Rise and Shine: Everything you need to know before the ASX opens

Pic: Via Getty

On Stockhead today, who was the bestest small cap on the ASX in January, another disastrous month for your lithium stocks, and will Evergrande’s collapse cripple iron ore and copper demand? No. No it won’t. (Spoiler.)

But first, the day ahead.

WHO’s LISTING?

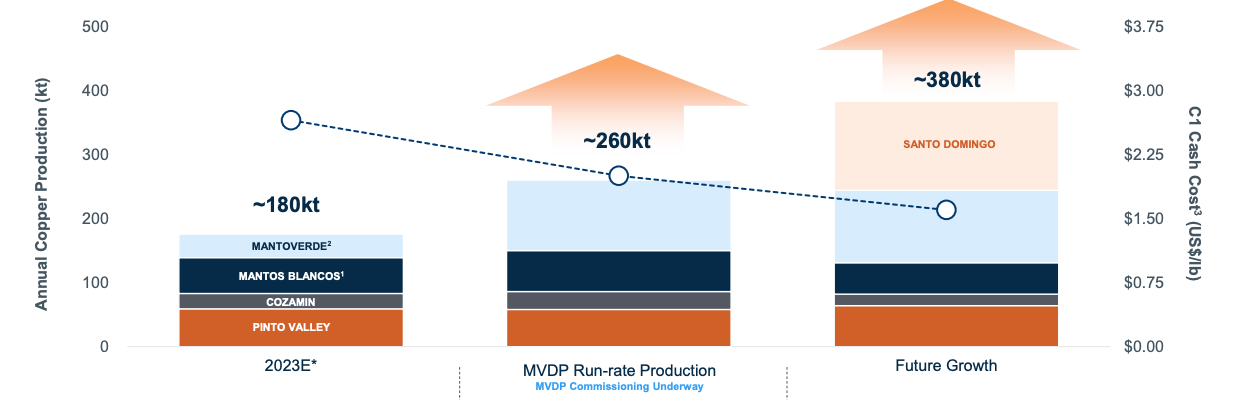

The ASX is getting some much needed mid-tier copper exposure when CAD$4.6bn-capped Capstone Copper (TSX:CS) launches its secondary listing at 12pm Eastern Time with the code ASX:CSC.

2023 production of 165,000t from its US and Chilean mines – jumping to 190-220,000t in 2024 – means Capstone is potentially well placed in a simmering copper market.

It has a medium term production target of ~380,000tpa and, ambitiously, believes it can reduce all important operating costs over this period:

COMMODITY/FOREX/CRYPTO MARKET PRICES

Gold: US$2,055.05(+0.88%)

Silver: US$23.18 (+1.14%)

Nickel (3mth): US$16,269/t (-1.45%)

Copper (3mth): US$8,608.50/t (-0.08%)

Oil (WTI): US$73.91 (-2.55%)

Oil (Brent): US$78.85 (-2.10%)

Iron 62pc Fe: US$132.67/t (-1.82%)

AUD/USD: 0.6574 (+0.1%)

Bitcoin: US$43,032 (+1.57%)

TRADING HALTS

These stocks went into trading halts yesterday and are expected out in the coming days:

Advanced Health Intelligence (ASX:AHI) – announcement of various potential funding solutions referred to in the company’s Quarterly Commentary

Regis Resources (ASX:RRL) – commencement of proceedings claiming a royalty applies to the Tropicana gold project

NeuRizer (ASX:NRZ) – update regarding amounts owing to DL E&C and negotiations to extend the payment date

Moab Minerals (ASX:MOM) – proposed acquisition

IODM (ASX:IOD) – a material revenue event

Metcash (ASX:MTS) – potential acquisition of Superior Food Group

Jayride Group (ASX:JAY) – capital raising

Unith (ASX:UNT) – capital raising

Silver Mines (ASX:SVL) – capital raising

Basin Energy (ASX:BSN) – material capital raising

Legacy Iron Ore (ASX:LCY) – material capital raising

BCI Minerals (ASX:BCI) – capital raising

Viridis Mining and Minerals (ASX:VMM) – capital raising

EP&T Global (ASX:EPX) – capital raising

RocketBoots (ASX:ROC) – capital raising

Linius Technologies (ASX:LNU) – capital raising

Yandal Resources (ASX:YRL) – capital raising

Bluechiip (ASX:BCT) – capital raising

WHAT GOT YOU TALKING YESTERDAY?

World #1 uranium producer Kazatomprom has just slashed 2024 production guidance. And you thought this market couldn’t get any hotter.

Boom! Kazatomprom $KAP 4Q23 Operations and Trading Update cuts #Kazakhstan‘s 2024 #Uranium Production Guidance from 25,300 tU (65.8M lbs #U3O8) to 21,750 tU (56.5M lbs) at -9.3M lbs below previous guidance (-14.2%)⚛️⏬ #Nuclear #SupplyCrunch ️ https://t.co/OR3ox28Hn8 pic.twitter.com/R7bTI0KFCc

— John Quakes (@quakes99) February 1, 2024

Searching for a lithium bottom? Morgan’s says “the downcycle [is] largely played out, presenting some attractive opportunities”.

And this:

“…we expect lithium prices are nearing a floor, with the current rapid decline likely to moderate this half.”

Eye on Lithium: ‘Downcycle largely played out’, says Morgans, eyeing PLS, MIN as buys in turbulent lithium environment and LTR a cautious hold. Stockhead > https://t.co/RsFlzRScjS

— Stockhead (@StockheadAU) February 1, 2024

Keep up to date with Stockhead coverage or you’ll miss gold like that EVERY DAY. Follow our Twitter page.

Also, be sure to check in at preopen each day for ‘Market Highlights and 5 ASX Small Caps to Watch’, and 10.40am for our daily ‘10 at 10’ column — a live summary of winners & losers at the opening bell.

YESTERDAY’S ASX SMALL CAP LEADERS

Here are Thursday’s best performing ASX small cap stocks:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Company | Price | % | Volume | MARKET CAP |

|---|---|---|---|---|---|

| MRC | Mineral Commodities | 0.028 | 87% | 416,193 | $14,767,089 |

| SHG | Singular Health | 0.15 | 60% | 5,943,163 | $13,283,165 |

| BPM | BPM Minerals | 0.12 | 50% | 2,097,437 | $5,369,777 |

| GES | Genesis Resources | 0.006 | 50% | 85,650 | $3,131,365 |

| M4M | Macro Metals Limited | 0.003 | 50% | 500,000 | $4,934,156 |

| CPO | Culpeominerals | 0.072 | 47% | 28,271,880 | $6,653,746 |

| RDM | Red Metal Limited | 0.13 | 35% | 7,387,398 | $28,639,040 |

| POD | Podium Minerals | 0.031 | 29% | 4,111,249 | $10,913,923 |

| OSL | Oncosil Medical | 0.009 | 29% | 12,438,445 | $13,821,788 |

| TMG | Trigg Minerals Ltd | 0.009 | 29% | 41,671 | $2,623,293 |

| CTN | Catalina Resources | 0.005 | 25% | 50,000 | $4,953,948 |

| GBZ | GBM Rsources Ltd | 0.01 | 25% | 4,797,451 | $5,851,463 |

| HCD | Hydrocarbon Dynamic | 0.005 | 25% | 200,000 | $3,078,664 |

| ROG | Red Sky Energy. | 0.005 | 25% | 38,001 | $21,208,909 |

| TML | Timah Resources Ltd | 0.045 | 25% | 873 | $3,195,351 |

| COB | Cobalt Blue Ltd | 0.175 | 21% | 765,556 | $54,492,017 |

| DGR | DGR Global Ltd | 0.018 | 20% | 128,699 | $15,655,402 |

| GCX | GCX Metals Limited | 0.042 | 20% | 795,893 | $8,252,254 |

| SPX | Spenda Limited | 0.018 | 20% | 19,452,063 | $64,686,867 |

| ASR | Asra Minerals Ltd | 0.006 | 20% | 2,957,549 | $8,182,479 |

| IBG | Ironbark Zinc Ltd | 0.006 | 20% | 1,207,148 | $7,969,363 |

| NET | Netlinkz Limited | 0.006 | 20% | 485,372 | $19,392,242 |

| NSM | Northstaw | 0.048 | 20% | 65,417 | $5,595,031 |

| GSM | Golden State Mining | 0.013 | 18% | 352,003 | $3,073,077 |

| HIQ | Hitiq Limited | 0.02 | 18% | 1,521,553 | $5,981,364 |

Red Metal (ASX:RDM) says the Sybella rare earths discovery in Queensland is a heap leachable source of rare earth oxide (REO) minerals “with the potential for highly competitive capital and operating costs”.

Heap leaching is a low-cost process whereby a mound of ore is irrigated with acid to dissolve the metal, which is collected in a pond or tank.

Medical tech company Singular Health Group (ASX:SHG) received a binding purchase order worth about $150,000.

And a double banger for cancer fighter Oncosil (ASX:OSL) as it inks new distribution rights for the OncoSil device in the Turkish market and fields growing demand from German hospitals.

YESTERDAY’S ASX SMALL CAP LAGGARDS

Here are Thursday’s worst performing ASX small cap stocks:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Company | Price | % | Volume | MARKET CAP |

|---|---|---|---|---|---|

| DXN | DXN Limited | 0.001 | -50% | 3,484,622 | $5,546,680 |

| VPR | Volt Power Group | 0.001 | -50% | 535,709 | $21,432,416 |

| IBX | Imagion Biosys Ltd | 0.11 | -35% | 642,325 | $5,549,914 |

| KGD | Kula Gold Limited | 0.006 | -33% | 27,453,467 | $3,808,907 |

| RR1 | Reach Resources Ltd | 0.002 | -33% | 5,883,892 | $9,630,891 |

| AUK | Aumake Limited | 0.003 | -25% | 6,259 | $7,657,627 |

| JTL | Jayex Technology Ltd | 0.006 | -25% | 2,921,691 | $2,250,228 |

| KPO | Kalina Power Limited | 0.003 | -25% | 29,652 | $8,840,512 |

| PKO | Peako Limited | 0.003 | -25% | 224,000 | $2,108,339 |

| TSI | Top Shelf | 0.21 | -24% | 163,551 | $57,179,612 |

| AUR | Auris Minerals Ltd | 0.007 | -22% | 600,000 | $4,289,634 |

| ARD | Argent Minerals | 0.008 | -20% | 4,651,423 | $12,917,590 |

| BFC | Beston Global Ltd | 0.008 | -20% | 16,920,839 | $19,970,469 |

| LSR | Lodestar Minerals | 0.002 | -20% | 1,267,500 | $5,058,493 |

| NAE | New Age Exploration | 0.004 | -20% | 119,628 | $8,969,495 |

| RLC | Reedy Lagoon Corp. | 0.004 | -20% | 41,570 | $3,097,704 |

| VML | Vital Metals Limited | 0.004 | -20% | 22,124,047 | $29,475,335 |

| WEL | Winchester Energy | 0.002 | -20% | 100,000 | $2,551,055 |

| IR1 | Irismetals | 0.565 | -19% | 536,579 | $90,639,487 |

| NGS | NGS Ltd | 0.013 | -19% | 1,288,993 | $4,019,638 |

| RSH | Respiri Limited | 0.022 | -19% | 188,615 | $28,616,461 |

| EXL | Elixinol Wellness | 0.009 | -18% | 1,518,365 | $6,961,588 |

| STN | Saturn Metals | 0.135 | -18% | 690,079 | $36,852,784 |

| AXN | Alliance Nickel Ltd | 0.032 | -18% | 92,095 | $28,307,745 |

| CAZ | Cazaly Resources | 0.019 | -17% | 1,351,507 | $10,456,635 |

Kula Gold (ASX:KGD) says recent drilling at the Cobra prospect failed to hit economic lithium mineralisation.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.