ASX September Winners: The 50 best stocks in a strong month for markets

The ASX lifted in September. Pic: Getty Images

- Renewed optimism lifted the S&P/ASX 200 by 3% in September, closing at a record 8,239.20 points

- S&P Dow Jones Indices said small cap companies outperformed in September, with the materials sector rebounding 13%

- Mithril Silver and Gold topped the winners in September, up 363%, as resources companies dominated best performers

The start of spring kicked off a stronger month for Australian equities, with the S&P/ASX 200 up 3% in September, closing at a new record high of 8,239.20 points, according to S&P Dow Jones Indices (S&P DJI).

The Aussie market was boosted by a 13% rebound in the materials sector and rising commodity prices, which followed a substantial stimulus package announced in China plus increasing demand for resources such as iron ore and coal.

The US Federal Reserve also dropped rates by 50bps in September, its first interest rate cut since the early days of the Covid-19 pandemic, further lifting optimism among investors.

The S&P 500 has marked four quarters in a row of gains – its longest winning streak since 2021.

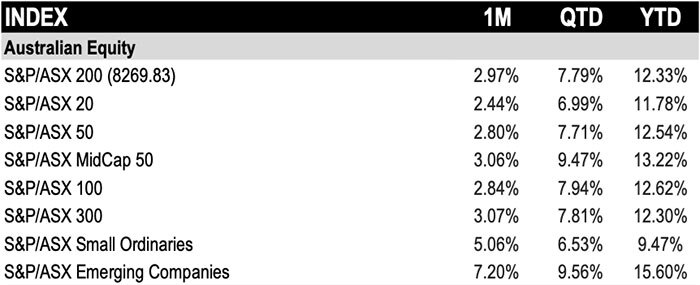

Amid the broad market rally, Australian small-cap companies outperformed with the S&P/ASX Small Ordinaries and S&P/ASX Emerging Companies rising 5% and 7% respectively.

IG market analyst Tony Sycamore told Stockhead the outperformance in September from small and mid caps comes from two sources.

“The first being the Fed commenced its eagerly awaited rate-cutting cycle and the RBA is expected to follow suit, possibly as early as December,” he said.

“Small and the mids are highly leveraged to expectations around interest rates.

“The second aspect is the dovish pivot last week in China, which has boosted commodity prices and has in turn supported the share price of junior miners and explorers.”

Nigel Green, founder and CEO of global financial advisory company deVere Group, told Stockhead global markets experienced a wave of optimism in September following dovish moves by the Fed and China.

“This significant monetary policy shift aimed to support the slowing economy and influenced market sentiments worldwide,” he said.

“China’s recent announcement of a substantial stimulus package further invigorated global market sentiment.

“This initiative included liquidity support of at least 800 billion yuan (~$113bn), aimed at stabilising the property market and stimulating weak economic growth.

China’s measures also involved cutting interest rates, lowering the reserve requirement ratio, and introducing policies designed to boost consumer spending.

The CSI 300 Index rallied 8.48% on September 30, marking its best day since September 2008.

Green said despite this immediate positive impact, analysts caution that the sustainability of these gains remained uncertain.

“Many believe that while the stimulus measures are a step in the right direction, they may not sufficiently address underlying issues like deflationary pressures and weak consumer demand,” he noted.

“We believe that more comprehensive fiscal and monetary policies may be required to sustain economic momentum in both the US and China.”

The Australian market has meanwhile kicked off the first day of October – traditionally a good month for stocks – down with a bit of profit taking.

Materials lead gains, up 13%

Eight of the 11 sectors gained in September, with materials leading after what had been a tough 2024 for the sector.

“Mining stocks led the gains, reflecting optimism about Australia’s export-driven economy,” Green said.

Information technology also had a strong month and remains the best performing sector YTD, up more than 48%.

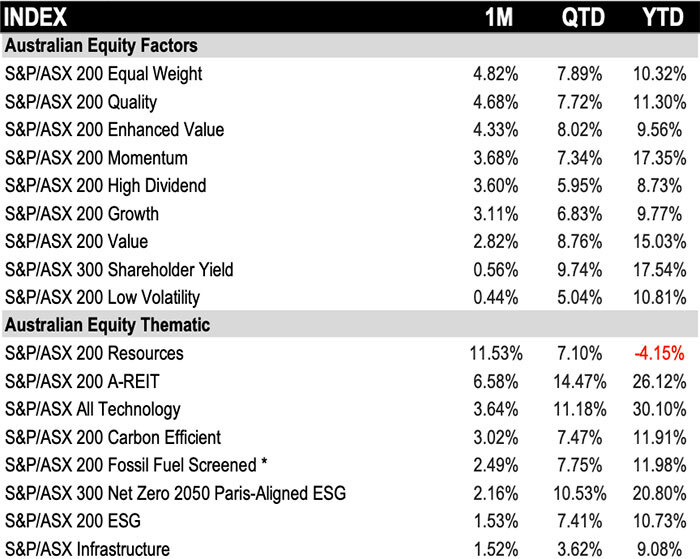

All Australian factor/thematic indices reported positive returns, led by the S&P/ASX 200 Resources, up 12%. Low Volatility and Shareholder Yield were among the laggards.

Equity volatility remained elevated globally, implying increased uncertainty priced in the options market, according to S&P Global. The S&P/ASX 200 VIX closed the month at 11.8, up 0.9 points from August.

Here were the 50 best performing ASX stocks in September

Scroll or swipe to reveal table. Click headings to sort.

| CODE | COMPANY | LAST SHARE PRICE | SEPTEMBER RETURN % | MARKET CAP |

|---|---|---|---|---|

| MTH | Mithril Silver Gold | 0.625 | 363% | $62,361,114 |

| OSM | Osmond Resources | 0.28 | 294% | $22,742,439 |

| MCM | Mc Mining Ltd | 0.145 | 292% | $76,178,456 |

| SHO | Sportshero Ltd | 0.012 | 200% | $8,031,827 |

| TMG | Trigg Minerals Ltd | 0.032 | 167% | $15,920,421 |

| CAN | Cann Group Ltd | 0.095 | 157% | $28,119,989 |

| ESR | Estrella Resources | 0.01 | 150% | $25,447,873 |

| EZZ | EZZ Life Science | 4.53 | 133% | $179,469,728 |

| FXG | Felix Gold Limited | 0.115 | 130% | $31,758,700 |

| PTR | Petratherm Ltd | 0.045 | 125% | $13,049,673 |

| AUA | Audeara | 0.056 | 124% | $8,132,551 |

| OCT | Octava Minerals | 0.096 | 113% | $4,644,777 |

| AGH | Althea Group | 0.039 | 105% | $14,997,300 |

| AZY | Antipa Minerals Ltd | 0.024 | 100% | $119,217,486 |

| GCR | Golden Cross | 0.002 | 100% | $2,194,512 |

| ICU | Investor Centre Ltd | 0.006 | 100% | $1,827,068 |

| MGA | Metals Grove Mining | 0.098 | 100% | $10,331,160 |

| BPM | BPM Minerals | 0.105 | 91% | $7,047,832 |

| PVL | Powerhouse Ven Ltd | 0.082 | 91% | $10,353,684 |

| EMP | Emperor Energy Ltd | 0.017 | 89% | $7,404,580 |

| MHK | Metalhawk | 0.17 | 87% | $17,113,900 |

| AGD | Austral Gold | 0.028 | 87% | $17,757,029 |

| AR3 | Austrare | 0.12 | 85% | $14,848,592 |

| EVS | Envirosuite Ltd | 0.079 | 84% | $108,434,687 |

| KAM | K2 Asset Management | 0.055 | 83% | $13,018,601 |

| PLG | Pearl Gull Iron | 0.02 | 82% | $3,681,752 |

| WLD | Wellard Limited | 0.072 | 76% | $36,656,272 |

| RIL | Redivium Limited | 0.007 | 75% | $16,481,129 |

| HYT | Hyterra Ltd | 0.054 | 74% | $47,519,887 |

| E25 | Element 25 Ltd | 0.335 | 72% | $72,571,092 |

| BTC | BTC Health Ltd | 0.065 | 71% | $21,068,015 |

| PEB | Pacific Edge | 0.14 | 71% | $109,608,656 |

| AZ9 | Asian Battery Metalas PLC | 0.029 | 71% | $9,368,664 |

| SMS | Star Minerals | 0.056 | 70% | $4,736,140 |

| C1X | Cosmos Exploration | 0.055 | 67% | $4,241,251 |

| CYQ | Cycliq Group Ltd | 0.005 | 67% | $2,227,583 |

| DOU | Douugh Limited | 0.005 | 67% | $5,410,345 |

| EXL | Elixinol Wellness | 0.005 | 67% | $6,605,912 |

| INP | Incentiapay Ltd | 0.005 | 67% | $6,219,650 |

| RKT | Rocketdna Ltd | 0.015 | 67% | $9,185,608 |

| YOJ | Yojee Limited | 0.083 | 66% | $22,006,811 |

| INR | Ioneer Ltd | 0.23 | 64% | $537,608,050 |

| MAY | Melbana Energy Ltd | 0.039 | 63% | $111,216,735 |

| AIM | Ai-Media Technologie | 0.755 | 62% | $148,257,973 |

| SNX | Sierra Nevada Gold | 0.071 | 61% | $8,607,644 |

| LRL | Labyrinth Resources | 0.017 | 61% | $62,614,033 |

| CR9 | Corellares | 0.008 | 60% | $3,255,647 |

| CTN | Catalina Resources | 0.004 | 60% | $4,953,948 |

| ODE | Odessa Minerals Ltd | 0.004 | 60% | $2,086,565 |

| SAN | Sagalio Energy Ltd | 0.008 | 60% | $1,637,281 |

Resources dominated the list of winners in September with Mithril Silver and Gold (ASX:MTH) up a whopping 363%. MTH had a series of positive announcements during the month, including an investor presentation outlining plans to expand its Copalquin gold and silver project in Mexico.

MTH has said the Copalquin mining district was home to five of the world’s 10 largest silver mines and supplies 25% of the world’s silver. MTH’s ordinary shares also commenced trading on the TSX Venture Exchange (TSXV) on September 27.

Osmond Resources (ASX:OSM) had a strong September and rose 294% after announcing the acquisition of an 80% stake in Iberian Critical Minerals, a move focused on securing the Orion EU project in Spain, which contains high-grade samples of critical minerals rutile, zircon and rare earths.

OSM also announced it had appointed Anthony Hall as managing director, replacing founding executive director Andrew Shearer. The company also undertook a $700k a share placement and appointed renowned resources entrepreneur Tolga Kumova as a strategic advisor.

Sports betting platform SportsHero (ASX:SHO) rose 200% last month with the company announcing on September 27 it had received firm commitments for a capital raising of $500k at 1 cent/share, which will be used to accelerate the commercialisation of existing partnerships, expand sales and marketing efforts.

The company said during September it had also secured an additional $500k drawdown facility from a major shareholder. The total drawdown facility is $1.5m with $1.2m drawdown remaining on September 30.

Here were the 50 worst performing ASX stocks in September

Scroll or swipe to reveal table. Click headings to sort.

| CODE | COMPANY | LAST SHARE PRICE | SEPTEMBER RETURN % | MARKET CAP |

|---|---|---|---|---|

| WEL | Winchester Energy | 0.001 | -60% | $2,044,528 |

| AKN | Auking Mining Ltd | 0.005 | -55% | $1,677,851 |

| ERA | Energy Resources | 0.007 | -53% | $155,038,094 |

| FHE | Frontier Energy Ltd | 0.22 | -52% | $113,034,561 |

| 1TT | Thrive Tribe Tech | 0.001 | -50% | $611,622 |

| FAU | First Au Ltd | 0.001 | -50% | $3,623,987 |

| FRX | Flexiroam Limited | 0.008 | -50% | $8,679,542 |

| IEC | Intra Energy Corp | 0.001 | -50% | $1,690,782 |

| RBR | RBR Group Ltd | 0.001 | -50% | $1,634,405 |

| RIE | Riedel Resources Ltd | 0.001 | -50% | $4,447,671 |

| SI6 | SI6 Metals Limited | 0.001 | -50% | $2,368,859 |

| M2R | Miramar | 0.007 | -46% | $2,777,763 |

| STM | Sunstone Metals Ltd | 0.005 | -44% | $21,629,518 |

| ACW | Actinogen Medical | 0.024 | -43% | $70,680,034 |

| TSI | Top Shelf | 0.04 | -43% | $13,004,294 |

| BUR | Burley Minerals | 0.07 | -42% | $7,969,660 |

| MPP | Metro Performance Glass Ltd | 0.05 | -40% | $7,415,123 |

| RC1 | Redcastle Resources | 0.009 | -40% | $4,103,258 |

| YRL | Yandal Resources | 0.09 | -40% | $24,102,685 |

| SGR | The Star Entertainment Group | 0.295 | -39% | $717,170,219 |

| VR1 | Vection Technologies | 0.008 | -38% | $10,612,712 |

| FTC | Fintech Chain Ltd | 0.005 | -38% | $3,253,848 |

| PFT | Pure Foods Tasmania | 0.017 | -37% | $2,075,569 |

| RFA | Rare Foods Australia | 0.012 | -37% | $3,263,799 |

| PPG | Pro-Pac Packaging | 0.05 | -36% | $8,902,698 |

| FGL | Frugl Group Limited | 0.015 | -35% | $1,573,629 |

| IXU | Ixup Limited | 0.015 | -35% | $23,216,289 |

| NAG | Nagambie Resources | 0.015 | -35% | $12,746,171 |

| THB | Thunderbird Resource | 0.017 | -35% | $5,152,880 |

| REY | REY Resources Ltd | 0.036 | -35% | $7,616,193 |

| NWF | Newfield Resources | 0.089 | -34% | $83,722,560 |

| AAU | Antilles Gold Ltd | 0.003 | -33% | $7,422,971 |

| ADD | Adavale Resource Ltd | 0.002 | -33% | $3,671,296 |

| AMD | Arrow Minerals | 0.002 | -33% | $25,378,730 |

| AUH | Austchina Holdings | 0.002 | -33% | $4,200,767 |

| AVE | Avecho Biotech Ltd | 0.002 | -33% | $6,338,594 |

| BPH | BPH Energy Ltd | 0.012 | -33% | $15,671,252 |

| GCM | Green Critical Min | 0.002 | -33% | $2,937,085 |

| PUR | Pursuit Minerals | 0.002 | -33% | $9,088,500 |

| SIT | Site Group Int Ltd | 0.002 | -33% | $5,204,980 |

| RIM | Rimfire Pacific | 0.047 | -33% | $128,533,127 |

| PNT | Panther Metals | 0.021 | -32% | $5,177,670 |

| FTZ | Fertoz Ltd | 0.026 | -32% | $7,707,974 |

| TMS | Tennant Minerals Ltd | 0.013 | -32% | $13,860,411 |

| ASH | Ashley Services Grp | 0.185 | -31% | $27,355,422 |

| INF | Infinity Lithium | 0.033 | -31% | $15,265,539 |

| TKM | Trek Metals Ltd | 0.031 | -31% | $15,917,659 |

| AER | Aeeris Ltd | 0.068 | -31% | $4,745,901 |

| ASN | Anson Resources Ltd | 0.077 | -30% | $100,786,000 |

| ICR | Intelicare Holdings | 0.014 | -30% | $7,292,822 |

The most high-profile drop in share price during September was troubled casino operator Star Entertainment Group (ASX:SGR), which fell 39% and hit the headlines for the wrong reasons during the month.

SGR, which owns casinos in Sydney, Brisbane and the Gold Coast, had been in a trading halt from August 28 until the start of trade on September 27. The company’s woes centred around its financial and liquidity position along with a second NSW inquiry which once again found the group unfit to hold a casino licence.

SGR delayed the release of its FY24 results until after market close on September 30, with the company outlining earnings uncertainty due to market share loss, financial crime remediation, and casino reforms. The delayed, over-budget $3.6bn Queen’s Wharf project in Brisbane had reportedly added further pressure to SGR.

The company announced on September 25 it had sold the Treasury Casino in Brisbane for $60.5m and it had secured a new debt facility for up to $200m from corporate lenders. SGR said its existing $450m facility had been reduced to $334 million, which was fully drawn.

In some good news for the company, its shares bounced back 22% on Monday on dip buying. Speculation is now mounting on what will be the next move for SGR in October.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.