How Josh Frydenberg’s responsible lending proposal will affect ASX small caps

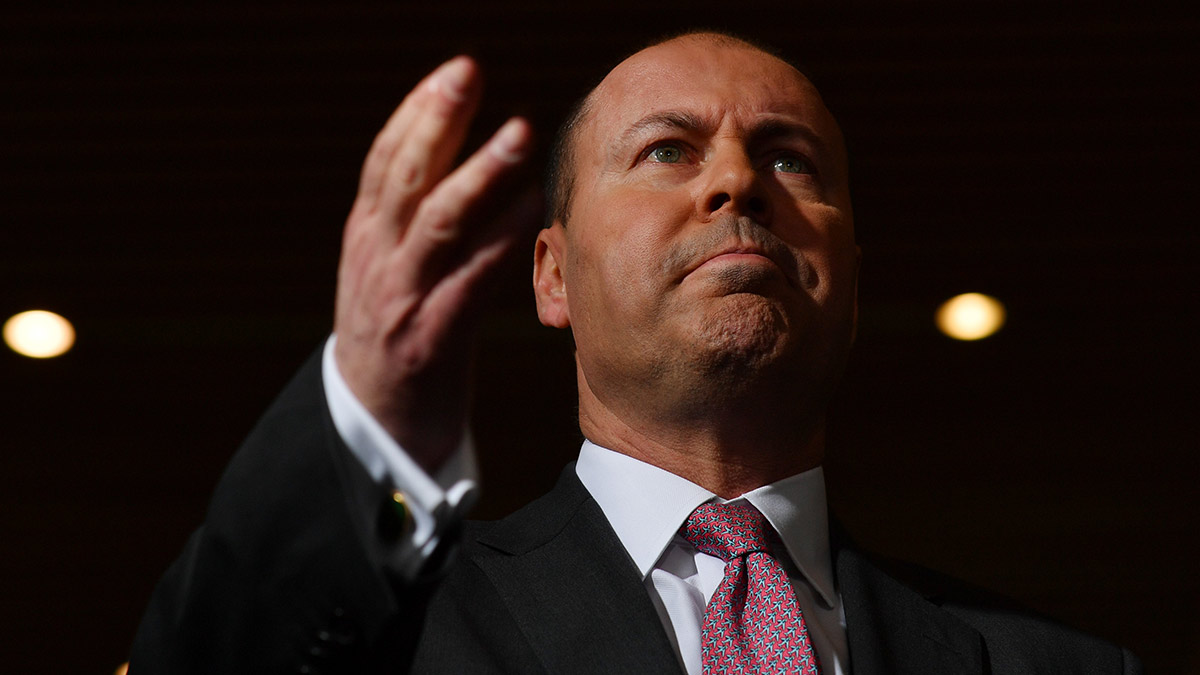

Josh Frydneberg's proposal to roll back Responsible Lending laws were the talk of markets on Friday, as bank stocks surged. (Pic: Getty)

Treasurer Josh Frydenberg was the talk of markets on Friday, after announcing a rollback of responsible lending laws first enacted in the wake of the 2008 financial crisis.

The proposed changes to the Credit Act will see lending standards fall under the purview of bank regulator APRA.

Previously, stricter measures were enforced by the Australian Securities & Investment Commission (ASIC).

In a blog post on his website, Frydenberg said the principle behind the change is to help free up the flow of credit in the economy to assist in the COVID-19 recovery.

The announcement immediately sparked fierce debate among the commentariat, particularly in the wake of the 2018 banking royal commission.

Just one day prior, Westpac had agreed to a $1.3 billion settlement with financial crimes authority AUSTRAC over a money laundering scandal.

But it was another Westpac case – the so-called “Wagyu and Shiraz” trial — that’s more relevant to the Treasurer’s new proposal.

In that case, ASIC alleged Westpac had breached its responsible lending obligations by assessing expenses for home loan applicants based on a simplified benchmark index – the Household Expenditure Measure (HEM).

But in ruling in favour of Westpac, the federal court found that expenses weren’t central to a loan application, because borrowers could cut them if necessary.

Such a view is in line with the government’s new proposal; rather than forcing banks to adhere to stricter credit risk assessment procedures, the legislation will in effect put the onus back on consumers to meet the obligations of loans they apply for.

Company view

Australia’s beleaguered big banks promptly surged on Friday following the announcement, as the ASX financials index rallied by 3.71 per cent.

And if successfully passed through parliament, the revised law will also have a bearing on the ASX’s small cap fintech sector, such as MoneyMe (ASX:MME) and Wisr (ASX:WZR).

Speaking with Stockhead, Wisr CEO Anthony Nantes welcomed the new law change.

He said the decision is a good follow-up to the $15 billion fund established by the Australian Office of Financial Management (AOFM), to help provide support for lenders in the wake of the COVID-19 disruption.

Nantes said Wisr is “pleased with the decision from the Australian Government to change the responsible lending law”.

“It clearly shows they are actively thinking about this sector, and we agree it will provide consumers with more choice, and encourage them to seek out a better deal.”

“Following the AOFM support for the Australian credit market, today’s decision demonstrates their understanding of the very important role credit plays in the economy for everyday Australians,” Nantes said.

In comments to Stockhead, regtech compliance platform Skyjed also offered a balanced view of what the proposed laws mean for Australia’s credit landscape.

CEO Leica Ison said the rollback was “rightfully” being met with concern by various consumer rights groups.

Chief among those concerns is that fact that debt loads may increase, at a time when unemployment is high and wage growth is low.

However, “in our view it’s the banks that still need to be aware, and they still have the most to lose”, Ison said.

“Poorly targeted products will be investigated. The regulatory environment today is far more stringent and complex, and provides a much more robust safety net for consumers.”

Ison cited Westpac’s record $1.3 billion fine will remain fresh in the mind of the banking sector, and said AUSTRAC has “spent a good deal of time signalling to the market that they are on the hunt for more high-profile cases”.

“Whilst the move is certainly a positive for growth as we recover from COVID, there is every reason to believe the banks will be treading far more cautiously with their product governance this time than they have in the past,” Ison said.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.