ASX Small Caps Lunch Wrap: Who took their world title-winning celebrations way too far this week?

Richard was mid-shower when, suddenly, the newly-crowned “Xiangqi King” popped in to borrow his hotel bathtub. Pic via Getty Images.

Local markets are up again this morning, hot on the heels of Wall Street which banked another positive session overnight.

New York’s S&P 500 was on track to set a new all-time high, but fell just shy of the mark, despite putting on +0.14% – so, keep your eyes peeled for how things pan out in the US tonight as that could be the banner headline driving even more gains for the ASX as we trundle towards the final trading day of the year.

It’s definitely a heady time of year, and one that – for some folks – involves taking their celebrations to extremes. However, one fella in China has a tale of woe that should give everyone pause when it comes to tempering their celebratory mood in a few days’ time.

I’m speaking, of course, about the now internationally-renowned 48-year-old Yan Chenglong, who climbed to the pinnacle of his chosen passion, becoming the Xiangqi (Chinese chess) world champion last week.

That is, in and of itself, a remarkable achievement, but Yan’s win has come at great cost to the reputation of the sport, which – like its more widely known stablemate – has been set abuzz by allegations of cheating via the use of vibrating anal beads.

You may recall back in September of this year, that 19-year-old prodigy Hans Niemann, was accused very publicly of using vibrating anal beads during competition with 31-year-old chess grandmaster Magnus Carlsen at the Sinquefield Cup at the St Louis Chess Club.

Well… it seems like that idea has caught on in the world of Xiangqi as well, with Yan’s accusers claiming that he had “clenched and unclenched rhythmically to communicate information about the chess board via code to a computer, which then sent back instructions on what moves to make in the form of vibrations”.

… admit it. You read that, and started clenching as well.

Anyway… As terrible as that kind of accusation might seem, it’s actually the least of Yan’s worries at the moment, as he has already been stripped of his “Xiangqi King” title by the Chinese Xiangqi Association.

It turns out that the excitement of winning the title was all a bit much for Yan, whose celebrations apparently got well out of control, leading the Chinese Xiangqi Association to claim he had been caught “disrupting public order” and displaying “extremely bad character”.

Yan’s crime? Getting super-duper drunk with a bunch of people in his hotel room, and then taking a sh-t in the bathtub…

By all accounts, that’s an unforgivable sin in the world of Xiangqi, but I had a quick scan of the rule book this morning and I couldn’t find a single mention of dropping a log in a hotel bathtub anywhere in there, so Yan might have some avenue to appeal.

Which I believe he definitely should, if only on the basis that he had no choice but to make an emergency deposit into the bathtub, after spending the previous week having his colon severely weakened to the point of outright destruction by the very same vibrating anal beads he allegedly used to win.

TO MARKETS

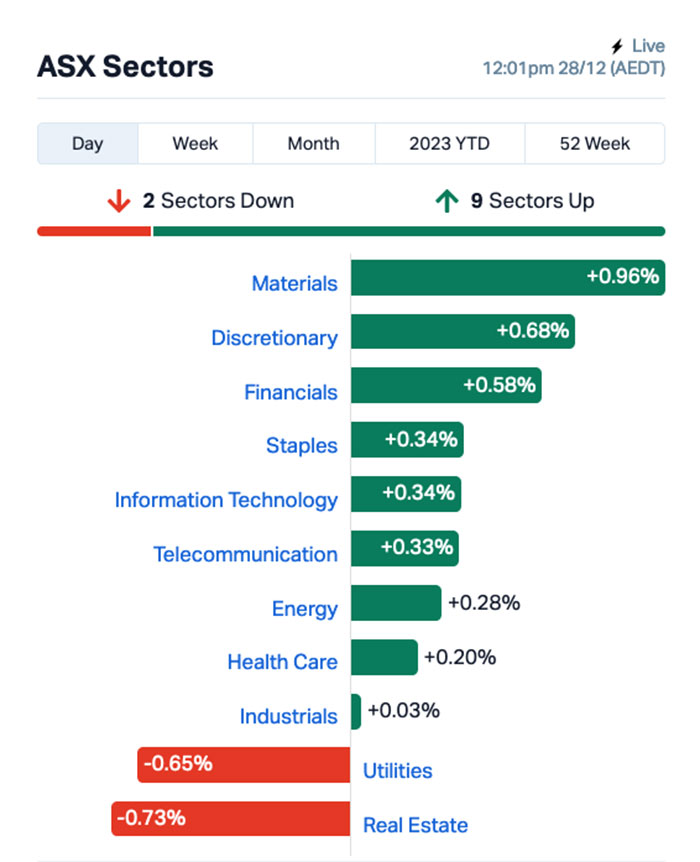

Things are looking a lot better than a turd in a bathtub for the ASX this morning, which is sporting a housekeeping-friendly +0.4% bump this morning, on the heels of another happy session in the US overnight.

The rise has lifted the benchmark to a 20-month high, the Aussie dollar is at its highest level in five months, the local Materials sector is experiencing something of a post-Christmas, last-minute boom before the end of 2023… All we need is for the Aussies to magically crush Pakistan at the MCG today and I will happily stick a fork in this year and declare it “done”.

Out in front of the market this morning are the ASX’s goldies, up 0.94% at the time of writing and on track to finish 2023 with a YTD return of more than 26.5% – which is, quite frankly, astonishing, second only to the performance from the Tech sector, which is on track to beat that high water mark by nearly 7.0%.

But… I’m getting ahead of myself. Today’s effort by the goldies is helping to propel the Materials sector to the top of the ladder on +0.81%, with the Big 3 – BHP (ASX:BHP), Fortescue (ASX:FMG) and Rio Tinto (ASX:RIO) all putting some workmanlike gains into the mix today.

Unlike yesterday, which was wall-to-wall happy days across the sectors, there are a couple of laggards – namely, Real Estate and Utilities, which are down 0.77% and 0.65% respectively, the former losing ground after the sector’s dawning realisation that it’s made up of people who work in Real Estate caused something of an existential crisis, and the latter out of sheer spite.

You know it’s true.

Among the market’s heavier hitters, lithium hopeful Latin Resources (ASX:LRS) is boasting a 6.7% rise this morning because it’s Latin Resources, and it can do whatever it wants, while Heartland Group – which does Finance stuff – is up 5.41% on a remarkably slim volume.

NOT THE ASX

In the US overnight, the S&P 500 flirted with making history but bottled out with the whole world watching, failing to reach a record high but looking good for a late record-breaking finish to the year, provided nothing spooks the American market while we’re all asleep tonight.

“As we start 2024, markets will need to see new, positive catalysts to send the S&P 500 to new all-time highs,” said Tom Essaye, the founder of The Sevens Report newsletter.

He sounds like a cool, upbeat kinda guy who could be fun to have coffee with.

It was still a positive day in New York though, which saw the S&P rise by +0.14%, the blue chips Dow Jones index up by +0.30%, and the tech-heavy Nasdaq lift by +0.16%.

Earlybird Eddy Sunarto reports that the yield on the benchmark US 10-year Treasury yield tumbled by 11 basis points to 3.79% as bond traders weighed the outlook for monetary policy in the coming year.

In US stock news, Tesla rose by almost 2% after Bloomberg reported that the EV giant was planning to start production of its Model Y from its Shanghai plant, with mass production potentially starting as soon as mid-2024.

The New York Times (NYT) rose almost 3% and Microsoft fell -0.15% after the former sued the latter and OpenAI for copyright infringement. The NYT claimed that its contents were used to train generative artificial intelligence and large-language model systems.

This is the first lawsuit by a major media organisation challenging the practice of large language model systems in scraping large swathes of texts from the web.

Experts say if the Times wins, the implications for OpenAI and chatbots in general could be severe.

“A court could order ChatGPT’s dataset rebuilt from scratch without Times content,” said Sunil Ramlochan, an AI expert at Prompt Engineering Institute.

“OpenAI also risks huge fines – up to $150,000 per infringing article. This would deliver a massive financial and technical blow to OpenAI.”

“Ultimately, if the Times succeeds, the precedent could severely restrict AI progress.

“Courts may limit training data to authorised sources only. This could stifle dataset diversity and accessibility that fuels cutting-edge AI. The Times case represents a key debate over AI and copyright,” said Ramlochan.

Muchos gracias to Eddy for that reporting.

In Asian market news, Japan’s Nikkei is down 0.60% this morning, with geopolitical ructions causing some pretty severe intestinal distress among investors – that’s thanks to Russia’s characteristically blunt warnings that any attempts by Japan to send Patriot air defence systems to Ukraine will have “grave consequences”.

If I’m reading the situation correctly here, the implications are very clear: Should plans to provide the missiles to Ukraine go ahead, the whole of Japan could mysteriously fall out of a 4th floor window in St Petersburg.

In Shanghai, markets are still closed because I am running way ahead of schedule. Same thing’s happening – or not happening, depending on your outlook – in Hong Kong.

I’m sure something will be happening there in a little while… but you’re gonna need to look that up for yourself, because I wanna knock off early and go to the beach.

ASX SMALL CAP WINNERS

Here are the best performing ASX small cap stocks for 28 December [intraday]:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Company | Price | % | Volume | Market Cap |

|---|---|---|---|---|---|

| ME1 | Melodiol Glb Health | 0.002 | 100% | 789,605 | $4,728,824 |

| FAU | First Au Ltd | 0.004 | 33% | 621,262 | $4,985,980 |

| RIE | Riedel Resources Ltd | 0.004 | 33% | 2,599,402 | $6,178,221 |

| EUR | European Lithium Ltd | 0.094 | 31% | 11,009,104 | $100,385,221 |

| RIM | Rimfire Pacific | 0.023 | 28% | 18,458,359 | $39,964,405 |

| ESR | Estrella Res Ltd | 0.005 | 25% | 250,245 | $7,037,487 |

| NXS | Next Science Limited | 0.3575 | 23% | 238,033 | $84,591,580 |

| ATR | Astron Corp Ltd | 0.555 | 22% | 31,180 | $71,336,820 |

| ADS | Adslot Ltd. | 0.003 | 20% | 695,016 | $8,061,239 |

| SFG | Seafarms Group Ltd | 0.006 | 20% | 135,000 | $24,182,996 |

| DGR | DGR Global Ltd | 0.031 | 19% | 644,025 | $27,136,030 |

| AWJ | Auric Mining | 0.13 | 18% | 1,815,258 | $14,394,555 |

| AUN | Aurumin | 0.026 | 18% | 1,289,362 | $7,005,748 |

| DCL | Domacom Limited | 0.02 | 18% | 424 | $7,403,530 |

| T3D | 333D Limited | 0.027 | 17% | 153,865 | $2,747,234 |

| RC1 | Redcastle Resources | 0.014 | 17% | 93,000 | $3,939,410 |

| RNO | Rhinomed Ltd | 0.028 | 17% | 226,619 | $6,857,273 |

| TX3 | Trinex Minerals Ltd | 0.007 | 17% | 1,500,000 | $8,922,148 |

| CR9 | Corellares | 0.022 | 16% | 111,267 | $8,836,727 |

| RNE | Renu Energy Ltd | 0.015 | 15% | 1,773,488 | $8,774,575 |

| BVR | Bellavistaresources | 0.115 | 15% | 5,800 | $4,961,097 |

| MOZ | Mosaic Brands Ltd | 0.115 | 15% | 8,695 | $17,850,644 |

| SVG | Savannah Goldfields | 0.05 | 15% | 116,124 | $8,748,407 |

| 1AG | Alterra Limited | 0.008 | 14% | 10,000 | $5,825,030 |

| TMK | TMK Energy Limited | 0.008 | 14% | 547,313 | $42,858,055 |

Rimfire Pacific Mining (ASX:RIM) is nominally at the top of the charts this morning, banking a solid gain off the back of a spike in volume, despite the lack of fresh news to the ASX, so I’m gonna just chalk that one up to today’s little gold rush and plough ahead with the rest of the list.

Astron Corporation (ASX:ATR) has made an appearance in the winner’s circle this morning, on news that it has inked a non-binding MoU with American mob Energy Fuels Resources to jointly develop the Donald rare earths and mineral sands project in Victoria, Australia.

As Reuben pointed out this morning, Donald could be a globally significant, long-life supplier of critical rare earth elements (REE), including neodymium, praseodymium, dysprosium, and terbium as well as zirconium and titanium minerals.

The deal would see Energy Fuels invest $180 million to earn 49% of the JV, with a share issue to ATR worth US$17.5 million as a nice little cherry on top.

And European Lithium (ASX:EUR) is sailing the high seas this morning, on news that a proposed merger transaction has been declared effective by the US Securities and Exchange Commission, clearing the way for the company to forge ahead with a business combination agreement with Sizzle Acquisition Corp.

The end result will be a newly-formed, lithium exploration and development company named “Critical Metals Corp.” which is expected to be listed on NASDAQ in the near future.

It’s been quite a long time coming – the merger was first approved by European Lithium shareholders about 11 months ago, with a final Special Meeting of Sizzle stockholders to approve the Transaction scheduled to be held on or around 23 January, 2024.

ASX SMALL CAP LOSERS

Here are the most-worst performing ASX small cap stocks for 28 December [intraday]:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Company | Price | % | Volume | Market Cap |

|---|---|---|---|---|---|

| BME | Blackmountainenergy | 0.012 | -43% | 3,287,735 | $8,047,708 |

| AVW | Avira Resources Ltd | 0.0015 | -25% | 2,113,605 | $4,267,580 |

| EXT | Excite Technology | 0.007 | -22% | 358,262 | $11,963,176 |

| AGR | Aguia Res Ltd | 0.018 | -22% | 2,571,915 | $11,626,060 |

| CHK | Cohiba Min Ltd | 0.002 | -20% | 684,839 | $6,325,575 |

| ERL | Empire Resources | 0.004 | -20% | 100,000 | $5,564,675 |

| R3D | R3D Resources Ltd | 0.042 | -19% | 88,322 | $7,923,322 |

| JPR | Jupiter Energy | 0.018 | -18% | 9,999 | $27,947,266 |

| HCD | Hydrocarbon Dynamic | 0.005 | -17% | 1,620,000 | $3,897,995 |

| M4M | Macro Metals Limited | 0.0025 | -17% | 125,000 | $7,401,233 |

| BMO | Bastion Minerals | 0.016 | -16% | 1,564,827 | $3,973,950 |

| TSO | Tesoro Gold Ltd | 0.027 | -16% | 984,040 | $36,831,691 |

| DYM | Dynamicmetalslimited | 0.14 | -15% | 58,800 | $5,775,000 |

| BKY | Berkeley Energia Ltd | 0.29 | -15% | 337,781 | $151,570,883 |

| HOR | Horseshoe Metals Ltd | 0.006 | -14% | 58,000 | $4,504,351 |

| MHC | Manhattan Corp Ltd | 0.0035 | -13% | 888,067 | $11,747,919 |

| PSL | Paterson Resources | 0.023 | -12% | 2,650,308 | $11,856,985 |

| PUR | Pursuit Minerals | 0.008 | -11% | 174,753 | $26,495,743 |

| HFY | Hubify Ltd | 0.017 | -11% | 705,229 | $9,426,590 |

| PPK | PPK Group Limited | 0.895 | -11% | 35,294 | $89,289,293 |

| LGP | Little Green Pharma | 0.13 | -10% | 21,465 | $43,513,519 |

| DTR | Dateline Resources | 0.009 | -10% | 436,576 | $13,129,455 |

| RFX | Redflow Limited | 0.14 | -10% | 1,034,243 | $36,753,596 |

| AML | Aeon Metals Ltd. | 0.01 | -9% | 246,000 | $12,060,407 |

| BRK | Brookside Energy Ltd | 0.01 | -9% | 16,724,369 | $55,160,002 |

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.