Traders’ Diary: Everything you need to get ready for the week ahead

Traders Diary: The ASX economics and IPO calendar. Picture Getty

What grabbed the headlines last week?

Easing inflation

The US Fed’s preferred inflation gauge (the PCE index) grew just 5% from a year ago, confirming the recent trend of easing inflation.

The index was down from 5.2% last month, and from the 40-year high of 5.4% registered last February.

Unlike the better known consumer price index or CPI, the PCE index takes into account how consumers change their buying habits due to rising prices.

The latest data shows that personal spending, adjusted for changes in prices, rose 0.5% in October, the most since the start of 2022.

In Australia, the story is similar with the monthly gauge of Australian CPI showing that headline inflation in Australia fell to 6.9% YoY in October.

It was way below market expectations of 7.6% as food prices unexpectedly fell during the month.

“The RBA will be happy to hear that inflation was much lower than expected, even if it does remain historically high,” said Matt Simpson, senior market analyst at City Index.

The RBA will convene for its last meeting of the year on Tuesday, where experts expect another 25bp rise.

ANZ economists believe that the RBA cash rate will peak at 3.85% (from the current 2.85%), and that the RBA will not start cutting rates again until November 2024.

Goldman report says US will avoid a recession

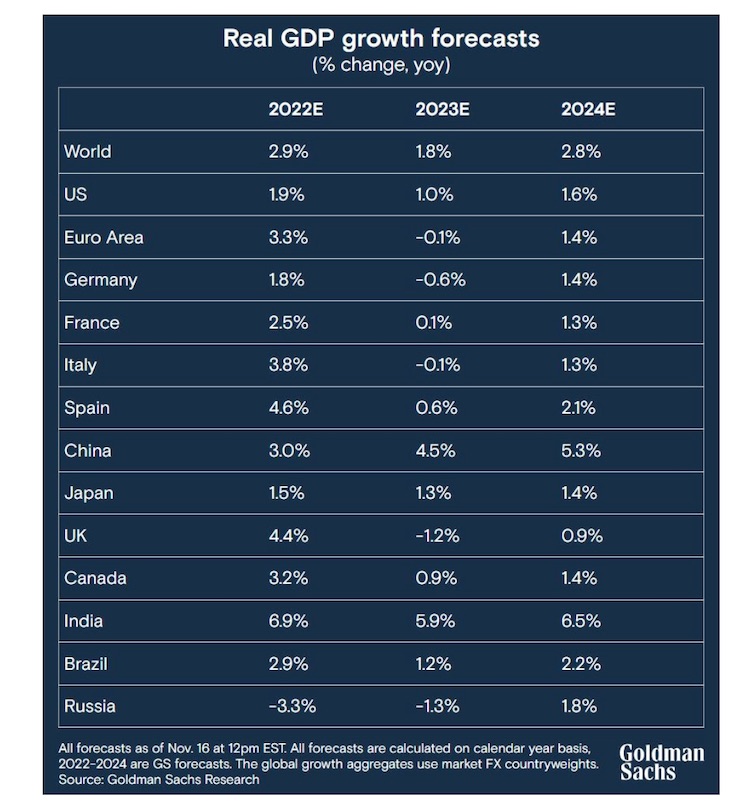

In its 2023 Outlook report, economists at Goldman Sachs expect the US to narrowly avoid a recession next year as Europe’s economy contracts.

Goldman however says there’s a 35% probability the US will tip into recession the year after, in 2024, an estimate that’s well below the median of 65% among forecasters in a Wall Street Journal survey.

“The US may avoid a downturn in part because data on economic activity is nowhere close to recessionary,” says the Goldman Sachs report.

Jan Hatzius, head of Goldman Sachs Research, said there are strong reasons to expect positive growth in the US in coming quarters.

“Real personal income (adjusted for inflation) is springing back from the drop during the first half of the year,” he said.

“Even as financial conditions have tightened and are now subtracting about 2 percentage points from growth, the rise in real income is likely to be the stronger force next year.”

Meanwhile, Goldman expects China to begin to relax its zero-Covid policy in April 2023.

China’s economic growth is poised to get a meaningful boost from reopening in the second half of the year that could extend into 2024.

“The Chinese property market will however remain a headwind,” says the report.

The Economic Calendar

Monday December 5 – Friday December 9

All sources from Commsec and Investingdotcom

Australia and New Zealand

MONDAY

Business indicators for the September quarter

Purchasing manager indexes for November

TUESDAY

CommBank household spending intentions

Housing spending indicator for October

Balance of payments for the September quarter

RBA meeting and interest rates decision

Value of dwellings for the September quarter

WEDNESDAY

National accounts for the September quarter

THURSDAY

Payroll jobs and wages

International trade for October

Speech from RBA Assistant Governor

Global

For US and EU, timezone is local

MONDAY

US Purchasing manager indexes for November

US factory orders for October

EU S&P Global Composite PMI for November

EU services PMI for November

EU Sentix investor confidence for December

EU retail sales for October

TUESDAY

US International trade for October

WEDNESDAY

EU employment change for Q3

EU GDP for Q3

China export and imports

THURSDAY

US weekly jobless claims

ECB President Lagarde speaks

FRIDAY

US producer prices for November

US consumer sentiment for December

China inflation for November

The ASX IPO calendar for this week

Important: listing dates taken from the ASX, and they could change at short notice.

Listing: December 5

IPO: $10m at $0.20

As our intrepid deputy editor Reubs is fond of reminding us, Patriot’s Etta mine once hosted spodumene crystals as long as 14m, dwarfing the mine workers who used to dig lithium at the South Dakota pegmatite mine between 1898 and 1960.

Patriot, chaired by former Tianqi Australia boss Phil Thick and led by experienced mining exec Matt Gauci, boasts three US hard rock lithium projects; Keystone (South Dakota) and Tinton West (South Dakota/Wyoming) in the Black Hills district, and Wickenburg in Arizona.

Thick says the US thematic is ‘very important’ with Patriot progressing plans to get drilling approval over the coming months.

“We will do whatever we can on the ground right from day one, like mapping and sampling, as we put in our applications for permits to drill,” he told Stockhead.

“In South Dakota that is a process that could be six to 12 months; it could be less, but we are being conservative there.

“Maybe in our Arizona project we will get to drilling earlier than that, but there is a lot of work for us to do in that first 6-12 months.”

Patriot Battery Metals (ASX:PMT)

Listing: December 7

IPO: $4.2m at $0.60

Ironically slated to list just two days after its namesake, the Ken Brinsden chaired PMT has already made its mark on the Canadian stock exchange.

But Brinsden thinks the best lithium investors are in Oz, where he hopes to garner support to develop a new spodumene hotspot in Quebec, Canada, perfectly placed to service the undersupplied North American battery supply chain.

It plans to have a maiden resource out early next year for the Corvette discovery in Canada’s James Bay region, a find that is already generating nearology plays.

Richmond Vanadium Technology (ASX:RVT)

Listing: December 7

IPO: $35m at $0.40

Formerly part of gold explorer Horizon Minerals (ASX:HRZ), Richmond Vanadium wants to bring its project of the same name to market with plans to start a BFS after listing.

The largest non-titanomagnetite vanadium deposit of its kind in the world, the company says it can produce a significant supply of vanadium for the steel and emerging energy storage markets over a 25-year initial life of mine.

Located 500km west of Townsville and 400km east of Mt Isa between the towns of Julia Creek and Richmond, the 1.8Bt deposit is located near the proposed Copper String 2.0 high voltage network line and Great Northern rail line to the Townsville Port.

It could also be the beneficiary of a commitment from the Queensland Government to lob at least $10m towards constructing a common user facility to process vanadium from the State’s deposits and kickstart a local battery storage industry.

Listing: December 8

IPO: $10m at $0.20

Taiton’s projects include the Lake Barlee gold project in WA, the Highway polymetallic project in SA, and the Challenger West gold project also in SA.

The company believes its dominant land holding at the Highway Project will allow it to potentially uncover the Next Elephant Deposit in Australia.

Taiton will be undergoing a series of grassroots exploration and also several walk-up drilling targets.

Listing: December 9

IPO: $6m at $0.20

A spin-out from Argonaut Resources (ASX:ARE), Orpheus is planning to explore for and discover greenfield uranium deposits in South Australia and the NT.

They have four projects in the NT – Woolner, Ranger North-East, Mt Douglas and T-bone – and two projects in SA – Frome and Cummins.

The decision to explore those jurisdictions is notable because they have hosted uranium mines and boast State and Federal regulatory systems that are supportive of the development of new uranium mines.

CEO Simon Mitchell told Stockhead at the IMARC conference in Sydney last month a recent run in uranium spot prices was ‘only the start’ thanks to a dearth of exploration since the early 1990s decades.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.