The Ethical Investor: ESG booms in Australia, and Plato’s Dr. David Allen talks about his net zero carbon Fund

Pic: Fraser Island, Getty Image

The Ethical Investor is Stockhead’s weekly look at ESG moves on the ASX. This week’s special guest is Dr. David Allen, a former Head of Research at JP Morgan and currently, a portfolio manager at Plato Investment Management.

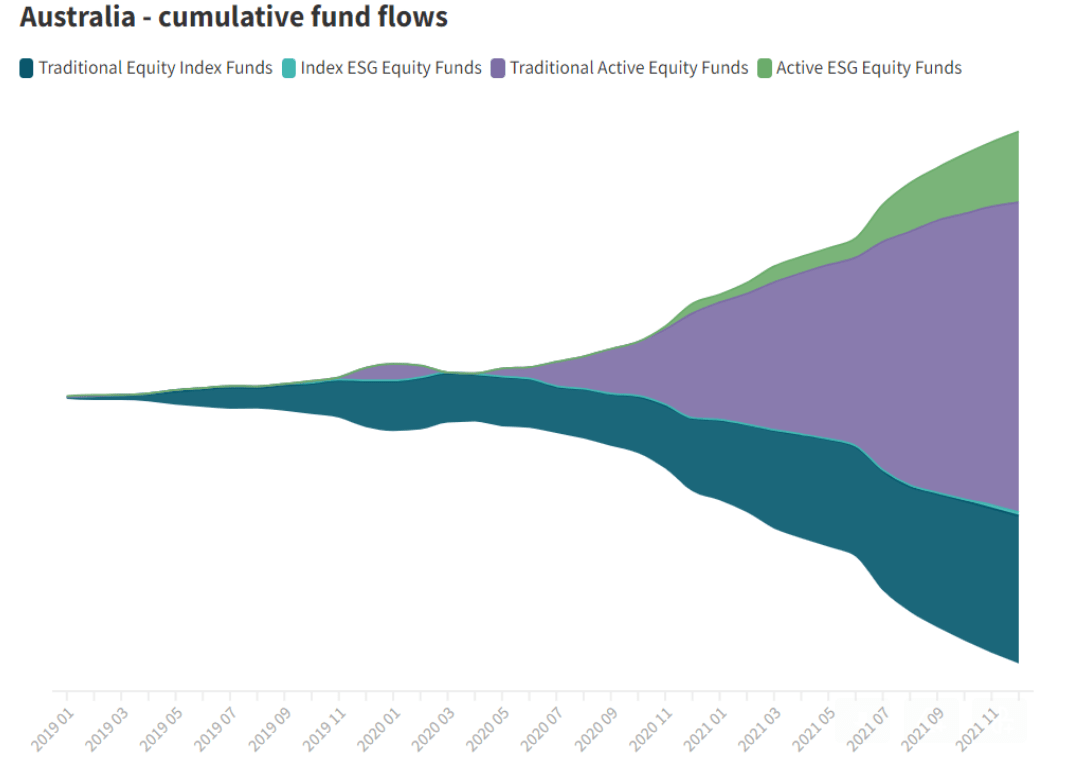

ESG strategies are the hands-down winners in the fund flow race at present, according to new data from Calastone.

Globally, ESG equity funds on Calastone’s network gained an incredible $32 billion in new capital in 2021, equivalent to $3 in every $5 of new cash committed to equity funds of all kinds.

Trading activity in ESG funds was dominated by buy orders in 2021, and for every $1 of selling activity, investors bought $1.69 of ESG equity funds.

Europe and the UK are where most of the action is concentrated. In that region, new capital committed to ESG funds has doubled in 2021 vs 2020, and has increased ten-fold compared to 2019.

The ESG boom catches on in Australia

The data also revealed that ESG equity funds in Australia have more than quadrupled in 2021 to $3 billion.

Despite the boom, Australia still lags other markets when it comes to ESG equity investing. Aussie investors allocated only $2 in every $10 to ESG equity funds in 2021, compared to $8 in every $10 in the UK.

Other Europeans meanwhile, even withdrew money from traditional (i.e. non-ESG) funds in 2021, but doubled their subscription to ESG fund offerings.

ESG is becoming a meaningful driver of fixed income funds too.

In Australia, $4 in every $10 of inflows to fixed income funds last year were devoted to ESG strategies. In this respect, Australian investors are ahead of those elsewhere.

Where to from here

Teresa Walker, Head of Australia and New Zealand at Calastone, said that what happens to ESG investments going forward will depend on many factors.

“Firstly, there is the extent to which governments will legislate on ESG standards,” Walker told Stockhead for this article.

“Legislation affects behaviour of companies, and therefore whether they are eligible to be included in ESG funds. Secondly, there is how fund managers select companies, the ESG criteria they apply, and how strictly they do that.”

Walker warns that ESG is not immune from macro conditions such as a bear market, but she’s confident that it will continue to attract growing investor interest in relative terms.

“We feel that it is likely to continue to grow for now, but any changes in those factors could accelerate or decelerate the trend,” Walker said.

Active vs Passive funds

Although passive ESG funds are beginning to compete more successfully for investor attention, Aussie investors are turning more to active funds.

In 2021, almost all the ESG equity cash invested by Australians (around 98%) went into actively managed funds.

In a first for the Australian funds management industry, Plato Investment Management has launched a global equities fund with a total focus on net zero carbon footprint, without using costly carbon credits.

The Plato Global Net Zero Hedge Fund aims to outperform the MSCI World Index, while maintaining a net zero carbon exposure.

The Fund is an active extension long/short strategy that targets high carbon-emitting listed companies via short positions, while taking long positions in companies with better carbon footprints.

To find out more about this unique ESG fund, Stockhead spoke to Plato Fund’s co-portfolio manager, Dr. David Allen.

Interview with Plato’s Dr. David Allen

Prior to becoming a portfolio manager at Plato, Dr. David Allen spent 15 years at global investment bank JP Morgan, where he became the Head of Research in London.

In that role, he ran two successful long/short hedge funds for the Bank, which includes a EUR 6 billion strategy and a EUR 1 billion market neutral strategy.

Why the Plato Global Net Zero Hedge Fund?

“We believe decarbonisation is the most important investment thematic of the next 30 years,” Allen told Stockhead.

“Decarbonisation is going to affect every part of how how we live – from how we get to work, how we fly, how we heat and cool our homes, and how we grow our food.

“Australia is sadly a long way behind the rest of the world, and our government has been a laggard in committing to net zero by 2050, especially when over 100 countries around the world have made pledges to do so.

“There will be a lot of pressure for high polluting companies in terms of regulations and taxes, and their ability to access capital is also going to be starved off, and that will depresses their stock prices.

“So what we look to do is to be on the right side of that historical transformation, where we’re betting on the companies who have lower emissions on the long side, and shorting against companies that have high emissions.”

What are the environmental benefits of investing in this fund?

“An average sized SMSF (self managed super funds) invested in the ASX 200 requires 3,135 trees to get to net zero, or to put it in a different way, that’s equivalent to flying from Sydney to Melbourne 71 times,” Allen said.

“Poeple are just starting to realise that the carbon footprint of their investing activities often dwarfs the carbon footprint of their daily activities like driving or commuting.

“So now people are starting to ask, how can I make a difference?

“I think this new Fund is a game-changer for those who want a simple solution to help them generate alpha, while maintaining a net zero carbon footprint.”

What methodology do you use for the Fund?

“Although we use extensive data points from over 850 sources and process 5 million data points per day, half the process is actually still very fundamental,” Allen explained.

“We do run discounted cash flows across 10,000 companies globally.

“We also have a system of over 100 red flags that we screen companies on before deciding to invest on the long or the short side.

“And that’s actually a very powerful way of identifying stocks that will be landmines in the long side of your portfolio, and then much better on the short side of your portfolio.”

Tells us more about these “red flags” methodology

“The idea for these red flags first came when I was invested in a Spanish tech company almost 10 years ago, where it ended up being an accounting fraud,” Allen said.

“My team looked at it and asked, should we have been aware and was there a red flag that we had missed? And in this case, it was something really obvious. The company had used an auditor that nobody else in the market was using.

“It was similar to what Bernie Madoff did, where his accountant was his uncle up in Queens that no one else was using for a hedge fund that size.

“So then we extended that to as many different red flags as we could by looking at historical accounting scandals and corporate failures over the last 30 years.

“And slowly but surely, we built up this toolkit of 100 red flags that help identify companies you really want to stay away from.”

What are some of your ASX stocks on the long side?

“On the long side, we like JB Hi Fi (ASX:JBH). They’ve been beneficiaries of the pandemic as people worked from homes and built home offices,” Allen told Stockhead.

“There was a lot of money that would have been normally spent on overseas holidays that wasn’t, and that money was in many cases diverted to beneficiaries like JB Hi-Fi. It’s also a company that has very low emissions.

“ Sonic Healthcare (ASX:SHL) is another ASX listed name that we like. They were huge beneficiaries of the Omicron testing blitz, and of the vaccine rollout as well. And they’re also a company that has very low carbon emissions.”

What are some of the stocks you’re shorting?

“The airlines industry is probably one of the hardest industries to make money in the best of times. You’ve got a cut throat competition between all the different airlines, as well as huge capital costs and high regulation,” Allen said.

“Since the pandemic, people have realised you don’t need to be flying to Stockholm to do five meetings and then fly back again. And the business class segment is really where airlines make their highest margin by far.

“So add all that up, we’re shorting Qantas (ASX:QAN). Qantas is committed to be net zero by 2050, but unfortunately there’s no existing technology that will allow them to get to net zero in an economically feasible way. And for those same reasons, we’re also short on Singapore Airlines and EasyJet.

“We’re also shorting Kogan (AXX:KGN). With Kogan, there’s been an increased capitalisation of intangibles, which can be a sign of accounting manipulation.

“There have also been executives on the audit committee and a vote against remuneration, so on our proprietary model for earnings manipulation, Kogan scored very badly.”

Could the recent geopolitical tensions cause headwinds for the Fund?

“With our decarbonisation thematic, we take a medium term view. Companies that could decarbonise in a superior fashion are going to benefit, but that doesn’t mean they’re going to do it over the month or quarter,” Allen said.

“But for the medium term investors that are going to be invested in the next 1, 3, or 5 years, then it definitely is a good time to get in front of this thematic for the long term.

“We launched the Fund in September last year, and we’re basing it against the global MSCI World benchmark index.”

“In that period, we’re already up around 4.35% over the benchmark despite the geopolitical backdrop.”

ESG news on the ASX this week

As reported by Stockhead’s green expert, Jessica Cummins:

Fortescue Metals Group (ASX:FMG)

Fortescue Future Industries (FFI) – the green leg of Twiggy Forrest’s Fortescue, announced on Tuesday its plan to develop a battery electric Infinity Train that will rid the miner of having to use diesel-powered fleet to carry iron ore to port.

Through its recent purchase of Williams Advanced Engineering (WAE) – an offshoot of the Williams F1 team founded by the revered, late Sir Frank Williams CBE – FFI said the Infinity Train will help the company reach its goal of net zero emissions by 2030.

Province has completed the scoping study for its planned HyEnergy green hydrogen development in the Western Australia’s Gascoyne region, allowing the project to move forward to the next pre-feasibility study phase.

The scoping study found that thanks to the prevailing wind conditions and quality of the solar resource in the Gascoyne region, optimised configuration of wind turbines and solar farms would lead to a relatively high-capacity factor and electrolyser utilisation.

After signing a Memorandum of Understanding (MoU), mining services company Orica and Origin will conduct a feasibility study into the viability of a green hydrogen production facility, or ‘Hunter Valley Hydrogen Hub’, and downstream value chain opportunities.

The $37 million project is designed to deliver up to 95 per cent abatement efficiency from unabated levels, reducing the site’s total greenhouse gas emissions by almost 50 per cent.

Share prices:

The views, information, or opinions expressed in the interview in this article are solely those of the interviewee and do not represent the views of Stockhead.

Stockhead has not provided, endorsed or otherwise assumed responsibility for any financial product advice contained in this article.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.