The Ethical Investor: ESG moves – and should investors simply move on and accept failure when they see poor ESG actors?

Picture: Getty Image

Royal couple Harry and Meghan have become the latest celebrities to endorse and put their brand on the ESG movement.

The Sussex royals have now become “impact partners” at Ethic, a New York-based firm started by former British and Aussie bankers in 2015 that puts money into ESG-related investments.

“They’re (Harry and Meghan) deeply committed to helping address the defining issues of our time — such as climate, gender equity, health, racial justice, human rights, and democracy,” a statement by the firm read.

Other celebs to have put their names on ESG initiatives in the past include Leonardo de Caprio and Matt Damon – but by far the most successful story was that of actress Jessica Alba, who turned her startup into a US$300m revenue company in just 10 years.

The Honest Company, which she founded in 2011 along with angel investor Brian Lee, makes eco-friendly household products that ditches the use of chemicals.

The involvement of celebrities shows just how much ESG-related products have proliferated to all levels of society, which is why the ESG sector has grown from a standing start a decade ago into a $35 trillion market, where it’s now become a top-down issue for almost every company.

And as the sector evolves, investors are also increasingly asking a different question: it’s no longer just whether a company has good intentions, but whether it has the strategic vision to achieve a strong ESG performance.

In other words, investors want companies to walk their talk and start measuring and reporting the results of their ESG initiatives, said Dr Kaushik Sridhar, an expert in ESG.

Dr Sridhar said that moving from intention to results is the next evolution that investors are looking for.

And the only way to outperform in this new era will be for companies to make material ESG issues central to their strategy, he argued.

ESG view with special guest eInvest’s Tamas Calderwood

In this fortnight’s chat with Stockhead, eInvest’s Tamas Calderwood said that while investors should consider a company’s ESG metrics – and other metrics as well – sometimes a greater impact can be had on a company not by selling or refusing to buy, but by pressuring the company to change its ways.

He noted the example of Shell which has in the past three decades changed the way it goes about decommissioning its North Sea platforms.

And this may not have happened had investors simply sold out and moved on with only environmental activists pressuring the company.

“In early ’90s when Shell airily announced its disposal of the Brent Spar oil platform by simply sinking it in a North Sea trench, its sales plummeted and environmental groups rallied a fierce opposition.

“But the company came up with a new plan to dismantle it, and in the end decided to just re-use it.

“By 2017 when Shell needed to decommission more North Sea platforms, they took a very different approach. Working with fishermen, environmental groups and academics, the company developed a comprehensive disposal plan that was widely accepted.

“This radical change in behaviour is not only because Shell is conscious of its ESG rating, although it most certainly is.

“It is also the example from the public reaction to its environmental carelessness, demonstrating very clearly that its behaviour can impact revenues in the real world.”

Calderwood says even when companies do not change their ways, ESG still matters.

“We still get our occasional VW Dieselgates, Enrons, Theranos’ and the rest,” he said.

“Those scandals, however, have only heightened the use of ESG when looking at a company’s value. In order to dodge the bad actors and allocate capital to the good ones, ESG metrics are crucial.”

Calderwood also said ESG metrics matter to debt investors as well as equity investors.

“It’s the same company that is being financed, so while financial metrics can discriminate between equity and debt, ESG metrics don’t,” he said.

“A tobacco company is a tobacco company. If you don’t want to own a tobacco company in your equity portfolio, I’m pretty sure you don’t want to lend them any money through your fixed income portfolio either.

“Similarly, if you are building a portfolio and you have sustainability in mind, then ESG metrics will be used across asset classes.

“ESG brings risk management to the table by avoiding stocks with low ratings, and as an investor, it allows your money to be invested in a manner consistent with your values.”

What’s happening in Australia

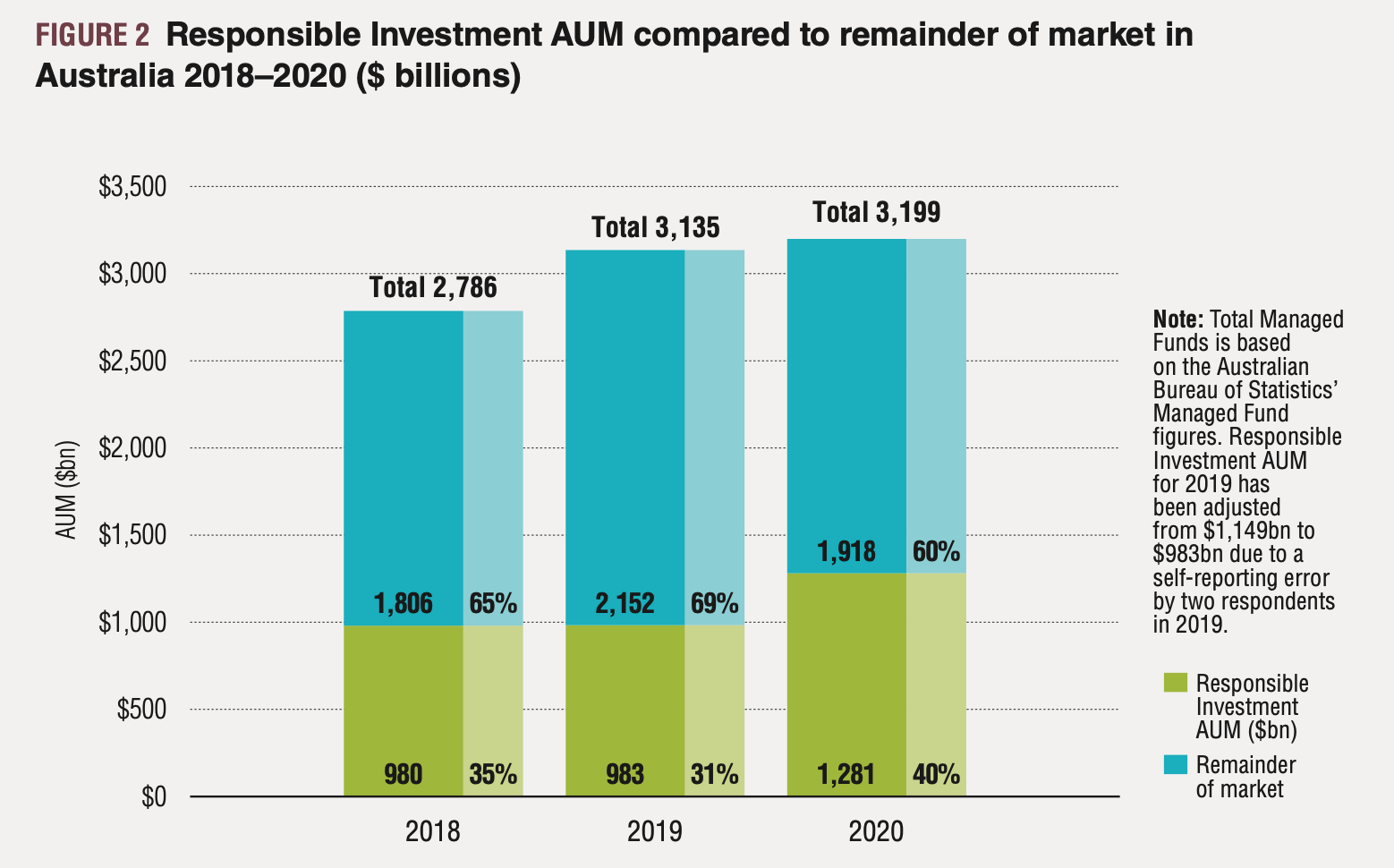

Fund inflows into Australian ESG-related managed funds are climbing fast, and as new data from the Responsible Investment Benchmark Report 2021 revealed, responsible investments now make up 40% of the total Aussie market.

Meanwhile, businesses at this week’s AFR Energy & Climate Summit called on the Morrison government to end the political bickering, and start bringing more clarity on Australia’s 2050 zero carbon goal position.

The Business Council of Australia, backed by Atlassian founder Mike-Cannon Brookes, has called for the government to be on top of its game on climate change.

“Australia should aim for 500% renewables,” Cannon Brookes said during Thursday’s episode of TIME100 Talks. “We’re in one of the sunniest, windiest countries in the world.”

The tech billionaire said Australia shouldn’t just produce renewable energy for its own needs, but we should also be exporting it to other countries.

Another billionaire that has taken a pot shot at politicians this week was Fortescue founder, Andrew Forrest.

Forrest said it would be a ‘cop out’ if PM Morrison did not attend the COP26 summit in Glasgow this November.

Even Prince Charles was stunned to learn that some world leaders, including PM Morrison, may not attend the global event.

“Is that what he says, does he? Mmm,” Prince Charles replied after being told by the BBC that Morrison wasn’t planning on attending.

He warned this might be the last chance the world has of staving off a future catastrophe.

“It will be a disaster. I mean it will be catastrophic. It is already beginning to be catastrophic because nothing in nature can survive the stress that is created by these extremes of weather,” he told the BBC.

The PM has however hinted today that he may go to the Glasgow talks.

“It is an important event. The government will be finalising its position to take to the summit,” PM Morrison said.

Notable ASX ESG-related news during the week

Things got a bit confrontational at the bank’s annual general meetings (AGM) this week, as ESG activists piled the pressure on the company to do more.

In Wednesday’s AGM, the bank had to defend its position when challenged by environmental activists Market Forces about its fossil fuel lending business.

CBA’s chairman Catherine Livingstone told shareholders that CBA may restrict loans in the future, based on data from the International Energy Agency.

“Our philosophy overall is to support the transition, but to make it very science-based and data-based,” Livingstone said.

The bank’s CEO, Matt Comyn, added: “We’re also working on initiatives, such as the first sustainability linked bonds, because we believe that a sustainable future is a critical part of planning for the future economy.”

Traditional Owners and Aboriginal communities across the NT have voiced their concerns to ORG, ahead of the company’s AGM on October 20th.

The local communities are opposed to Origin’s plans to commence drilling oil in the region by way of fracking, a process the community said could endanger the “land, water, health, cultural heritage and impacts on future generations”.

“The government is throwing money to fracking, to Origin, giving them money to destroy our land…the money should be spent on our communities, not damaging our country and making us sick,” said Mudburra Traditional Owner, Ray Dixon.

“It’s terrible, we don’t want this to happen. We want the government to listen, we want the government to do the right thing for us. And stop the fracking.”

The scene is now set for an interesting and confrontational AGM next Wednesday.

The company released its ESG and Sustainability report this week, highlighting its ESG progress by signing the company’s first Modern Slavery Statement.

The company has vowed to prevent modern slavery by opening up an independent Whistleblower Disclosure Line for its employees and contractors, and strengthening its internal human rights policies.

The company has this week unveiled its renewable energy initiative, announcing the construction of the world’s largest electrolyser, renewable industry and equipment manufacturing centre at Gladstone, Queensland.

Established under a landmark agreement with the Queensland government, Fortescue says the centre will be a key enabler to Fortescue achieving its industry-leading target of carbon neutrality by 2030.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.