Q+A: Upcoming IPO Patriot Lithium is hunting hard rock paydirt near the biggest spodumene crystals ever found

Picture: Getty Images

Lithium IPOs have been the closest thing investors have to a sure thing in 2022.

Atlantic Lithium (ASX:A11), Oceana Lithium (ASX:OCN), Lithium Plus Minerals (ASX:LPM), Green Technology Metals (ASX:GT1) and Winsome Resources (ASX:WR1) have handsomely outperformed (most of) the broader IPO market with gains of between 50-350%.

Next cab off the proverbial rank is Patriot Lithium (ASX:PAT), which is planning to list in December after selling 50m shares at 20c in an IPO to raise $10m.

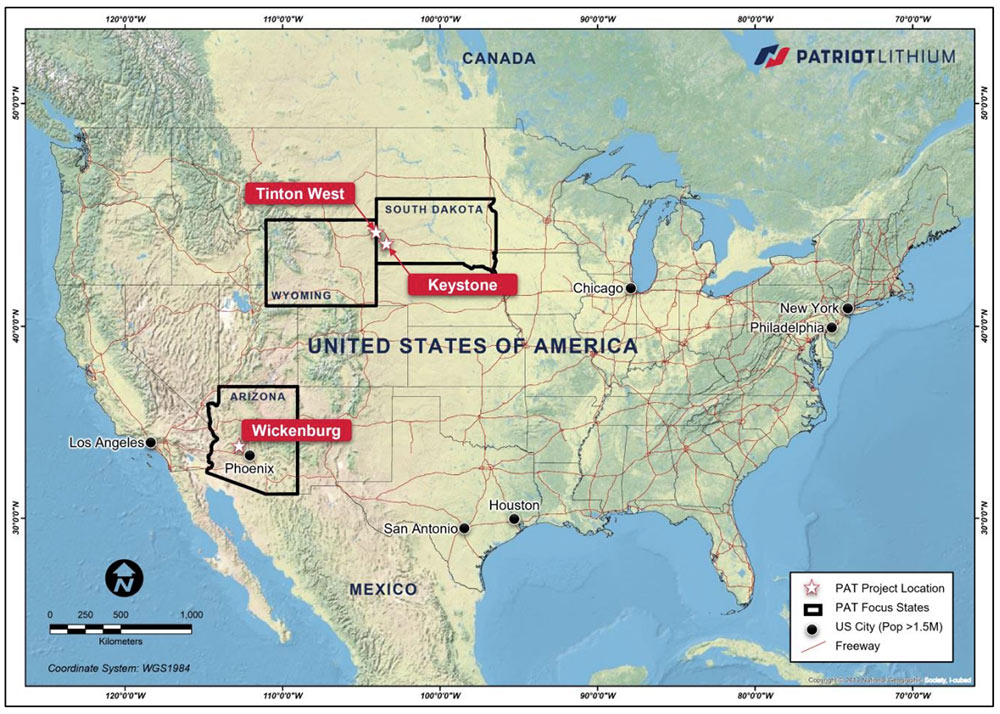

Patriot will list with three US hard rock lithium projects; Keystone (South Dakota) and Tinton West (South Dakota/Wyoming) in the Black Hills district, and Wickenburg in Arizona.

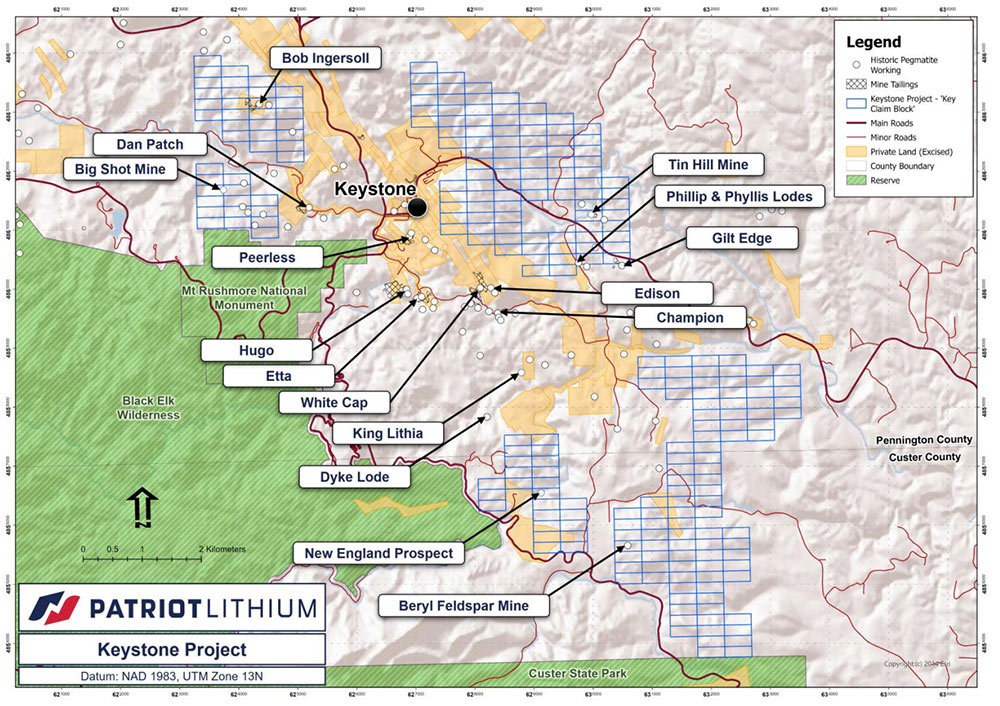

Keystone is down the road from the historic Etta mine, an important global lithium source between 1898 and 1960.

At times, it was the main source of spodumene in the world and yielded the largest (up to 14m long) spodumene crystals ever mined.

That’s right — 14m long. Here’s some proof:

Despite this, the company’s Black Hills projects are underexplored, the company says.

Running the Patriot show are highly experienced lithium execs Phil Thick and Matt Gauci. For five years, Thick headed up Tianqi Lithium Australia, a subsidiary of Tianqi Lithium Corp, one of the world’s largest lithium companies.

Gauci has more than 20 years’ experience as a senior mining exec and previously built one of the Pilbara’s largest lithium exploration portfolios, which was eventually sold to major lithium company SQM.

Stockhead caught up with Thick to chat about gigantic crystals, Patriot’s plans after listing, and the enormous US lithium opportunity.

Let’s start with an overview of the company and the plans you have for listing.

“I joined the board last year, but Patriot Lithium was put together a couple of years ago targeting North American opportunities, predominantly in the US,” Thick says.

“We saw that as the sweet spot in the current market, given the USA’s dependence on the rest of the world for its battery minerals, particularly lithium.

“That was clear and recognisable a couple of years ago even before the US government took some serious steps around that position.

“The government is now throwing a lot of money at domestic battery minerals in general for self-sufficiency, and that’s an important piece in our story.

“The company spent 2-3 years looking at the best options and have reached a point where we have three prospective projects signed off and ready to go.

“That’s why we are going to market. We are raising between $8-10m, but we are very confident we will get the $10m easily.

“We are being a bit conservative in terms of dollars [raised] but that will cover our needs to explore and hopefully prove up one of these three – if not all three – projects and take the next step towards mining them.”

You say in the prospectus that you looked at about 30 projects before you settled on these three. What made the Black Hills projects in particular stand out?

“We think Black Hills is probably the most highly prospective area in the US,” Thick says.

“It is our focus. There has been a lot of mining activity over a long time at Black Hills – including a history of mining lithium pegmatites over several years — but it is all fairly small scale.

“Not a lot of drilling activity or deeper exploration has been conducted.

“There is certainly enough evidence on the surface to suggest that there is a high prospect of success.”

I just saw photos of the Etta mine. I didn’t even know spodumene crystals could get 14m long.

“Well, neither did we. We when first saw those images we though they were a good Photoshop, but no,” Thick says.

“There are a lot of spodumene crystals at surface right across this area that are much smaller than that, 1-2m, which is still significant.

“If you have this evidence at the surface, there’s a high chance you are going to find something at depth as well.”

Both Matt and yourself know lithium well.

“We have a very solid team,” Thick says.

“Matt brings a lot of experience with smaller end companies, and he has done that multiple times very successfully.

“My experience is probably five or six years of working with Tianji Lithium in Perth and running their Australian operations.

“Back in 2016 I think the only operating mine in WA was Greenbushes, which we owned 51% of. At the time Pilbara Minerals and the others were just starting up, so I’ve probably been involved in lithium as long as anyone has in WA.

“Not directly in the mining space, but certainly right across the business. That gives me a good breadth of experience to be able to contribute.

“[Dr] Oliver Kreuzer is another one of our directors who is right in the heart of this. He has been working for the last two, three years with Matt on choosing the best prospects and putting those in place.”

What are your initial exploration plans?

“We will do whatever we can on the ground right from day one, like mapping and sampling, as we put in our applications for permits to drill.

“In South Dakota that is a process that could be six to 12 months; it could be less, but we are being conservative there.

“Maybe in our Arizona project we will get to drilling earlier than that, but there is a lot of work for us to do in that first 6-12 months.”

What makes Patriot a good investment?

“We are in the right jurisdiction, at the right time,” Thick says.

“The lithium market remains hot. Yes, there’s debate whether it will come off, but prices are at record levels — it can come off and still be hugely commercial.

“No one really believes the supply demand curve will flip at any point in the next few years. And the US thematic is very important.

“The potential in that market is enormous, and if we can find something it has huge potential for us.”

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.