September Winners Column: Battery metals sentiment has come roaring back

Pic: DKosig / iStock / Getty Images Plus via Getty Images

In September, 35 ASX-listed small cap stocks posted gains of 100 per cent or more – a substantial drop on July (58) and August (51).

September was about the time that five months of rampant global market enthusiasm began to wane.

The major Wall Street indexes recorded their first monthly declines since March, as did our own benchmark ASX200.

The amount of cash raised on the ASX in September — $2.28bn — was also less than half of August’s total.

But here’s some good news:

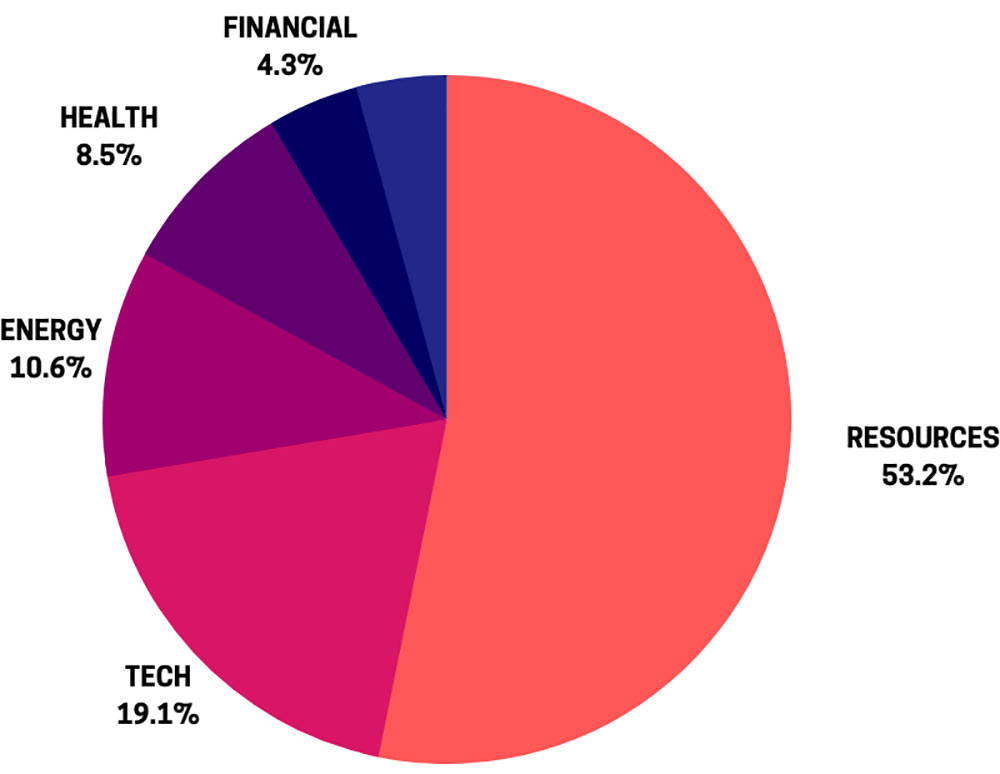

Oh, and battery metals sentiment has come roaring back. Gold exploration is booming. Tech deals are happening. Health stocks are making important breakthroughs that most of us don’t understand.

And random small caps are still spiking for no reason.

HERE’S THE TOP 50 SMALL CAPS FOR THE MONTH OF SEPTEMBER >>>

Scroll or swipe to reveal table. Click headings to sort.

| CODE | COMPANY | OCTOBER RETURN % | 1 YEAR RETURN % | SHARE PRICE | MARKET CAP |

|---|---|---|---|---|---|

| ESR | Estrella Resources | 1015 | 1218 | 0.145 | $ 114,223,430.71 |

| DOU | Douugh | 741 | 921 | 0.26 | $ 79,260,572.56 |

| REZ | Resources & Energy Group | 313 | 125 | 0.099 | $ 38,380,396.23 |

| AYM | Australia United Mining | 267 | 1000 | 0.011 | $ 20,268,352.34 |

| XPL | Xplore Wealth | 194 | 185 | 0.185 | $ 55,044,204.40 |

| E2M | E2 Metals | 186 | 268 | 0.7 | $ 91,840,130.20 |

| ARR | American Rare Earths | 180 | 348 | 0.098 | $ 28,510,120.02 |

| WCN | White Cliff Minerals | 175 | 560 | 0.033 | $ 17,047,796.11 |

| EM1 | Emerge Gaming | 163 | 650 | 0.105 | $ 82,471,497.89 |

| FFG | Fatfish Group | 159 | 389 | 0.044 | $ 40,350,150.46 |

| PNC | Pioneer Credit | 153 | -73 | 0.67 | $ 42,544,250.27 |

| GIB | Gibb River Diamonds | 150 | 331 | 0.125 | $ 25,751,180.63 |

| YRL | Yandal Resources | 146 | 126 | 0.59 | $ 46,053,437.66 |

| RDN | Raiden Resources | 143 | 325 | 0.034 | $ 19,054,064.20 |

| KSS | Kleos | 139 | 127 | 0.68 | $ 79,850,700.68 |

| IDZ | Indoor Skydive Australia | 133 | 40 | 0.014 | $ 4,713,801.39 |

| RAN | Range International | 120 | 22 | 0.022 | $ 7,950,171.77 |

| DAU | Dampier Gold | 114 | 275 | 0.06 | $ 17,097,632.40 |

| SPQ | Superior Resources | 110 | 180 | 0.021 | $ 24,318,628.03 |

| BIR | BIR Financial | 107 | -40 | 0.06 | $ 4,875,022.20 |

| WBT | Weebit Nano | 105 | 280 | 1.5 | $ 157,665,778.50 |

| AJQ | Armour Energy | 105 | -25 | 0.041 | $ 47,621,278.11 |

| CCE | Carnegie Clean Energy | 100 | 25 | 0.002 | $ 22,282,904.90 |

| DSE | Dropsuite | 100 | 195 | 0.13 | $ 73,061,060.41 |

| NTI | Neurotech International | 100 | 73 | 0.026 | $ 10,102,683.66 |

| IOU | Ioupay | 97 | 2338 | 0.195 | $ 71,870,455.80 |

| AOU | Auroch Minerals | 96 | 85 | 0.135 | $ 31,218,513.08 |

| CWL | Consolidated Financial | 95 | 1049 | 0.037 | $ 4,692,628.53 |

| AZS | Azure Minerals | 95 | 157 | 0.36 | $ 87,189,342.12 |

| VRS | Veris | 93 | -18 | 0.056 | $ 22,694,072.02 |

| BAT | Battery Minerals | 93 | 238 | 0.027 | $ 47,451,295.77 |

| FUN | Funtastic | 92 | 303 | 0.125 | $ 30,050,509.38 |

| SCT | Scout Security | 90 | 127 | 0.15 | $ 14,350,160.40 |

| WWI | West Wits Mining | 89 | 1300 | 0.07 | $ 83,722,926.98 |

| SOR | Strategic Elements | 88 | 54 | 0.12 | $ 34,365,586.92 |

| IXU | Ixup | 84 | 53 | 0.068 | $ 40,506,261.49 |

| NSX | NSX | 79 | -3 | 0.145 | $ 37,309,359.56 |

| AMO | Ambertech | 75 | 59 | 0.175 | $ 13,379,624.13 |

| RMX | Red Mountain Mining | 75 | 100 | 0.014 | $ 15,782,514.85 |

| SRN | Surefire Resources | 73 | 375 | 0.038 | $ 23,869,838.32 |

| TMZ | Thomson Resources | 72 | 208 | 0.081 | $ 14,477,685.26 |

| PWN | Parkway Minerals | 71 | 100 | 0.012 | $ 22,809,047.80 |

| TIG | Tigers Realm Coal | 71 | -27 | 0.012 | $ 91,375,163.38 |

| KIS | King Island | 71 | 34 | 0.099 | $ 26,206,230.90 |

| GLH | Global Health | 70 | 152 | 0.39 | $ 16,418,344.80 |

| ESH | Esports Mogul | 69 | 83 | 0.022 | $ 55,963,959.22 |

| 8VI | 8Vi Holdings | 69 | 633 | 1.1 | $ 48,815,189.50 |

| ICI | Icandy Interactive | 69 | 303 | 0.145 | $ 67,095,189.82 |

| CNJ | Conico | 67 | 233 | 0.03 | $ 17,642,871.06 |

| TNT | Tesserent | 66 | 645 | 0.365 | $ 292,912,978.88 |

Are battery metals making a comeback?

There’s light at the end of the tunnel for long-suffering battery metals stocks, and their investors.

A steady stream of good news post COVID-19 was kicked up another level by Tesla’s Battery Day spectacular. To meet stated production goals the EV pioneer will need a lot more nickel, lithium, copper, manganese, cobalt … and everything else.

Piedmont Lithium (ASX:PLL) flew 255 per cent after announcing a deal to supply Tesla with a big chunk of its planned spodumene production for an initial five years.

The US company anticipates that more supply deals with European and US EV companies are in the pipeline.

Euro Manganese (ASX:EMN) is now at 16-month highs after noting that Elon Musk’s new battery design is expected to result in a material increase in demand for high-purity manganese.

WA battery anode hopeful EcoGraf (ASX:EGR) also bathed in the bullish sentiment, while lithium explorer Vulcan Energy (ASX:VUL). moved higher after former Tesla director Jochen Rudat joined the team.

Tech dealmakers

September was a good month for mobile gaming platform iCandy Interactive (ASX:ICI).

It raised $1.25m in a “strongly supported” placement which received more than $5m in bids.

Shares then jumped on strong trial results for its new Masketeers game, and again after progressing a deal to launch a game in China in partnership with Alibaba unit 9Games.

Music database company Jaxsta ripped higher after announcing a new credit licensing deal.

Jaxsta’s service, which aims to provide a central database for musicians and engineers to receive song credits, will partner with US song licensing company Songtradr to create a beefed up version of its platform.

Quantify Technology (ASX:QFY) is buying fellow smart home company GSM Innovations to create “Australia’s leading electrical Internet of Things provider”.

And the ASX’s only virtual reality stock Vection (ASX:VR1) signed up a public hospital to trial its ‘Augmented Reality’ (AR) tech.

A picture of health

Rhythm Biosciences (ASX:RHY) says it has hit a critical milestone in developing a cheap and effective blood test for colorectal cancer that it hopes will replace the current faecal tests.

Rhinomed (ASX:RNO) is developing a new “less invasive” nasal swab to test for influenza and coronavirus.

Botanix Pharmaceuticals (ASX:BOT), shares climbed on a renewed government focus on antimicrobial resistance — which is something the clinical cannabis company is working on.

It was also a strong month for Cyclopharm (ASX:CYC) after a phase-three trial of its radioactive lung imaging agent met its primary endpoint.

That puts it on schedule for commercial sales in the US next year.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.