Richer, higher, faster: Aussie homeowners just got an early Xmas present

Via Getty

Aussie home owners are laughing.

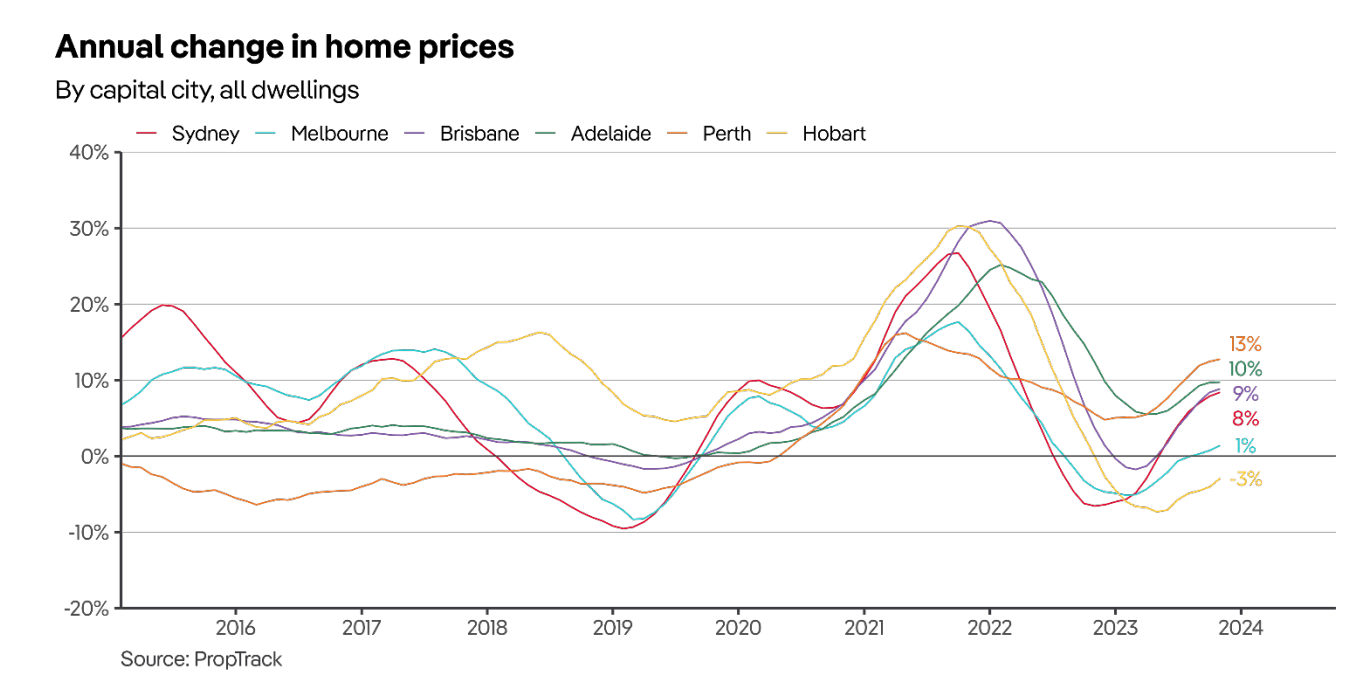

The Reserve Bank might’ve just hoisted interest rates again, but that hasn’t stopped either demand or prices from continuing to skyrocket according to the latest research from Aussie property data firms PropTrack and CoreLogic.

According to the the November PropTrack Home Price Index, across Australia home prices have clambered on up to even more terrifying new heights, leaving the have-nots even further from a foot in the property market door, which hasn’t budged an inch during the cycle of interest rate tightening.

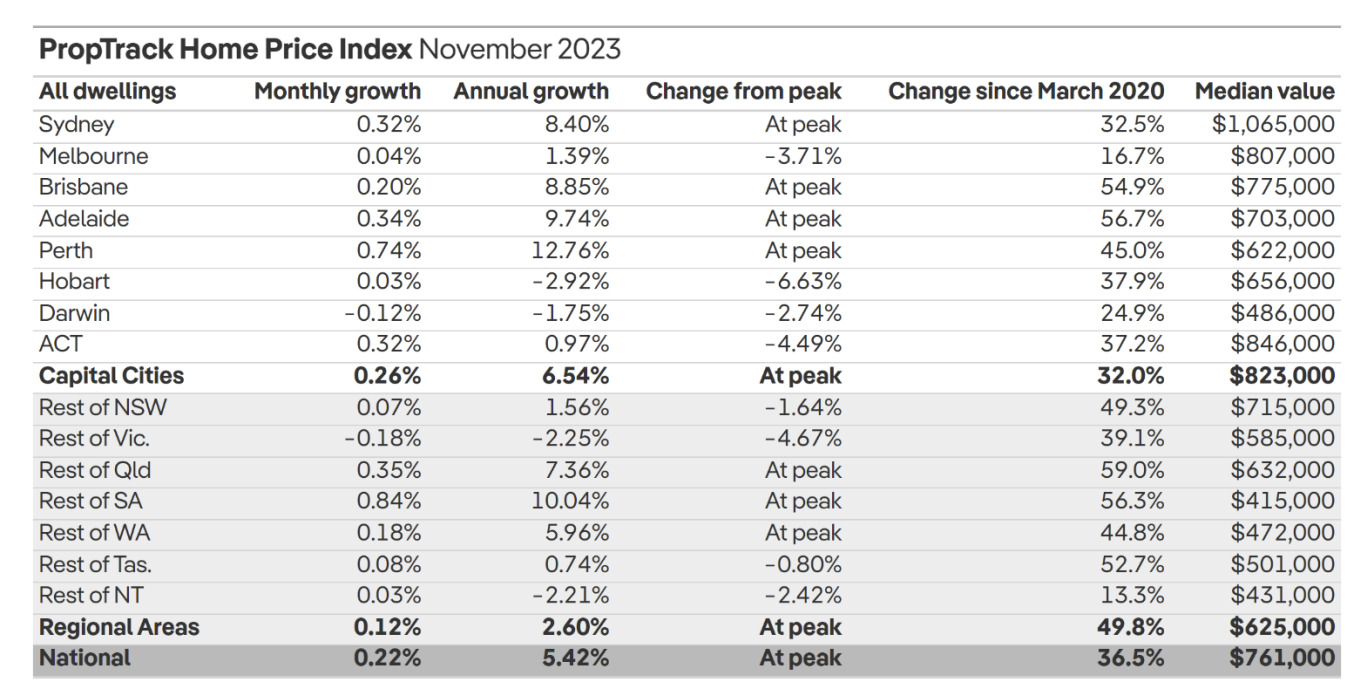

The national median home value climbed a further 0.22% in November to a record high, although the pace of growth slowed as more properties hit the market.

All capitals, except Darwin, recorded price rises in November. Perth continued its streak with prices rising 0.74% month-on-month.

This made Perth PropTrack’s strongest capital throughout the month.

Adelaide (+0.34%), Sydney (+0.32%) and Canberra (+0.32%) also saw strong growth.

Capital cities have outperformed regional markets

Extraordinary times: Gareth Aird

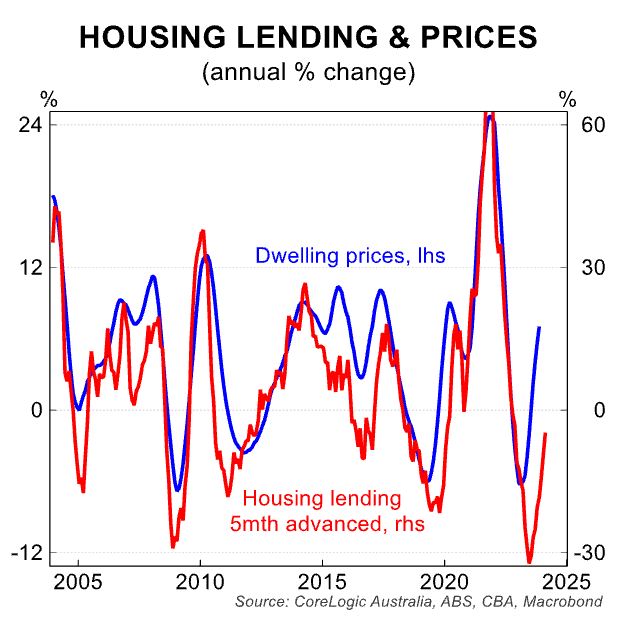

CBA’s head of Australian economics Gareth Aird says home affordability ‘has deteriorated significantly’ throughout 2023.

The average Aussie access to home borrowing has crashed by almost a full third, but at the same time property prices have easily moved beyond their previous peaks – circa April 2022 – just as a slow-reacting RBA began to start raising rates.

“The usual relationship between new lending and home prices has broken down. Housing loan commitments have fallen by around 30% since May 2022,” according to Aird.

“A decline of this magnitude would ordinarily be expected to be accompanied by an ongoing decline in home prices. But these are extraordinary times.”

Massive rates of immigration have seen Australia’s population surge over the past year. And home building simply hasn’t kept up.

As a result, vacancy rates have dropped to record lows in most capital cities and the rental market is off in a world of madness all it’s own.

Also adding new pressure on home prices – a return and notable influx of foreign capital in the market.

According to NAB’s residential property survey the share of total market sales to foreign buyers in new housing markets increased for the fourth straight quarter.

New sales to foreign buyers hit a near six-year high of 10.1% in Q3, NAB says.

At least CBA agrees there’s early signs prices growth nationally is easing – according to CoreLogic it was running at its softest monthly pace so far this year – while auction clearance rates have recently softened too.

Town and Country

Meanwhile moving to the country and eating a lot of peaches remains an option, as although home values in both city and regional markets reached fresh peaks in November, capital cities saw stronger growth (+0.26%) than elsewhere (+0.12%).

“National home price growth slowed in November, with the spring selling surge increasing choice for buyers.

“Strong housing demand, buoyed by record net overseas migration, tight rental markets, low unemployment and home equity gains, has worked alongside limited housing stock to offset the impacts of higher interest rates this year.

“Despite interest rates climbing again in November and the flow of listings hitting the market increasing, housing demand has remained strong and national prices have now risen for 11 straight months.”

Property prices reached new peaks in Sydney, Brisbane, Adelaide and Perth, in addition to regional areas across Queensland, South Australia and Western Australia.

What interest rate hikes?

Home prices have proved resilient to the impact of higher interest rates this year – a trend that continued in November.

PropTrack senior economist Eleanor Creagh said even though the number of houses for sale has risen, demand has easily kept pace.

“Strong housing demand, buoyed by record net overseas migration, tight rental markets, low unemployment and home equity gains, has worked alongside limited housing stock to offset the impacts of higher interest rates this year,” Creagh said.

While national home prices have hit a new record high, the pace of growth slowed as more properties came to market.

National home prices climbed 0.22% in November to peak levels, bringing them up 5.53% so far this year and 1.29% above their previous peak recorded in March 2022.

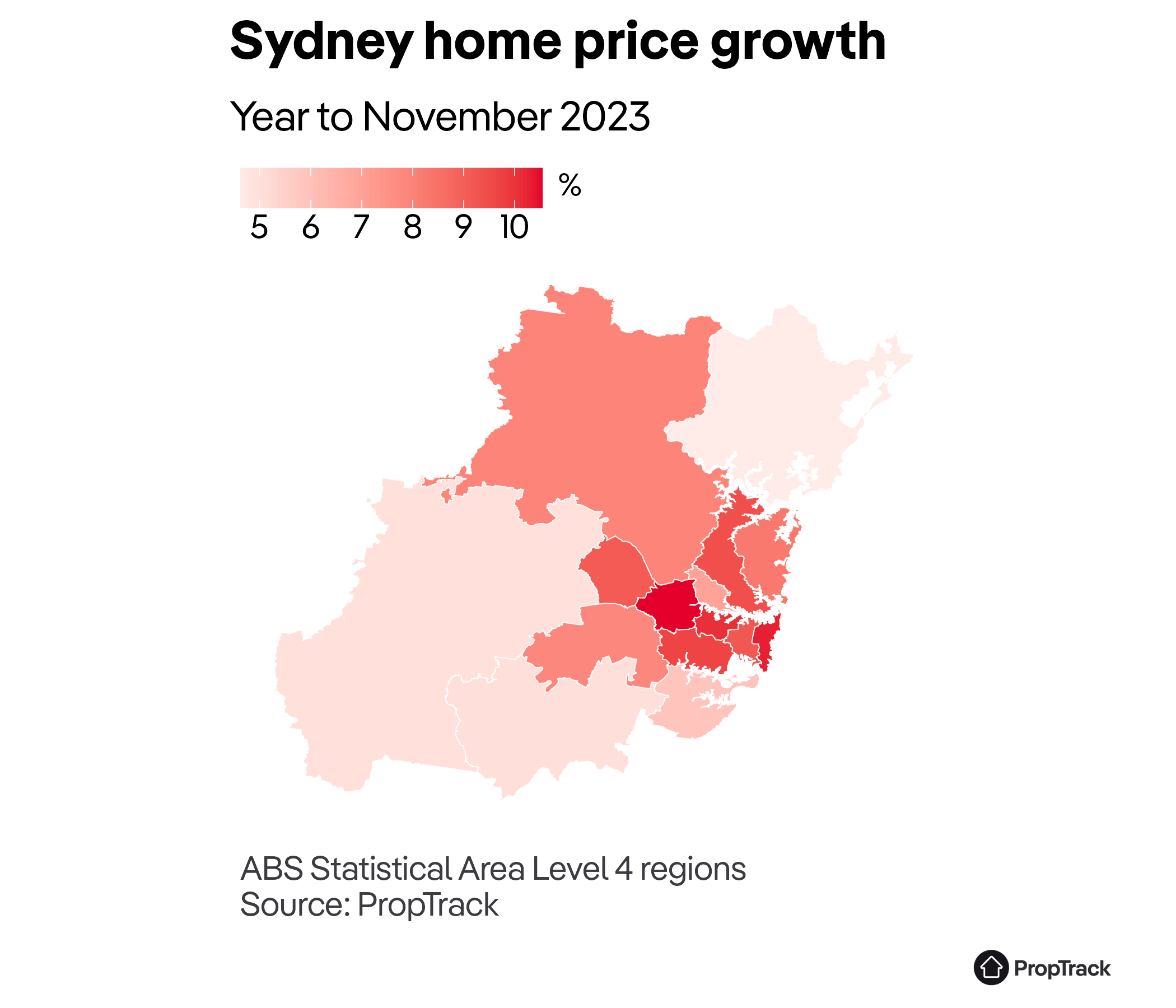

Sydney continues to drag national home prices higher

Although growth in Sydney has slowed, prices hit a record high in November, increasing 0.32%.

Sydney is at the forefront of Australia’s housing market resurgence, not only recouping the losses seen in 2022, but surpassing its previous peak in February 2022 by 1%.

After falling 6.82% from February to November 2022, prices have now risen for 12 consecutive months and are up 8.40% from their low point in November 2022.

Sydney prices are now up 8.27% so far this year and 1.00% above their previous peak recorded in February 2022, Eleanor says.

“Meanwhile, the sharp rise in construction costs and labour and materials shortages have slowed the delivery of new builds, hampering the supply of new housing.

“Looking ahead, price growth is expected to continue as the positive tailwinds for housing demand and a slowdown in the completion of new homes counter the sharp deterioration in affordability and slowing economy.

“However, prices are likely to lift at a slower pace than they have across 2023.”

Finally, where it’s cheaper to buy than rent

This could be both good and bad… so maybe take a seat those home-hunters who’ve made it to the end of another horrible housing update.

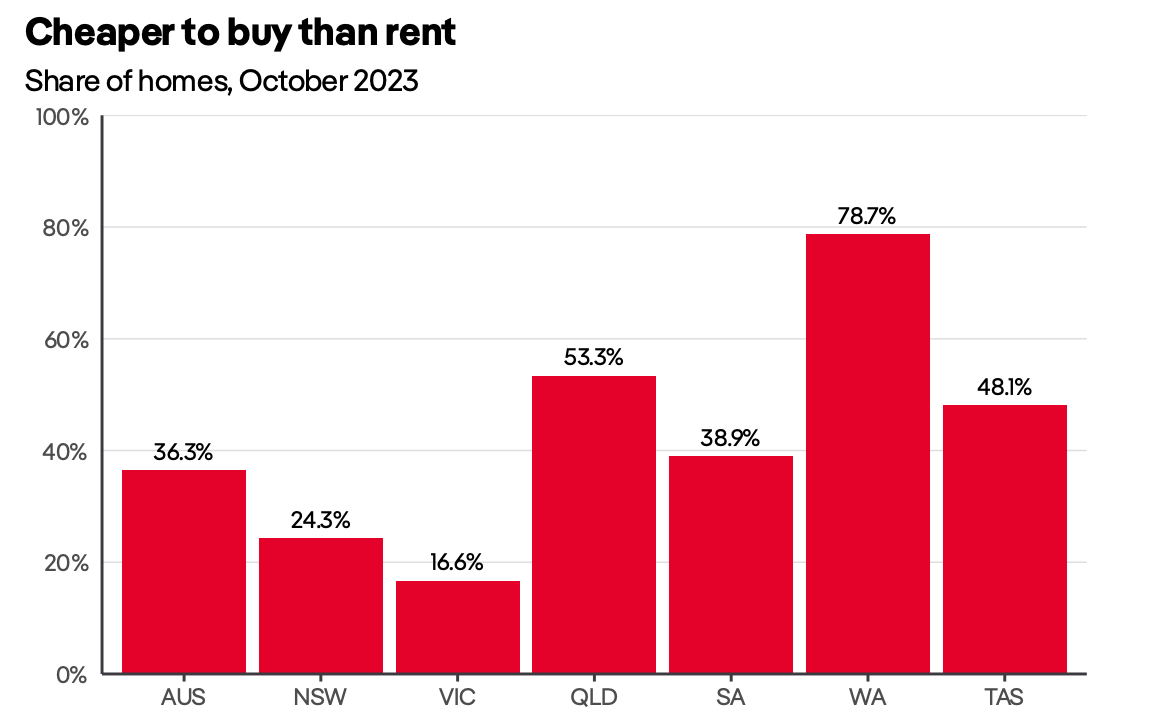

According to the same research team at PropTrack – more than a third of homes across the country are cheaper to buy than rent – based on a countrywide analysis of estimated purchase and rent prices.

PropTrack senior economist Paul Ryan says the record pace of rent growth – with advertised rents up 14.6% over the past year – has offset higher buying costs in many regions.

“More than a third of homes across Australia are cheaper to buy than rent. Favourable buying conditions remain despite a record pace of interest rate increases, and home prices increasing 36% since the pandemic… This shows that there are still opportunities for buyers across the housing market.”

Here’s the bare bones:

- As of end November Queensland, Tasmania and Western Australia offer the highest proportion of homes that are cheaper to buy, so buying conditions are more favourable in Queensland, Tassie and WA

- In WA, more than three out of four homes are cheaper to buy than rent

- This suggests stronger price growth conditions will persist in these states, a trend seen since the onset of the COVID-19 pandemic, which may reduce the share of homes cheaper to buy

- Buying conditions remain more favourable for units – with over half (55%) estimated to be cheaper to buy than rent (while circa 29% of houses across the country are cheaper to buy)

- Many of the capital cities where buying conditions are most favourable reflect recent unit development, where prices are low compared with rents following recent record rent growth

“Looking to 2024, higher interest rates will challenge housing affordability for many. This may slow price growth and rebalance buying conditions across the market,” Paul adds.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.