Traders’ Diary: Everything you need to get ready for the week ahead

We got your back. Via Getty

The Reserve Bank of Australia Board Meeting Minutes for September will be the local highlight this week.

I’m a nut for a good pore over the minutes of the last rates meet. I can recite the key bits which only ever slightly change and indeed my wife will sometimes ask for a few pars before lovemaking.

Last week, the RBA Governor Dr Philip Lowe appeared before Parliament and said a 25 or 50 basis point rate hike are the only options at the next meeting.

Belinda Allen at Commbank says her Gareth Aird aligned team continue to expect a 25bp lift in the cash rate in both October and November.

The week that was

That was a cracking week, rich with hubris then panic as the stronger-than-wanted core US CPI print for August played cat and pigeons in the States. Let’s recap.

- The US headline CPI rose by 0.1% (-0.1% expected) for an annual rate of 8.3%

- The core measure rose by 0.6% (0.3% expected) for the annual rate to accelerate to 6.3%/yr.

- The trimmed mean rate of inflation accelerated to 0.6%/mth.

Belinda said this created volatility on equity markets and movements in bond yields as markets repriced expectations of the US FOMC’s course of monetary policy tightening.

That happens this week (see below).

Global equity markets

Largely smashed after taking a nasty tumble on Tuesday and never got their mojo back.

In fact the trio of key indices would not have enjoyed their biggest weekly drop since June with the economic bellwether FedEx scared the bejesus out of twitchy investors barely coping already with this week’s 48 hour upcoming marathon FOMC meet for the US Federal Reserve.

The S&P 500 index fell -0.7% on Friday, bringing weekly losses to -4.8%. The tech-funky Nasdaq Composite shed -0.9% as we snoozed on Saturday morning for a -5.4% week at the office.

The largest falls in two years on Wall Street hoovered up all the optimistic gains and the optimism of the previous week and what happens in New York spreads south with the dawn.

Regional markets were rocked by volatility and at home the benchmark lost 2.5% during the sell-offs of the following session, while the small caps index only gave away 1%.

All the 11 sectors on the main index were impacted. REITs and property stocks, consumer staples and discretionary, as well as healthcare and industrial sectors all felt the worst of it.

In the tectonic plates of the market, US bond yields continued to drift further apart as the length, breadth and height of short-term interest rates came into calculations.

Following this strong result we now expect the FOMC to hike by 75bp next week with the risk of a 100bp lift.

Stuff you probably didn’t know

Pineapples take two years to grow.

Armadillos are bulletproof. (Trust me, but don’t ask me how I know… and don’t test the theory.)

The Week Ahead

First up, Le Federal Reserve’s war-on-everything-inflationary will dominate hearts and minds this week, with the monetary policy team holding a two-day meet to nut out a plan.

Blood pressures and imaginations alike are high, so is the sense of pervading doom that the FOMC will pull the trigger on a full point rate hike after that godawful August read that came in hotter than a French referee and a last minute scrum.

Given that and the follow up hawkery-rhetoric from a gaggle FOMC members, a 75 basis point hike at the September meet appears the least of Wall Street’s worries.

Indeed, the market is pricing some chance of a 100bp increase, says Westpac.

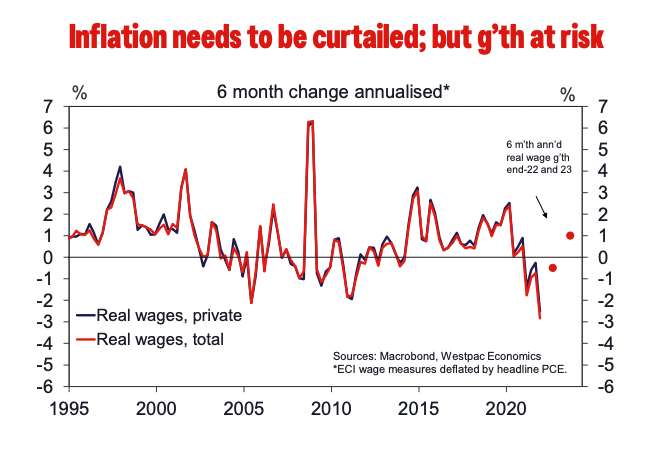

“To us, at this point in the cycle and with real term interest rates around +1.0%, a 100bp increase is unnecessary and potentially risky. Also note that an additional 100bps of hikes is forecast for the remainder of the year; and the market sees the risk of more.”

The good people at Nomura are calling a terminal rate of 4.50% to 4.75% by around Australia Day next year, before they say inflation will cool quicker than Julius Caesar’s Gaius Cassius:

BRUTUS:O Cassius, you are yok’d with a lambThat carries anger as the flint bears fire,Who, much enforced, shows a hasty sparkAnd straight is cold again.

In terms of comparative numbers in any case, mainly because the year-on-years begin to line up with the war in Ukraine.

Elsewhere, arguably 3 of the top 5 most trendsetting central banks of the world’s largest economies will get together and muck about with rate decision meetings.

We’ve got the aforementioned US Fed, the Bank of England (BoE) and the Bank of Japan (BoJ).

While the Poms are fun to watch because they’ll get kicked no matter what they do, it’s really all about The Fed – especially after the tanty Wall Street put on following the higher than could possibly cope with August inflation data.

Other scheduled central bank meets abound. Que the Philippines, Indonesia, Hong Kong, Switzerland, Brazil and Taiwan.

Inflation data is released in Japan and Canada.

“Globally the highlight will the US FOMC meeting noted above. The Bank of England is expected to lift the Bank Rate by 50bp (risk of 75bp) while inflation is not sustainably high enough to encourage the Bank of Japan to increase the policy rate yet in our view,” says Belinda Allen.

At home, we’ve got some flash PMIs here in Australia-land as well as in the UK, the US, Japan and what’s currently left of the EU.

The PMIs are pretty timely actually and should give all you number-munching nerds a decent idea of what kind of an economic performance we can hope for at the end of Q3.

And don’t forget, the ASX will close the exchange on Thursday September 22 after the PM Anthony ‘Marrickville’ Albanese declared a public holiday to ‘Mourn-ebrate’ the death of Queen Elizabeth II. Or the ascension of Charles.

The Economic Calendar

Monday 19 – Friday 23 September

Source: Commbank, Westpac and Investing.com

Australia and New Zealand

TUESDAY

RBA Board Meeting Minutes, Sept

WEDNESDAY

RBA Deputy Governor Michelle Bullock is speaking at Bloomberg in Sydney. Eddy loves Aussie Fedspeak and will be up early for strong coffee and canapes.

Westpac–MI Leading Index

THURSDAY

Markets closed – National Day of Mourning for Her Majesty The Queen.

S&P Australia flash PMIs

Global

MONDAY

UK Sep Rightmove house prices

US Sep NAHB housing market index

TUESDAY

Jpn Aug CPI

US Aug housing starts

US Aug building permits

WEDNESDAY

US Aug existing home sales

US FOMC policy decision, midpoint

THURSDAY

US FOMC Funds rate

EU Sep consumer confidence

UK BoE policy decision

US Initial jobless claims

US Aug leading index

US Sep Kansas City Fed index

FRIDAY

UK & EU flash PMIs

EU Sep GfK consumer sentiment

US Sep S&P Global manufacturing PMI

US Sep S&P Global services PMI

The ASX IPO calendar for this week

According to the ASX, these stocks will make their debut this week (could change without notice).

Australia Sunny Glass Group (ASX:AG1)

Listing: 21 September

IPO: $7.5m at $0.35

This Australian-based holding company, through its subsidiaries, operates a glass production and supply business for structural building facades.

The group has a fully automated processing plant which it says is highly-efficient, accurate and scalable and an R&D focus on the development of cyclone resistant glass using new laminating and bonding techniques.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.