IOOF sells 6m Oliver’s shares for $260k – four months after buying them for $680k

Pic: Getty Images

After several sets of poor financial results, management at Oliver’s Real Food (ASX: OLI) are taking action to try and turn the company around.

They have overhauled the board, liquidated four subsidiary owned stores and sent a letter of reassurance to shareholders.

But the company’s second largest holder, IOOF (ASX: IFL), has sold 6 million shares, receiving $262,551.60.

Only four months earlier, IOOF bought 13 million shares in an 11 cent placement, through one of their funds co-operated with Perennial. The stake sold last Friday would have cost almost $680,000, representing a 62% loss.

IOOF first bought shares in Oliver’s in May 2018 and topped up its holdings monthly, reaching 23 million in October. Then in November it made its most recent purchase – at 11 cents.

But in the new year, Oliver’s shares have plunged and now sit at 3 cents.

Last Friday, IOOF decided to sell a chunk of its Oliver’s shares. It still holds 12.5% of Oliver’s and is the second largest shareholder. The largest is New Zealand not-for profit fund Haurauki Trust who hold over 17%.

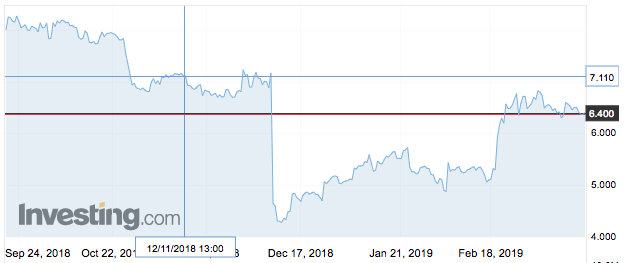

IOOF is down 10.53% since its ill-fated investment although it has recovered somewhat since its early December plunge – sparked by revealing APRA wanted to disqualify five of its executives.

- Subscribe to our daily newsletter

- Join our small cap Facebook group

- Follow us on Facebook or Twitter

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.