LAST ORDERS: A mid-week peek at the news from the ASX and elsewhere you might have missed today

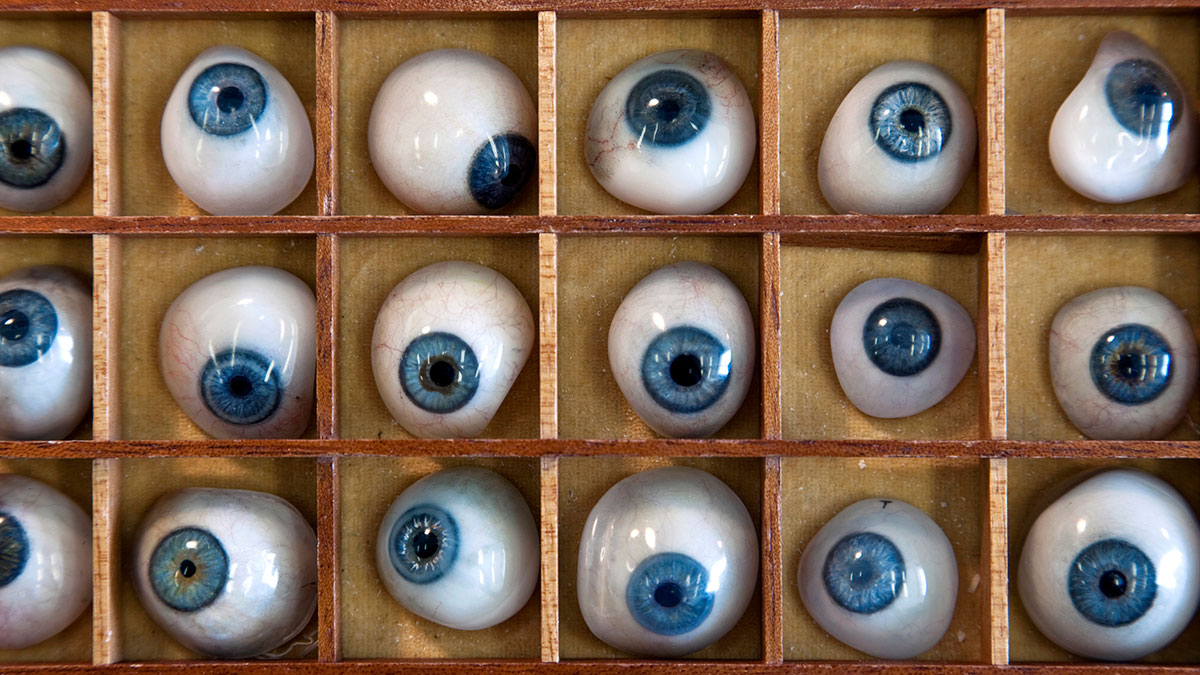

This is how he knows if you've been bad or good, kids... Pic via Getty Images.

Christmas is nearly here!! Can you feel the magic in the air? Or is that just pollen? It’s honestly getting hard to tell.

Either way, it’s the end of the last Wednesday before Christmas, and there can’t be a much better reason than that to kick off your loafers and start loafing yourself (excuse me?), as we being you all the news from the market and elsewhere that you might have missed today.

Enjoy…

FROM THE HEADLINES

Everyone will drink themselves to death this Xmas

As we lurch towards Christmas, there will no doubt be a number of people heading out for last-minute work Christmas parties – but thankfully, the good people at news.com.au have a story to help you make sure you don’t over-indulge at your work do this year.

Not in a ‘don’t get loaded and completely lose your shit’ sense, though… more in a ‘don’t get fat over Christmas’ kinda way – but there’s a few numbers in there that seem a little rubbery – as would the floor at the Christmas party if thoes number are actually on the money.

Specifically the claim that “the average office party attendee will consume 4941 calories”, before breathlessly telling us that a Long Island Iced Tea – known kryptonite to all but the hardiest of souls – contains an 400 calories a go.

Now, I’m no mathlete, but even I can spot that – even accounting for a solid plate of pub food (1000 or so calories) – that’s suggesting that the “average” punter is downing the equivalent of somewhere around 10 Long Island Iced Teas, or about 40 standard drinks – so it’s unlikely to be your waistline you’ll be worried about with that lot on board.

Told ya so… the votes are in, and Musk is out.

And, surprising absolutely nobody except everyone who didn’t see Elon Musk’s recent Twitter poll for anything other than what it blatantly was – he’s said he’s stepping down from the hot seat of the Greatest Folly of 2022.

Should I step down as head of Twitter? I will abide by the results of this poll.

— Elon Musk (@elonmusk) December 18, 2022

The votes are in and Musk is out – pretending all the while like he hadn’t already made up his mind at least a few days ago, while hanging out in a corporate box at the World Cup Final with Trump son-in-law Jared Kushner, Putin’s PR / propaganda mouthpiece Nailya Asker-Zade and a bunch of big-dollar Saudi dudes.

Totally unfounded rumours that Musk has stepped down to make time to take on the role of a Batman supervillain, however, continue to swirl – even as Musk says that the search for someone “foolish enough to take on the job” to replace him begins. #BringBackTomFromMySpace

LAST ORDERS

The War for Warrego (ASX:WGO) has been slowly bubbling away on the backburner for a while now, but today there’s been a new salvo fired from the Hancock trenches, with Rinehart’s bid team revealing that it’s received firm undertakings from shareholders representing 15.84% of Warrego that they’re prepared to take the Hancock deal.

That includes Warrego co-founder David MacNiven, who carries more than 11% of Warrego’s stock through his UK-based Mira LasNubes LLP business, along with a few MacNiven allies including Serena Arif, a 1.05 per cent stakeholder in Warrego with 12.8 million shares, who is connected to MacNiven through oil and gas entity Delphian Ballistics.

The deal-clincher would be Hancock making its 28c per share bid unconditional within two trading days – something Hancock says it will be taking the time to consider and will let the market know on the final trading day before Christmas.

Importantly, as The Australian notes, Strike Energy’s one for one share bid currently values the company at 32c, “for various reasons including the listed company’s possible share price volatility post-acquisition.”

Meanwhile, in slightly smaller news, Aquis Entertainment (ASX:AQS) has announced that it’s been given the all-clear by regulators to finalise its sale of Casino Canberra to Iris CC Holdings, operator of the Lasseters casino property in Alice Springs.

Casino Canberra – the RSL-on-steroids lurking in the cold, dead heart of the nation’s capital – has been on the market for quite some time, and its sale will see Aquis considering its future as a listed entity, with the company offering a “sometime around the end of January” timeline for a decision about its future to be made.

And some late mail today from Argonaut Resources (ASX:ARE), informing the market that field work undertaken in October has returned highly encouraging lithium-caesium-tantalum (LCT) pegmatite exploration results within the Darson Pegmatite Swarm at its 80% held Higginsville project in Western Australia.

Argonaut says it’s identified a drill-ready, high-priority 700m high-prospectivity LCT pegmatite target, with peak lithium in rock-chip samples at 224ppm Li (Darson South), and peak soil results including 135ppm Li with 52 samples greater than 50ppm.

TRADING HALTS

Earlypay (ASX:EPY) – Halt called pending an announcement in relation to an update regarding its previously reported FY23 Outlook & Guidance.

Opyl (ASX:OPL) – Capital raise.

Nuheara (ASX:NUH) – Capital raise.

Infinity Lithium (ASX:INF) – Halt called pending an announcement in relation to an update regarding the Investigation Permit Valdeflorez at its San José Lithium Project.

IRIS Metals (ASX:IR1) – Capital raise and material transaction.

Fiji Kava (ASX:FIJ) – Capital raise.

PhosCo (ASX:PHO) – Halt called pending an announcement by the Company to the market in relation to the Chaketma Mining Concession Application.

Vital Metals (ASX:VML) – Halt called pending the release of an announcement of the outcome of a review with respect to optimising the Tardiff Project and the Saskatoon Plant.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.