ASX Green Energy Stocks: Origin outlines net-zero strategy with $250m buyback

Origin Energy's 2,880 megawatt Eraring plant in NSW will now close in 2025. Pic: Getty

Aussie gas and electricity company, Origin Energy (ASX:ORG) has revealed this morning it will buy back $250 million shares starting in April as part of a strategy refresh in response to the continuing, rapid transition of the National Electricity Market (NEM).

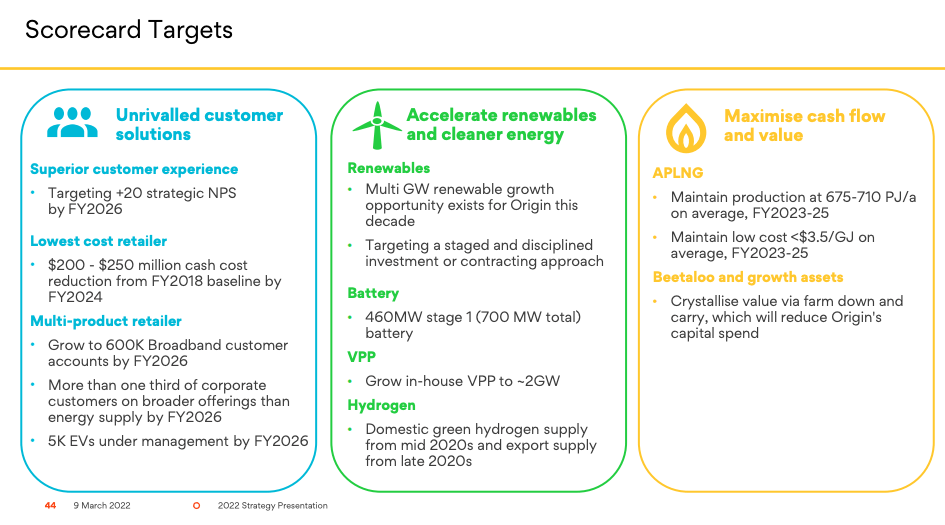

In its latest presentation to shareholders, the company outlined its plan to lead the transition to net-zero through cleaner energy and customer solutions.

ORG chief executive officer Frank Calabria said the company was in a “strong financial position” with a robust outlook for the business and capital structure “comfortably” within its target range.

“This means we are now in a position to increase shareholder distributions with a share buyback of $250 million,” he said.

“Going forward, we will continue to balance expected increased cash flow available for shareholder distributions with growth investments.”

Origin has been steadily divesting its fossil fuel assets, the latest being its 10pc share in Australia Pacific LNG to global energy investor EIG Partners worth $2bn.

At the time, the company said the divestment would not change Origin’s role as upstream operator, responsible for the upstream exploration, development, and production activities.

“The material cash injection from this divestment provides further flexibility to deliver returns to shareholders and pay down debt, while allowing Origin to accelerate investment in growth opportunities,” Calabria said.

Since then, the company announced the closure of its coal-fired Eraring Power Station – the largest of 16 remaining coal power plants supplying the NEM – seven years earlier than expected.

Origin said the company is strategically positioned to benefit from the energy transition through growth opportunities such as energy retailing, providing a diverse portfolio of energy supply in a low-carbon post-Eraring world, gas production and wholesaling, and its investment in British renewable energy group, Octopus Energy.

Early results from soil carbon and nutrient retention trials

Emerging mineral processing tech company, Zeotech (ASX:ZEO) says it has achieved “promising” early-stage results form pilot-scale trials which have highlighted the potential to sequester long-term soil carbon.

The trails found that treatments containing ZEO products “consistently exhibited higher organic matter/carbon contents” than controls for all soil and organic amendment conditions.

This program, undertaken by Griffith University, was designed to validate ZEO’s products for applications in two high potential areas of carbon markets and agricultural nutrient management.

“Achieving organic soil carbon protection levels averaging 25% compared with controls, combined with high nutrient carrying capacity and slow-release potential are exciting early findings,” Griffith University Dr Chris Pratt said.

The results will inform the design of larger trials set to kick off within weeks and further validate Zeotech’s commitment to developing solutions for sustainable farm productivity.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.