The Ethical Investor: Deciphering the alphabet soup of ESG regulations with BDO’s Catherine Bell

Ethical Investor 8 April. Picture: Getty

- The alphabet soup of regulations are confusing ESG investors

- Stockhead provides a summary of the most important legislations out there

- A chat with ESG expert Catherine Bell of BDO Australia

The Ethical Investor is Stockhead’s weekly look at ESG moves on the ASX. This week’s special guest is BDO Australia’s Catherine Bell.

Investments into ESG assets are exploding.

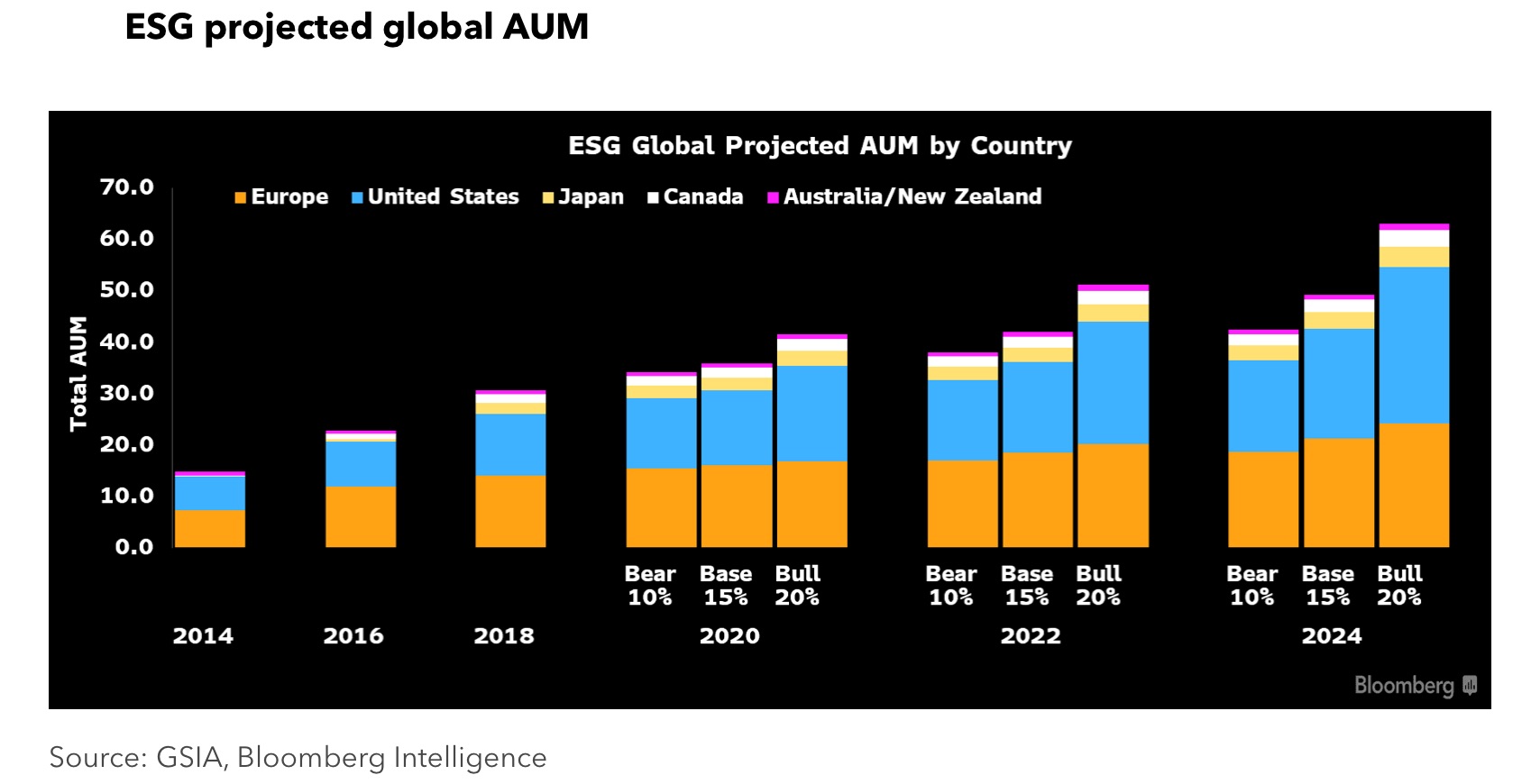

According to data from Bloomberg, global ESG assets are on track to exceed $53 trillion by 2025, which is a third of all assets under management.

Europe accounts for half of global ESG assets right now, but projections indicate the US may dominate starting in 2022. After that, the next wave of growth could come from Asia, particularly Japan.

Meanwhile, regulators are scrambling to catch up with this explosive demand.

The current lack of a consistent set of global framework has understandably confused investors. And compounding this confusion is that there isn’t one overarching ratings agency on ESG.

What’s the world doing about it?

Things may soon get a lot simpler.

The European Union (EU) has put sustainable finance at the forefront of its agenda, and is stringing together a set of rules for the industry.

The US is also beginning to take steps towards legislating activities in the ESG world. In March, the SEC took its first step by proposing rule changes that would require listed companies to include climate-related disclosures in their reports.

Meanwhile, Australia has taken more of a follow the leader approach.

Many companies here have already reported their ESG metrics, but there isn’t one overarching source of ESG regulation. Rather, the ESG regulation landscape in Australia is a patchwork of rules operating at the Commonwealth, State and Territory levels.

Here’s a quick summary of the current legislations in place are around the world, and what each means.

Europe leads ESG regulations

The SFDR

The cornerstone of EU’s ESG regulation is the Sustainable Finance Disclosure Regulation, or SFDR.

The SFDR imposes mandatory ESG disclosure obligations for asset managers starting from 10 March 2021.

It aims to bring a level playing field for financial market participants and financial advisers in relation to sustainability claims of financial products.

The EU Taxonomy

The SFDR was introduced by the EU alongside the Taxonomy regulation.

The EU Taxonomy is a classification system which establishes a list of what can be regarded as environmentally sustainable economic activities.

In other words, it provides companies and investors with appropriate definitions for which economic activities can be considered environmentally sustainable.

The idea is to create security for investors and protect them from greenwashing, while helping shift investments where they are most needed.

Benchmarks and indexes

The EU Low Carbon Benchmark Regulation requires providers of benchmarks or indexes to disclose ESG factors in their methodology documents.

The providers are required to use a specific template, and to disclose information such as whether the benchmark methodology takes ESG factors into account.

These disclosures also require a description of the sources of ESG data used in the methodology.

Other global frameworks

In November last year, the IFRS Foundation Trustees announced the creation of a new standard-setting board – the International Sustainability Standards Board (ISSB).

The ISSB aims to unify all the alphabet soup of bodies and regulations into a simpler, more transparent one.

Around 40 governments worldwide have expressed their support for the formation of the ISSB, including Australia’s regulator ASIC.

Another global standard, the Task Force on Climate-Related Financial Disclosures (TCFD), was created by the international organisation FSB to develop consistent climate-related financial risk disclosures.

The TCFD framework encourages companies to undergo scenario analysis and stress testing in order to assess the materiality of their climate-related risks.

The US and Australia are catching up

The US Securities Exchange Commission (SEC) has the mandate to regulate the industry, but there are currently no mandatory ESG disclosures at the federal level.

Before March, the SEC had only required that all public companies disclose information that may be material to investors.

But the SEC has recently proposed changes to its rules, and wants to make it mandatory for listed companies to report their exposure to climate change risks.

Meanwhile in Australia, only the largest emitters are required by law to report their emissions, a process overseen by the Clean Energy Regulator (CER).

But despite the Morrison government pushing back, Aussie companies are increasingly drawn towards using the TCFD and the ISSB frameworks.

Interview with ESG expert, Catherine Bell

To put all this jumbled confusion into perspective, Stockhead reached out to ESG expert Catherine Bell, the Principal of Sustainability at BDO Australia.

Bell was responsible for launching BDO’s global sustainability program three years ago.

She has worked with many leading global brands such as The Economist, IDC, Mercer, and National Australia Bank across Australia, Singapore, Thailand, and Europe.

Please summarise the landscape around ESG regulations right now

“It’s a very difficult time at the moment because there is no one clear framework,” Bell told Stockhead.

“This means that people are interpreting data in different ways, and classifying companies in different ways.

“You can have ratings agencies analysing the same company on ESG and get vastly different results. Facebook is a great example of that.

“But fundamentally, you can’t buy your way into a good ESG rating. And I wouldn’t recommend chasing good ESG rating because the methodologies across the market are very different.

“What we do suggest as consultants is that you look at the fundamentals of your business through an ESG lens, to make sure you’re addressing the risks of your business and respond to them in an authentic, accountable and transparent way.

“This includes ensuring that you you’ve got systems and processes in place to track, measure and improve, and to integrate those metrics into the corporate culture.

Are these global frameworks converging?

Yes, frameworks are converging and aligning,” said Bell.

“And it is moving towards the ISSB, which is the International Sustainability Standards Board.

“Biodiversity is also going to become a hot topic this year, with the release of the Task Force on Nature-related Financial Disclosures (TNFD).

“They are already becoming almost mandatory in Europe and the US, and ultimately they will land in Australia in the not too distant future.

“The framework they’re moving towards are a mix of qualitative and quantitative. The idea being that there will be apples to apples comparisons, where everything has to be measurable and quantifiable.”

“We live in and operate in a global economy, so most companies here in Australia are connected to other companies globally.

“The commercial world has essentially taken over the regulatory world, meaning companies know that they have to align to global ESG standards.

How do you as a consultant advise companies on sustainability?

“ESG is obviously very broad, and there’s a number of rabbit holes you can go down, so no one person can be an ESG expert,” explained Bell.

“My job at BDO is to help companies activate sustainability within their own business, and the earlier the better, because for some companies without an ESG story, they won’t attract capital.

“When we’re looking at the ‘E’ or environmental aspect of a mining company for example, we’d look at things like water management, tailings management, emissions, and what they’re doing around reducing emissions.

“We also measure biodiversity loss caused by the mining operations.

“When we’re talking about ’S’ in ESG, the really important one is community engagement. What are you doing in the community around where you’re operating? Obviously, in mining, indigenous land is very important.

“For the ‘G’ governance, it’s about the policies that ensure what you’re doing is supported by a governance and risk framework.

“For companies like lithium miners, which are currently in high demand, the fact that they’re mining ‘green’ metals doesn’t absolve them of their ESG requirements or obligations.

“Regardless of what you’re pulling out of the ground, every company needs to activate their ESG baseline and integrate sustainability practices into their business.

“And importantly, they need to align with a global framework that can be understood by the global markets.

“There is no point saying I do community engagement, because it needs to be in a format that is understood by the external market.”

Other ESG news on the ASX this week

As reported by Stockhead’s green expert, Jessica Cummins:

The recycling company has won the Diamond Award, which is the top global sustainability award for packaging, at the Dow Packaging Innovation Awards in Switzerland.

Close the Loop creates products and packaging that includes recyclable and made-from recycled content. They also collect, sort, reclaim and reuse resources that would otherwise go to landfill.

Vulcan Energy Resources (ASX:VUL)

Vulcan has executed a binding purchase agreement with MVV Energie for 240 gigawatt hours per year of renewable heat in a 20-year long term contract beginning in 2025.

The agreement includes the supply of a minimum of 240,000MWh per year to a maximum of 350,000MWh per year to households in Mannheim, outside of Frankfurt, Germany.

The views, information, or opinions expressed in the interview in this article are solely those of the interviewee and do not represent the views of Stockhead.

Stockhead has not provided, endorsed or otherwise assumed responsibility for any financial product advice contained in this article.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.