Market Highlights: Wall Street cops it on strong jobs but who cares when we’ve got all these lovely ASX lithium leads

ASX lithium leads worth pocketing. Via Getty

- ASX to open lower, as markets fall in New York

- US 10-year yields continue to threaten 5%, so everyone’s still upset

- Noxopharm comes good on FDA

- AND… So. Much. Lithium. News.

Aussie shares are headed for another early October retreat after US stocks slumped overnight after a lot more new US jobs turned up in August – which is bad – and really iced the higher-for-longer cake they’ve been baking over at the US Federal Reserve.

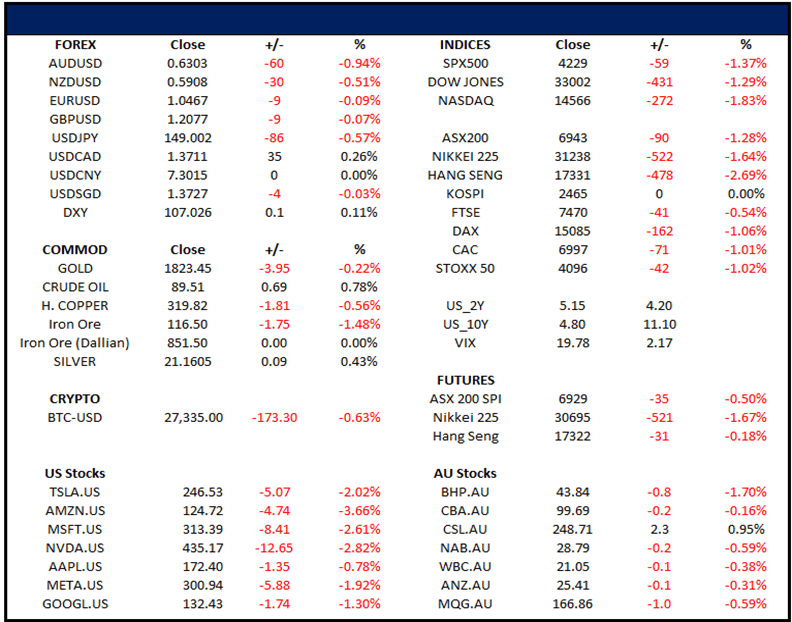

At 9.45am in Sydney, the SPI 200 Futures index stood at 6,929 points, down -35.00 or -0.50%.

US job vacancies rose from 8.92 million in July to 9.61 million in August (expected: 8.82 million), according to the JOLTS survey (Job Openings and Labor Turnover). Another rate hike from The Fed appears a sure thing on Wall Street now as does the reality of rates staying up in the ether for some time ahead.

After the toppy ISM print earlier this week and last night’s JOLTS read, the focus now turns with mounting trepidation to Friday night’s Non-Farm Payrolls report.

If the payrolls delivers the good (which is bad) news of a still heated US jobs market then who knows just how depressed the punters might get and what that might do to the rabble-rousing risk sentiment which drives Wall Street’s profit pack.

Naturally, ultra-sensitive US bond yields reacted with equal, opposite and upward force – the 10-year Treasury yield hit 4.8%, still the highest level in 16 years, the 30-year Treasury yield hit 4.925%, also the highest since 2007.

This in turn placed equal, opposite and downward force on US sharemarkets during the overnight session.

During the overnight session the Dow Jones index went back into negative territory for 2023, giving up 430 points or -1.3%.

The S&P 500 index struck its lowest tune since June, down -1.4%, and the selling was even stronger on the tech heavy Nasdaq Composite which lost almost 250 points or -1.95%.

In US company news, with the average rate on a 30-year fixed mortgage approaching 8%, the SPDR S&P Homebuilders ETF (XHB) fell circa 2% with Home Depot and Lowe’s leading the retreat. Financial names like Goldman Sachs and American Express led losses on the Blue Chip industrial average.

On the Nasdaq, this weeks mega-tech gainers Nvidia (NVDA) and Microsoft (MSFT) fell the hardest as support for growth stocks disintegrated on the themes above. Amazon (AMZN) shares backtracked more than 3.5%.

Across the markets

Gold price was down -0.22% to US$1,823.45 an ounce.

Oil prices tumbled +0.78%, with Brent crude now trading at US$89.51 a barrel.

Iron ore dropped 1.5% to US$116.50 a tonne.

Base metals prices were mixed with nickel futures rising, and copper futures falling.

The Aussie dollar tumbled again down almost 1% to US63.03c.

Bitcoin meanwhile lifted more than -0.60% in the last 24 hours to trade at US$27,335.

ASX small caps to watch today

Caught by the ASX speeding police after Tuesday’s torrent of buying, the Aussie biotech Noxopharm has shared the news that the US Food and Drug Administration has granted Orphan Drug Designation (ODD) status to Noxopharm’s CRO-67 preclinical drug candidate, for the treatment of pancreatic cancer.

The FDA grants ODDs for drugs designed to prevent, diagnose or treat rare diseases or conditions, and the designation comes with various benefits that include:

• Tax credits for qualified clinical trials

• Exemption from user fees (e.g. FDA application fees)

• Potential seven years of market exclusivity after approval

So far this year only x2 other Aussie companies have received an ODD from the FDA, from a total of 260 issued.

“CRO-67’s designation as an orphan drug supports the company’s development plan for the asset, and its future commercial value, as Noxopharm continues to build the data package that will be required for regulatory progression,” NOX said in a release to the bourse.

Noxopharm CEO Dr Gisela Mautner:

“For CRO-67 to achieve an ODD is a significant milestone in the development of the drug. In addition to financial benefits, the ODD will also strengthen our commercial position in a market that has seen very few new treatments over recent decades.

“Our pancreatic cancer program is a high priority, and we are committed to progressing its development as quickly as possible. Further studies are in the works, as are investigations into dosing and formulation.”

Aussie battery materials recycler, Neometals is chuffed with the results of trials on a new lithium recovery option which it plans to offer under supply and technology licensing agreements.

“Lithium recoveries exceeding 93% were achieved precipitating lithium fluoride (“LiF”) together with purity of 95%. This process improvement option can replace Primobius’ current lithium solvent-extraction circuit which produces lithium sulphate (“LiSO4”) and is expected to reduce both operating and capital costs,” the company told the ASX.

LiF is used to produce lithium hexafluorophosphate (“LiPF6”), an inorganic compound which is a key ingredient ‘in state-of-the-art electrolytes used in lithium-ion battery (LiB) manufacturing’.

LiF trades historically at a 60% premium over lithium carbonate (Li2CO3), and NMT says further improvements to product purity are expected to be achieved over the coming months.

Neometals managing director Chris Reed:

“Firstly, I would like to congratulate the Primobius, SMS and Neometals technical teams on another outstanding innovation. Our original plant design now includes EV module discharging and dismantling, and has the flexibility to produce intermediate, cathode or electrolyte lithium products. In addition to meeting regulatory and customer requirements, greater efficiency translates into stronger economics for the owners of our recycling plants.”

Lithium Plus Minerals (ASX:LPM)

Staying with Li2O, Lithium Plus has the latest ‘exceptional’ assay results (from diamond hole BYLDD019) at the Lei Prospect, Bynoe Lithium Project, saying there’s ‘thick high-grade mineralised intervals’, with standouts like:

− 13m @ 1.36% Li2O from 611m (~8m true width); and

− 81m @ 1.59% Li2O from 653m (~48m true width) including:

− 41m @ 1.94% Li2O from 683m (~25m true width).

Executive chairman, Dr Bin Guo, says these numbers make BYLDD019 home to ‘some of the highest grade and widest mineralised intervals ever recorded from the Bynoe pegmatite field’:

“Today’s announcement provides confirmation of the exceptional lithium grade and thickness intersected in hole BYLDD019. The extremely high 1.94% Li20 grade reported over a wide 41m interval opens the door for consideration of DSO potential development pathways as we continue to explore and advance the project. In the meantime, drilling continues, with four diamond holes and seven infill holes underway at Lei. We continue to focus on delivery and remain on track for declaration of a maiden lithium resource during Q4 2023.”

Four more diamond holes are underway at Lei with assay results expected later this month.

Up over 40% since listing a few weeks back, the upstart Queensland gold, antimony and critical metals explorer is reporting its Maiden Inferred Mineral Resource Estimate (MRE) at Yellow Jack Project – clocking 1.84Mt at 0.86g/t gold (Au) for 51,100oz contained gold and is a reported above a 0.5g/t Au cutoff grade.

Some bullies:

• Oxide gold resource, open at depth and along strike with initial drilling limited to only 70m vertical depth

• Further diamond core drilling and RC drilling is planned in the coming months and is expected to expand the Mineral Resource

• Metallurgical test work is planned on the drill cores to determine if ore-sorting and other potential metallurgical processes can improve the gold head grade

• A conceptual mine plan, LiDAR survey, and other works are planned for the coming months as GDM advances towards a Pre-Feasibility Study for mining at Yellow Jack.

Justin Haines is the CEO:

“We are excited to announce GDM’s first Mineral Resource Estimate at Yellow Jack of 1.84Mt @ 0.86g/t Au for 51,100oz contained gold, within weeks of being listed on ASX.

“This MRE is the first step towards eventual gold production at Yellow Jack, which could take advantage of nearby existing infrastructure, including multiple processing plants, facilitating a low capex mining operation at Yellow Jack. We are in the process of completing a conceptual mine plan for Yellow Jack in the coming weeks.”

Redstone has revealed it’s partnering with Galan Lithium (ASX:GLN) ‘to further solidify its exposure to the highly sought after, Tier‐1 mining jurisdiction, that is the James Bay Lithium district in Québec, Canada.’

Yep, RDS is in like Flynn at James Bay and – wait, there’s more – it’s secured an option in northwest Ontario, another premier Canuck lithium area.

Take it away Redstone chair Mr Richard Homsany:

“Redstone has recently commenced operating in Canada and will be the manager of the Joint Venture.

“Galan is a highly experienced lithium exploration business that will bring to the table considerable technical depth and expertise as we aim to accelerate our exploration efforts in the region. Galan is exploring Greenbushes South Lithium Project, that hosts the emplacement of the lithium‐bearing pegmatite at Greenbushes, and which is approximately 3km to the south of the Greenbushes mine.

“These new Canadian assets are a welcome addition to our existing copper and lithium portfolio, and further strengthen our strategy of becoming a leading critical metals explorer and developer. Our technical team is also very encouraged by the quality of the areas the JV projects and nearby high calibre discoveries, with the James Bay Lithium Projects being adjacent to the Patriot Battery Metals high‐grade CV8 pegmatite discovery, and the PAK Lithium Projects situated in Ontario’s Electric Avenue.

“Redstone has very quickly secured a highly valuable position in two of the world’s premier lithium exploration hotspots and we are now focused on accelerating our exploration strategy and unlocking value for shareholders.”

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.