Rise and Shine: Everything you need to know before the ASX opens

Depiction of SH newsroom structure while Pete's away. I'm the yellow button. One of the yellow buttons. The big one. Al the other ones do the same things pretty much. Except the Gregor button. fairly sure that's the scary one at the bottom. The alarming one. That's certainly how he is IN the newsroom. Via Getty

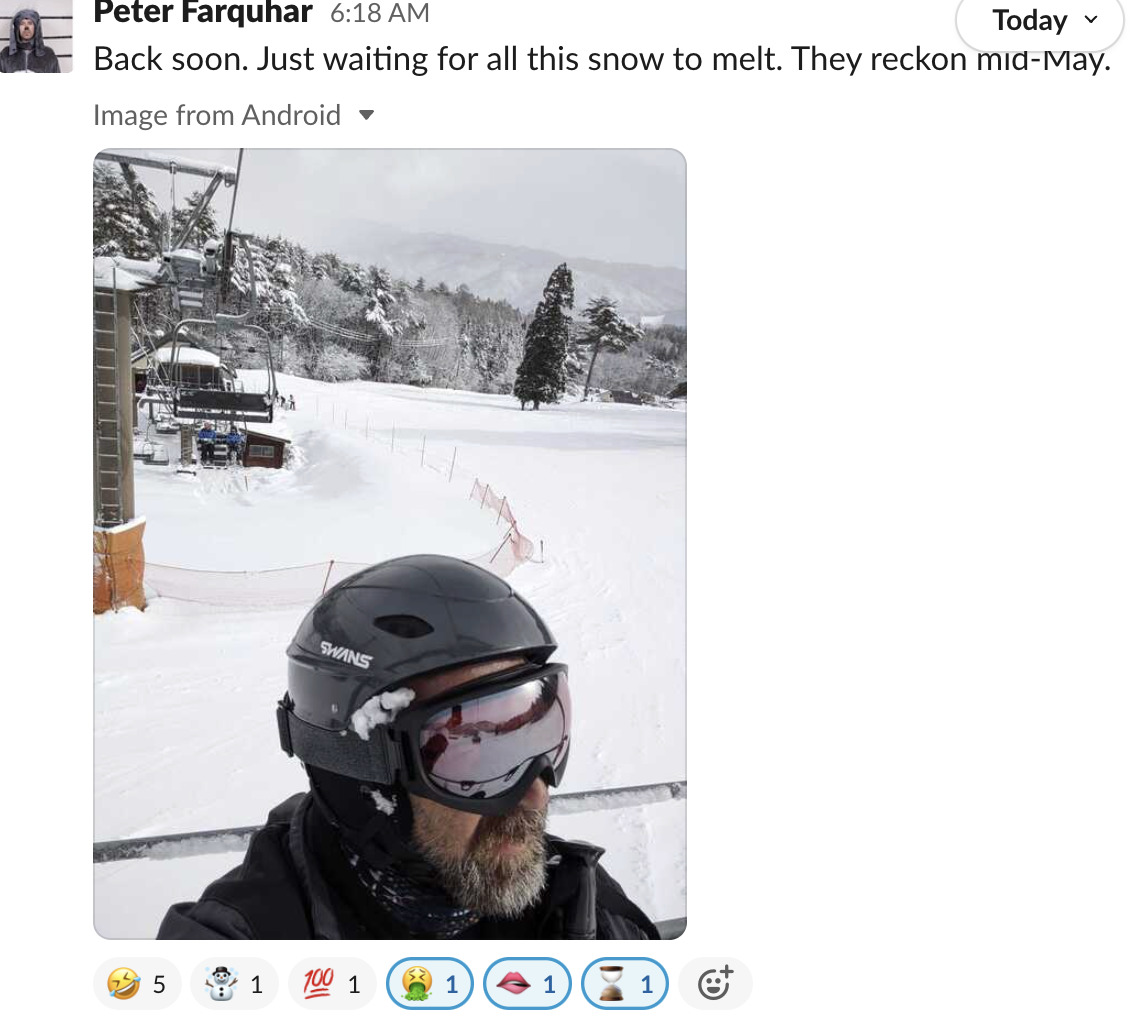

On Stockhead today, Peter’s still away.

He was in Tokyo. Now he’s… elsewhere:

We’re okay, though. I guess.

A little short… But hey! There’s an ETF for that now too:

Nadine’s got Australia’s top performing ETFs from last year as… the ones which shorted US stocks! And most particularly tech. Makes sense, I suppose. But who thinks of these?

A joyously bumptious new year James Whelan says you’ll want cash right now for what’s coming. Literally, he says that.

We’ve got a shirtload of dry cleaning all about M&A. It’s clean, it smells great and it’s cash only. So you and your buddy Goldman Sachs go get your $66mn and we can talk.

Also Chinese tech has been green lit by a shady inner circle bureaucrat … actually he’s also the central bank governer these days so… anyway, his green light has in turn been greenlit by UBS and others. So we’re good for Chinese tech again. Sorry Jack.

And now, the day ahead…

TRADING HALTS

These are the stocks which were halted at the end of the last ASX session:

Tuesday. And then there were none.

WHAT GOT EVERYONE TALKING

An oldie but a goodie. People just dig gold. It’s like a comfort blanket that gets softer the more you hug it:

Many experts have taken a bullish turn on gold heading into 2023 after the safe haven metals wild and windy 2022.https://t.co/GLq6bM5KXh

— Stockhead (@StockheadAU) January 8, 2023

For all you crypto lovers Stockhead’s Coinhead Facebook group is the place to share your views, insights, tips and ideas.

Also, be sure to check in preopen each day for ‘Market highlights and 5 ASX small caps to watch’, and 10.30am for our daily ‘10 at 10’ column — a live summary of winners & losers at the opening bell.

COMMODITY/FOREX/CRYPTO MARKET PRICES

Gold: $US1871.03 (+0.31%)

Silver: $US23.61 (+2.65%%)

Nickel (3mth): $US21,900/t (-0.85%)

Copper (3mth): $US7,850/t (+2.98%)

Lithium Carbonate, China (Benchmark Minerals Intelligence, DEC 28): $US82,075/t (+114.4% year-to-date)

Lithium Hydroxide, China (Benchmark Minerals Intelligence, DEC 28): $US80,650/t (+164.4% year-to-date)

Oil (WTI): $US74.83 (+1.44%)

Oil (Brent): $US79.80 (+1.61%)

Iron 62pc Fe: $US118.50 (+2.16%)

AUD/USD: 0.6909 (+0.51%)

Bitcoin: $US17,221 (+1.63%)

ASX SMALL CAP LEADERS

Here are the best performing ASX small cap stocks from Tuesday

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Company | Price | % | Volume | Market Cap |

|---|---|---|---|---|---|

| WBE | Whitebark Energy | 0.0015 | 50% | 1,519,354 | $6,464,886 |

| SMX | Security Matters | 0.18 | 38% | 307,598 | $21,828,499 |

| EVE | EVE Health Group Ltd | 0.002 | 33% | 1,258,085 | $7,911,724 |

| SRN | Surefire Rescs NL | 0.015 | 25% | 13,624,230 | $18,976,362 |

| AQX | Alice Queen Ltd | 0.0025 | 25% | 257,961 | $4,400,500 |

| CYM | Cyprium Metals Ltd | 0.14 | 22% | 7,461,612 | $83,972,805 |

| M24 | Mamba Exploration | 0.18 | 20% | 357,784 | $6,326,250 |

| OLY | Olympio Metals Ltd | 0.15 | 20% | 75,915 | $4,899,565 |

| OAR | OAR Resources Ltd | 0.006 | 20% | 369,998 | $12,055,189 |

| MVL | Marvel Gold Limited | 0.026 | 18% | 143,010 | $15,498,876 |

| BUY | Bounty Oil & Gas NL | 0.007 | 17% | 815,173 | $8,223,006 |

| LIO | Lion Energy Limited | 0.036 | 16% | 282,524 | $13,209,417 |

| OPL | Opyl Limited | 0.029 | 16% | 1,456,468 | $1,601,301 |

| TNY | Tinybeans Group Ltd | 0.225 | 15% | 16,560 | $11,970,164 |

| LYK | Lykos Metals | 0.115 | 15% | 28,266 | $6,240,000 |

| NGL | Nightingale Intel | 0.115 | 15% | 115,101 | $9,674,871 |

| GRL | Godolphin Resources | 0.092 | 15% | 142,600 | $9,469,556 |

| TRJ | Trajan Group Holding | 2.06 | 14% | 61,780 | $273,745,557 |

| INP | Incentiapay Ltd | 0.008 | 14% | 51,117 | $8,855,445 |

| KZA | Kazia Therapeutics | 0.12 | 14% | 545,399 | $17,157,942 |

| SRR | Sarama Resources | 0.12 | 14% | 70,500 | $3,968,159 |

| CNQ | Clean Teq Water | 0.45 | 14% | 128,429 | $22,795,568 |

| MMI | Metro Mining Ltd | 0.017 | 13% | 3,337,894 | $65,457,445 |

| C6C | Copper Mountain | 2.26 | 13% | 215,361 | $33,533,292 |

| AL8 | Alderan Resource Ltd | 0.009 | 13% | 538,372 | $4,626,129 |

Cyprium Metals (ASX:CYM) jumped 22% on solid volume, after recently announcing an offtake agreement for 100% (~140,000 tonnes) of the Copper Cathode produced during Phase 1 of its Nifty Copper Project restart, alongside a US$35M Secured Offtake Prepayment Facility through Transamine SA.

Copper Mountain Mining (ASX:C6C) is up about 15% now production has resumed at its 75% owned Copper Mountain Mine located in southern British Columbia near the town of Princeton, following a ransomware attack that brought production to a halt in the final days of 2022.

Turaco Gold (ASX:TCG) went off like a rocket following a chunky gold hit, the highlight being a 26m @ 4.82g/t gold from 35m at the Satama discovery in Côte d’Ivoire.

TCG says the zone of high-grade mineralisation remains open in all directions.

As Gregor noted yesterday: By the end of the day, TCG had added an entire $0.01c to its trading price – which is actually pretty epic, because that’s a better-than-17% rise.

ASX SMALL CAP LAGGARDS

Here are the least performing ASX small cap stocks for Tuesday:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Company | Price | % | Volume | Market Cap |

|---|---|---|---|---|---|

| KEY | KEY Petroleum | 0.001 | -33% | 301,000 | $2,951,892 |

| ROO | Roots Sustainable | 0.0015 | -25% | 173,010 | $2,078,439 |

| XST | Xstate Resources | 0.0015 | -25% | 183,575 | $6,430,363 |

| IS3 | I Synergy Group Ltd | 0.02 | -20% | 500,003 | $7,227,009 |

| ALM | Alma Metals Ltd | 0.008 | -20% | 709,068 | $9,140,008 |

| MTL | Mantle Minerals Ltd | 0.002 | -20% | 6,000 | $13,364,013 |

| SW1 | Swift Networks Group | 0.013 | -19% | 28,193 | $9,484,747 |

| M4M | Macro Metals Limited | 0.005 | -17% | 48,500 | $11,682,467 |

| AHI | Advanced Health | 0.105 | -16% | 24,323 | $24,506,746 |

| NSM | Northstaw | 0.16 | -16% | 106,033 | $22,824,130 |

| KNM | Kneomedia Limited | 0.012 | -14% | 2,218,133 | $18,952,994 |

| LNU | Linius Tech Limited | 0.003 | -14% | 64,866,635 | $9,909,945 |

| KED | Keypath Education | 0.535 | -14% | 226,704 | $132,419,545 |

| CXM | Centrex Limited | 0.1125 | -13% | 5,404,706 | $79,510,604 |

| PGY | Pilot Energy Ltd | 0.0175 | -13% | 9,329,877 | $15,626,882 |

| DRO | Droneshield Limited | 0.255 | -12% | 6,623,309 | $130,802,176 |

| VHM | Vhmlimited | 1.005 | -12% | 1,718,509 | $160,641,250 |

| 1AE | Aurora Energy Metals | 0.15 | -12% | 132,944 | $20,433,478 |

| AXI | Axiom Properties | 0.075 | -12% | 30,000 | $36,780,661 |

| SPX | Spenda Limited | 0.015 | -12% | 3,759,981 | $55,470,645 |

| SIX | Sprintex Ltd | 0.039 | -11% | 99,874 | $11,191,590 |

| CTN | Catalina Resources | 0.008 | -11% | 4,772,845 | $11,146,382 |

| ESR | Estrella Res Ltd | 0.016 | -11% | 2,303,028 | $26,704,294 |

| RDS | Redstone Resources | 0.008 | -11% | 67,867 | $6,631,492 |

| SNS | Sensen Networks Ltd | 0.049 | -11% | 1,236,968 | $37,326,450 |

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.