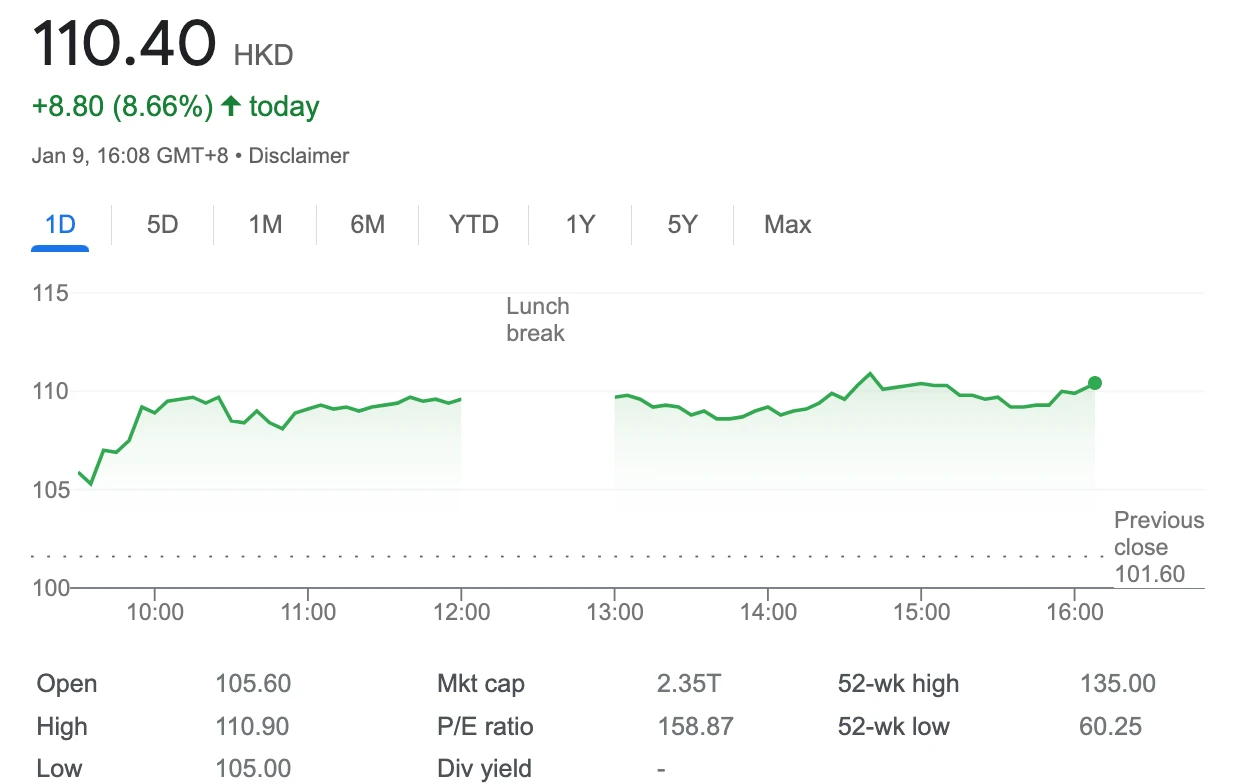

Once the Apple of Beijing’s eye, Alibaba jumps 9% as founder Jack Ma becomes just another Ant

Ah, there he is. Via Getty

Belittled and probably terrified Chinese entrepreneur Jack Ma has officially ceded control of the fintech giant Ant Group.

That’s why the fintech’s parent company, the one Ma founded called Alibaba climbed 9% in one Hang Seng session on Monday.

In a stealthy statement worthy of a cowed former tech giant, the owner of AliPay said on Saturday, its shareholders had agreed to slightly tweak voting rights, with the result that Ma’s voice has been whittled down to an inconsequential 6% whisper.

The move puts the kibosh on Ma’s inner-Ant voting clique, which alongside chairman Eric Jing, former chief executive Simon Hu and long-time Alibaba veteran Jiang Fang, allowed the bloc led by the autodidact former teacher to contain a controlling 53% of Ant’s voting power.

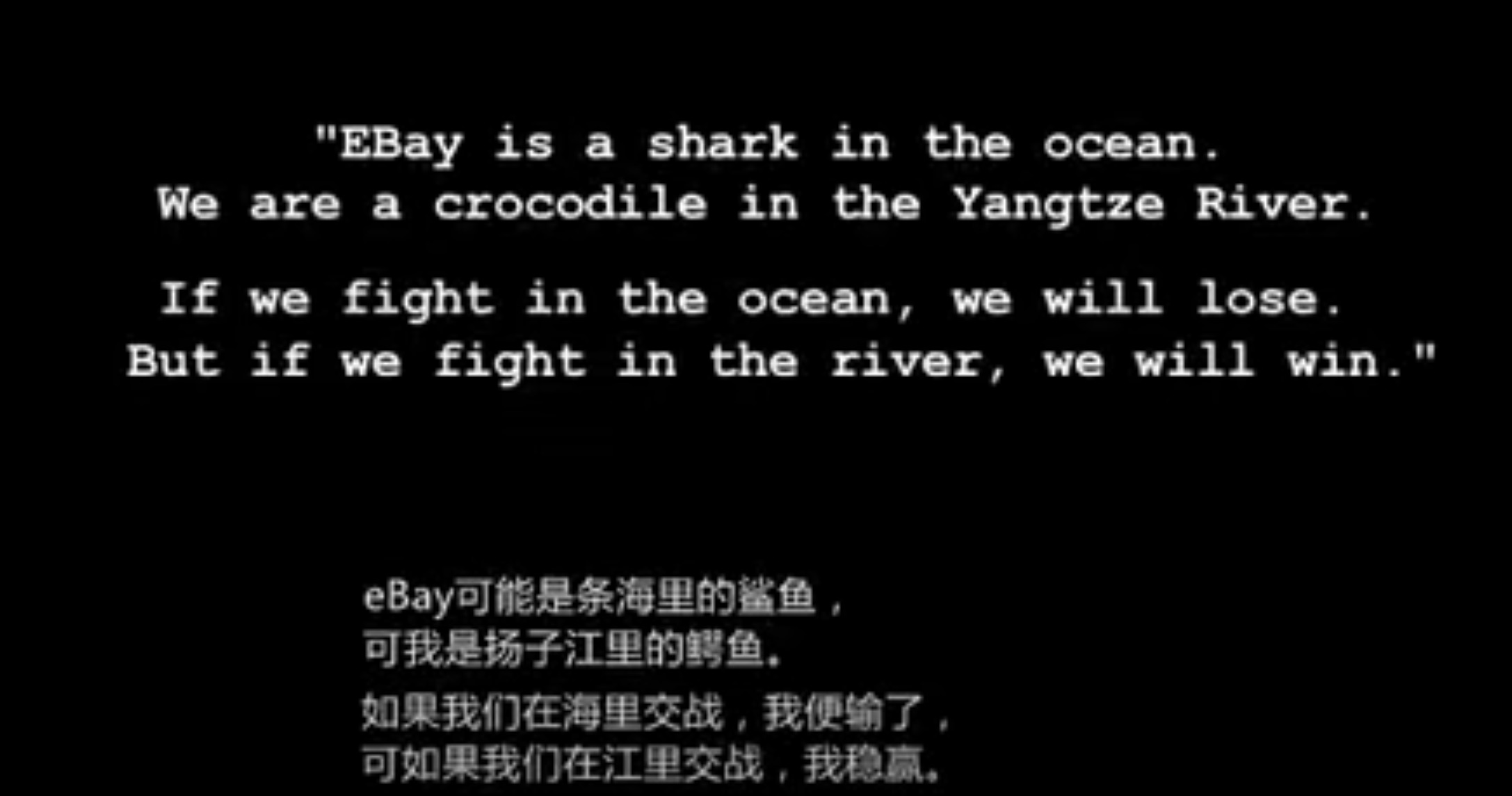

The original Yangtze Crocodile, now muzzled by Beijing, Ma was the most celebrated and most emblematic of the great era of Chinese entrepreneurs.

Founder of the e-commerce juggernaut Alibaba, which single-handedly contributed to transforming the economy of the Middle Kingdom into a thing of astonishing dynamism has had his final tooth pulled, losing all his snap, crackle and pop inside and outside the group.

Created in 2014 – a lifetime ago – Ant was Alibaba’s financial masterpiece, known for it’s AliPay platform which at its zenith welcomed some 730 million daily users and which was redistributing wealth with an efficient ease that, it’s now obvious, horrified President Xi Jinping.

The latest nail in Ma’s coffin follows China’s epic regulatory crackdown that so spectacularly said you’re a marked human now Jack, and put a stake through the heart of Ant’s would’ve-been-historic US$37 billion IPO in late 2020 and led to squishing the buoyancy out ofChinese tech, Ma’s life and began a forced restructuring of the Fintech.

Ma only owns a 10% stake in Ant, the formerly groundbreaking fintech affiliate of his Single’s Day inspiring e-commerce tour de force.

Back in the day, Ma held more than 50% of voting rights at Ant via Hangzhou Yunbo and two other set ups, but has kept a hand over the fintech through related entities, according to Ant’s (collectors edition) IPO prospectus offered up to investors back in 2020.

Ant over the weekend said the voting rights “adjustment”, was just all about making the shareholder structure “more transparent and diversified,” and “will not result in any change to the economic interests of any shareholders.”

Ant said its 10 major shareholders, including Ma, had agreed to no longer act in concert when exercising their voting rights, and would only vote independently, and thus no shareholder would have “sole or joint control over Ant Group.”

Ant’s job is done – as is the long and patient process to formally dilute Ma’s sway and to ensure China’s flagship fintech is “transparent and diversified”, allowing the party to wallow in a rebooted initial public offering (IPO), and have a big seat at a smaller table.

I must obey my master

Ant, based in Hangzhou, has done its master’s bidding ever since the IPO furore that decapitated not just Ant, Ma and Alibaba, but also succesfully put the genie of tech entrepreneurship back in the bottle.

There’s also now a 5th “independent” director, neatly stacking the “independent vote” to more than half of the nine-member board.

The South China Morning Post says to “further cleave itself from its parent Alibaba, certain executives have exited the Alibaba Partnership, a collection of the most powerful executives in the company.”

Alibaba which is out of Ma’s hands and into the mouthpiece of the Chinese Communist Party owns the South China Morning Post.

Ant has been doing the bidding of President Xi Jinping’s government, unwinding its connection with Ma’s Alibaba a company even the SCMP is now saying Ma was but a co-founder of Alibaba et al, in some delightful revisionist history.

“It looks like Jack Ma renounced his control of Ant, and it can open an opportunity for new investors to come in, which could be [either] state capital or other types of private equity”, Li Chengdong, head of the internet industry think tank Dolphin told the SCMP.

“I don’t think Ant’s IPO would be imminent, as China puts the priority on gathering resources for the hi-tech sector, but it would be easier to allow an IPO if equity and control issues get resolved at Ant”.

Ant’s very public 2020 execution, just 48 hours before its IPO began a classic putsch-style crackdown on China’s Behemoth Big Tech sector, marking the death of unchecked, innovation for what were some of the world’s most valuable tech names.

The ensuing silence, punctuated only by occassional punitive displays – Alibaba copped a record US$2.8 billion antitrust fine in April ’21 – was deafening as investors fled and voluble CEO’s like Ma disappeared.

Ant was told to pull the head of its ubiquitous mobile payment platform Alipay right back in under the guise of enhancing users’ data protection. If that was an actual priority for the Chinese Government, then it wouldn’t be the world’s greatest surveillance apparatus ever conceived. Which it is.

And meantime, in the realpolitik of finance

The good news is Ma lives. He actually resurfaced, looking alive and – as you would be – relaxed in Bangkok on Friday night, with this apparent Insta evidence posted about 12 hours before Ant Group told everyone they were done with his peculiar brand of being humble and nice.

View this post on Instagram

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.