ASX Small Caps Lunch Wrap: Who wants to play a game of Good News and Bad News this morning?

"Ewww... No dad, I don't know what that is or why it's on your goolies, but that is definitely something to talk to your doctor about." Pic via Getty Images.

Local markets are down by, like, a lot this morning, which is sad – but there are three (count ‘em, three) Small Caps that have gone A-Grade Bananas, so there is some good news coming out of the ASX.

Before I get to that, it’s time for a quick US history lesson from the early 1800s, which is all about the importance of covering all your bases when building an online presence.

(That’ll make sense once you’ve read this, I promise).

A few years back, the US state of Maryland – in a fit of bloodthirsty patriotic zeal – decided that it would the Right Thing to Do to launch a statewide celebration of The War of 1812.

It was a brutal conflict, fought across the eastern states of the US between American forces and those of the United Kingdom, who were still kinda mad about losing the War of Indepence a few decades earlier.

Following the War of Independence, things between the US and the UK were somewhat fractious, as you’d expect.

There were the usual post-conflict flare-ups, which developed into a drawn-out series of super-boring trade war stuff – but which, notably, included the hilariously named Non-intercourse Act of 1809 – a law that forbade any ships carrying goods to or from England or France to dock at American ports.

Thomas Jefferson, who was US President at the time, was clearly sending the UK a message – because nothing quite says “Don’t F#!k With Us” like a Non-intercourse Act.

Anyway… tensions built between the UK and the US, until there was a bit of a boilover and they all went back to fighting again, resulting in The War of 1812, which America went on to win on penalties, if my memory is correct.

The state of Maryland decided that the 200th anniversary of the conflict needed to be celebrated (because ‘Murica!) and so, the War of 1812 Bicentennial Commission was formed in 2007 to organise the celebrations.

One of the methods used by Maryland to celebrate the deaths of thousands of people was commemorative number plates, featuring the web address of a non-profit called “Star-Spangled 200 Inc”, which was leading fundraising efforts for bicentennial projects and events,

It was, from the outset, an organisation with a clearly limited lifespan. Not so much for the licence plates, however.

They were slapped on every newly-registered car in Maryland between 2010 and 2016 (four years after the event was over, because life moves kinda slow in Maryland), and at last count, state officials say there are nearly 800,000 cars currently puttering around the state with those plates still on them.

The problem, however, is that the non-profit is – as you’d expect more than 10 years later – defunct, but the web address is not, because nothing on the internet ever dies.

A very enterprising casino gambling website based in the Philippines spotted an opportunity, when it found that ownership of the domain had lapsed, so it snapped up the domain name for themselves, and promptly set it to redirect to their own online endeavours.

The total cost of setting something like that up would be maybe $150 – $200… which isn’t a bad deal for 800,000 mobile billboards for your 100% totally legit online casino.

TO MARKETS

I’ll kick off the local market news with something slightly-very alarming that Stockhead’s own super-smart contributor Bottom Picker just this minute dropped in my lap.

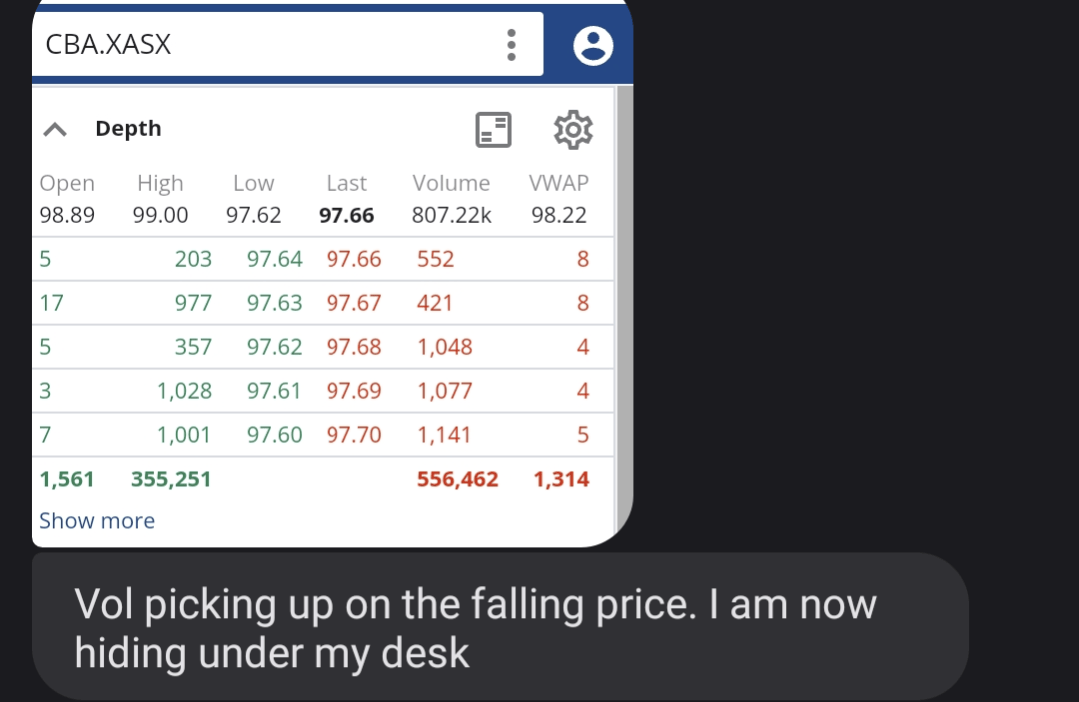

The big banks – all of them – took a collective kick in the nuts at 11:30am, just as the Australian Bureau of Spreadsheets released data showing that inflation for the year to April has surged to 6.8% (well above the expected 6.4%), despite the RBA’s efforts to bring it under control with its recent run of rate hikes.

There were massive spikes in volume, and near-vertical drops in trading price, causing more than a little clenching of the markets butt-cheeks to see where it was all about to land.

“What we are seeing is a lack of support for Australian blue chips which will flow through to the smaller caps,” Bottom Picker told me, from a hastily constructed fort underneath his desk. Actual:

“Coal is down 40% in a month and tax-year-end selling will only increase the downside, especially among African miners,” he continued.

But it’s not all terrible news, as this time of year is often a bit fraught on the ASX – the old adage “Sell in May and Go Away” is something of a tradition for local investors.

That said, with the confluence of recent events – rate hikes, inflationary pressures and increasing market volatility – there are likely to be some terrific bargains on the table for those with the stones to go looking for them between now and when it’s time to pay the tax man.

To Bottom Picker’s enduring credit, he picked this one early – you can read his analysis of how things might play out here.

That’s all happening against the backdrop of a steep market-wide fall this morning, after the benchmark began its day with an immediate 0.35% fall which has continued somewhat relentlessly all the way through to lunch.

By midday, the ASX 200 benchmark has fallen to -1.15%, and that’s despite news that the US debt ceiling crisis looks like it’s about to come to a favourable end… more on that in a minute.

But pretty much the only thing stopping the entire market from sliding into the sea like a greased up, well-oiled backpacker at Bondi is the tech sector. The ASX XTX All Ords Tech index is down, but still outperforming the rest of the market by a considerable margin.

InfoTech and Utilities are the only broad sectors in the green so far today, on +0.48% and +0.21% respectively.

For New People: the InfoTech sector scan and the ASX XTX All Ords Tech index cover two different selections of stocks, which is why they are sometimes showing wildly different results.

I know this, because I had to look it up, and I mention it because I don’t want anyone to think I’m any more of an idiot than I actually am.

On the downside, Energy, Materials and Consumer Discretionary are being hit with sticks by an angry mob this morning.

Energy’s down 2.5%, Materials has fallen 2.1% and Discretionary is lower by 1.77% – which, obviously, isn’t very good.

NOT THE ASX

Wall Street came back from a long weekend to deliver a mixed bag of results overnight, which left the S&P 500 dead flat, the Dow lower by 0.15% and the Nasdaq up 0.32%.

The big ticket news on the markets was Nvidia’s continuing rise, after the chipmaker’s AI-fuelled run to the stars continued, pushing it briefly over the magic $1 trillion market cap line, before it retreated towards the end of the session.

Earlybird Edy Sunarto reports that Nvidia is benefiting from an AI frenzy that has taken hold since ChatGPT came to the scene. UBS estimated that developing ChatGPT took 10,000 Nvidia chips.

Other stocks related to AI also rose, including Palantir which gained 8%, and C3.ai Inc which surged more than 33%.

Elsewhere, US consumer confidence slipped in May to a six-month low, while US home prices increased month over month.

US investors were closely watching for the debt ceiling deal to get over its next hurdle, which was an approval by Congress – which, in slightly “breaking news”, I can confirm that it has.

The debt ceiling deal is now set to go back to the US House of Representatives for a final rubber stamp, which is widely expected to be ushered through with a minimum of fuss.

But, US politics being what it is these days, I wouldn’t be at all surprised if the deal’s progress is somehow scuttled by a caucus of dimwits because it doesn’t go far enough to provide rifles and ammunition to school kids, or something.

In Japan, the Nikkei is down 0.88% because Japan’s version of Playboy magazine has officially done what pretty much everyone thought about doing when AI generated images became a thing.

The latest issue of the magazine features a model called Ai Satsuki, who is – according to the magazine – 157cm tall, blessed with helplessly unrealistic body measurements and “enjoys playing video games as a hobby”.

She’s also completely AI-generated… Hence the name Ai, which is also the Japanese word for “love”. What a happy coincidence that is.

I knew, deep down in my depressingly cold, black heart, that it would be Japan who was first out of the blocks with the first commercial-grade AI-generated adult magazine spread – which, in a way, is possibly a far more ethical approach to the outright objectification of women.

So, just to satisfy your morbid curiosity, here’s what a computer reckons a Japanese gravure model should look like – and please note, this is taken from Ai Satsuki’s own Twitter account… which can only end well.

私のデジタル写真集が発売されました。

皆さんに見ていただけるととっても嬉しいです。グラジャパ!限定カット付https://t.co/EBtBtGRW7e pic.twitter.com/yIMwrnfT1h

— さつきあい (@ai_satsuki_ai) May 29, 2023

Reactions so far from Japanese perverts are highly mixed, with some quite positive…

- “She’s cute! Following her account and going to keep an eye on what she does next.”

- “No scandals. No scheduling problems. No talent agency problems. No appearance fees. Sounds good.

… while others still a little unsure about what the future of Japanese soft porn will look like:

- “I hope this is a one-time thing, and doesn’t take page space away from real gravure models.”

- “Things are going to get tougher for 3-D women.”

- “She needs more tentacles. And goo.”

I might have made that last one up.

Over in China, where pornography is an evil distraction cooked up by decadent Western perverts to rob strong, robust workers of their Chi energy to make them lazy and unproductive, Shanghai markets are down 0.46%.

In Hong Kong, the Hang Seng is also down, falling 1.39% in early trade.

Over in CryptoLand, where you’re way behind the times if you haven’t already tried to use AI to Weird Science the woman of your dreams into existence, BTC and ETH are being very boring while XRP is on a bit of a surge.

XRP is up about 6% over the past 24 hours, 12% over the past week and nearly 20% over the past fortnight, while the team behind do battle with the US SEC over a securities violation accusation.

ASX SMALL CAP WINNERS

Here are the best performing ASX small cap stocks for May 31 [intraday]:

Swipe or scroll to reveal full table. Click headings to sort:

Code Company Price % Today Volume Market Cap ZLD Zelira Therapeutics 2.8 198% 466,219 $10,666,326 SLM Solis Minerals 0.25 79% 7,703,767 $6,517,696 GSM Golden State Mining 0.05 67% 15,262,579 $3,510,426 IS3 I Synergy Group Ltd 0.01 43% 13,940 $2,023,563 WC8 Wildcat Resources 0.14 27% 13,586,902 $72,822,500 BET Betmakers Tech Group 0.155 24% 11,350,216 $117,942,700 SGC Sacgasco Ltd 0.006 20% 15,833 $3,078,619 AXE Archer Materials 0.56 18% 1,320,257 $121,052,331 KSC K & S Corporation 2.35 15% 13,737 $279,171,925 VTM Victory Metals Ltd 0.23 15% 143,683 $13,311,339 AKP Audio Pixels Ltd 14 15% 48,680 $354,345,852 AAU Antilles Gold Ltd 0.047 15% 1,932,992 $23,794,321 BAT Battery Minerals Ltd 0.004 14% 1,194,037 $11,749,298 DOU Douugh Limited 0.008 14% 84,576 $6,887,289 GMN Gold Mountain Ltd 0.004 14% 1,308,773 $6,894,764 PVS Pivotal Systems 0.008 14% 977,961 $3,742,331 RDS Redstone Resources 0.008 14% 92,500 $5,802,149 EGR Ecograf Limited 0.17 13% 1,595,440 $67,550,019 OCN Oceana Lithium 0.34 13% 286,249 $11,752,950 SRT Strata Investment 0.18 13% 127,777 $27,107,772 NCL Netccentric Ltd 0.064 12% 500 $16,131,665 COY Coppermoly Limited 0.01 11% 50,498 $3,819,482 SKN Skin Elements Ltd 0.01 11% 497,909 $4,195,214 IKE Ikegps Group Ltd 0.8 10% 104,879 $116,002,930

It’s far from being all doom and gloom on the market today, though – thanks to a clutch of Small Caps that have gone booming throughout the morning.

At the top of the pile, Zelira (ASX:ZLD) has kicked the mother of all match-winners this morning, after an IRB-approved 1 multi-arm head-to-head study of its proprietary diabetic nerve pain drug ZLT-L-007 showed that it outperforms the current go-to drug Lyrica.

This is massive news – Lyrica (also known as pregabalin) is a multi-billion dollar money spinner, prescribed heavily around the world to tackle pain associated with horribly painful peripheral neuropathy (nerve damage) brought on by diabetes and other ailments. And my gout.

Zelira is already up 192.55% at the time of writing and, despite being tightly held, looks like it’s going to continue to climb for a while.

Meanwhile, Solis Minerals (ASX:SLM) has also gone soaring, up 89.2% this morning on news that the company has executed an option to acquire the Jaguar hard rock lithium project in Bahia State, Brazil.

Rock chip samples from Jaguar’s pegmatite has confirmed spodumene grades in oxidised pegmatite up to 4.95% Li2O, and the project has extensive pegmatite body mapped over 1km of strike, with widths in excess of 50m with coarse visible spodumene exposed across pegmatite body.

Solis will have some excellent assistance in getting started at the site, with its largest shareholder, Latin Resources (ASX:LRS), lined up to provide exploration guidance and in-country experience.

And in third place for the morning, it’s Golden State Mining (ASX:GSM), also flying very high, but without any fresh news to provide an explanation.

GSM recently announced the acquisition of exploration rights adjacent to the Nomad lithium prospect at the Yule project in WA’s Pilbara region, but that was a week ago… still, its trading price has leapt 66.7% so far this morning.

ASX SMALL CAP LOSERS

Here are the most-worst performing ASX small cap stocks for May 31 [intraday]:

Swipe or scroll to reveal full table. Click headings to sort:

Code Company Price % Volume Market Cap SVY Stavely Minerals Ltd 0.13 -26% 970,726 $57,097,900 PUA Peak Minerals Ltd 0.003 -25% 9,055,000 $4,165,506 YPB YPB Group Ltd 0.002 -20% 260,000 $1,548,122 SAU Southern Gold 0.017 -19% 212,718 $6,305,991 CAV Carnavale Resources 0.0025 -17% 842,666 $8,200,655 NZS New Zealand Coastal 0.0025 -17% 636,500 $4,962,030 OAU Ora Gold Limited 0.0025 -17% 30,077,140 $11,810,775 PYR Payright Limited 0.005 -17% 16,535 $5,285,311 FIN FIN Resources Ltd 0.016 -16% 581,000 $11,752,172 RFA Rare Foods Australia 0.064 -16% 10,055 $15,374,431 CLU Cluey Ltd 0.085 -15% 50,802 $20,161,357 ADR Adherium Ltd 0.003 -14% 45,744 $17,487,534 AFW Applyflow Limited 0.012 -14% 96,250 $2,070,329 CPT Cipherpoint Limited 0.006 -14% 8,023,015 $8,114,692 FAU First Au Ltd 0.003 -14% 8,416,667 $5,081,976 GFN Gefen Int 0.006 -14% 12,000 $476,701 PPY Papyrus Australia 0.024 -14% 381,010 $13,302,293 OMA Omega Oil & Gas 0.19 -14% 1,640,545 $33,643,311 CTN Catalina Resources 0.0035 -13% 1,000,000 $4,953,948 GCM Green Critical Min 0.014 -13% 481,443 $15,783,658 IEC Intra Energy Corp 0.007 -13% 1,699,634 $5,646,253 VAL Valor Resources Ltd 0.0035 -13% 3,225,000 $15,212,139 ZAG Zuleika Gold Ltd 0.015 -12% 100,000 $8,891,861 BNZ Benz Mining 0.31 -11% 114,042 $29,074,926 EDE Eden Inv Ltd 0.004 -11% 14,215 $13,486,250

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.