Lunch Wrap: Resources the only bright spot as ASX stumbles

The threat of a 35% tariff on Canadian goods has iced out much of the ASX at lunch on Friday. Pic: Getty Images

- ASX pulls back after a strong open

- 35% US tariff on Canadian goods finally shakes markets

- Resources the only bright spot, up 2.04pc

Trump threatens 35% tariff on Canada

Despite reversing a digital revenue tax on US companies, Canada’s trade negotiations with the White House are not going the way Ottawa – or the rest of us – might’ve liked.

Last night US President Trump threatened to impose a 35% blanket tariff on Canada starting next month, in a letter released on his Truth Social platform.

This latest letter follows a slew of others sent to US trading partners threatening tariffs of up to 40% on imported goods.

While those earlier salvos did little to shake markets, this latest attack on America’s northern neighbour has had an immediate impact.

Despite surging almost 0.6% this morning, the ASX 200 has made a bit of a hash of things as of lunchtime AEST, down 0.04%. Could be worse, of course… and in fact it was just a short time ago.

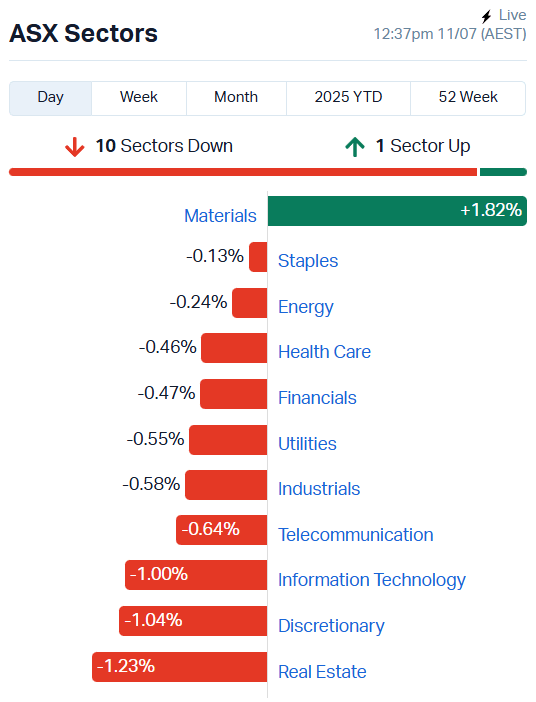

Every sector but resources is in a strategic retreat, with real estate leading the backpedal.

There’s not much to report in the indices, either – the ASX 200 Ressie is up 1.77% but other than that it’s pretty much a sea of red.

Taking a look at our big cap movers, rare earths and lithium are on the up as Canadian miners grapple with being left out in the cold.

Iluka Resources (ASX:ILU) has added 17.7%, Lynas Rare Earths (ASX:LYC) 17.6%, Mineral Resources (ASX:MIN) 6.8% and Brazilian Rare Earths (ASX:BRE) 2.98%.

Other minerals are benefiting from the spectre of Canadian tariffs too – aluminium manufacturer Capral (ASX:CAA) is up 4%, and iron ore giant Fortescue (ASX:FMG) has added 3.57%.

ASX SMALL CAP WINNERS

| Security | Description | Last | % | Volume | MktCap |

|---|---|---|---|---|---|

| FAL | Falconmetalsltd | 0.335 | 76% | 4805415 | $33,630,000 |

| NPM | Newpeak Metals | 0.032 | 52% | 11026862 | $6,763,506 |

| SRN | Surefire Rescs NL | 0.003 | 50% | 15512980 | $4,972,891 |

| RMI | Resource Mining Corp | 0.02 | 43% | 1346229 | $10,282,347 |

| LKY | Locksleyresources | 0.0925 | 36% | 26873582 | $12,466,666 |

| AOA | Ausmon Resorces | 0.002 | 33% | 564000 | $1,966,820 |

| RNX | Renegade Exploration | 0.004 | 33% | 380000 | $3,865,090 |

| ATH | Alterity Therap Ltd | 0.012 | 33% | 30528236 | $82,146,336 |

| CMB | Cambium Bio Limited | 0.27 | 26% | 95628 | $3,930,773 |

| FHS | Freehill Mining Ltd. | 0.005 | 25% | 1750040 | $13,655,414 |

| TON | Triton Min Ltd | 0.005 | 25% | 249329 | $6,273,555 |

| JNS | Januselectricholding | 0.18 | 24% | 601463 | $13,037,568 |

| HIQ | Hitiq Limited | 0.016 | 23% | 685694 | $5,976,073 |

| JGH | Jade Gas Holdings | 0.032 | 23% | 593692 | $43,857,688 |

| BCA | Black Canyon Limited | 0.22 | 22% | 962542 | $23,337,125 |

| BMM | Bayanminingandmin | 0.061 | 22% | 6039247 | $5,147,770 |

| 1AI | Algorae Pharma | 0.006 | 20% | 83299 | $8,436,974 |

| AAU | Antilles Gold Ltd | 0.006 | 20% | 31905207 | $11,895,340 |

| ADR | Adherium Ltd | 0.006 | 20% | 149 | $6,934,791 |

| BCM | Brazilian Critical | 0.012 | 20% | 3038561 | $13,105,332 |

| EM2 | Eagle Mountain | 0.006 | 20% | 3626120 | $5,675,186 |

| PGY | Pilot Energy Ltd | 0.012 | 20% | 5527425 | $21,586,600 |

| WR1 | Winsome Resources | 0.225 | 18% | 1651128 | $46,339,756 |

| LOC | Locatetechnologies | 0.13 | 18% | 181370 | $25,756,968 |

| CXU | Cauldron Energy Ltd | 0.01 | 18% | 437993 | $15,224,869 |

In the news…

A startlingly high-grade gold hit of 1.2m at 543 g/t has brought Falcon Metals (ASX:FAL) sharply into the spotlight, as the company drills the first wedge hole at the Blue Moon prospect.

FAL was topping ASX charts last week on claims they’d found Bendigo-style gold mineralisation after hitting 0.3m at 48.7 g/t gold at Blue Moon.

These latest results certainly support that assertion – the Bendigo Goldfield has produced 22 million ounces of gold since it was first discovered in 1851, a bounty Falcon is keen to tap into.

Surefire Resources (ASX:SRN) has wrapped up a 27-hole, 3651m drilling program at the Yidby gold project, targeting new zones of wide sulphide mineralisation.

Neighbour Capricorn Metals (ASX:CMM), owner of the nearby 3.9Moz Mt Gibson gold deposit, has been snapping up more land just 30km to the south in the same greenstone belt.

With 564 samples off to the laboratory for assay, SRN is expecting the first results within days with plenty more to come.

Eye and tissue repair biotech Cambium Bio (ASX:CMB) has begun dosing patients in a Phase 3 trial for its Elate Ocula dry eye disease therapy.

Management says it’s an important milestone in the journey to commercialisation, as CMB enters the final stages of developing the therapy in a clinical setting.

Concussion management technology company HitIQ (ASX:HIQ) has expanded into the UK market, launching its PROTEQT system for rugby players and similar ‘collision sports’ like hockey.

HIQ is running a dual business model with both upfront product sales and an ongoing subscription; players receive a new instrumented mouthguard each year that includes the latest innovations.

ASX SMALL CAP LAGGARDS

| Code | Name | Price | % Change | Volume | Market Cap |

|---|---|---|---|---|---|

| ICU | Investor Centre Ltd | 0.001 | -67% | 752314 | $913,534 |

| HLX | Helix Resources | 0.001 | -50% | 4012451 | $6,728,387 |

| OB1 | Orbminco Limited | 0.001 | -33% | 1275000 | $5,103,852 |

| PAB | Patrys Limited | 0.001 | -33% | 300000 | $3,548,715 |

| ALR | Altairminerals | 0.003 | -25% | 603750 | $17,186,977 |

| CRR | Critical Resources | 0.003 | -25% | 501305 | $11,080,342 |

| NTM | Nt Minerals Limited | 0.0015 | -25% | 100000 | $2,421,806 |

| PRS | Prospech Limited | 0.018 | -22% | 2556325 | $8,712,995 |

| BMG | BMG Resources Ltd | 0.008 | -20% | 13374986 | $8,443,972 |

| VFX | Visionflex Group Ltd | 0.002 | -20% | 13000 | $8,419,651 |

| ADD | Adavale Resource Ltd | 0.0205 | -18% | 4568119 | $2,859,088 |

| TX3DA | Trinex Minerals Ltd | 0.1 | -17% | 54415 | $2,090,695 |

| CHM | Chimeric Therapeutic | 0.005 | -17% | 303251 | $12,091,165 |

| IPB | IPB Petroleum Ltd | 0.005 | -17% | 1088198 | $4,238,418 |

| SIS | Simble Solutions | 0.005 | -17% | 128334 | $6,493,982 |

| CCX | City Chic Collective | 0.08 | -15% | 1615670 | $36,204,833 |

| AKA | Aureka Limited | 0.09 | -14% | 516632 | $13,235,280 |

| EMT | Emetals Limited | 0.003 | -14% | 45000 | $2,975,000 |

| RDS | Redstone Resources | 0.003 | -14% | 250000 | $3,619,936 |

| VKA | Viking Mines Ltd | 0.006 | -14% | 108085 | $9,407,641 |

| AGY | Argosy Minerals Ltd | 0.025 | -14% | 19688263 | $42,221,707 |

| AX8 | Accelerate Resources | 0.007 | -13% | 159 | $6,537,510 |

| GTR | Gti Energy Ltd | 0.0035 | -13% | 410855 | $14,835,762 |

| AQC | Auspaccoal Ltd | 0.015 | -12% | 3578886 | $11,907,949 |

| OSL | Oncosil Medical | 1.115 | -11% | 64648 | $17,775,971 |

IN CASE YOU MISSED IT

Neurizon Therapeutics (ASX:NUZ) has made progress toward lifting a US Food and Drug Administration (FDA) clinical hold on its lead drug NUZ-001.

Codeifai’s (ASX:CDE) acquisition target – which will be called the QuantumAI secure platform – has locked in an exclusive deal with a NATO-approved defence firm.

LAST ORDERS

DY6 Metals (ASX:DY6) is systematically exploring its 4,974km2 landholding at the Central rutile project in Cameroon with a soil sampling campaign.

Plotted on 5km by 1km line spacing, the program will cover the entire regional geological trend, zeroing-in on areas of higher rutile grades to provide drilling targets for an upcoming program.

At Stockhead, we tell it like it is. While DY6 Metals is a Stockhead advertiser, it did not sponsor this article. This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.