TECH-HEAVY: FedEx is castaway; Facebook is so 2019; And The Fed’s finger is ready to fire

Via Getty

The week that was

You might’ve missed Friday in New York because it was Saturday in bed for us, but Wall Street took another tumble; all three major indices closed out their worst week since June an average ~5% lower.

Yes, the hotter-than-expected inflation data ahead of this week’s FOMC meeting hurt, but the late mail was an absolute corker of a profit guidance ambush by everyone’s favourite bellwether stock, FedEx (FDX). It flagged a profit warning and itself crashed almost 25% during the Friday session and contributed about 0.5% alone to the 3.8% decline in the blue-chip index which ended the session short some down 140 points.

Alongside FDX, among the week’s shockers were Messrs Apple (AAPL), Meta Platforms (META), Microsoft (MSFT), Walt Disney (DIS) and Salesforce (CRM).

But back to FedEx in a bit…

For the week now gladly past, the Dow Jones Industrial Average and the Nasdaq Comp each fell 4.7% and 6.2%, respectively.

For the Nasdaq, it’s been the single worst weekly loss in three months and there’s been a lot of choice.

The week ahead

Another big week is a few hours away from kick-off for global markets. If we include Switzerland, which in this case is most def not neutral, we have four central banks of the world’s most advanced economies giving the word on their latest monetary policy decisions.

There’s a likely 75 basis point hike on the cards from the US Federal Reserve, the Bank of England (BoE), as well as the Swiss National Bank. Bucking the trend is the hot mess inside The Bank of Japan (BoJ), which neither believes in inflation nor fears it more than the state of its own currency.

In any case, aside from burying QEII, all attention is eclipsed by the bods at The Fed who run the FOMC deadpool.

Worth another look:

Here’s how YoY CPI would look going forward with a constant 0.1% MoM print like today’s headline reading. pic.twitter.com/QIGL7fMP5l

— Bespoke (@bespokeinvest) September 13, 2022

They meet for two days this week and the overall sense is that rates are either up by 75bp into a range of 3-3.25% or the more hawkish full-on, take-no-prisoners hike of 100bp, hitching the Feds Funds rate to a year end of circa 4-4.25%.

Following the S&P500’s 25% pre-June sell down and then it’s post-June 20% rally, the view at City Index remains that the S&P500 “has entered a period of choppy range”, trading between 4300/3800 into November.

On the gold front, after going for around US$2070 about six months ago, My Precious is flatlining at $1670 last week.

Tony Sycamore at City Index says gold appears to have completed a double top. That’s a technical term for not great.

“If the breakdown is confirmed early this week, the downside target is the $1450/$1270 region,” he warns.

Meanwhile Bitcoin is trading at $19,489 (-3%). Tony says Bitcoin needs to “return to the safety of the trend channel” (which is above US$22,500) to “negate the risks” of a revisit of June’s US$17,952 wash out.

And on the bonds front, I thought this was prescient and articulate from Jack Ablin, CIO at Cresset Capital, on CNBC this morning:

“When you can get 4% yield in the front end of the yield curve that’s an attractive alternative. The bond market had been competing for capital with both hands tied behind its back. Now it’s not.”

Oh my god that central bank has a gun

So very many in Wall Street were thinking, hoping, guessing and banking that the US August CPI report would show the clear path to downward inflationary trend.

And let’s be clear – the headline figure did moderate for a second straight month, the drop wasn’t as big as had been expected and while disappointing, core inflation was on both the menu and the specials board.

Be that as it may, traumatised US investors are fixated on the Federal Reserve’s itchy trigger finger with at least another three-quarter point hike target acquired and only waiting on what will likely be a 48-hour relaxathon for the Federal Open Market Committee (FOMC) before the sound of gunfire.

However, economists and investors, fundies and punters abound have gone and priced in the chance of a full on percentage point increase.

The Fed, egged on by the Brainards of the FOMC, couldn’t be discounted – but it does seem a mite aggressive for a central bank a little too central in the minds of everyone, everywhere right now.

So, if stupidity and history remain decent indicators there’s a possibility of a “relief rally” in New York, if the bank disappoints to the upside.

The corporate watch

FedEx (FDX)

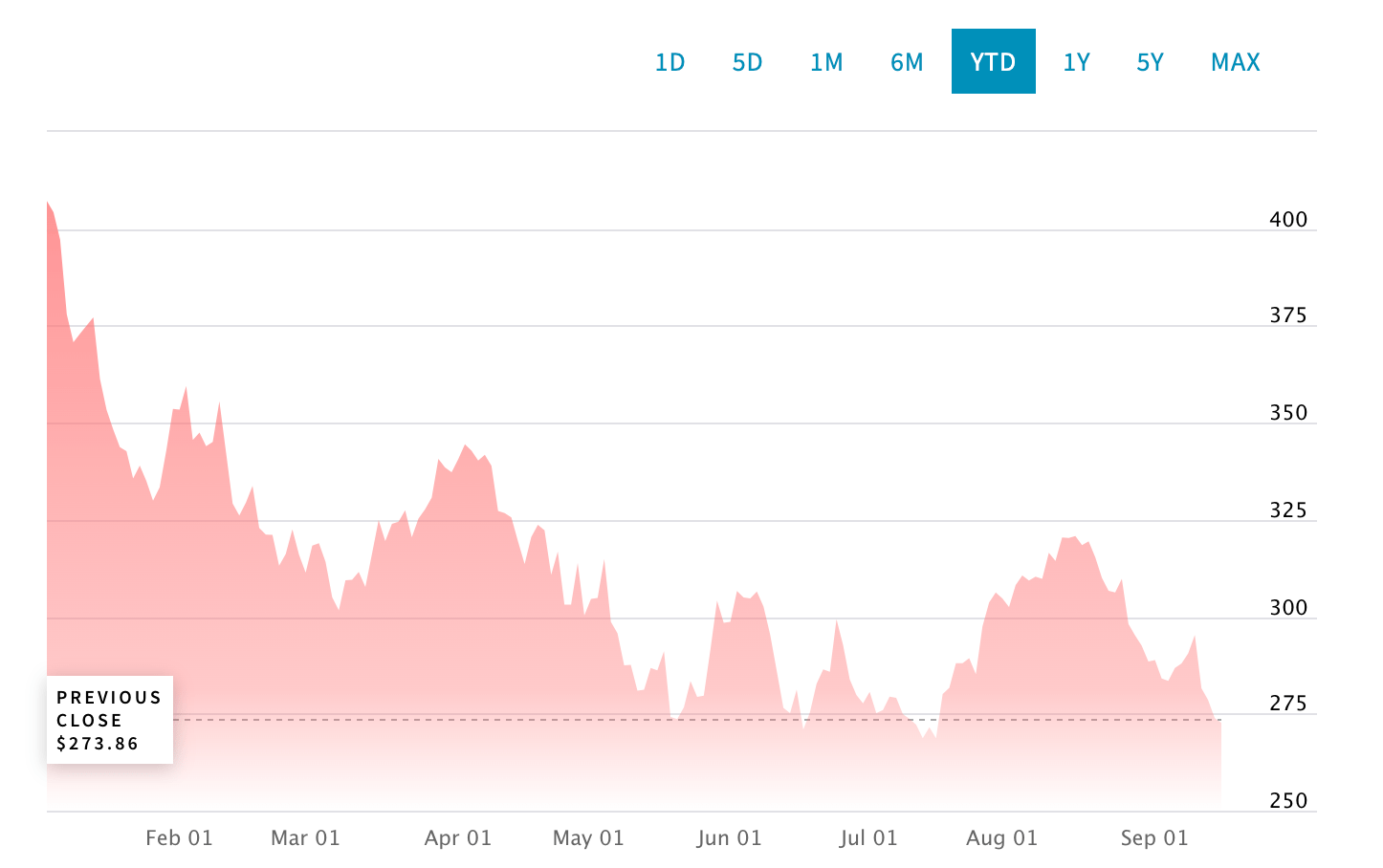

After revealing its revenue was circa $300 million below previous guidance, FedEx warned its results would be “adversely impacted by global volume softness that accelerated in the final weeks of the quarter.”

After officially withdrawing its full-year guidance on Friday, FDX flagged a round of cost-cutting “to offset weakness” in global shipping volumes amid a “significantly worsened” global economic outlook.

Transport stocks are widely regarded as a gauge of global economic activity and none more so than FedEx. Ergo Sum: if FDX says there’s softness ahead in shipping then it’s little surprise Wall Street has battened down the hatches so smartly.

Shares of the Tom Hanks movie giant ran aground circa 25% Friday after the company released preliminary earnings results that were not only significantly below analyst expectations, but also saw management pull its guidance for fiscal 2023.

“Global volumes declined as macroeconomic trends significantly worsened later in the quarter, both internationally and in the US,” CEO RaSubramaniam said in the Friday note to the market.

“We are swiftly addressing these headwinds, but given the speed at which conditions shifted, first quarter results are below our expectations.”

The magnitude of the Q1 miss is noteworthy. The company expects first quarter adjusted EPS to be $3.44, which is more than 30% below the $5.10 analysts expected. FDX reports after the close, Thursday.

Meta Platforms Inc (META) – A concerning lack of Face?

The indecipherable institution formerly known as Facebook saw its stock value crash all week. Just crashing away happily, until the share price was back below the earliest days of the pandemic.

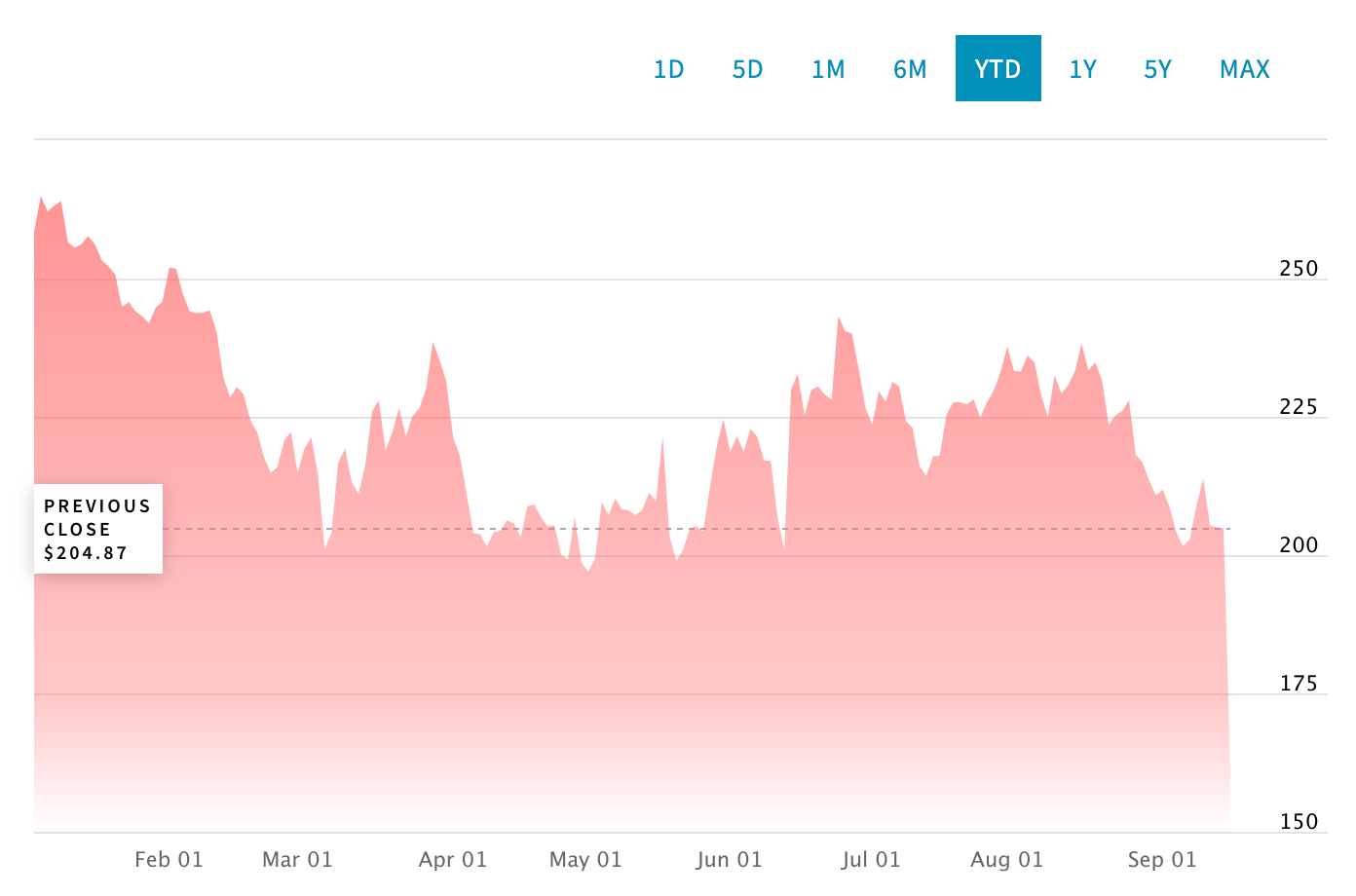

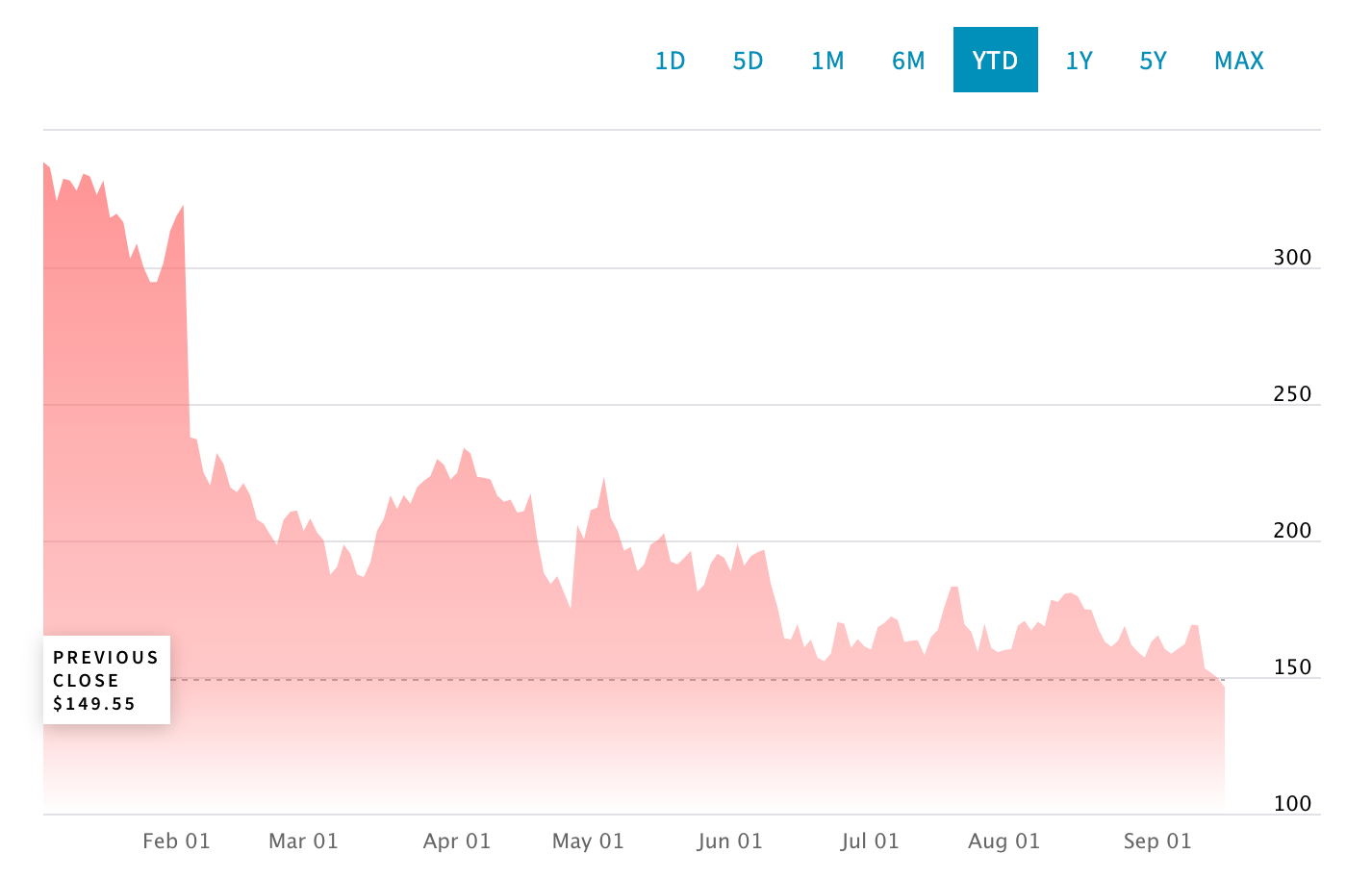

The -14% for last week and the -61% over the past 12 months represents by far the single ugliest flop from among the FAANGs and in fact any decently sized tech stock for 2022 so far.

It’s way past twice the retreat the Nasdaq Composite has made this year and even now it doesn’t feel far enough from enemy lines.

If should the… thing… slide below $146.01, it will be the lowest since January 2019. That’s when Facebook was dealing with the aftermath of the Cambridge Analytica Scandal that tested consumer confidence in the social media company and led to a series of heated congressional hearings.

Accenture (ACN)

Could be a big week for the Dublin-based professional services firm. Wall Street is forecasting a return of $2.58 EPS on revenue of $15.4bn, a serious step up on the $1.95 and $11.9bn of this time last year.

Both earnings and profits have come rolling in, while ACN hasn’t avoided the totality of the software sector slump. It’s shed 17% in six months and almost 40% YTD. Reports before the open, Thursday.

And some Elon Watch

— Elon Musk (@elonmusk) September 18, 2022

The week in Earnings and IPOs

Other high-profile events during the week that are worth tracking include Nvidia (NASDAQ:NVDA) holding its closely-watched GTC conference virtually across September 19-22, just as shares begin to simmer around 12-month lows.

Monday – AutoZone (AZO)

Tuesday – Stich Fix (SFIX) and Aurora Cannabis (ACB), Nvidia (NVDA) CEO Huang’s GTC keynote will be live-streamed at 8am.

Wednesday – General Mills (GIS), Trip.com (TCOM)

IPO – Biotech Jupiter Neurosciences (JUNS)

Thursday – Costco (COST), FedEx (FDX), Darden Restaurants (DRI), Accenture (ACN), and Manchester United (MANU)

IPO – immune therapeutics developer Alopexx (ALPX)

The Week in Macro

MONDAY

US NAHB housing market index

TUESDAY

US Aug housing starts

US Aug building permits

WEDNESDAY

US Aug existing home sales

US FOMC policy decision, midpoint

THURSDAY

US FOMC Funds rate

US Initial jobless claims

US Aug leading index

US Sep Kansas City Fed index

FRIDAY

US Sep S&P Global manufacturing PMI

US Sep S&P Global services PMI

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.