Lunch Wrap: Goldies up (as usual); Super Retail CEO sacked over alleged office fling

What happens in the office doesn't always stay in the office. Picture via Getty Images

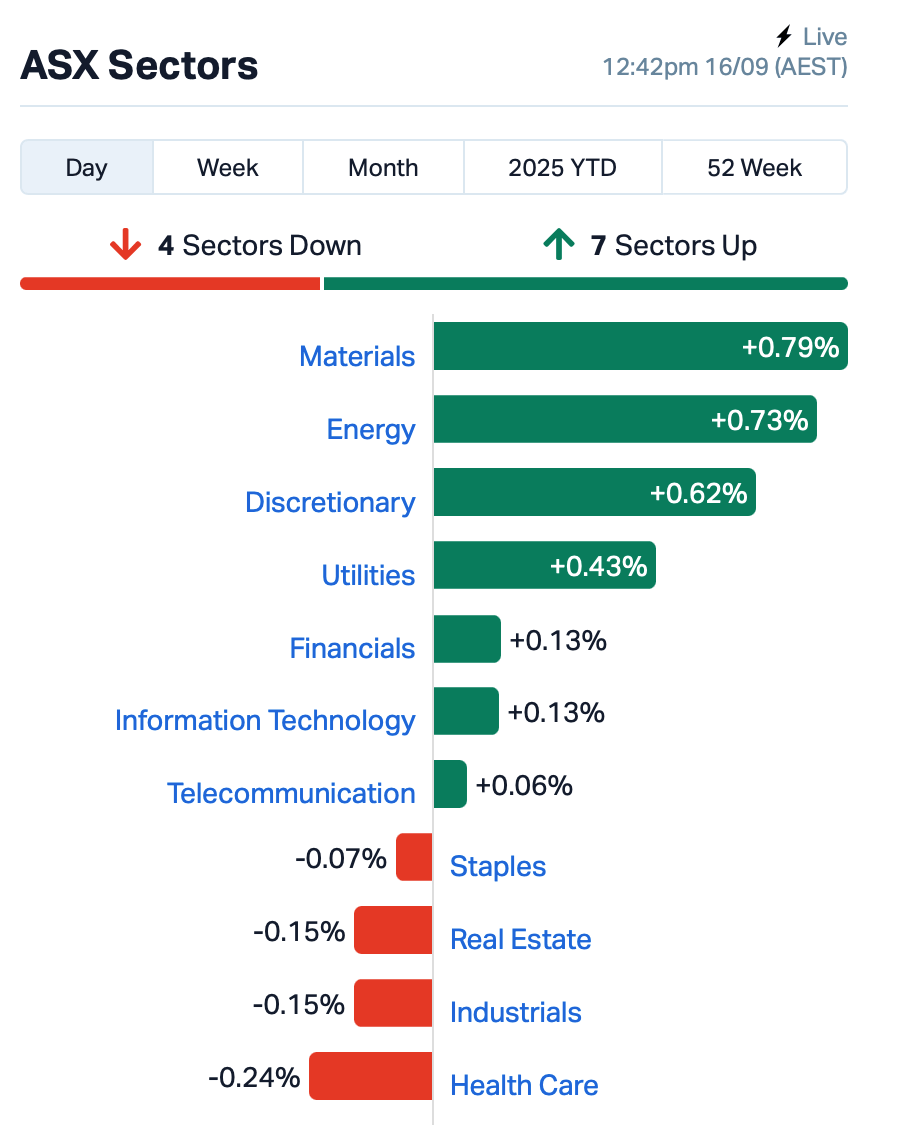

- ASX edges higher on miners and gold

- Super Retail dumps CEO after fallout of alleged office affair

- Gold stocks rise again

The ASX was up around 0.2% by Tuesday lunchtime in the east, ticking along nicely on the back of record highs out of Wall Street.

Overnight, the S&P 500 cracked through 6600 for the first time, while the Nasdaq kept piling on new records.

Tesla helped, up more than 3% after Elon Musk bought US$1.5 billion worth of shares out of his own cash.

Locally, mining stocks were leading the charge this morning.

Iron ore futures jumped 1.5% in Singapore, handing the big three – BHP (ASX:BHP), Rio Tinto (ASX:RIO) and Fortescue (ASX:FMG) – the green light to push higher.

Gold was also shining, with bullion rallying past US$3680 an ounce as punters keep betting Jerome Powell will cut rates. “Warm the set and cool the tinnies”, because his decision will be announced on Thursday AM, AEST.

Energy names joined the winners’ circle, too, with oil edging higher as Ukraine kept targeting Russia’s refineries with drones.

In large-cap news, CSL (ASX:CSL) slipped 1% after coughing up US$117 million upfront for Dutch biotech VarmX.

It’s the company’s first big swing since axing 3000 staff, which makes CSL look like it’s cutting with one hand and writing big cheques with the other.

Super Retail Group (ASX:SUL) – the owner of Rebel, BCF and Supercheap Auto – tanked 3% after CEO Anthony Heraghty was shown the door for failing to properly disclose an alleged relationship with former HR boss Jane Kelly.

The board didn’t just cut him loose, they stripped his incentives, too – a very expensive lesson in office politics.

Chemist Warehouse parent Sigma Healthcare (ASX:SIG) edged up 1% after roping in Richard Murray as CFO.

If two decades running JB Hi-Fi and Total Tools doesn’t prep you for the nation’s biggest chemist, nothing will.

And, coal miner New Hope Corp (ASX:NHC) jumped 7% after reporting a full-year profit of $439m, which sounds chunky until you realise it’s down 7% from last year.

Still, it threw investors a fully franked 15c dividend, so no complaints there.

ASX LEADERS

Today’s best performing stocks (including small caps) intraday:

| Security | Description | Last | % | Volume | MktCap |

|---|---|---|---|---|---|

| XST | Xstate Resources | 0.020 | 122% | 7,583,957 | $2,262,428 |

| OB1 | Orbminco Limited | 0.002 | 100% | 38,184,919 | $3,402,568 |

| WEL | Winchester Energy | 0.004 | 100% | 26,173,149 | $2,726,038 |

| CZN | Corazon Ltd | 0.003 | 50% | 5,347,581 | $2,469,145 |

| PRX | Prodigy Gold NL | 0.003 | 50% | 500,000 | $13,483,725 |

| T3D | 333D Limited | 0.220 | 38% | 2,216,887 | $30,216,610 |

| RAN | Range International | 0.004 | 33% | 1,587,890 | $2,817,871 |

| WBE | Whitebark Energy | 0.004 | 33% | 1,647,252 | $2,110,538 |

| SRL | Sunrise | 4.440 | 33% | 1,404,682 | $394,757,809 |

| AVH | Avita Medical | 1.875 | 27% | 2,672,617 | $108,634,229 |

| CCE | Carnegie Cln Energy | 0.075 | 27% | 1,823,047 | $23,797,185 |

| FGH | Foresta Group | 0.015 | 25% | 5,446,194 | $31,834,877 |

| SRZ | Stellar Resources | 0.025 | 25% | 18,030,999 | $44,799,761 |

| TMK | TMK Energy Limited | 0.003 | 25% | 7,612,651 | $20,444,766 |

| LMS | Litchfield Minerals | 0.135 | 23% | 336,774 | $3,640,566 |

| THR | Thor Energy PLC | 0.011 | 22% | 10,721,013 | $6,593,725 |

| RKB | Rokeby Resources Ltd | 0.006 | 20% | 799,721 | $9,129,409 |

| VEN | Vintage Energy | 0.006 | 20% | 75,000 | $10,434,568 |

| BSA | BSA Limited | 0.155 | 19% | 2,796,401 | $9,789,034 |

| RAC | Race Oncology Ltd | 2.140 | 19% | 929,468 | $312,844,707 |

| LKY | Locksleyresources | 0.580 | 18% | 13,963,380 | $124,767,744 |

| CXU | Cauldron Energy Ltd | 0.013 | 18% | 4,731,340 | $19,680,771 |

| EMU | EMU NL | 0.020 | 18% | 91,521 | $3,591,224 |

| WMG | Western Mines | 0.235 | 18% | 188,500 | $19,437,669 |

| AFA | ASF Group Limited | 0.007 | 17% | 30,000 | $4,754,385 |

Xstate Resources (ASX:XST) has finished civil works at its Diona-1 well site in Queensland’s Surat-Bowen Basin, where it holds a 51% stake and operatorship. Diona-1 will test three proven hydrocarbon reservoirs to a depth of 2,600m, with drilling expected to take less than 15 days. If drilling proves successful, the well could be tied into the nearby Waggamba pipeline almost immediately, giving Xstate a rapid path to market, said XST.

Orbminco (ASX:OB1) has wrapped up its first drilling program at the Majestic North gold project, confirming shallow, robust gold mineralisation with hits up to 7.62g/t. The 53-hole program validated the existing JORC resource, and showed a continuous mineralised zone up to 500m wide and 1.5km long, which remains open north and south. Stronger grades in the northern section point to a potential high-grade zone and possible proximity to the primary bedrock source, which Orbminco plans to target in the next round of drilling.

Winchester Energy (ASX:WEL) has signed a binding farm-out deal with a private US investor group for a 30% stake in the Varn waterflood project in Texas. Winchester keeps operatorship and a 70% interest, while banking US$112k upfront and getting the partner to fund 40% of development costs. The Varn field holds 2P reserves of just over 1 million barrels of oil equivalent and is expected to add meaningfully to production over coming years.

Sunrise Energy Metals (ASX:SRL) has received a Letter of Interest from the US Export-Import Bank for up to US$67m in debt funding for the Syerston Scandium Project in NSW, around half the project’s estimated development cost. The Syerston feasibility study is now due mid-to-late October to fold in the upgraded resource and optimise the mine plan. Sunrise says EXIM’s support should help advance financing talks and lock in customer offtakes.

ASX LAGGARDS

Today’s worst performing stocks (including small caps) intraday:

| Code | Name | Price | % Change | Volume | Market Cap |

|---|---|---|---|---|---|

| ZMM | Zimi Ltd | 0.010 | -41% | 1,530,061 | $8,330,745 |

| BUY | Bounty Oil & Gas NL | 0.003 | -25% | 3,091,074 | $6,245,887 |

| DTM | Dart Mining NL | 0.002 | -20% | 2,000,000 | $3,436,315 |

| MEM | Memphasys Ltd | 0.004 | -20% | 1,648,841 | $9,917,991 |

| TMX | Terrain Minerals | 0.002 | -20% | 450,000 | $6,612,869 |

| FAL | Falconmetalsltd | 0.775 | -19% | 5,004,691 | $204,139,226 |

| TMS | Tennant Minerals Ltd | 0.007 | -19% | 1,727,272 | $8,527,123 |

| CYQ | Cycliq Group Ltd | 0.005 | -17% | 319,388 | $2,763,100 |

| ENT | Enterprise Metals | 0.005 | -17% | 556,858 | $8,647,904 |

| JAY | Jayride Group | 0.005 | -17% | 8,495,077 | $8,567,335 |

| FUN | Fortuna Metals Ltd | 0.105 | -16% | 539,827 | $23,418,011 |

| MNC | Merino and Co | 0.135 | -16% | 227,364 | $8,492,251 |

| ADN | Andromeda Metals Ltd | 0.017 | -15% | 31,938,153 | $76,333,528 |

| AGD | Austral Gold | 0.040 | -15% | 108,022 | $28,778,634 |

| AX8 | Accelerate Resources | 0.006 | -14% | 315,504 | $5,720,321 |

| TFL | Tasfoods Ltd | 0.006 | -14% | 5 | $3,059,669 |

| 1AD | Adalta Limited | 0.004 | -13% | 6,885,834 | $5,285,266 |

| AM5 | Antares Metals | 0.007 | -13% | 354,581 | $4,118,823 |

| FHS | Freehill Mining Ltd. | 0.004 | -13% | 269,999 | $13,655,414 |

| HFY | Hubify Ltd | 0.007 | -13% | 135,000 | $4,089,090 |

| TON | Triton Min Ltd | 0.007 | -13% | 140,442 | $12,547,110 |

| LAT | Latitude 66 Limited | 0.055 | -11% | 1,186 | $8,890,844 |

| TIA | Tian An Aust Limited | 0.200 | -11% | 3,150 | $19,486,987 |

| FAU | First Au Ltd | 0.008 | -11% | 1,871,364 | $23,548,362 |

| FRX | Flexiroam Limited | 0.008 | -11% | 66,666 | $13,656,587 |

IN CASE YOU MISSED IT

West Australian gold explorer TG Metals (ASX:TGM) has mobilised a drill rig at its Van Uden gold project with plans for resource extension works at the Tasman Pit. A second rig will join the fray in coming days.

Second time’s the charm for Power Minerals (ASX:PNN) after re-assaying of drill samples at its Santa Anna project in Brazil revealed a record 6.2% TREO. Follow-up drilling and leach testing on recovery rates is now underway.

Drilling at Victory Metals’ (ASX:VTM) North Stanmore rare earths project north of Cue in Western Australia has intercepted some of the highest-grades ever for dysprosium in a clay-hosted system, revealing 218ppm dysprosium oxide.

LAST ORDERS

Gold and copper developer Medallion Metals (ASX:MM8) is surging ahead with its plans to achieve near-term production after placing an order for a secondary ball mill.

The company plans to mine high-grade sulphide mineralisation from its Ravensthorpe gold project and feed it through the Cosmic Boy concentrator. The ball mill marks a key long lead item, integral to MM8’s plans to modify Cosmic Boy to handle gold and copper – instead of nickel.

With the input of GR Engineering Services, MM8 hopes to achieve 650,000tpa throughput with the ball mill. The company announced last month a resource upgrade at Ravensthorpe to notch 950,000oz at 5.2g/t gold equivalent.

In the meantime, MM8 is progressing a feasibility study for completion this October and targeting a final investment decision by December.

Bayan Mining and Minerals (ASX:BMM) has kicked off detailed ground geophysical surveys at its Desert Star projects in California, US.

Desert Star sits in San Bernadino Country, encompassing 72 federal lode claims across roughly 6sq km of ground northeast of MP Materials’ Mountain Pass rare earths mine and southeast of Dateline Resources’ (ASX:DTR) Colosseum gold mine.

BMM’s works at Desert Star will see magnetic, radiometric and gravity surveys undertaken. Works are expected to take two weeks’ time.

The company will refine rare earths anomalies – including four high-priority targets – to guide drill targeting and follow up exploration works.

Ground datasets will be integrated with recent surface geochemical sampling and the desktop geophysical, delivering a technical foundation for the drilling. BMM has an active engagement with the Bureau of Land Management to progress drill permitting and other regulatory approvals at Desert Star.

The Mountain Pass mine is one of the largest and highest-grade rare earths operations globally, while the Colosseum gold mine hosts a 27.1Mt at 1.26g/t gold for 1.1Moz resource. Both are located in the same regional corridor.

Goldfields explorer Verity Resources (ASX:VRL) is commencing a 6,400m, Phase 2 diamond and RC drilling program at its Monument Gold project in Laverton, Western Australia.

Drilling will focus on upgrading and expanding the existing 154,000oz gold resource (3.3Mt at 1.4g/t) across the Korong and Waihi deposits, with down plunge and high-grade extensions to be investigated. Phase 2 follows on from a 3,600m RC drilling program completed at Korong in August, with assays expected in coming weeks to inform an upgrade to indicated confidence level and to help progress towards a mining licence.

VRL management says mineralisation from the resource at Monument remains open in all directions. The project also sits directly adjacent to Genesis Minerals’ (ASX:GMD) 3.3Moz Laverton gold project and 3.1Mtpa operating mill.

Aura Energy (ASX:AEE) has appointed Michelle Ash as non-executive director, who carries experience in global mining, innovation, technological strategy, and transformational leadership across 30 years with BHP (ASX:BHP), Barrick Gold (now Barrick Mining), OZ Minerals, Acacia Mining and more.

Ash most recently served as vice president of growth at BHP, where she developed a multi-billion-dollar copper growth strategy. At Barrick Gold, she served as chief innovation officer.

AEE is currently working on a uranium project in Mauritania and a polymetallic project in Sweden.

At Stockhead, we tell it like it is. While Medallion Metals, Bayan Mining and Minerals, Dateline Resources, Verity Resources and Aura Energy are Stockhead advertisers, they did not sponsor this article.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.