Blackham misses the target again as gold production dips

Blackham Resources says it produced 14,922 oz of gold in the last quarter, down 4.5 per cent on the prior period.

The company (ASX:BLK) had expected its open pit mine to be cash flow positive this quarter, but didn’t provide any financial data to indicate whether this has happened.

The gold miner is scrambling to refinance $15 million of a total $38 million loan to Orion Fund by January 15, after missing a December payment deadline.

It is planning a $36 million entitlement issue after that to recapitalise the company. On Friday it said it had $10 million in cash and bullion in the bank.

Blackham lost a debt package in December after funder Pacific Road walked away. Although the terms were harsh, it would have solved the company’s financial problems.

Lower grades

Blackham said December was a good month, providing some of the highest grades of gold milled so far.

It got an average mill feed grade of 1.6 grams per tonne (g/t) from the M4 and Galaxy pits during December, with a total monthly production of 8,038 oz.

However, the full quarter was a different story.

The average quarterly grade was 1.1 g/t, compared to 1.4 g/t in September and 1.3 g/t in June.

Blackham says waste stripping during calendar 2017 has given it access to “high grade ore zones” in its open pit areas.

It’s built stockpiles of 51,000 tonnes with a grade of 1.6 g/t, and drilling has produced results ranging between a 20 metre-long intercept with a grade of 1.85 g/t of gold, and a 6 metre intercept at 4.13 g/t. Most of the grades found were between 2g/t and 3 g/t.

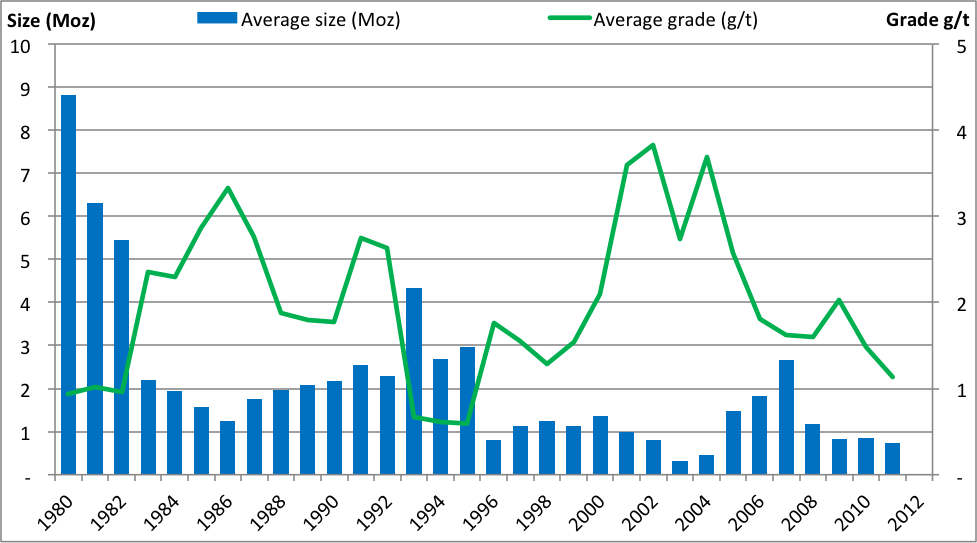

Anything between 1.5 g/t and 5 g/t tends to be considered medium grade rather than high, but in Australia grades have tended to be lower as the better areas have been mined.

According to the Minerals Council of Australia, companies are increasingly focusing on brownfields sites – like Blackham’s Wiluna mine – and this has pushed average gold grades down to 1 g/t.

No financials this time

Unlike in prior quarters, Blackham did not provide any indication of what their costs have been for the December period.

According to Stockhead calculations based on financial data from the three quarters to the end of September, the company had an average All In Sustaining Cost (AISC) — that is, costs including all expenses — of $2200/oz.

But in the September quarter is was selling gold at an average of $1617/oz, a sizeable loss.

It said at the time that heavy rainfall in the early months of 2017, the need to fix an unstable mine wall, and the need to strip a lot of waste from the open pit mines delayed and lowered production rates.

“Strip ratio for remaining oxide reserves is expected to reduce to 7:1 (waste:ore) from 16.5:1 in first half [of] FY18,” the company said.

In the September quarter, Blackham sold its gold for $1601/oz with cash costs (those without other expenses included) of $1390/oz.

On similar numbers the company would have made $23.9 million in the last quarter. The cash cost would be $20.7 million and the total AISC would be $32.8 million.

Blackham has been suspended from trade since mid-November.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.