Quality over quantity: These ASX small caps think Australia can be a world-leader in advanced manufacturing

(Getty Images)

Amid Australia’s transition to a services economy, the plight of traditional manufacturers has been well-documented.

Despite that, the manufacturing sector is still an important contributor to growth.

Data from industry research body Ai Group shows manufacturing contributed more than $20bn of gross added value in the September quarter last year.

So while Ford and Holden no longer make cars here, manufacturing is still the sixth biggest sector behind mining, construction and the rise of services.

More recently though, the latest performance of manufacturing index (PMI) for January 2020 turned some heads when it was released last week.

The PMI measures changes in activity levels across Australia’s manufacturing sector from one month to the next. Anything above 50 signals that activity levels are improving while a reading below suggests they’re deteriorating.

And the index contracted by another 2.9 points in January to a reading of 45.4. Not only was that the lowest level since 2015, it also marked a notable decline from December.

“January is traditionally the slowest month for Australian manufacturing, but the start to 2020 was even slower than usual,” the Ai Group said.

“All manufacturing sectors reported weaker conditions in January compared to December and only the food & beverage sector reported expanding conditions.”

While noting the impact of catastrophic bushfires, Ai Group said it was only moderate and cited sharp falls in new orders and deliveries as evidence that soft conditions would “continue for some months into 2020”.

Despite the broader challenges it faces, there’s one sense in which manufacturing is no different from any other sector; how it adapts to changes in technology.

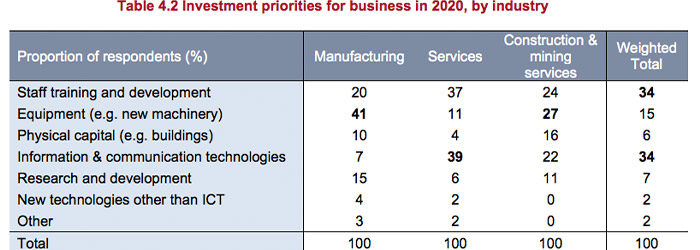

In manufacturing, the tech focus is largely around advances in production machinery. That can be contrasted against services, where more capital is deployed towards IT and communications.

This chart from Ai Group demonstrates those differing priorities:

When asked where they expect to deploy the most capital in 2020, 41 per cent of Australian manufacturers said new equipment — the largest portion of respondents for any category across manufacturing, services and construction.

When it comes to ASX small caps, there are a number of companies trying to build market share with new technologies such as 3D additive manufacturing — so-called because of the production process which builds products layer by layer.

The most recent entrant in the additive manufacturing space was Melbourne-based Amaero Ltd (ASX:3DA), which raised $8m in December at 20c per share.

Amaero has made a solid start to listed life, as it taps public markets to help advance capex-heavy projects with customers such as Boeing and Raytheon.

Across the advanced manufacturing space more broadly though, the promise of new technology hasn’t yet translated into a notable shift in investor appetite.

| Code | Name | Price (I) | 1Y Tot Ret | 6M Tot Ret | 1M Tot Ret | Market Cap |

|---|---|---|---|---|---|---|

| TTT | TITOMIC LTD | 0.84 | -63.2% | -54.0% | -17.8% | $100.1M |

| OEC | ORBITAL CORP LTD | 0.535 | 55.8% | 76.5% | 84.6% | $48.1M |

| OVN | OVENTUS MEDICAL LTD | 0.4 | 24.6% | -17.5% | -19.2% | $54.2M |

| 3DA | AMAERO INTERNATIONAL LTD (listed Dec) | 0.325 | N/A | 62.0% | -4.1% | $55.1M |

| KTG | K-TIG LTD | 0.195 | -2.3% | -14.5% | -13.3% | $28.2M |

| A3D | AURORA LABS LTD | 0.155 | -63.5% | -48.3% | -16.2% | $16.6M |

| FBR | FBR LTD | 0.051 | -60.0% | -30.7% | 10.6% | $93.5M |

| SF1 | STEMIFY LTD | 0.021 | -92.6% | -77.8% | -31.0% | $3.1M |

| DDD | 3D RESOURCES LTD | 0.0025 | 25.0% | 66.7% | 25.0% | $3.5M |

Over the last six months, the nine companies tracked by Stockhead have fallen by an average of 12.5 per cent — a figure boosted by the outsized returns of Amaero and Orbital Ltd (ASX:OEC).

WA-based Orbital is the manufacturer of advanced propulsion systems for unmanned aerial vehicles (UAVs), with a focus on the defence industry.

After tracking at around 35c for most of last year, Orbital shares jumped sharply at the start of January following a positive half-year trading update.

Speaking with Stockhead, Orbital’s comms manager Ian Donabie said the company’s recent success was an example of how Australia is viewed as high end for its premium products and services for niche markets.

“We operate in a high-value advanced manufacturing environment, where patented technologies, technical expertise and commitment to quality are all key,” Donabie said.

“In addition, the defence industry continue to invest significantly in R&D, which is driving the development of cutting-edge innovations and technologies. And we’re proud to be part of the wave of advanced manufacturing coming out of Australia that is meeting this demand.”

Orbital’s production divisions are split between Perth and Oregon, US where it builds UAVs as part of a long-term supply agreement with Boeing subsidiary Insitu.

“With half of our production coming from Australia, we also have a responsibility to bring our supply chain along on the journey — supporting them to drive continuous improvement and deliver to the highest possible standards,” Donabie said.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.