The Ethical Investor: Investing in the circular economy with Close the Loop’s CEO, Joe Foster

We look at plastics recycling in this week’s Ethical Investor. Picture: Getty Image

The Ethical Investor is Stockhead’s weekly look at ESG moves on the ASX. This week’s special guest is Close the Loop’s CEO, Joe Foster.

Over the past two weeks, we saw large parts of the east coast being engulfed by flood waters caused by some of the heaviest rainfall in recorded Australian history.

The flooding has displaced thousands of people and forced PM Scott Morrison to declare a national emergency.

In Lismore, a record 14-metre flood peak flattened the town of 44,000 people.

As reported by the ABC, hundreds of protesters gathered at the Lismore City Council on Wednesday to await PM Morrison’s visit. The protestors had blamed the federal government’s lack of action on climate change for the floods.

Some brandished signs saying “this isn’t strange, it’s climate change”. Others chanted: “the water is rising, no more compromising”.

Their grievance has been backed by a recent 2,600 page dossier issued by the Intergovernmental Panel on Climate Change (IPCC), which found that this supposedly “one-in-100-year flood event” could potentially happen “several times a year”.

The report also said that some coastal areas of Australia will be lost as sea levels rise, which will be made worse by more intense storms.

Plastic is part of the problem

Plastic pollution has become a global crisis, which science says has contributed to flooding and climate change.

As our climate changes and the planet gets hotter, plastic breaks down into more methane and ethylene, increasing the rate of climate change and perpetuating the cycle.

And what most people don’t realise is that plastics originate from fossil fuels.

In fact, the World Bank says the plastic industry accounts for about 6% of global oil consumption, and is expected to reach 20% by 2050.

Due to the energy-intensive processes required to extract and distill oil, the production of plastics generates enormous amounts of greenhouse gas (GHG) emissions.

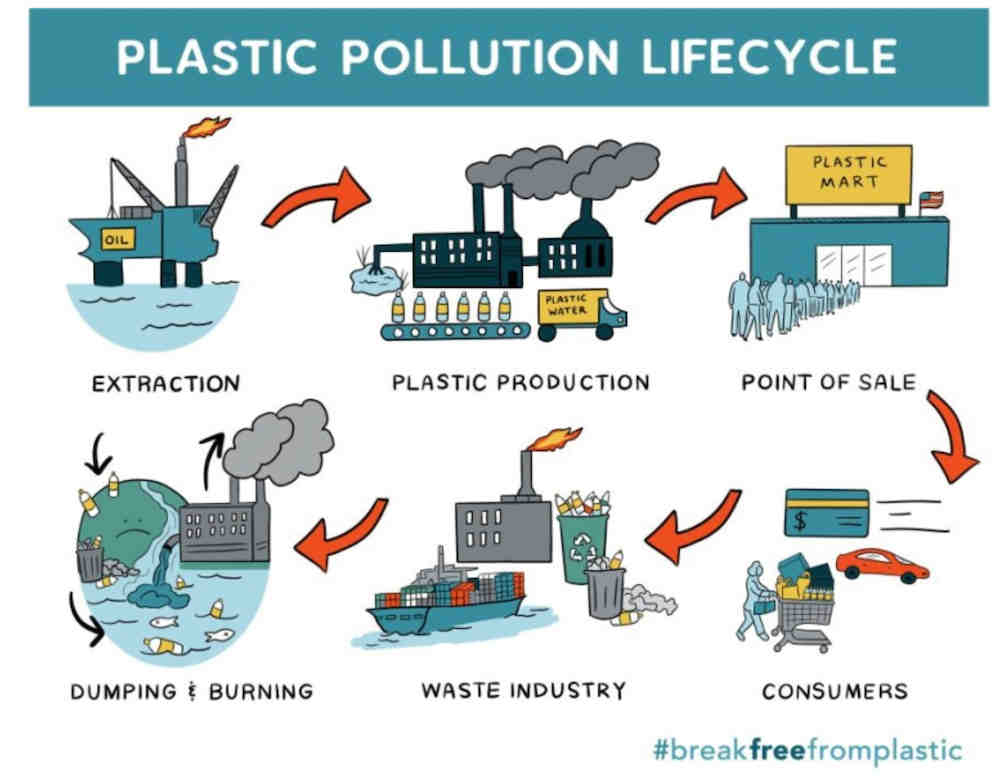

According to World Bank, there is a vicious cycle from the use of plastics that continues to damage our planet::

There’s some good news

It appears though that the world is finally coming together on this issue.

On March 2, 175 countries in the UN have agreed to develop a legally binding, global agreement aimed at ending plastic waste.

Described as the most meaningful environmental treaty since the Paris climate agreement of 2015, the resolution addresses the full lifecycle of plastics — from production to disposal.

The resolution establishes an intergovernmental negotiating committee, which will begin meeting on the new plastic treaty later this year with the aim of finalising it by the end of 2024.

What about Australia? What are we doing about plastic recycling, and how can we create a circular economy that avoids the use of single use plastic?

To understand more about the issue, Stockhead reached out to Joe Foster, who is the CEO of ASX-lister Close the Loop (ASX:CLG).

Interview with Joe Foster, CEO of Close the Loop

Close the Loop (ASX:CLG) is an Australian sustainable packaging company focusing on the circular economy.

It creates packaging products that includes recyclable and made-from-recycled contents. The company also collects, sorts, reclaims and reuses resources that would otherwise go to landfill.

CLG is headed by Foster, a 40-year plus veteran of the packaging industry who founded O.F. Pack way back in 1998 in South Africa.

O.F. Pack merged with Australia’s Close the Loop to become the ASX-listed company we know today.

Tell us more about CLG’s circular process

“When we start designing the packaging, it would take anything up to three to five weeks from a manufacturing point of view,” Foster told Stockhead.

“What’s interesting is that depending on the type of product, we will design the packaging materials to suit that product in terms of the shelf life.

“If we take the food industry for example, you may have a packaging or packed product in the supermarket that could be from five days to one month, or even six months of shelf life.

“So we design the packaging material to ensure the product would remain fresh and safe within that period of time.

“We also work closely with REDcycle, an organisation that partners with Coles and Woolworths where consumers have the ability to take back their plastic waste to the store.

“Those plastic materials then get picked up by REDcycle and sent across to Closed the Loop’s facility here in Somerton Melbourne, where we process those plastic materials within a couple of weeks.”

How many times can a material be recycled?

“As you know, the more times you recycle these plastic materials, the less benefits and performance you’re going to get from these materials,” Foster said.

“It’s difficult to say exactly how many times a material can be recycled, because that depends on the distinct materials that are being recycled.

“There are many different types of plastic materials, such as different types of polyethylene and polypropylene that makes it very difficult to single out an individual plastic material and say, that can be recycled five times or 10 times.

“PET bottles are a great example of closed circularity. Because they’re made from a single type of plastic material, they’re very easy to recycle.

“The PET bottles can be processed and go back to the full circle economy many times, because as these products come out of the plastic recycling facility, they will be blended with virgin material together with a secondary source of material.”

Tell us more about the ‘urban mining’ opportunities that CLG is currently pursuing

“When we talk about urban mining opportunities, we’re not just talking about soft plastics,” Foster said.

“We’re also talking about the printer cartridges, e-waste, cosmetics, power tools, battery recoveries, and even mobile phone covers.

“In the case of toner cartridges, we engage with the major OEMs of these products, where they collect from over 60,000 collection sites in Australia, and 200,000 collection sites in America.

“They then bring them to our processing plants, where we either repurpose them back into new toner ink and cartridges, or we break those cartridges and sell off the the plastic and ferrous metal components.

“Recently we’ve invested in equipment in North America that can clean up the plastic even further, which allows us to sell that plastic back to the OEMs, who in turn will use them to make new cartridges.

“And that’s really a true circular economy.”

Give us an example of the end product you’re making

“As an example, we take the waste toner from the cartridge, blend the toner with the soft plastics and some other key ingredients, and we make them to what we call Tonerplas,” said Foster.

“It’s a specialised additive for asphalts for the roads in Australia, which will give longevity in terms of road’s shelf life.

“Currently, we’ve just completed two major projects using Tonerplas. One is the M80 freeway, and the other is the Monash freeway upgrade here in Victoria.”

Are we behind when it comes to plastic regulations?

“I don’t think Australia is behind on regulations,” Foster explained.

“I do believe that Australia is following the same targets that have been put out in Europe and the UK, so we’re very much on the same level.

“The Australian government has actually been forward thinking for a number of years, in terms of the policies they’ve put in place in 2019 with the National Waste Action Plan (NWAP).

(Note: The NWAP is driving Australia’s plans to regulate waste exports, reduce total waste by 10% per person by 2030, and recover 80% of all waste by 2030.)

“What happened in the past was, these plastic waste were going to Asia and China. When China banned the import of plastic waste back in 2017, there is suddenly a race to to find an end market.

“It does take businesses like Closed the Loop to really disrupt the market, to try and make the changes rather than waiting for the industry to come to us.”

Close the Loop share price today:

On the ASX, other stocks that focus on the renewable packaging space include: Secos Group (ASX:SES), Amcor (ASX:AMC), and Papyrus Australia (ASX:PPY).

Other ESG news on the ASX this week

As reported by Stockhead’s green expert, Jessica Cummins:

On Wednesday, Aussie gas and electricity company Origin announced the buy-back of $250 million in shares starting in April, as part of a strategy refresh in response to the continuing, rapid transition of the National Electricity Market (NEM).

In its presentation to shareholders, the company outlined its plan to lead the transition to net-zero through cleaner energy and customer solutions.

Origin has been steadily divesting its fossil fuel assets, the latest being its 10pc share in Australia Pacific LNG to global energy investor EIG Partners worth $2bn.

Macquarie’s Green Investment Group (GIG) has revealed plans to launch a new offshore wind business – Corio Generation – set to kick off next month with a project pipeline of more than 15 GW.

Macquarie says Corio will take projects from origination through development and construction, and into operations.

It will build on GIG’s existing portfolio – which includes previously announced projects in UK, Europe, Taiwan, Korea, and Australia.

Share prices today:

The views, information, or opinions expressed in the interview in this article are solely those of the interviewee and do not represent the views of Stockhead.

Stockhead has not provided, endorsed or otherwise assumed responsibility for any financial product advice contained in this article.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.