‘We don’t have a commercial future’: Factor boss on 97pc share price drop

Health & Biotech

Health & Biotech

Factor Therapeutics bosses say they are yet to make a decision on whether the company will be wound up, but all options are on the table after today’s collapse.

Factor (ASX:FTT) today became the latest biotech to plummet on the back of a failed clinical trial.

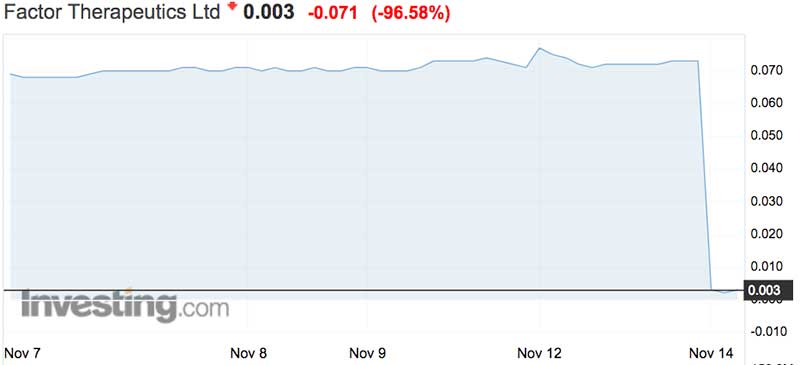

It was testing its wound-dressing drug VF001 to treat venous leg ulcers. But the trial failed and the stock was nearly entirely wiped out, closing 97 per cent to 0.2c — a record low after closing at 7.3c yesterday.

The business is now capped at just $1.7 million. More than $59 million was wiped from the stock the second the market opened.

More than 240 million shares were offloaded for a total of $500,000.

Outgoing CEO Dr Rosalind Wilson and chairman Dr Cherrell Hirst spoke to investors on a conference call after the news hit, telling investors their immediate focus was to halt all of the company’s activities as soon as possible.

“Our focus is on putting a stop to all company activities as quickly as possible,” Dr Wilson said.

“Part of that process is to downsize the company and we will need to re-evaluate our options going forward as a company,” Dr Hirst said.

As part of that downsizing, Dr Wilson will be stepping aside as CEO, which she told Stockhead was a mutual decision.

“The focus for the company is on downsizing and reducing costs and it is the right thing to do,” she said. “I knew that when I took the job on. I am completely comfortable, it is the best thing for the company and the shareholders.”

The call began in a sombre mood, with Dr Hirst saying that the previous data upon which they’d launched the Phase 2 clinical trial had not held up.

“We started with hope and belief based on the evidence we had that it would be effective and we could take it to market,” she said. “But the results were strongly negative and there was no ambiguity.”

“The healing observed in previous trials were likely related to the higher standard of care and attention that the patients received in the trial than they received before being enrolled,” Dr Wilson added.

The pair also said that the results did not show that the treatment was unsafe or ineffective, but that it was no improvement on the patients who received a placebo.

“For us to have taken it forward, it needed to be significantly more effective than current treatments and the placebo,” Dr Hirst said. “We don’t have a commercial future for VF001.

“We’ve not yet made a decision on whether to wind the company up, we are focusing on our intellectual property for the time being.

“We will be in touch with investors for as long as the company exists.”

Factor’s drug VF001 was undergoing assessment in a Phase 2 clinical trial for treatment of severe leg ulcers.

It was added to standard wound dressings and compression bandages. 157 patients were recruited for the trial.

But the company today told investors that on all three indicators — reduction in wound size, proportion of patients whose ulcers fully healed and time to achieve full healing — the drug had failed to provide any benefit whatsoever compared to placebo.

The company said all its Australian directors had committed to assessing the next steps on zero pay.

Investors were in shock this morning. It was one of the most-discussed companies on stock chat forum HotCopper: