Last week’s ASX small cap winners: which stocks made it look easy

Gold Medallist Kevin Mayer of France made it look easy at the IAAF Championships in England this week. Pic: Getty

ASX Small Cap Winners Mar 5-9

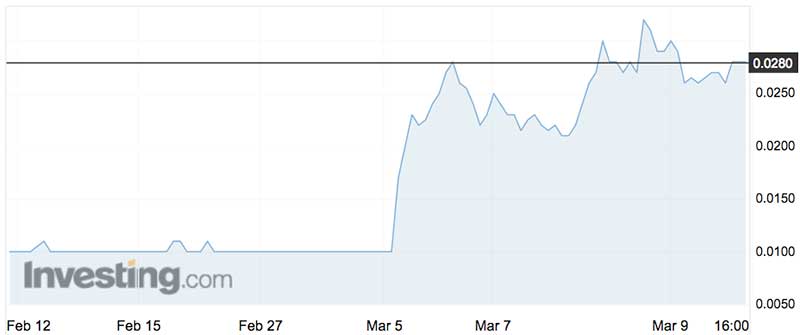

Cancer drug developer Bard1 Life Sciences (ASX:BD1) was the winner of the week, up 160 per cent to 2.6c.

Bard1 touched 3.3c on Thursday after telling investors on Tuesday that independent testing confirmed high accuracy for detection of ovarian cancer with 89 per cent sensitivity (the number of patients correctly identified as having cancer) and 82 per cent specificity (the number of people identified as not having cancer).

The results follow previously announced study results from January — confirming the test’s robustness and potential utility as a diagnostic aide for early detection of ovarian cancer, the company says.

Gold producer Blackham Resources (ASX:BLK) made something of a recovery last week after telling investors it had logged another record month of gold production.

The shares surged 62 per cent for the week to close at 8.1c compared to 5c the previous Friday.

Record production hit 6713 ounces for February, topping the previous record of 6498 ounces in January.

Blackham is well down on its high of 54c a year ago, however.

The company’s loss from continuing operations for the December half was $14.4 million.

Blackham, which began commercial production at its Matilda-Wiluna mine in Western Australia at the start of 2017, has been bogged down with problems including missed production targets and high costs.

Cancer drug developer Patrys (ASX:PAB) has continued to soar since after the announcement of positive results on February 28.

The stock was up 70 per cent this week to 5.6c — on top of a 50 per cent jump last week to 3.3c.

Last month Patrys reported evidence to show its brain tumour treatment could cross the blood-brain barrier and reduce the size of growths.

- Bookmark this link for small cap breaking news

- Discuss small cap news in our Facebook group

- Follow us on Facebook or Twitter

- Subscribe to our daily newsletter

The last trial showed drug candidate PAT‐ DX1 killed cancer cells in the lab, and the latest one shows that is works on mice with human glioblastoma tumour implants as well.

Patrys will now prepare for clinical trials in 2019.

Troubled law firm Slater and Gordon (ASX:SGH) has continued to ralley.

It closed up 42 per cent this week after rejoining the All Ords.

The law firm updated the market last week with half-year results from its “transformation” program.

Slater and Gordon reported an 18 per cent fall in revenue to $96 million for the December half and a net loss of $21.2 million. But fundamentals were strong and rationalisation of its operations were progressing, the firm said.

The shares hit a low of $1.18 last month compared to a 12-month high of $15 a year ago.

They finished this week at exactly $4.

Positive results sent Immuron (ASX:IMC) on a wild ride this week.

The shares traded as high as 55.5c on Thursday after news of positive study results for its anti-inflammation drug.

Profit-takers then pushed the stock back down to 39c at the close on Friday — still up 44 per cent for the week.

The Aussie drug-maker is developing and commercialising treatments for inflammatory and infectious disease, starting with liver enzymes for patients with NASH — a disease that causes liver damage.

“This is truly a proof-of-concept for this first-in-class drug candidate. The potential clinical applications for this drug candidate are numerous and very exciting indeed,” said the study’s lead investigator Professor Arun Sanyal.

Junior nickel and copper play Boadicea Resources (ASX:BOA) surged 38 per cent to 18c after starting a follow-up electromagnetic survey.

Earlier this year Boadicea reported four significant anomalies at the Bell Ringer project targeting nickel and copper in Western Australia.

Now, the survey will refine the anomalies ahead of priority drill testing. First results are expected in three to four weeks.

Here are last week’s best performing ASX small cap stocks:

Scroll for full list. This table may be best viewed on a laptop or desktop.

| Ticker | Name | One-week price change | Price Mar 9 | Price Mar 2 | Market Cap |

|---|---|---|---|---|---|

| BD1 | BARD1 LIFE SCIENCES | 1.6 | 0.026 | 0.01 | 21517876 |

| PAB | PATRYS | 0.69696969697 | 0.056 | 0.033 | 54034124 |

| BLK | BLACKHAM RESOURCES | 0.62 | 0.081 | 0.05 | 102504600 |

| AFT | AFT CORP | 0.5 | 0.0015 | 0.001 | 9020528 |

| GGX | GAS2GRID | 0.5 | 0.003 | 0.002 | 3097227.25 |

| RMT | RMA ENERGY | 0.5 | 0.003 | 0.002 | 6300707 |

| IMC | IMMURON | 0.444444444444 | 0.39 | 0.27 | 60778268 |

| 1AG | ALTERRA | 0.428571428571 | 0.06 | 0.042 | 9477599 |

| SGH | SLATER & GORDON | 0.423487544484 | 4 | 2.81 | 276718400 |

| BOA | BOADICEA RESOURCES | 0.384615384615 | 0.18 | 0.13 | 8814541 |

| MSP | MAXSEC GROUP | 0.375 | 0.022 | 0.016 | 10384240 |

| RAP | RESAPP HEALTH | 0.333333333333 | 0.14 | 0.105 | 82379952 |

| EMP | EMPEROR ENERGY | 0.333333333333 | 0.004 | 0.003 | 3463431 |

| MEM | MEMPHASYS | 0.333333333333 | 0.002 | 0.0015 | 4458829 |

| TMZ | THOMSON RESOURCES | 0.333333333333 | 0.06 | 0.045 | 5186407.5 |

| HXG | HEXAGON RESOURCES | 0.314285714286 | 0.23 | 0.175 | 54005152 |

| GMN | GOLD MOUNTAIN | 0.3 | 0.13 | 0.1 | 59241408 |

| CT1 | CCP TECHNOLOGIES | 0.3 | 0.026 | 0.02 | 8392282 |

| AOA | AUSMON RESOURCES | 0.285714285714 | 0.009 | 0.007 | 2573475.5 |

| SMI | SANTANA MINERALS | 0.285714285714 | 0.018 | 0.014 | 4739723 |

| WRR | WORLD REACH LIMITED | 0.285714285714 | 0.18 | 0.14 | 7402283.5 |

| RES | RESOURCE GENERATION | 0.283333333333 | 0.077 | 0.06 | 40696624 |

| ACB | A-CAP RESOURCES | 0.277777777778 | 0.046 | 0.036 | 38362936 |

| ADR | ADHERIUM | 0.265060240964 | 0.105 | 0.083 | 20001598 |

| AVD | ANTILLES OIL AND GAS NL | 0.25 | 0.025 | 0.02 | 3746669 |

| IVX | INVION | 0.25 | 0.02 | 0.016 | 117455472 |

| SBI | STERLING PLANTATIONS | 0.25 | 0.01 | 0.008 | 520000 |

| IGE | INTEGRATED GREEN ENERGY SOLU | 0.25 | 0.25 | 0.2 | 74088928 |

| KGD | KULA GOLD | 0.25 | 0.03 | 0.024 | 11269741 |

| OEC | ORBITAL CORP | 0.246376811594 | 0.43 | 0.345 | 37524068 |

| BNO | BIONOMICS | 0.24358974359 | 0.485 | 0.39 | 226736016 |

ASX Small Cap Losers Mar 5-9

Besieged franchiser Retail Food Group lost 42 per cent to $1.18 after the closure of 66 stores in the December half — a period in which RFG posted a loss of $87.8 million.

On top of those closures, RFG may be forced to close more than a third of its Australian operations over the next three years according to investment bank UBS.

UBS said additional closures would likely focus on food outlets in RFG’s network of franchised stores, including Michel’s Patisserie, Donut King and Gloria Jeans. The number of closures could reach 450 by 2020, UBS believes.

Analysts from the bank have also downgraded their earnings forecasts and put a sell-rating on the company’s stock (ASX:RFG), with a target price of 90c.

Junior miner MetMinco (ASX:MNC) plunged 59 per cent his week but told the ASX it had no unnannounced information to explain an increase in trading.

MetMinco announced on Monday it would be undertaking a seven-for-two renounceable rights issue at 1c to raise up to $5.1 million.

The money will speed up a gold exploration program in Colombia.

The company said it was in the process of appointing a new board and executive team.

The shares closed Friday at 1.6c, down from 3.9c seven days earlier.

Here are last week’s worst performing ASX small cap stocks:

Scroll for full list. This table may be best viewed on a laptop or desktop:

| Ticker | Name | One-week price change | Price Mar 9 | Price Mar 2 | Market Cap |

|---|---|---|---|---|---|

| NOX | NOXOPHARM | -0.224080267559 | 1.16 | 1.495 | 118479528 |

| LBT | LBT INNOVATIONS | -0.225 | 0.155 | 0.2 | 23804856 |

| CAE | CANNINDAH RESOURCES | -0.22641509434 | 0.041 | 0.053 | 5810490.5 |

| FYI | FYI RESOURCES | -0.230769230769 | 0.1 | 0.13 | 15871092 |

| NME | NEX METALS EXPLORATION | -0.25 | 0.021 | 0.028 | 3207056 |

| AJC | ACACIA COAL | -0.25 | 0.0015 | 0.002 | 3161401.75 |

| BDI | BLINA MINERALS NL | -0.25 | 0.0015 | 0.002 | 6470824 |

| PRL | PETREL ENERGY | -0.25 | 0.003 | 0.004 | 5057804 |

| ROG | RED SKY ENERGY | -0.25 | 0.003 | 0.004 | 1826183.75 |

| RNL | RISION | -0.25 | 0.003 | 0.004 | 5530184 |

| SHK | STONE RESOURCES AUSTRALIA LT | -0.25 | 0.003 | 0.004 | 2408631.5 |

| IEC | INTRA ENERGY CORP | -0.25 | 0.015 | 0.02 | 7366756.5 |

| FE8 | FASTER ENTERPRISES | -0.28 | 0.054 | 0.075 | 5987812 |

| AS1 | ANGEL SEAFOOD HOLDINGS | -0.282051282051 | 0.14 | 0.195 | 16953016 |

| HDY | HARDEY RESOURCES | -0.285714285714 | 0.005 | 0.007 | 5096578 |

| DSX | DECIMAL SOFTWARE | -0.305555555556 | 0.025 | 0.036 | 8841648 |

| RXH | REWARDLE HOLDINGS | -0.318181818182 | 0.015 | 0.022 | 4914638 |

| MXR | MAXIMUS RESOURCES | -0.333333333333 | 0.001 | 0.0015 | 3027302 |

| PPY | PAPYRUS AUSTRALIA | -0.333333333333 | 0.016 | 0.024 | 3538392.25 |

| GWR | GWR GROUP | -0.34375 | 0.21 | 0.32 | 51761356 |

| EPM | ECLIPSE METALS | -0.363636363636 | 0.007 | 0.011 | 6892044.5 |

| GLA | GLADIATOR RESOURCES | -0.375 | 0.005 | 0.008 | 4326002 |

| BMG | BMG RESOURCES | -0.380952380952 | 0.013 | 0.021 | 5018482.5 |

| RFG | RETAIL FOOD GROUP | -0.419117647059 | 1.185 | 2.04 | 217467152 |

| CUL | CULLEN RESOURCES | -0.5 | 0.001 | 0.002 | 2598560.25 |

| FCR | FERRUM CRESCENT | -0.5 | 0.001 | 0.002 | 3055281.5 |

| JVG | JV GLOBAL | -0.5 | 0.001 | 0.002 | 2506445.25 |

| LKO | LAKES OIL NL | -0.5 | 0.001 | 0.002 | 55211136 |

| SSN | SAMSON OIL & GAS | -0.5 | 0.001 | 0.002 | 3283000.5 |

| MNC | METMINCO | -0.589743589744 | 0.016 | 0.039 | 2544006 |

| ORM | ORION METALS | -0.6 | 0.02 | 0.05 | 7701949 |

| ARK | AUSROC METALS | -0.83 | 0.17 | 1 | 16905664 |

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.