ASX January winners: The best 50 stocks as ASX S&P reaches record high

Pic: Getty Images

- The S&P ASX 200 rose 1.19% in January to finish at a record high

- Energy was the winner with a 5% gain due to the turnaround in oil prices

- Health stocks up in January, including Singular Health Group and PharmAust

After some up days and down days to start 2024, Australia’s S&P ASX 200 benchmark rose 1.19% in January to finish at a record high of 7680.7 points.

The ASX 200 rose for eight days in a row at the end of January, its longest winning streak in the past 10 months.

Australia’s CPI inflation rate for the December quarter fell to 4.1%, from 5.5% in the September quarter and while still above the RBA’s target of 2-3%, it was below the central bank’s November forecast of 4.5% and is heading in the right direction.

Furthermore, analysts and economists are increasingly confident that inflation is falling fast enough to enable interest rate cuts later this year. Australia has seen 13 interest rate hikes since May 2022, in the most aggressive monetary policy in decades.

It was a mixed month for Australia’s small and mid cap sector with the S&P ASX Small Ordinaries up 0.9% and the S&P ASX MidCap 50 falling 2.17%.

The S&P ASX Emerging Companies index was also in the red for January, tumbling 5.20% for the year, according to S&P Dow Jones Indices.

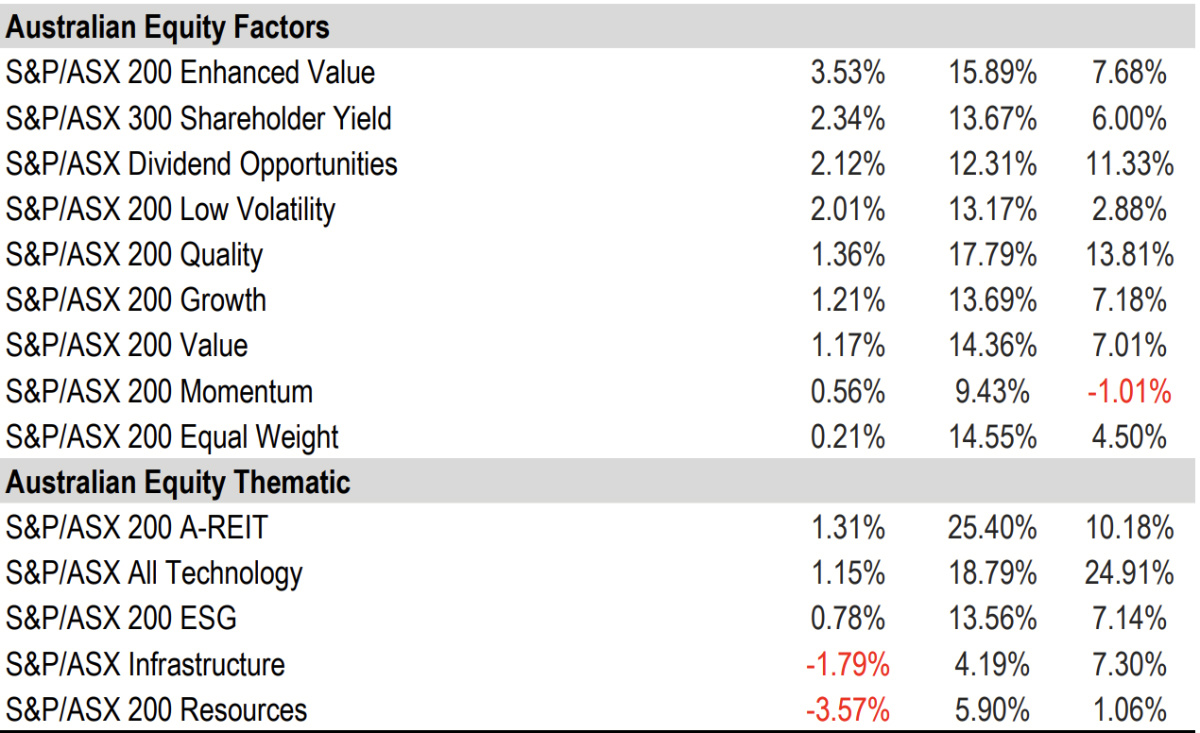

Energy lead winners, all equity factors up

Energy was the winner with a 5% gain due to the turnaround in oil prices, while materials was the worst performer with a 5% loss.

The S&P ASX 200 enhanced value was the best-performing factor with a 4% gain in January, while momentum and equal weight lagged with gains of less than 1%.

Against the bullish market backdrop, S&P Dow Jones Indices says equity volatility remained largely muted with the S&P ASX 200 VIX hovering at an 11 handle.

With the prospect of rate cuts later this year the S&P ASX 200 A-REIT made a comeback in January as the best performing Australian thematic, followed by S&P ASX All Technology. On the other end, in line with a drop in the materials sector in January the S&P ASX 200 Resources equity thematic was down 3.57%, while S&P ASX Infrastructure also sustained a loss.

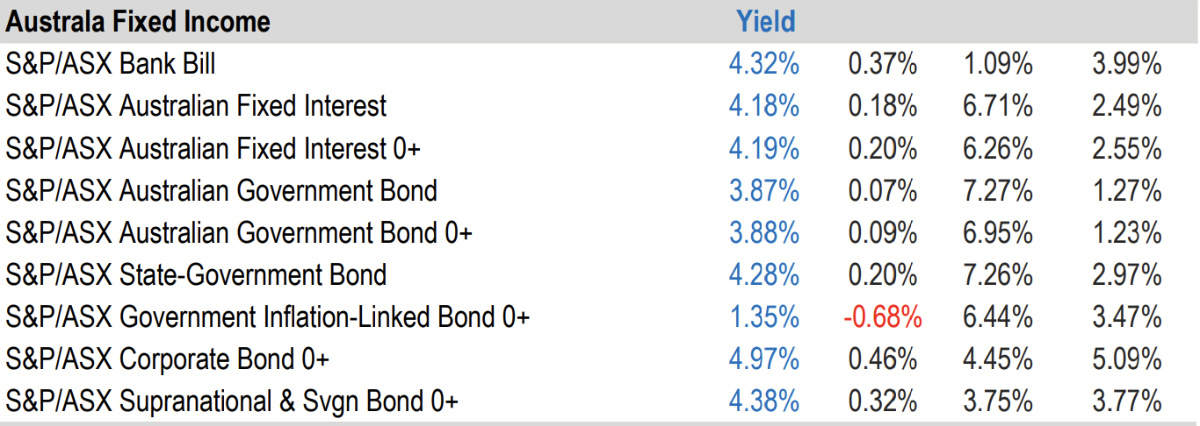

Fixed income mostly flat in January

Aussie bonds ended January mostly flat, with the exception of inflation-linked bonds, dropping on falling CPI figures. Global X product and investment strategist Marc Jocum told Stockhead local bonds initially witnessed an early steepening that propelled yields to reach levels as high as 4.3%.

However, he says bond yields fell sharply towards the end of the month following the release of softer-than-expected inflation data, causing government bond yields to end the month hovering at a yield of around 4%.

“While inflation-linked bonds outperformed government bonds in 2023, they encountered a tougher start to the year due to prospect of a continued deceleration inflation (known as disinflation),” he says.

He says Australian bonds remain a key tenant in diversified portfolios but nonetheless, their performance in the current year will likely be shaped by the anticipated central bank policy decisions by the RBA.

“Markets are pricing in a couple of interest rate cuts in 2024, especially with the recent softer inflation data,” he says.

“However, we could see the RBA holding rates for longer.

“We believe that investors should focus on geographic diversification within their bond portfolio.”

He says US bonds look more attractive, particularly given US inflation numbers are closer to target than Australia and the prospect of the Federal Reserve to cut rates may come sooner than the RBA.

“Bond prices could experience reasonable capital gains in 2024 given their prices are inversely related to interest rates with lower rates meaning higher capital appreciation,” he says.

He says investors could consider US treasury bonds and investment grade corporate bonds which can be accessed through ETFs like the Global X US Treasury Bond ETF (Currency Hedged) (ASX:USTB) or Global X USD Corporate Bond ETF (Currency Hedged) (ASX:USIG) respectively.

Here are the 50 best performing ASX stocks for January:

Scroll or swipe to reveal table. Click headings to sort.

| CODE | COMPANY | LAST SHARE PRICE | JANUARY RETURN % | MARKET CAP |

|---|---|---|---|---|

| RGS | Regeneus Ltd | 0.008 | 167% | $2,451,495 |

| SHG | Singular Health | 0.094 | 147% | $13,283,165 |

| OEQ | Orion Equities | 0.155 | 128% | $2,425,630 |

| KOB | Koba Resources | 0.155 | 121% | $15,812,500 |

| AKM | Aspire Mining Ltd | 0.215 | 105% | $111,680,137 |

| VPR | Volt Power Group | 0.002 | 100% | $10,716,208 |

| EEL | Enrg Elements Ltd | 0.011 | 83% | $10,099,650 |

| FHS | Freehill Mining Ltd | 0.011 | 83% | $34,486,013 |

| FFG | Fatfish Group | 0.031 | 82% | $41,707,191 |

| WCN | White Cliff Minerals | 0.016 | 78% | $20,037,890 |

| ERA | Energy Resources | 0.061 | 65% | $1,240,304,755 |

| CBE | Cobre | 0.072 | 64% | $19,796,859 |

| CXU | Cauldron Energy Ltd | 0.039 | 63% | $40,366,275 |

| CE1 | Calima Energy | 0.105 | 62% | $67,264,983 |

| MSG | MCS Services Limited | 0.016 | 60% | $3,169,594 |

| ACR | Acrux Limited | 0.07 | 59% | $20,274,169 |

| FND | Findi Limited | 1.62 | 57% | $75,153,880 |

| PXX | Polarx Limited | 0.011 | 57% | $21,315,018 |

| BMG | BMG Resources Ltd | 0.017 | 55% | $11,408,349 |

| BSN | Basin Energy | 0.185 | 54% | $10,587,601 |

| PAA | PharmAust Limited | 0.185 | 54% | $75,068,291 |

| AI1 | Adisyn Ltd | 0.026 | 53% | $4,197,689 |

| CG1 | Carbonxt Group | 0.098 | 51% | $33,168,273 |

| EMU | EMU NL | 0.0015 | 50% | $3,037,157 |

| RBR | RBR Group Ltd | 0.003 | 50% | $3,236,809 |

| A1G | African Gold Ltd | 0.04 | 48% | $6,772,448 |

| SMI | Santana Minerals Ltd | 1.48 | 47% | $250,742,426 |

| XST | Xstate Resources | 0.019 | 46% | $6,430,383 |

| CZR | CZR Resources Ltd | 0.305 | 45% | $74,256,413 |

| EQX | Equatorial Resources | 0.18 | 44% | $22,345,710 |

| VMS | Venture Minerals | 0.01 | 43% | $19,890,117 |

| DAF | Discovery Alaska Ltd | 0.027 | 42% | $6,324,337 |

| CPO | Culpeo Minerals | 0.049 | 40% | $5,839,001 |

| IPB | IPB Petroleum Ltd | 0.014 | 40% | $6,216,347 |

| NMR | Native Mineral Resources | 0.028 | 40% | $5,663,264 |

| VAR | Variscan Mines Ltd | 0.014 | 40% | $5,306,005 |

| ICI | Icandy Interactive | 0.039 | 39% | $52,415,258 |

| TML | Timah Resources Ltd | 0.036 | 38% | $3,195,351 |

| GTR | Gti Energy Ltd | 0.011 | 38% | $19,474,497 |

| DEL | Delorean Corporation | 0.037 | 37% | $6,471,627 |

| LBT | LBT Innovations | 0.015 | 36% | $18,901,067 |

| EL8 | Elevate Uranium Ltd | 0.605 | 36% | $175,814,551 |

| MRL | Mayur Resources Ltd | 0.265 | 36% | $75,622,769 |

| CMP | Compumedics Limited | 0.38 | 36% | $69,093,550 |

| HUM | Humm Group Limited | 0.67 | 35% | $337,939,285 |

| ARE | Argonaut Resources | 0.135 | 35% | $22,780,250 |

| NWF | Newfield Resources | 0.135 | 35% | $122,740,997 |

| BMN | Bannerman Energy Ltd | 3.63 | 35% | $550,226,772 |

| FLC | Fluence Corporation | 0.155 | 35% | $161,427,707 |

| DYL | Deep Yellow Limited | 1.46 | 34% | $1,074,331,797 |

Healthcare names were among the winners for January including Singular Health Group (ASX:SHG), which has experienced a surge in success after announcing a enterprise licence order for 5,000 annual licences of the 3Dicom Patient software in the US.

TechWorks 4 Good, acting on behalf of U.S. Veterans, acquired the licences with the aim of enhancing the comprehension and transferability of medical records for veterans.

PharmAust (ASX:PAA) was on the winners list after several positive announcements in January, including receiving approval for an open-label extension study of lead asset monepantel, in patients with Motor Neurone Disease (MND)/Amyotrophic Lateral Sclerosis (ALS).

All Phase 1 MEND Study patients have expressed interest in continuing treatment and participating in the study, which is forecast to kick off in February.

Read more here: ASX Health January Winners

As the price of uranium hits a new high due to a resurgence in nuclear power, ASX stocks focused on the commodity, which has been labelled by pundits as “the new lithium”, have seen an uplift in their share price.

Koba Resources (ASX:KOB) rose in January after announcing it has expanded its recently acquired Yarramba uranium project in South Australia following the grant of two new tenements covering 1,085km2, just 17km north of the Honeymoon uranium mine – where production recently resumed from resources totalling 71.6Mlb @ 620ppm U3O8.

Among other uranium plays on the ASX January winners list was Deep Yellow (ASX:DYL). In its December quarterly activities report DYL says recent metallurgical test work at its Mulga Rock project in Western Australia yielded promising outcomes, suggesting a potential increase in the uranium resource estimate at the site and an expansion of its critical minerals suite.

Simultaneously, ongoing studies at DYL’s Alligator River project in the Northern Territory are progressing, with the results of a heritage survey currently pending.

Internationally, DYL in collaboration with the Japanese Government agency JOGMEC, is poised to enhance the resource estimate of its Nova joint venture project in Namibia following promising results from a recent drilling program.

Here are the 50 worst performing ASX stocks for January:

Scroll or swipe to reveal table. Click headings to sort.

| CODE | COMPANY | LAST SHARE PRICE | JANUARY RETURN % | MARKET CAP |

|---|---|---|---|---|

| WML | Woomera Mining Ltd | 0.005 | -83% | $6,090,695 |

| GL1 | Global Lithium | 0.505 | -58% | $144,447,241 |

| ME1DA | Melodiol Glolbal Health | 0.017 | -58% | $4,019,500 |

| S3N | Sensore Ltd | 0.04 | -56% | $5,227,730 |

| BRX | Belararox Ltd | 0.14 | -55% | $10,286,883 |

| MRC | Mineral Commodities | 0.015 | -53% | $25,596,288 |

| IBX | Imagion Biosys Ltd | 0.17 | -52% | $5,713,146 |

| LM8 | Lunnon Metals | 0.29 | -52% | $65,208,371 |

| OZM | Ozaurum Resources | 0.073 | -51% | $11,906,250 |

| CXL | Calix Limited | 1.685 | -51% | $326,531,173 |

| M4M | Macro Metals Limited | 0.002 | -50% | $4,934,156 |

| FL1 | First Lithium Ltd | 0.26 | -50% | $17,863,175 |

| IND | Industrial Minerals | 0.385 | -49% | $27,504,000 |

| CY5 | Cygnus Metals Ltd | 0.069 | -49% | $19,242,903 |

| APX | Appen Limited | 0.325 | -48% | $74,542,236 |

| LNR | Lanthanein Resources | 0.006 | -48% | $8,383,777 |

| OCN | Oceana Lithium | 0.063 | -48% | $3,406,820 |

| C7A | Clara Resources | 0.01 | -47% | $2,079,429 |

| 29M | 29Metalslimited | 0.34 | -47% | $294,552,439 |

| WR1 | Winsome Resources | 0.555 | -47% | $112,563,180 |

| NRZ | Neurizer Ltd | 0.009 | -47% | $12,401,511 |

| GRE | Greentech Metals | 0.245 | -47% | $19,789,276 |

| CTM | Centaurus Metals Ltd | 0.29 | -46% | $148,457,290 |

| GT1 | Greentechnology | 0.155 | -46% | $46,001,554 |

| GMN | Gold Mountain Ltd | 0.003 | -45% | $7,941,775 |

| DCL | Domacom Limited | 0.011 | -45% | $5,661,523 |

| KTA | Krakatoa Resources | 0.02 | -44% | $9,442,144 |

| NET | Netlinkz Limited | 0.005 | -44% | $23,118,599 |

| REY | REY Resources Ltd | 0.1 | -44% | $22,230,342 |

| PLL | Piedmont Lithium Inc | 0.24 | -44% | $102,265,753 |

| MKL | Mighty Kingdom Ltd | 0.009 | -44% | $3,331,466 |

| MI6 | Minerals260 | 0.18 | -44% | $42,120,000 |

| SYA | Sayona Mining Ltd | 0.04 | -44% | $432,318,433 |

| SLB | Stelar Metals | 0.155 | -44% | $7,861,189 |

| CVB | Curvebeam Ai Limited | 0.235 | -43% | $55,755,071 |

| MEG | Megado Minerals Ltd | 0.02 | -43% | $5,852,478 |

| WC8 | Wildcat Resources | 0.4 | -42% | $520,189,584 |

| WHK | Whitehawk Limited | 0.014 | -42% | $5,935,273 |

| DLI | Delta Lithium | 0.275 | -41% | $206,427,696 |

| JBY | James Bay Minerals | 0.185 | -41% | $6,164,550 |

| 8IH | 8I Holdings Ltd | 0.01 | -41% | $3,573,560 |

| A8G | Australasian Metals | 0.1 | -41% | $6,515,062 |

| TG1 | Techgen Metals Ltd | 0.046 | -41% | $5,190,377 |

| BNR | Bulletin Res Ltd | 0.083 | -41% | $25,250,746 |

| LRS | Latin Resources Ltd | 0.17 | -40% | $475,363,554 |

| KGD | Kula Gold Limited | 0.009 | -40% | $3,385,695 |

| VTX | Vertexmin | 0.087 | -40% | $5,805,800 |

| ASN | Anson Resources Ltd | 0.084 | -40% | $120,859,482 |

| PNM | Pacific Nickel Mines | 0.05 | -40% | $20,076,149 |

| APM | APM Human Services | 0.74 | -40% | $692,472,369 |

As lithium prices continue their downward trajectory, on the losers list in January were several ASX lithium stocks.

Woomera Mining (ASX:WML) topped the January losers list, dropping 83% for the month. The company was hit by an ASX price query, requesting details relating to the change in its share price from a high of 2.6 cents/share on January 15 to a low of 1.75 cents/share on January 17, together with a significant increase in the volume of the securities traded between those dates.

In response WML confirmed that it was not aware of any undisclosed information that could explain recent trading activity in its securities.

However, WML did note an ASX announcement on January 17 – the day of the ASX price query – about completion of RC drilling at its Ravensthorpe Project.

“The ASX announcement also refers to the receipt of assay results from the first 2 drill holes of 26 from its Ravensthorpe drilling program,” WML says.

“Given the assay results received were only a small portion of the wider assay results yet to be received, the board considered that it was not required to release this information to the ASX at this stage.

“However, as a result of the change in price and increase in volume of the Company’s securities, the board decided in the abundance of caution to bring forward the disclosure of these initial results to ensure the market is fully informed.”

Furthermore on January 29 WML released its December quarterly activities report, which noted “results received for first two Mt Short RC holes, no significant lithium results returned”.

At Stockhead, we tell it like it is. Although PharmAust and Koba Resources are Stockhead advertisers, they did not sponsor this article.

The views, information, or opinions expressed in the interview in this article are solely those of the interviewee and do not represent the views of Stockhead. Stockhead has not provided, endorsed or otherwise assumed responsibility for any financial product advice contained in this article.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.