Rise and Shine: Everything you need to know before the ASX opens

Pic: Chalabala, iStock / Getty Images Plus

On Stockhead today, 5000 Aussies tell where they’re investing next, is green gold real, and top stocks to watch this reporting season.

But first, the day ahead.

Local shares are set to open higher today. At 8am AEDT, the ASX 200 August futures is pointing up by 0.70%.

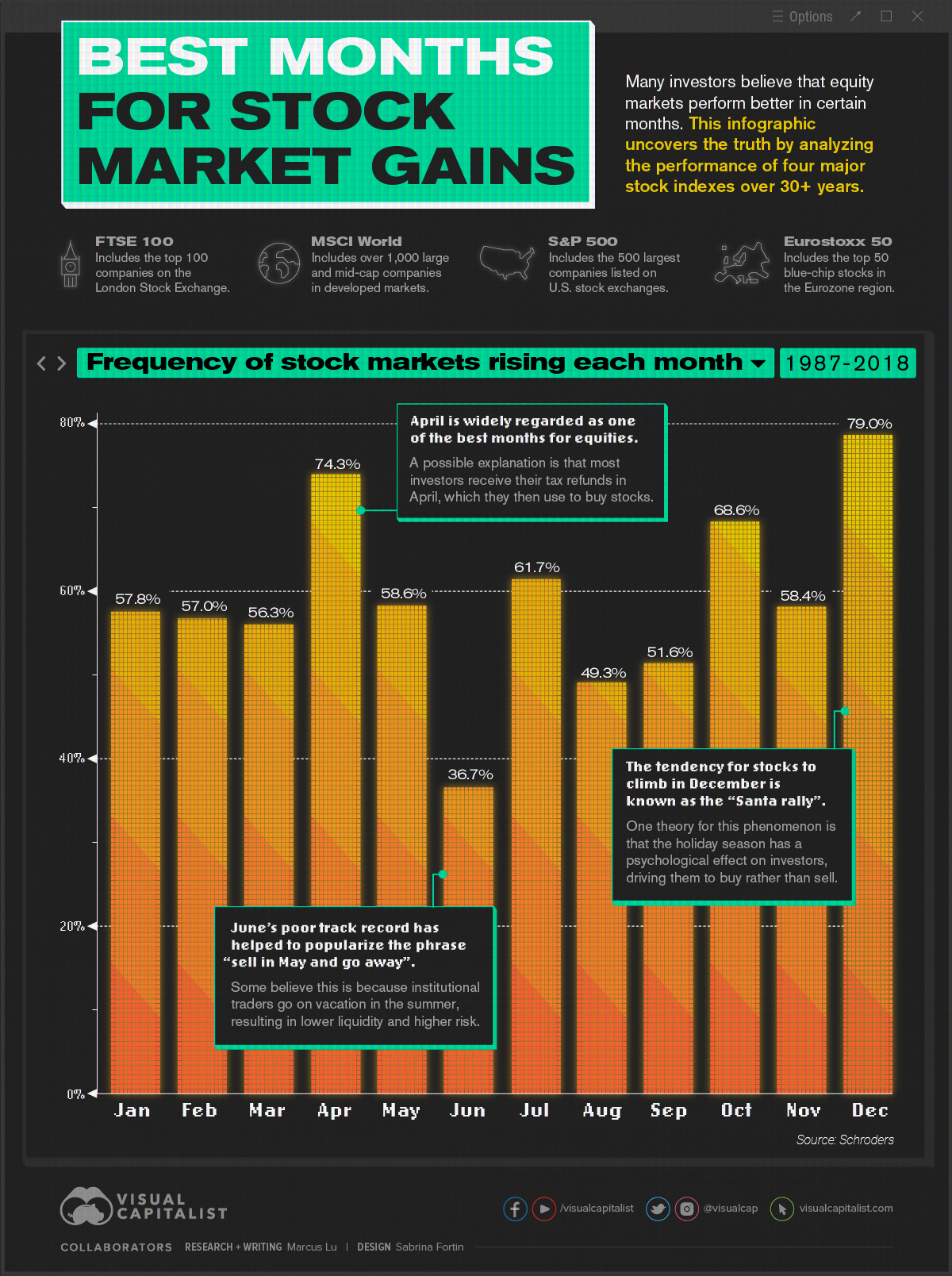

According to Visual Capitalist, August has been the second worst month (behind June) over the last 30+ years for stocks, on average.

Will 2022 buck that trend?

Corelogic releases the Home Value Index today, with data expected to show home prices continuing fall from recent highs in Melbs and Sydney.

Aussie Industry Group/S&P Global drop results of surveys from purchasing managers in the manufacturing sector.

“Activity continues to expand,” Commsec says.

Monthly inflation and job adverts data is also due.

TRADING HALTS

The following companies are in trading halts and are expected out in the coming days:

Celsius Resources (ASX:CLA) – Capital raise

Raiden Resources (ASX:RDN) – Capital raise

Alice Queen (ASX:AQX) – Capital raise

Design Milk (ASX:DMC) – Material announcement

Dreadnought Resources (ASX:DRE) – Capital raise

Venture Minerals Limited (ASX:VMS) – Results from the South West Project

Technology Metals Australia Limited (ASX: TMT) – Ore reserve update and anticipated production profile from Murchison Technology Metals Project

Carbonxt Group (ASX:CG1) – Capital raise

Cauldron Energy (ASX:CXU) – Drill assay results from Blackwood Gold Project

Caravel Minerals (ASX:CVV) – Capital raising

Pacific Edge (ASX:PEB) – Trading halt while the company figures out who needs to be sent a bill for use of its CxBladder cancer market codes

Felix Gold (ASX:FXG) – Positive drilling results from Felix’s Alaskan project

LiveTiles (ASX:LVT) – It looks like LiveTiles wants to get off the ASX merry go round

COMMODITY/ FOREX/ CRYPTO MARKET PRICES

Gold: $US1,765.22 (-0.31%)

Silver: $US20.20 (-0.11%)

Nickel (3mth): $US21,935/t

Copper (3mth): $US7,762/t

Lithium Carbonate, China (Benchmark Minerals Intelligence, June 30): $US69,750/t

Lithium Hydroxide, China (Benchmark Minerals Intelligence, June 30): $US70,875/t

Oil (WTI): $US97.90 (-0.75%)

Oil (Brent): $US103.37 (-0.59%)

Iron 62pc Fe: $US107.22 (+0.31%)

AUD/USD: 0.6986 (-0.20%)

Bitcoin: $US23,604 (-0.65%)

WHAT GOT YOU TALKING OVER THE WEEKEND?

Gold is running, again. The return of the bull market, or another discouraging fizzer?

• #Gold price hits three-week high post-FOMC rates decision, outlook strong

• #ASX Quarterly Gold Wrap: producers hit a low bar, investors are pleased

• Demand falls in H1 as cost-of-living pressures bite, WGC says

By @reubenadams6https://t.co/pDzd8EbEOL— Stockhead (@StockheadAU) July 29, 2022

Keep up to date with Stockhead coverage or you’ll miss gold like that EVERY DAY. Follow our Twitter page.

For all you crypto lovers Stockhead’s Coinhead Facebook group is the place to share your views, insights, tips and ideas.

Also, be sure to check in preopen each day for ‘Market highlights and 5 ASX small caps to watch’, and 10.30am for our daily ‘10 at 10’ column — a live summary of winners & losers at the opening bell.

ASX SMALL CAP WINNERS:

Here are the best performing ASX small cap stocks for July 25 – July 29:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Company | Price | % Week | Market Cap |

|---|---|---|---|---|

| SZL | Sezzle Inc. | 0.955 | 282% | $204,852,301.80 |

| LBY | Laybuy Group Holding | 0.115 | 161% | $38,222,880.15 |

| PSC | Prospect Res Ltd | 0.1225 | 147% | $55,471,135.44 |

| INP | Incentiapay Ltd | 0.017 | 143% | $15,180,763.50 |

| CBE | Cobre | 0.086 | 139% | $14,225,002.86 |

| SMX | Security Matters | 0.26 | 117% | $46,455,229.52 |

| WBE | Whitebark Energy | 0.002 | 100% | $11,296,438.39 |

| NGY | Nuenergy Gas Ltd | 0.03 | 88% | $42,947,709.41 |

| MCM | Mc Mining Ltd | 0.235 | 81% | $48,425,443.15 |

| OPY | Openpay Group | 0.375 | 74% | $79,139,669.50 |

| POL | Polymetals Resources | 0.15 | 67% | $6,008,484.90 |

| ABE | Ausbondexchange | 0.415 | 66% | $12,032,282.79 |

| GNX | Genex Power Ltd | 0.215 | 65% | $297,813,085.10 |

| ZIP | ZIP Co Ltd.. | 1.21 | 56% | $1,045,734,979.28 |

| MRR | Minrex Resources Ltd | 0.052 | 53% | $43,466,025.40 |

| ANL | Amani Gold Ltd | 0.0015 | 50% | $35,540,161.69 |

| GNM | Great Northern | 0.006 | 50% | $10,254,305.86 |

| TYX | Tyranna Res Ltd | 0.027 | 50% | $33,711,934.67 |

| VMG | VDM Group Limited | 0.0015 | 50% | $10,391,491.43 |

| KGN | Kogan.Com Ltd | 4.66 | 49% | $502,559,734.10 |

| SDV | Scidev Ltd | 0.32 | 49% | $57,822,411.79 |

| B4P | Beforepay Group | 0.55 | 47% | $22,347,262.74 |

| PYR | Payright Limited | 0.13 | 44% | $10,167,848.21 |

| NWM | Norwest Minerals | 0.046 | 44% | $7,766,117.64 |

| ARN | Aldoro Resources | 0.2075 | 43% | $20,913,336.57 |

| APS | Allup Silica Ltd | 0.11 | 43% | $4,075,731.11 |

| TGM | Theta Gold Mines Ltd | 0.084 | 42% | $52,271,597.02 |

| SPN | Sparc Tech Ltd | 0.93 | 41% | $58,031,852.28 |

| GLV | Global Oil & Gas | 0.0035 | 40% | $5,620,064.12 |

| KNO | Knosys Limited | 0.105 | 40% | $18,804,066.73 |

| CAU | Cronos Australia | 0.285 | 39% | $160,178,500.82 |

| BIR | BIR Financial Ltd | 0.033 | 38% | $5,743,085.01 |

| IR1 | Irismetals | 0.375 | 36% | $21,465,000.00 |

| NXS | Next Science Limited | 1.035 | 36% | $205,124,577.97 |

| IND | Industrialminerals | 0.34 | 36% | $9,408,000.00 |

| IS3 | I Synergy Group Ltd | 0.054 | 35% | $13,959,994.15 |

| TTB | Total Brain Ltd | 0.058 | 35% | $7,755,825.60 |

| SOP | Synertec Corporation | 0.12 | 35% | $41,096,464.40 |

| INV | Investsmart Group | 0.31 | 35% | $41,743,260.30 |

| 4DX | 4Dmedical Limited | 0.7 | 35% | $127,463,015.43 |

| GL1 | Globallith | 1.465 | 34% | $229,318,979.92 |

| CY5 | Cygnus Gold Limited | 0.2 | 33% | $18,877,650.40 |

| RR1 | Reach Resources Ltd | 0.004 | 33% | $5,730,151.92 |

| VPR | Volt Power Group | 0.002 | 33% | $18,689,067.12 |

| GTN | GTN Limited | 0.5 | 33% | $107,639,520.50 |

| HE8 | Helios Energy Ltd | 0.091 | 32% | $221,344,202.66 |

| E79 | E79Goldmineslimited | 0.13 | 31% | $7,222,263.10 |

| ZEO | Zeotech Limited | 0.065 | 31% | $97,594,590.08 |

| XPN | Xpon Technologies | 0.19 | 31% | $26,497,014.64 |

| SPX | Spenda Limited | 0.017 | 31% | $54,088,249.56 |

On Friday, BNPL comeback story Sezzle (ASX:SZL) reported a 6.8% bump in total quarterly income after already gaining some 263% for the week.

In fact it was a good week for BNPL-facing stocks full stop, with Laybuy Group (ASX:LBY), Incentiapay (ASX:INP), Openpay (ASX:OPY), Zip (ASX:ZIP) and Beforepay (ASX:B4P) also making significant gains.

Explorer Cobre (ASX:CBE) was ~140% after making a “significant new copper discovery” at the Ngami project in Botswana.

And blockchain auditing tech company Security Matters (ASX:SMX) will be back-ended into the NASDAQ via a SPAC called Lionheart. That’s good for shareholders, it says.

ASX SMALL CAP LOSERS:

Here are the worst performing ASX small cap stocks for July 25 – July 29:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Company | Price | % Week | Market Cap |

|---|---|---|---|---|

| SRX | Sierra Rutile | 0.3075 | -99% | $156,967,485.39 |

| CPT | Cipherpoint Limited | 0.009 | -49% | $4,252,870.36 |

| PVS | Pivotal Systems | 0.13 | -35% | $30,298,587.50 |

| MEB | Medibio Limited | 0.001 | -33% | $2,756,490.12 |

| HXG | Hexagon Energy | 0.017 | -32% | $8,206,654.42 |

| NTO | Nitro Software Ltd | 1.1225 | -32% | $269,923,733.56 |

| WYX | Western Yilgarn NL | 0.11 | -29% | $4,530,075.44 |

| TD1 | Tali Digital Limited | 0.005 | -29% | $7,395,783.14 |

| HIO | Hawsons Iron Ltd | 0.32 | -27% | $251,958,003.00 |

| LVT | Livetiles Limited | 0.059 | -27% | $54,458,257.05 |

| NVU | Nanoveu Limited | 0.011 | -27% | $2,565,973.03 |

| SPA | Spacetalk Ltd | 0.056 | -26% | $11,315,498.95 |

| ICG | Inca Minerals Ltd | 0.053 | -25% | $26,504,210.65 |

| AL8 | Alderan Resource Ltd | 0.009 | -25% | $5,049,877.76 |

| PPG | Pro-Pac Packaging | 0.3 | -25% | $28,388,643.50 |

| T3D | 333D Limited | 0.0015 | -25% | $4,551,445.00 |

| JRV | Jervois Global Ltd | 0.405 | -24% | $607,900,384.40 |

| AQC | Auspaccoal Ltd | 0.095 | -24% | $4,796,056.95 |

| CMO | Cosmometalslimited | 0.13 | -24% | $3,316,300.00 |

| AR9 | Archtis Limited | 0.15 | -23% | $40,889,497.09 |

| DUB | Dubber Corp Ltd | 0.68 | -22% | $283,724,057.76 |

| ALY | Alchemy Resource Ltd | 0.014 | -22% | $16,202,258.97 |

| RLC | Reedy Lagoon Corp. | 0.014 | -22% | $8,918,830.59 |

| NUH | Nuheara Limited | 0.23 | -22% | $28,811,018.46 |

| RLG | Roolife Group Ltd | 0.011 | -21% | $7,724,539.49 |

| TGH | Terragen | 0.13 | -21% | $25,144,500.55 |

| FGL | Frugl Group Limited | 0.015 | -21% | $3,039,782.93 |

| SEG | Sports Ent Grp Ltd | 0.23 | -21% | $60,055,766.44 |

| APC | Aust Potash Ltd | 0.04 | -20% | $33,952,077.94 |

| AHI | Adv Human Imag Ltd | 0.12 | -20% | $20,009,925.84 |

| CFO | Cfoam Limited | 0.004 | -20% | $2,201,521.90 |

| EXL | Elixinol Wellness | 0.04 | -20% | $12,650,622.84 |

| R3D | R3D Resources Ltd | 0.1 | -20% | $12,003,761.77 |

| SHP | South Harz Potash | 0.1 | -20% | $52,671,339.96 |

| PTG | Proptech Group | 0.25 | -19% | $40,210,239.60 |

| GCX | GCX Metals Limited | 0.046 | -19% | $9,288,934.70 |

| MMI | Metro Mining Ltd | 0.021 | -19% | $58,281,008.97 |

| EMH | European Metals Hldg | 0.645 | -18% | $79,109,491.56 |

| NCR | Nucoal Resources Ltd | 0.009 | -18% | $6,917,511.19 |

| CE1 | Calima Energy | 0.135 | -18% | $88,855,429.86 |

| SGA | Sarytogan | 0.32 | -18% | $20,593,678.62 |

| WCN | White Cliff Min Ltd | 0.0115 | -18% | $8,496,843.71 |

| AHN | Athena Resources | 0.014 | -18% | $10,568,578.25 |

| MRL | Mayur Resources Ltd | 0.07 | -18% | $16,908,056.41 |

| OSX | Osteopore Limited | 0.14 | -18% | $17,003,894.51 |

| ASR | Asra Minerals Ltd | 0.019 | -17% | $29,275,230.68 |

| CAY | Canyon Resources Ltd | 0.049 | -17% | $40,321,103.20 |

| X2M | X2M Connect Limited | 0.09 | -17% | $9,888,172.88 |

| VIP | VIP Gloves | 0.01 | -17% | $9,441,377.22 |

| IBX | Imagion Biosys Ltd | 0.035 | -17% | $42,606,304.29 |

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.