Who Made the Gains? Here are October’s top ASX miners and explorers

Mining

In early October, while assessing September data, we asked “Are we nearing the bottom of this bear market for junior resources companies?” Now it’s early November and judging by the October we just had… the question still begs.

It might’ve been “Uptober” in the metaversal fantasy land of magic internet monies (ahem, Bitcoin was up 28% for the month) but in the real world, where you can actually touch and smell things pulled from ground/orifices … yeah, not quite as stonking on the whole.

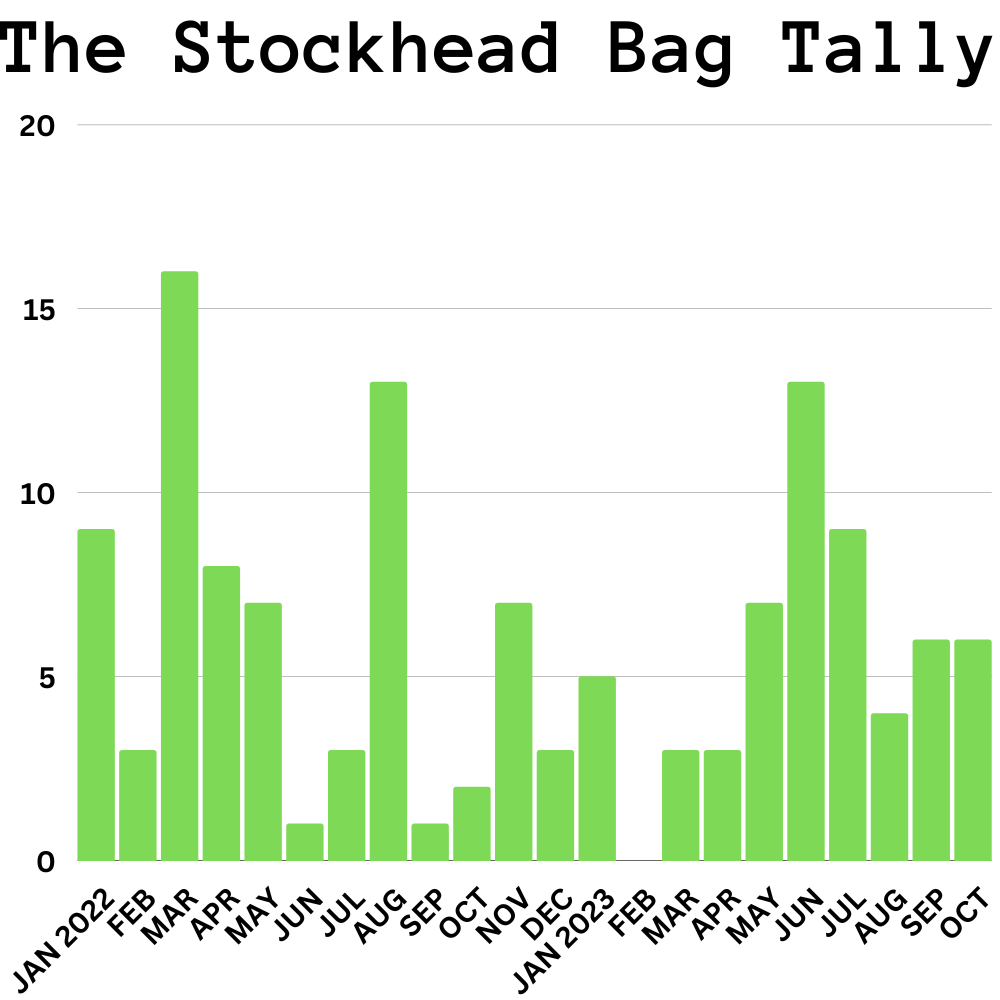

That’s not to say there weren’t some serious gainers. Of course there were. Just a fairly modest amount again this time around compared with the heady days of June (not to mention March 2022) – as you can see from our highly scientific Bag Tally chart below.

October’s Bag Tally — stocks with gains of 100% or more — was, like September’s, solid but unremarkable. A pass mark, head in clouds of drill dust, and a “must try harder note” for next/this month.

Maybe Jerome Powell over at the US Federal Reserve can help the Bag Tally lift in November.

Per Eddy “Market Highlights” Sunarto:

The Fed Reserve’s decision to keep its main cash rate at 5.25%-5.5% was unanimous, and many on Wall Street believe the Fed is done with rate hikes.

“The Fed did not rule out a rate increase in the coming months, but swap contracts showed traders weren’t convinced,” said Oanda’s Edward Moya.

“The Fed tried to deliver a hawkish hold but Wall Street is not believing additional tightening will happen this cycle.”

Not so sure the RBA’s Michele Bullock’s is on the same page, but. We’ll see.

We digress. Back to the matter at hand…

Scroll or swipe to reveal table. Click headings to sort.

| CODE | COMPANY | OCTOBER RETURN | PRICE | MARKET CAP |

|---|---|---|---|---|

| TG6 | TG Metals | 251% | 0.33 | $14,911,570 |

| DCN | Dacian Gold Ltd | 167% | 0.28 | $352,872,272 |

| FIN | FIN Resources Ltd | 158% | 0.031 | $17,388,990 |

| PIM | Pinnacle Minerals | 71% | 0.145 | $3,964,125 |

| TIE | Tietto Minerals | 67% | 0.56 | $637,145,105 |

| WA1 | WA1 Resources | 65% | 8.49 | $362,310,444 |

| STK | Strickland Metals | 52% | 0.105 | $160,114,610 |

| MTL | Mantle Minerals Ltd | 50% | 0.003 | $18,442,338 |

| RIM | Rimfire Pacific | 50% | 0.009 | $18,947,203 |

| AX8 | Accelerate Resources | 48% | 0.037 | $20,970,099 |

| ZAG | Zuleika Gold Ltd | 45% | 0.016 | $7,845,759 |

| OBM | Ora Banda Mining Ltd | 45% | 0.16 | $272,871,179 |

| FL1 | First Lithium Ltd | 43% | 0.35 | $25,568,858 |

| EGR | Ecograf Limited | 109% | 0.23 | $95,044,294 |

| BNR | Bulletin Res Ltd | 103% | 0.16 | $46,974,576 |

| KRR | King River Resources | 100% | 0.019 | $26,409,924 |

| IND | Industrial Minerals | 96% | 0.96 | $64,380,000 |

| BPH | BPH Energy Ltd | 61% | 0.029 | $31,784,033 |

| WC8 | Wildcat Resources | 58% | 0.705 | $895,130,574 |

| BAT | Battery Minerals Ltd | 57% | 0.047 | $5,262,598 |

| BMR | Ballymore Resources | 53% | 0.13 | $19,005,644 |

| BOC | Bougainville Copper | 51% | 0.46 | $176,467,500 |

| CZN | Corazon Ltd | 50% | 0.018 | $11,080,762 |

| AWJ | Auric Mining | 48% | 0.062 | $7,720,716 |

| SUH | Southern Hemisphere Mining | 92% | 0.046 | $26,572,784 |

| LPI | Lithium Power International | 46% | 0.525 | $330,349,719 |

TG Metals (ASX:TG6) +251%

Dacian Gold (ASX:DCN) +167%

Fin Resources (ASX:FIN) +158%

Ecograf (ASX:EGR) +109%

Bulletin Resources (ASX:BNR) +103%

King River Resources (ASX:KRR) +100%

This lithium, nickel and gold exploration junior was the month’s clear ressie stocks winner. In fact, never mind that, it was the clear winner on the ASX overall for October.

In fact, even though it’s pulled back by about 11% on the daily timeframe at the time of writing, it’s up roughly 352% now over the past 30 days.

A week or so ago, it announced an interception of high-grade lithium at its Lake Johnston Li-Ni-Au project in the Lake Johnston Greenstone Belt of WA.

The company, dubbed a “tethered goat” by Joe “Mr Lithium” Lowry, noted that initial drilling of the 4.5km by 1.7km Burmeister lithium soil anomaly within the project has found a spodumene-bearing pegmatite with grades up to 2.28% Li2O.

#TGMetals featured @StockheadAU

“Tethered Goat” as Joe “Mr Lithium” Lowry recently dubbed #TG6 – is continuing the good vibes from its recent find with an investor presentation drilling further into the details for shareholders & other interested partieshttps://t.co/wctHDdGSGA— TG Metals Limited (@TGMetals) November 1, 2023

As noted in our special report the other day:

The stock listed on the ASX May last year with assets prospective for nickel, lithium, and gold in the Goldfields-Esperance region of WA.

It had amassed the largest land package ever held by one exploration company within the Lake Johnston Greenstone Belt, saying the region has been “historically overlooked and underexplored”.

Five of the six holes completed, which were drilled to depths of between 120m and 132m, intersected multiple-stacked pegmatites with all pegmatite intervals hosting lithium mineralisation averaging 1.46% Li2O in spodumene.

Down-hole widths ranging from 9m to 12m and the better intercepts are 9m at 1.35% Li2O from a down-hole depth of 30m and 9m at 1.62% Li2O from 87m.

TG6 share price

Dacian had a big month on the back of an acquisition bid from Raleigh Finlayson’s $1.5b market capped gold miner Genesis Minerals (ASX:GMD), which announced it was going all in for the much smaller goldie in a takeover a long time in the works.

Dacian boasts a 2.9Mtpa processing facility and highly prospective land package in the Leonora/Laverton region.

More on the takeover news here.

TODAY'S ASX NEWS:

Dacian Takeover Offer – Improved Offer Consideration now payable – https://t.co/MJaT8nsGip #mergersandacquisitions #manda #growth $DCN $GMD pic.twitter.com/49IFPtKJl2

— Genesis Minerals Ltd (@genesisminerals) October 29, 2023

There’s actually some fresh news on this gilt-edged narrative for DCN today (November 2).

Genesis Minerals has announced to the ASX it’s set to proceed with its ‘post-bid compulsory acquisition’ of any DCN shares not accepted into Genesis’ takeover offer. Genesis has now lodged a compulsory acquisition notice with ASIC. More on that here.

DCN share price

Fin Resources had a truly spod-tastic October, discovering pegmatite bodies left, right and centre over in lithium hotspot James Bay, Canada.

Here’s just some of what occurred:

October 9 – Young lithium bull shark Fin Resources carved through ASX waters after its maiden fieldwork program identified abundant spodumene crystals within a broad pegmatite outcrop at the Cancet West project in James Bay, Canada.

October 16 – Fin increases Cancet West project area by 57% to 79km2 after finding large spodumene crystals. New claims more than double strike extent of highly prospective LCT pegmatite trend.

October 23 – Fin discovers five pegmatite bodies at the Ross project, part of the Mt Tremblant lithium project in James Bay.

Oh, and news just in…

November 2 – MORE spodumene crystals have now just been found at Cancet West just six months after project acquisition. The new discovery area named White Bear and drilling is being planned for early next year.

FIN share price

At Stockhead we tell it like it is. While TG Metals and FIN are Stockhead advertisers at the time of writing, they did not sponsor this article.