0504 | 0.0652 |

| Marreterram | MTM | $38.6M | Sea Harvest | 0.6783 | 0.7079 |

| Virtus Health | VRT | $327.2M | Allan Gray | 0.0509 | 0.0611 |

| White Cliff Minerals | WCN | $2.8M | Denman Income Ltd | 0.1071 | 0.1215 |

| ADX Energy | ADX | $6.0M | Jetosea | 0.0925 | 0.117 |

| GR Engineering Services | GNG | $163.5M | CBA | 0.1094 | 0.1197 |

| Healthia | HLA | $57.6M | Glen Frank Richards | 0.0687 | 0.0734 |

| KYCKR Ltd | KYK | $7.7M | IOOF Holdings | 0.0609 | 0.0719 |

| Jiancheng International Group | JCI | $26.0M | Guopin Investment | 0.0856 | 0.1051 |

| Mareterram | MTM | $38.2M | Sea Harvest | 0.7079 | 0.7979 |

| Thorney Technologies | TEK | $57.9M | Thorney Holdings | 0.2218 | 0.2319 |

| Zip Co | Z1P | $583.2M | Regal Funds Mgmt | 0.0673 | 0.0779 |

Decreasing

Last week we reported IOOF sold a stake in Oliver’s Real Foods (ASX: OLI) that it had bought four months earlier – losing 62%. Since then, it sold another block of shares and lost 68%.

The $105,274 it netted from the sale of 2.9 million shares was well short of the $329,261 it would have cost at 11 cents per share in November. It has now sold two thirds of the shares it bought but still hold 11% in the company.

IOOF also reduced its stake in Uniti Wireless (ASX: UWL) from 15.4 per cent to 10.6 per cent. There has been some deal of saga surrounding its board.

Also this week, one new director bought nearly $1 million of stock.

Collins Street Asset Management, whose value fund was ranked by Morningstar as No 1 in Australia, reduced its stake in microcap Crowdmedia (ASX: CM8) from 6.7 per cent to 5.6 per cent.

Jupiter Asset Management cut its 8.3 per cent stake in Sky TV (ASX/NZX: SKT) from 8.3 per cent to 7.2 per cent. Perpetual reduced its stake in Rural Co (ASX: RHL) from 9.5 per cent to 8.4 per cent.

National Tyre and Wheel (ASX: NTD) boss Terence Smith saw his stake fall from 39.5 per cent to 31.3 per cent. This was due to a release of shares from escrow, a dilution and also a gift of his share to employees.

| Listed Company | Code | Market Cap | Seller | Past Stake | Present Stake |

|---|---|---|---|---|---|

| AVZ Minerals | AVZ | $102.7M | Huayou International Mining | 0.112 | 0.0949 |

| Hotel Property Investments | HPI | $511.4M | Investors Mutual | 0.1281 | 0.1152 |

| Oliver's Real Food | OLI | $8.0M | IOOF | 0.1225 | 0.1106 |

| Uniti Wireless | UWL | $49.1M | IOOF | 0.1538 | 0.1062 |

| Altura Mining | AJM | $256.2M | Shaanxi J&R Optimum | 0.1513 | 0.1397 |

| Alliance Aviation | AQZ | $334.7M | Kiowa Two Thousand Corporate Trustee | 0.1058 | 0.0699 |

| Atrum Coal | ATU | $91.1M | Lenark | 0.1211 | 0.0961 |

| Bowen Coking Coal | BCB | $13.3M | Area Coal | 0.0946 | 0.0801 |

| CropLogic | CLI | $8.6M | Managed Account Holdings | 0.0899 | 0.0733 |

| Lakes Oil | LKO | $32.8M | Gina Rinehart | 0.1119 | 0.0984 |

| National Tyre and Wheel | NTA | $53.4M | Terence Smith & Sussane Smith | 0.395 | 0.3134 |

| Sky TV (NZ) | SKT | $505.9M | Jupiter Asset Mgmt | 0.0828 | 0.0719 |

| Boss Resources | BOE | $85.6M | Davey Management | 0.112 | 0.0921 |

| Uniti Wireless | UWL | $49.1M | IOOF | 0.1062 | 0.0932 |

| CropLogic | CLI | $8.3M | Managed Accounts | 0.0733 | 0.0531 |

| Ruralco | RHL | $461.2M | Perpetual | 0.0951 | 0.084 |

| Venturex | VXR | $62.1M | Regent Pacific Group | 0.1552 | 0.1432 |

| Bowen Coking Coal | BCB | $11.1M | Cape Coal/Redel Resources/Gerhard Redelinghuys | 0.1769 | 0.1494 |

| Actinogen Medical | ACW | $62.6M | BVF Partners | 0.199 | 0.1943 |

| Citadel Group | CGL | $357.6M | Jakeman Holdings | 0.152 | 0.14 |

| FlexiGroup | FXL | $528.5M | Abercrombie Group | 0.2405 | 0.2301 |

| Jaxsta | JXT | $72.0M | Jaxsta | 0.4222 | 0.4076 |

| Liontown Resources | LTR | $28.6M | Timothy Goyder | 0.2049 | 0.1899 |

| Megaport | MP1 | $522.1M | Capital Group | 0.106 | 0.096 |

| Northern Minerals | NTU | $108.4M | Conglin Yue | 0.1443 | 0.1342 |

| Bardoc Gold | BDC | $46.2M | P&J Buttigieg Nominees | 0.0774 | 0.064 |

| Crowd Media Holdings | CM8 | $3.7M | Collins St Asset Mgmt | 0.0665 | 0.0561 |

| Galan Lithium | GLN | $28.8M | Hongze Group | 0.1406 | 0.1182 |

| Total Brain | TTB | $17.9M | Och-Ziff Holding | 0.089 | 0.071 |

| Zip Co | Z1P | $583.2M | Westpac | 0.1716 | 0.1571 |

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.