FREE WHELAN: ‘Have cash on hand for what’s ahead’

Pic: CSA Images/ Via Getty Images

In this legendary Stockhead series, investment manager James Whelan from VFS Group offers his insights on the key investment themes and trends in domestic and global markets. From macro musings to the metaverse and everything in between, Whelan offers his distilled thoughts on the hot topic of the day, week, month or year, from the point of view of a damn fine professional money manager.

Top of the year to you and we hope 2023 comes in marginally better than 2022.

I’m writing from the remote setup we have in East Gippsland where I’ve had enough time to reset and now get back into the thick of it.

There are some good ideas out there that need to be put into play. Raise a glass to the 5G network of Australia.

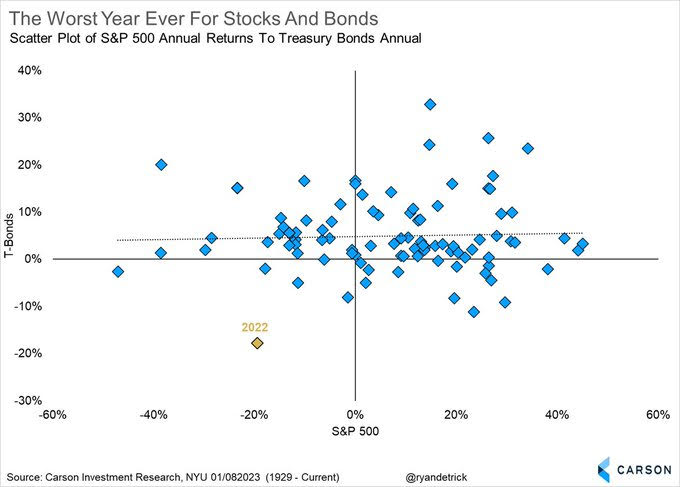

Just a reminder that 2022 was historic in that the US market and bonds were both off over 10%. That’s never happened before. Generally speaking, there weren’t many places to hide. More specifically, there were lots of places to hide because “the market” is more than just these two things.

I again maintain my confidence that a 60/40 portfolio will default to its usual solid performance this year.

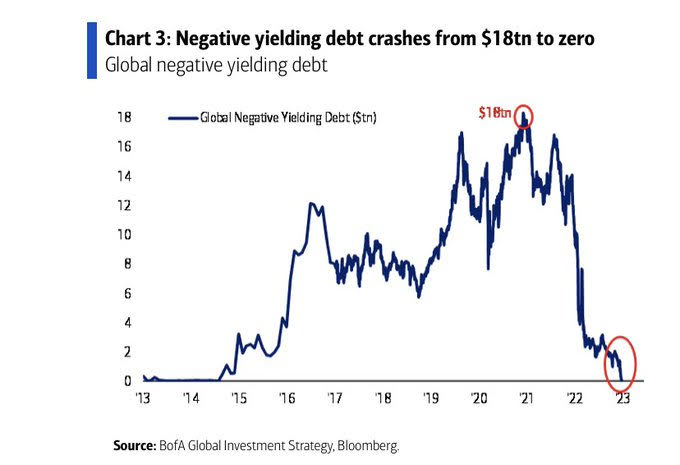

We did cross a pretty significant point though recently with the last kicking courtesy of the Bank of Japan finally putting the last nail in the coffin of negative yielding debt.

The confusing situation that was negative debt is, for now, behind us. But what an extraordinary ride it’s been. No comment on what happens from here.

What I am sure of is that the word of the month for January will be “recession” and you’re going to see a lot of “when a recession happens this usually also happens.

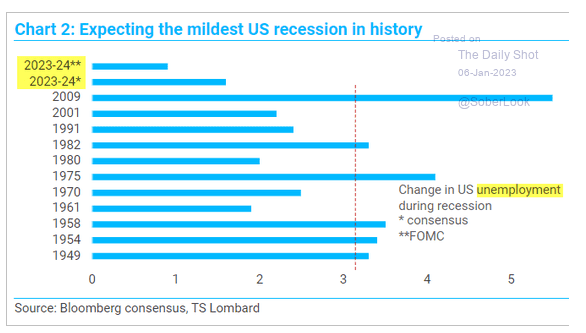

I’ll cut straight to it and start with the expectations for the US based on consensus. This chart is showing that in the impending recession the expectations are mild with regards to what it’s going to do to unemployment.

You see an average 3% increase in unemployment for past recessions but the one forecast will only have a 1-1.5% lift in unemployment. So there’ll be at least two consecutive quarters of negative growth but everyone is still keeping their jobs. Fair enough I guess.

Keep in mind that Friday’s US market leaped over 2% on the back not of strong US jobs numbers (good news is bad news, remember) but because average hourly earnings slowed their growth a little.

Not going to lie, I find that a little flaky. The Fed still has a job to do and they will continue to do it until it’s done.

CPI numbers on Thursday will apparently guide the Fed to either keep raising at 50bps or slow things down. I think there’s a big enough difference between Fed messaging “we see no reason to ease rates this year” and the bond market messaging “uh, actually we do and it’s currently shown in the price.”

The battle of “the bond market always knows first” vs “don’t fight the Fed” looks to have taken corners and the bell is about to ring. Pay attention.

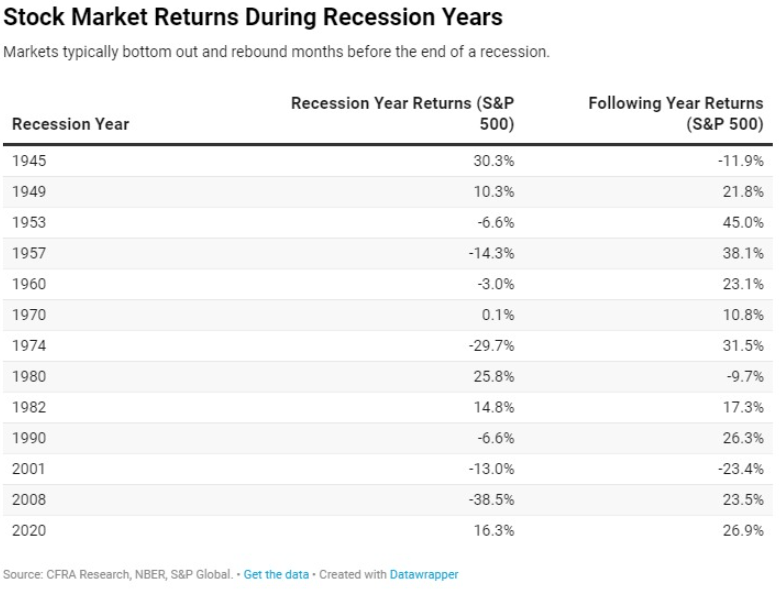

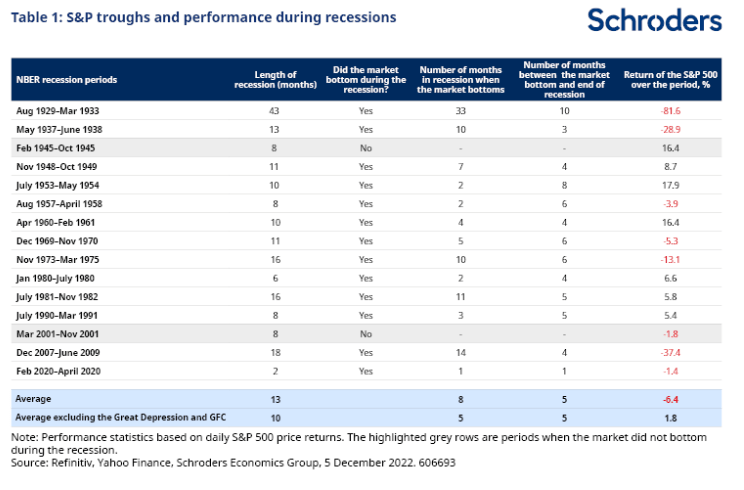

For those looking to get stuck right in to the recession things here’s some information that you’ll see a bit of in the coming months.

Big disclaimer on this to not trust averages on these things. However the numbers do say one thing which is clear: Don’t be overly bullish heading in to the recession but find a time to charge in when panic stations are sounded. Markets almost always see through recessions and find their bottom.

Note the third column below.

If I was to make a call I’m saying stay the course and have cash on hand for what’s ahead.

Continue to add to bonds on pops and make sure you’re set for the actual rally that will come as rates do actually need to be lowered. If you want more information on past recessions the link to the Schroders article is here. Note also that the market will bottom before company earnings too. It’s all so well known and talked about it’s practically a non-event. Take this note as caution to ignore much of the noise in the press this year on this subject.

But my get, from here, thinks that 3-5 months between recession call and market bottom sounds about right.

Note all that is US based, and yes it’s the biggest economy in the world. But we have our own drivers and we’re doing ok. Apparently the China reopening is set to add 1% to Australia’s GDP. That’s contained in a JP Morgan note I’ve not had a chance to get to but sounds about right.

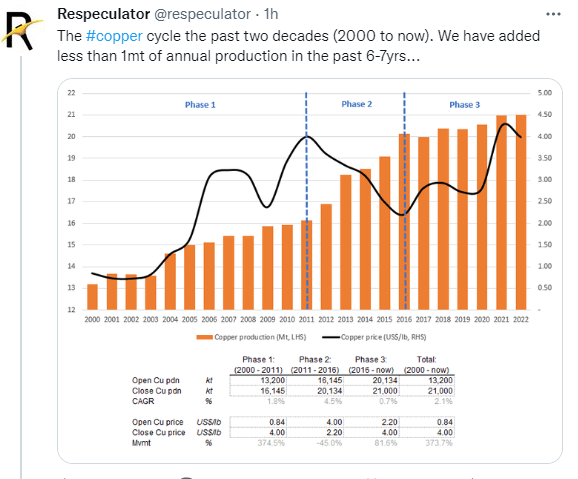

Finally here’s something interesting about the impending shortage in copper which really highlights what I’ve been saying for a long time now.

We, as a species, have literally not done enough to supply ourselves for the main ingredient upon which we’ve based our future.

China reopening exacerbates this glaring deficit. I’ll be making moves this week to capitalise more so.

Stay safe and all the best,

James

The views, information, or opinions expressed in the interviews in this article are solely those of the interviewees and do not represent the views of Stockhead. Stockhead does not provide, endorse or otherwise assume responsibility for any financial product advice contained in this article.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.