Rise and Shine: Everything you need to know before the ASX opens

Picture: Getty Images

On Stockhead today, a shiny dollar for guessing who September’s top ASX explorer was, no prizes for guessing best commodity, and the best stocks to protect you from Optus.

But first, the day ahead.

WHO’S SCHEDULED TO LIST?

This list is speculative because things can, and often do in life, go wrong. Best to check with the exchange and an adult if keen to follow up.

Bridge SaaS (ASX:BGE)

Listing: 4 October

IPO: $4.5m at $0.20

This company provides Software-as-a-Service (SaaS) based Customer Relationship Management (CRM) and workflow solutions to employment, care and support industries. The software is a single platform that simplifies the unique data, compliance and documentary evidence requirements of major government-funded programs through a unified user interface, BGE says.

Listing: 4 October

IPO: $25m at $1.50

This company is focused on solving gas emission issues for landfill sites while generating dispatchable, distributed and renewable electricity and creating Australian Carbon Credit Units (ACCUs).

LGI has a current portfolio of 26 projects with long-term contracts, across the Australian eastern seaboard and says it has a strong pipeline of growth opportunities, investing capital to optimise the conversion of biogas to revenue.

The plan after listing is to increase biogas revenue through additional ACCU projects and landfill biogas-to-power stations, and expanding existing biogas-to-power stations; increase exposure to high quality landfill gas sites; and strengthen the premium electricity offering deploying hybrid battery systems that increase LGI’s ability to optimise the price it receives for electricity.

Basin Energy (ASX:BSN)

Listing: 4 October

IPO: $9m at $0.20

Basin Energy is a uranium exploration and development company with an interest in three highly prospective projects positioned in the southwest corner and margins of the world-renowned Athabasca Basin in Canada.

TRADING HALTS

The following companies went into trading halts yesterday and are expected out in the next few days:

Southern Cross Gold (ASX: SXG) – Pending an announcement in relation to material exploration results at the Sunday Creek Project

New Zealand Coastal Seafoods (ASX:NZS) – Pending an announcement in relation to a material acquisition

Nanoveu Limited (ASX:NVU) – Capital raise

Beacon Minerals Limited (ASX: BCN) – In relation to a material acquisition

COMMODITY/FOREX/ CRYPTO MARKET PRICES

Gold: $US1,660.39 (+0.06%)

Silver: $US18.81(–.40%)

Nickel (3mth): $US22,410/t (+2.77%)

Copper (3mth): $US7,515/t (+1.25%)

Lithium Carbonate, China (Benchmark Minerals Intelligence, Sept 14): $US71,500/t (+98.6% year-to-date)

Lithium Hydroxide, China (Benchmark Minerals Intelligence, Sept 14): $US70,550/t (+135.6% year-to-date)

Oil (WTI): $US81.53 (-0.75%)

Oil (Brent): $US88.61 (-0.79%)

Iron 62pc Fe: $US98.42 (-0.10%)

AUD/USD: 0.65 (+0.50%)

Bitcoin: $US19,471 (-0.90%)

WHAT GOT YOU TALKING YESTERDAY?

Yeah Elon Musk, WHY?

– #Vanadium redox flow #batteries have shown promise over the past few years and delivered very little

– Big developments in #China and a perceived #shortage of #batterymetals may be the spark this battery technology needs to lift off https://t.co/djZXPlhyg2 #ASX $AVL $TMT— Stockhead (@StockheadAU) October 2, 2022

Keep up to date with Stockhead coverage or you’ll miss gold like that EVERY DAY. Follow our Twitter page.

For all you crypto lovers Stockhead’s Coinhead Facebook group is the place to share your views, insights, tips and ideas.

Also, be sure to check in preopen each day for ‘Market highlights and 5 ASX small caps to watch’, and 10.30am for our daily ‘10 at 10’ column — a live summary of winners & losers at the opening bell.

YESTERDAY’s BIGGEST SMALL CAP WINNERS

(Stocks highlighted in yellow rose after making announcements during the trading day).

Scroll or swipe to reveal table. Click headings to sort.

| CODE | COMPANY | PRICE | % TODAY | VOLUME | MARKET CAP |

|---|---|---|---|---|---|

| AVW | Avira Resources Ltd | 0.004 | 33% | 510,000 | $6,356,370 |

| DNK | Danakali Limited | 0.33 | 27% | 3,936,699 | $95,766,930 |

| MTH | Mithril Resources | 0.005 | 25% | 1,892,354 | $11,760,932 |

| CVR | Cavalierresources | 0.18 | 24% | 330,088 | $4,406,412 |

| INP | Incentiapay Ltd | 0.011 | 22% | 20,000 | $11,385,573 |

| CVV | Caravel Minerals Ltd | 0.25 | 22% | 168,868 | $85,932,796 |

| AQX | Alice Queen Ltd | 0.003 | 20% | 3,287,776 | $5,500,625 |

| DLT | Delta Drone Intl Ltd | 0.013 | 18% | 108,611 | $3,298,749 |

| AUH | Austchina Holdings | 0.007 | 17% | 2,380,009 | $12,220,996 |

| LNU | Linius Tech Limited | 0.0035 | 17% | 500,000 | $7,141,599 |

| RAN | Range International | 0.007 | 17% | 100,018 | $5,635,742 |

| RNX | Renegade Exploration | 0.007 | 17% | 250,000 | $5,337,760 |

| ALY | Alchemy Resource Ltd | 0.0315 | 17% | 65,978,469 | $25,733,051 |

| RCW | Rightcrowd | 0.048 | 14% | 52,977 | $10,988,974 |

| TMT | Technology Metals | 0.415 | 14% | 807,469 | $76,585,963 |

| MCM | Mc Mining Ltd | 0.465 | 13% | 86,131 | $81,038,497 |

| GGE | Grand Gulf Energy | 0.017 | 13% | 4,017,082 | $23,199,160 |

| CI1 | Credit Intelligence | 0.13 | 13% | 81,389 | $9,602,403 |

| SFX | Sheffield Res Ltd | 0.45 | 13% | 296,156 | $138,635,022 |

| AL8 | Alderan Resource Ltd | 0.009 | 13% | 286,625 | $4,626,129 |

| DXN | DXN Limited | 0.009 | 13% | 220,000 | $13,770,519 |

| NAE | New Age Exploration | 0.009 | 13% | 1,964,060 | $11,487,191 |

| PNX | PNX Metals Limited | 0.0045 | 13% | 75,000 | $17,776,231 |

| POW | Protean Energy Ltd | 0.009 | 13% | 520,890 | $5,204,904 |

| G1A | Galena Mining | 0.1675 | 12% | 225,870 | $92,040,803 |

It was all about Danakali (ASX:DNK) yesterday. Shareholders were possibly cartwheeling over the chance their company could be selling its 50% interest in the flagship Colluli potash project in Eritrea for $US166m ($258m) pre-tax.

And returning 90% of those sale proceeds to them.

Until this morning, Danakali was worth, as a whole, $112m. Yes, it could be selling 50% of one project for twice its entire MC.

But then again, how much could that potash project be worth one day?

DNK says it will use the remaining $US12m “to identify new projects and potential new alternative growth opportunities”.

Recently listed WA gold explorer Cavalier Resources (ASX:CVR) has returned numerous thick, shallow, and reasonably high grades from drilling at its 101,000oz Crawford project.

Reuben Adams notes, highlights included 9m at 3.84g/t from 7m, and 3m at 12.52g/t from 67m, and sent CVR up some 24% for the day.

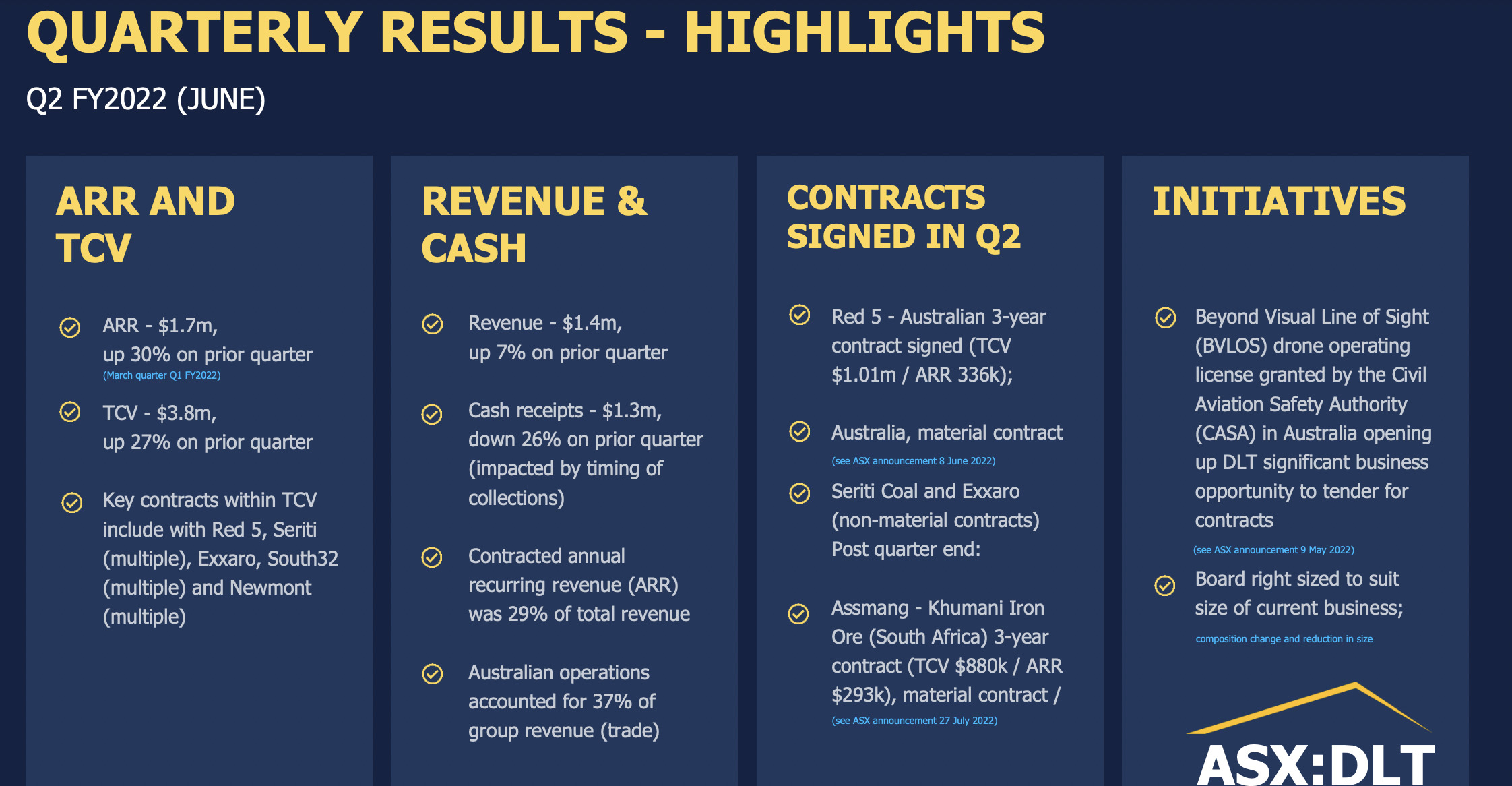

And Delta Drone International (ASX:DLT) rose almost 20% on this encouraging business:

CEO Christopher Clark says that on the back of DLT’s signing of its first long-term customer in Australia, Red 5, the company has set some baseline growth metrics.

YESTERDAY’S BIGGEST SMALL CAP LOSERS

(Stocks highlighted in yellow fell after making announcements during the trading day).

Scroll or swipe to reveal table. Click headings to sort.

| CODE | COMPANY | PRICE | % TODAY | VOLUME | MARKET CAP |

|---|---|---|---|---|---|

| GLV | Global Oil & Gas | 0.002 | -33% | 879,503 | $5,620,064 |

| MGG | Mogul Games Grp Ltd | 0.002 | -33% | 181,994 | $9,790,324 |

| BUR | Burleyminerals | 0.11 | -21% | 59,999 | $4,805,227 |

| EDE | Eden Inv Ltd | 0.0075 | -21% | 20,662,610 | $24,569,166 |

| LGM | Legacy Minerals | 0.12 | -20% | 250,000 | $6,868,620 |

| ADR | Adherium Ltd | 0.004 | -20% | 5,450,001 | $12,809,249 |

| SYN | Synergia Energy Ltd | 0.002 | -20% | 197,010 | $21,044,477 |

| TSC | Twenty Seven Co. Ltd | 0.002 | -20% | 30,263,694 | $8,848,782 |

| 5EA | 5Eadvanced | 1.63 | -20% | 1,901,320 | $580,962,878 |

| MTR | Metal Tiger | 0.3 | -19% | 2,000 | $7,318,085 |

| MRC | Mineral Commodities | 0.075 | -18% | 488,375 | $49,265,138 |

| CMO | Cosmometalslimited | 0.12 | -17% | 10,000 | $3,698,950 |

| G50 | Gold50Limited | 0.12 | -17% | 50,000 | $8,256,735 |

| TTB | Total Brain Ltd | 0.039 | -17% | 45,000 | $6,284,893 |

| AD1 | AD1 Holdings Limited | 0.02 | -17% | 180,400 | $16,817,551 |

| CTO | Citigold Corp Ltd | 0.005 | -17% | 13,330 | $17,001,955 |

| FAU | First Au Ltd | 0.005 | -17% | 8,980,992 | $5,588,466 |

| MAU | Magnetic Resources | 0.805 | -17% | 222 | $220,471,135 |

| NYR | Nyrada Inc. | 0.11 | -15% | 170,000 | $20,281,131 |

| AJQ | Armour Energy Ltd | 0.006 | -14% | 199,825 | $15,809,156 |

| CAV | Carnavale Resources | 0.006 | -14% | 3,278,429 | $19,029,862 |

| CMD | Cassius Mining Ltd | 0.03 | -14% | 1,280,896 | $14,130,932 |

| LSA | Lachlan Star Ltd | 0.012 | -14% | 196,126 | $18,466,178 |

| RR1 | Reach Resources Ltd | 0.006 | -14% | 4,653,000 | $13,370,354 |

| MM1 | Midasmineralsltd | 0.19 | -14% | 37,405 | $12,568,988 |

We’ll find out this morning what 5E Advanced Materials (ASX:5EA) has in its investor webcast that sent it down 18% yesterday. All it wants to do is discuss its small-scale boron facility at Fort Cady, in the US.

Jeez, guys. Remember optimism?

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.