Rise and Shine: Everything you need to know before the ASX opens

Via Getty

On Stockhead today, So far this year, the great majority of stocks on our 270-strong High Voltage list are down. 56 by almost a third, or more.

To cheer us up, Reuben reveals 5 outperforming ASX battery metal explorers with hefty market caps and good bone structure.

And c’mon Australia – forget dodgy pitches or bearish markets – Australia’s ETF industry just set a new record high for funds under management. The industry ended February with an amazeballs circa $140 billion in the kitty.

Nadine very sensibly asks what TF happened last month in the land of the lucky ETF?

Meanwhile, old energy always finds a new way to rise from the dead.

With prices at a tipping point, Josh asks, if thermal coal can once again prove the ultimate survivor?

But first, the day ahead…

TRADING HALTS

The following stocks went into trading halts and are expected out in the coming days:

Sultan Resources (ASX:SLZ) – Capital raising and material acquisition.

Kelsian Group (ASX:KLS) – Potential acquisition.

Great Boulder Resources (ASX:GBR) – Capital raising.

Olympio Metals (ASX:OLY) – Exploration results from the Eurelia Project in South Australia.

Patriot Battery Metals (ASX:PMT) – Capital raising.

Linius Technologies (ASX:LNU) – Capital raising.

Aeon Metals (ASX:AML) – Material resource estimates update.

IOUpay (ASX:IOU) – “Serious financial irregularities”.

IPH (ASX:IPH) – There’s been a “cyber incident”.

COMMODITY/FOREX/CRYPTO MARKET PRICES

Gold: $US1,867.09 (+1.98%)

Silver: $US20.52 (+2.24%)

Nickel (3mth): $US23,269/t (-2.94%)

Copper (3mth): $US8853.50/t (-0.65%)

Oil (WTI): $US76.68 (+1.27%)

Oil (Brent): $US82.56 (+1.19%)

Iron 62pc Fe: $US130.50/t (1.16%)

AUD/USD: 0.6579 (-0.17%)

Bitcoin: $US20,584 (+2.43%)

WHAT GOT YOU TALKING?

Why Higginsville, of course!

– China could account for a third of the world’s supply of #lithium by the middle of the decade, @UBS says

– @VWGroup chooses Canada as the location for its first overseas #gigafactory

– A program of works approved at @ASXARE Higginsville project https://t.co/ZFtvnjrw4x #ASX— Stockhead (@StockheadAU) March 14, 2023

Keep up to date with Stockhead coverage or you’ll miss gold like that EVERY DAY. Follow our Twitter page.

For all you crypto lovers Stockhead’s Coinhead Facebook group is the place to share your views, insights, tips and ideas.

Also, be sure to check in preopen each day for ‘Market highlights and 5 ASX small caps to watch’, and 10.30am for our daily ‘10 at 10’ column — a live summary of winners & losers at the opening bell.

ASX SMALL CAP LEADERS

Here are the best performing ASX small cap stocks:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Company | Price | % | Volume | Market Cap |

|---|---|---|---|---|---|

| MEB | Medibio Limited | 0.0015 | 50% | 1,913,085 | $4,150,594 |

| PRM | Prominence Energy | 0.0015 | 50% | 270,000 | $2,424,609 |

| POL | Polymetals Resources | 0.27 | 46% | 152,691 | $8,358,798 |

| ADG | Adelong Gold Limited | 0.01 | 43% | 9,402,161 | $3,736,756 |

| INP | Incentiapay Ltd | 0.004 | 33% | 302,579 | $3,795,191 |

| HCT | Holista CollTech Ltd | 0.019 | 27% | 10,000 | $4,182,001 |

| NC6 | Nanollose Limited | 0.05 | 25% | 85,972 | $5,955,455 |

| EMU | EMU NL | 0.0025 | 25% | 12,250,588 | $2,900,043 |

| HFY | Hubify Ltd | 0.028 | 22% | 298,948 | $11,411,135 |

| IS3 | I Synergy Group Ltd | 0.019 | 19% | 3,000 | $4,625,286 |

| NIM | Nimyresourceslimited | 0.235 | 18% | 206,927 | $13,553,760 |

| EQS | Equitystorygroupltd | 0.049 | 17% | 140,521 | $1,549,371 |

| AR3 | Austrare | 0.28 | 17% | 456,753 | $22,848,372 |

| TYM | Tymlez Group | 0.014 | 17% | 72,945 | $13,106,344 |

| CMG | Criticalmineralgrp | 0.185 | 16% | 146,047 | $4,885,692 |

| 14D | 1414 Degrees Limited | 0.069 | 15% | 185,443 | $12,119,127 |

| IVR | Investigator Res Ltd | 0.041 | 14% | 14,089,071 | $51,737,892 |

| B4P | Beforepay Group | 0.33 | 14% | 201,158 | $10,105,577 |

| TI1 | Tombador Iron | 0.025 | 14% | 403,759 | $47,013,612 |

| PPK | PPK Group Limited | 1.05 | 14% | 252,597 | $82,592,596 |

| EMC | Everest Metals Corp | 0.085 | 13% | 212,257 | $7,982,483 |

| FODDB | The Food Revolution | 0.09 | 13% | 45,809 | $18,935,233 |

| AVE | Avecho Biotech Ltd | 0.009 | 13% | 1,322,897 | $14,702,955 |

| RR1 | Reach Resources Ltd | 0.0045 | 13% | 540,197 | $9,510,203 |

| POD | Podium Minerals | 0.1 | 12% | 422,348 | $29,953,744 |

Polymetals Resources (ASX:POL) closed Tuesday 46% higher, saying it’s set to finally acquire 100% of Orana Minerals, paying 52 million in stock to bring Orana and its SVP in as wholly-owned subsidiaries.

PPK (ASX:PPK) jumped almost 20% on news it’s entered a series of conditional deals to acquire a ‘material interest’ in the lithium ferro phosphate (LFP) maker PowerPlus Energy, ‘Australia’s largest privately-owned lithium battery manufacturer.’

Elsewhere, Critical Minerals Group (ASX:CMG) rose 15.6% on Monday’s release that the final 23 core holes of its latest exploratory drill program all intersected shallow vanadium and alumina in oxidised mineralised zone at its Lindfield project.

The exploration program shows consistent thicknesses and grades across the deposit, with standout higher grade V2O5 assays including:

- Hole LIND011 15.89m – 16.22m @ 0.70% V2O5,

- Hole LIND016 6.50m – 6.90m @ 0.62% V2O5 and 6.90m–7.05m @ 0.65% V2O5.

ASX SMALL CAP LAGGARDS

Here are the worst performing ASX small cap stocks::

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Company | Price | % | Volume | Market Cap |

|---|---|---|---|---|---|

| C29 | C29Metalslimited | 0.14 | -35% | 2,731,639 | $8,893,885 |

| MCT | Metalicity Limited | 0.002 | -33% | 4,043,000 | $10,513,618 |

| PHL | Propell Holdings Ltd | 0.033 | -27% | 98,781 | $4,775,995 |

| CLE | Cyclone Metals | 0.0015 | -25% | 2,519,939 | $13,483,474 |

| SIX | Sprintex Ltd | 0.03 | -23% | 50,000 | $9,919,819 |

| CARRA | Carsales.Com Ltd. - Rts23Mar23 Forusdef | 1.7 | -21% | 6,090 | $53,666,402 |

| WC1 | Westcobarmetals | 0.096 | -20% | 129,714 | $10,366,049 |

| S66 | Star Combo | 0.1 | -20% | 1,000 | $16,885,373 |

| AUK | Aumake Limited | 0.004 | -20% | 5,089,881 | $4,372,235 |

| IEC | Intra Energy Corp | 0.004 | -20% | 748,800 | $3,528,908 |

| MTL | Mantle Minerals Ltd | 0.002 | -20% | 1,438 | $13,364,013 |

| THR | Thor Energy PLC | 0.004 | -20% | 3,045,091 | $7,390,564 |

| AX8 | Accelerate Resources | 0.021 | -19% | 130,000 | $9,817,646 |

| MYG | Mayfield Group Ltd | 0.275 | -19% | 325 | $30,799,204 |

| ICN | Icon Energy Limited | 0.009 | -18% | 1,352,186 | $8,448,150 |

| BTE | Botalaenergyltd | 0.095 | -17% | 30,000 | $6,131,417 |

| OLI | Oliver'S Real Food | 0.019 | -17% | 885,324 | $10,136,834 |

| VAR | Variscan Mines Ltd | 0.019 | -17% | 191,467 | $6,134,837 |

| M2R | Miramar | 0.048 | -17% | 287,742 | $4,099,541 |

| YAL | Yancoal Aust Ltd | 5.71 | -17% | 7,270,354 | $9,058,214,538 |

| NES | Nelson Resources. | 0.005 | -17% | 6,451,538 | $3,531,566 |

| OAU | Ora Gold Limited | 0.0025 | -17% | 103,110 | $11,810,775 |

| PIL | Peppermint Inv Ltd | 0.005 | -17% | 1,200,000 | $12,227,141 |

| TKL | Traka Resources | 0.005 | -17% | 400,000 | $4,336,647 |

| VRC | Volt Resources Ltd | 0.01 | -17% | 8,453,653 | $47,273,087 |

WHAT GREGOR SAW: TUESDAY ON THE ASX

Some Very Grim News from BNPL player IOUPay (ASX:IOU) which has had trading halted because somebody’s allegedly been a very naughty boy.

Yesterday, IOUPay announced to the market that its Chief Financial Officer, Kenneth Kuan Choon Hsuing, had been forcibly ousted from his position following “a preliminary review by the Executive Chairman of cost levels and financial performance in the company’s Malaysian business”.

Well, it turns out that it didn’t take long for that “preliminary review” to take on a much more solid form – the company has announced today that it has “discovered serious financial irregularities in its Malaysian business”.

That’s as much detail as I’ve managed to confirm at this stage, but it’s interesting to note the revelations come just five days after IOUPay’s Executive Chairman Isaac Chong Kwong Yang, who led the investigation, was elevated to the role from his previous position as plain ol’ Chairman.

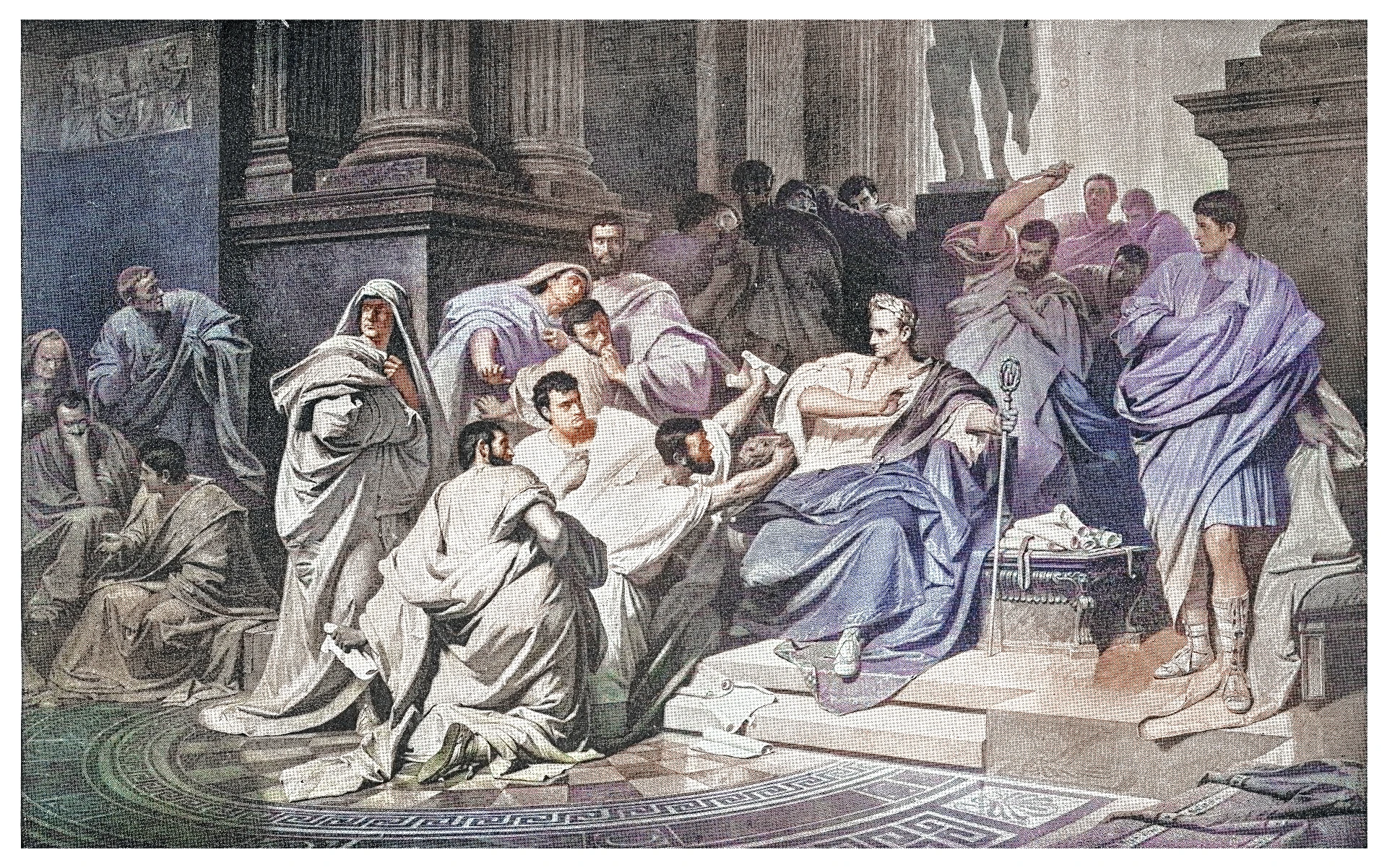

Finally, today’s the Ides of March

2067 years ago today Rome’s favourite son copped it right in the back – and then from all sides – from his favourite (adopted) son.

There’s a lesson here. It’s a good one. Noy sure exactly what it is right now, so here’s a pic. It’s a good’un too.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.