Lunch Wrap: ASX wobbles after CSL’s brutal plunge, Woodside dips

CSL plunges after biggest restrucuring in decades. Picture via Getty Images

- CSL slumps as healthcare sector practically freefalls

- Woodside profits slide, while copper cushions BHP

- Seek and Judo shine as earnings season heats up

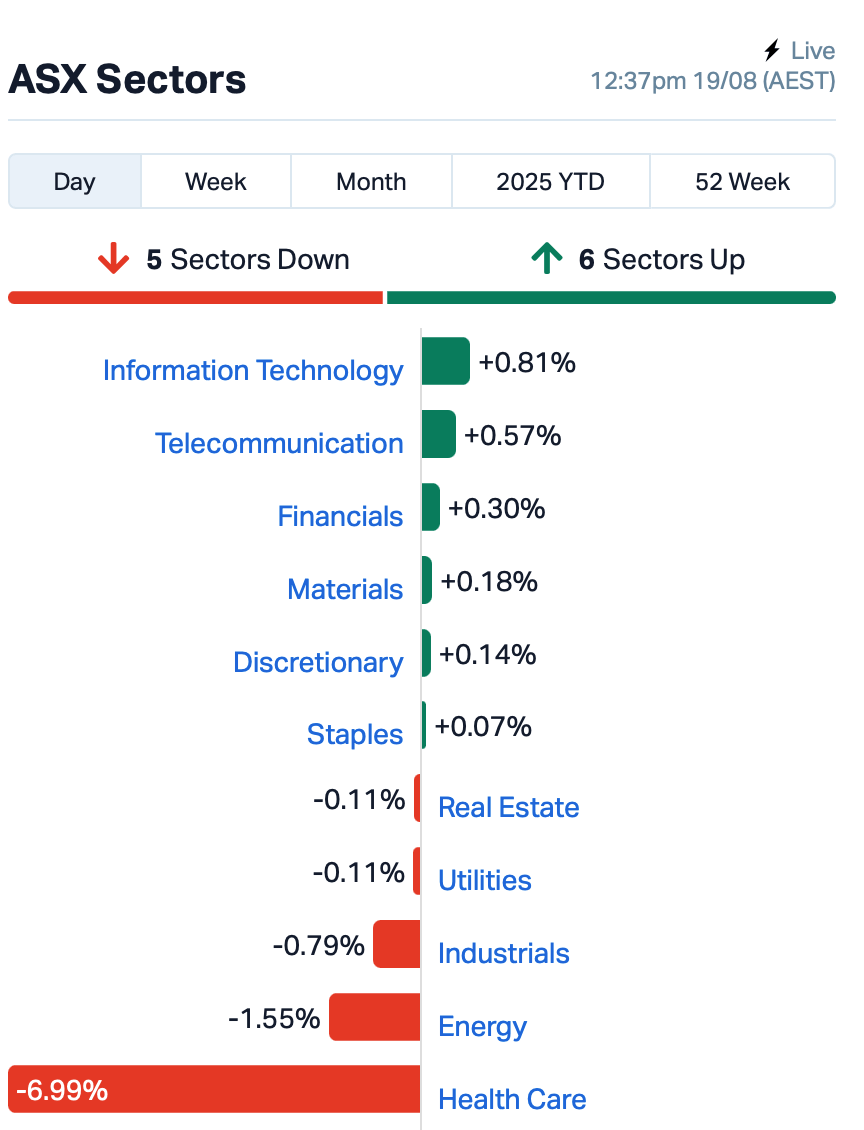

At Tuesday lunchtime in the east, the ASX was down 0.7%, pulling back from Monday’s high-water mark.

The main laggard was the healthcare sector, which tumbled hard by 7% (that’s almost a freefall by ASX standards).

And no real surprises who led the tumble: CSL (ASX:CSL), a giant that counts for a hefty chunk of ASX healthcare.

So when CSL plunged more than 13% today, the whole sector went off the rails.

The company dropped the bomb that it was sacking 3000 staff (15% of its workforce) in what it calls its “biggest shake-up in decades”.

It also has plans to spin off its vaccines arm Seqirus into its own ASX listing, and squashing divisions together to “simplify” the business.

CEO Paul McKenzie reckons it’ll save them about $550m a year, but punters clearly weren’t impressed.

Funny thing though, buried in the wreckage, CSL still managed to post a 14% lift in full-year profit to $US3.3 billion, right at the top of its guidance.

Read more on this from Tim Boreham, here: Health Check: CSL turns to a vaccines demerger in an ‘urgent’ get-fit drive

Santos (ASX:STO), meanwhile, was down more than 3%.

Remember the Abu Dhabi suitors that were meant to swoop in with a big takeover? Yeah, looks like the paperwork’s moving slower than a Centrelink queue.

Due diligence is “largely complete”, but the XRG Consortium says they still need four weeks for internal approvals.

The exclusivity deadline is this week, and Santos has already admitted it’s unlikely to hit.

Large cap earnings wrap

The earnings season is in full swing. Here are some of the other highlights:

Over in mining, the Big Aussie is looking a bit less jolly these days.

BHP reported a 26% slump in full year earnings and $US10.15 billion in underlying profit, hammered by softer iron ore and coal prices.

As for dividends… well, better than expected, but they were cut down to their lowest in eight years. Shareholders are getting US60 cents a pop, skinny compared to the glory days.

BHP is slashing spending on new mines, and getting more comfortable with debt.

The one bright spot was copper. Higher production and prices there gave it a bit of a cushion.

Read more about it from Josh Chiat, here: Big Australian’s profit drops to lowest in five years, but dividend beats forecasts and copper grows

Deterra’s year to June was a beauty on paper – revenue up 10% to $263m and EBITDA margins fat as ever at 95%.

The cheque book for shareholders stayed heavy too, with a fully franked final dividend of 13 cents, taking the year’s payout to 22 cents.

The engine room, as always, is BHP’s Mining Area C, which pumped out record tonnes thanks to South Flank hitting stride.

That sheer volume not only offset softer iron ore prices but also delivered Deterra a juicy $20m capacity payment.

Woodside Energy Group (ASX:WDS)

Woodside copped a 24% profit slide to US$1.25b as softer prices and fat costs chewed into the half, with net profit down 32%.

Divvy’s still decent at 53 cents a share, but shy of last year.

WDS has tightened full-year output, cost and capex guides, and kept Scarborough LNG steaming towards 2026.

Its North West Shelf, meanwhile, is still bogged down in Canberra red tape.

Seek came out swinging. Shares jumped more than 5% after the jobs board proved it can make more money even when job ads are falling.

How? Jacking up prices.

Revenue rose 1% to $1.1 billion, net profit came in at $238m, and it smashed analyst forecasts.

Judo Capital Holdings (ASX:JDO)

Judo Bank’s profit shot up 24% to $86.4m for the full year, with the loan book cracking $12.5b and deposits just shy of $10b.

Margins sit at 2.93%, and with a $14b loan book in sight by 2026, Judo reckons the days of building and scaling are done.

Now it’s all about fine-tuning the engine and putting the foot down.

ASX LEADERS

Today’s best performing stocks (including small caps) intraday:

| Security | Description | Last | % | Volume | MktCap |

|---|---|---|---|---|---|

| MGT | Magnetite Mines | 0.160 | 125% | 10,940,865 | $8,701,599 |

| ITM | Itech Minerals Ltd | 0.074 | 118% | 15,759,185 | $5,808,403 |

| NTM | Nt Minerals Limited | 0.002 | 100% | 21,302,360 | $1,210,903 |

| RGT | Argent Biopharma Ltd | 0.150 | 74% | 1,570,691 | $6,207,751 |

| MSI | Multistack Internat. | 0.006 | 50% | 250,000 | $545,216 |

| MTL | Mantle Minerals Ltd | 0.002 | 50% | 1,202,330 | $6,447,446 |

| RAN | Range International | 0.003 | 50% | 1,910,000 | $1,878,581 |

| HLX | Helix Resources | 0.002 | 33% | 27,958,433 | $5,046,291 |

| AOA | Ausmon Resorces | 0.006 | 33% | 131,742,569 | $5,900,460 |

| MBK | Metal Bank Ltd | 0.013 | 30% | 357,140 | $4,974,590 |

| SNX | Sierra Nevada Gold | 0.025 | 25% | 817,619 | $3,293,182 |

| PRX | Prodigy Gold NL | 0.003 | 25% | 9,883,586 | $13,483,725 |

| TKL | Traka Resources | 0.003 | 25% | 5,620,000 | $4,844,278 |

| LNR | Lanthanein Resources | 0.064 | 23% | 792,832 | $9,741,893 |

| PER | Percheron | 0.011 | 22% | 3,792,650 | $9,786,939 |

| ALM | Alma Metals Ltd | 0.006 | 20% | 4,305,741 | $9,253,686 |

| JAY | Jayride Group | 0.006 | 20% | 1,913,334 | $7,139,445 |

| IRD | Iron Road Ltd | 0.035 | 17% | 485,594 | $24,920,783 |

| BIT | Biotron Limited | 0.004 | 17% | 50,000 | $3,981,738 |

| BUY | Bounty Oil & Gas NL | 0.004 | 17% | 1,670,000 | $4,684,416 |

Magnetite Mines (ASX:MGT) has uncovered near-surface, clay-hosted rare earth mineralisation at its 100%-owned Ironback Hill project, right beside its big magnetite iron ore deposit. The grades run between 356ppm and 1,153ppm TREO, picked up after re-assaying archived drill samples from earlier iron ore work. It’s early days, but Magnetite is running low-cost follow-up work to test the find.

iTech Minerals (ASX:ITM) has mapped out two high-grade antimony zones more than 300m long at the Sabre and Falchion prospects, with rock chips grading up to 30% Sb and strong gold hits alongside. The zones, up to 14m thick, remain open along strike and at depth, but past explorers largely missed them by focusing on gold and not assaying for antimony. In total, iTech has now identified three surface antimony systems stretching over 2.5km.

Meanwhile, Kaili Resources (ASX:KLR) is still on a trading halt after Monday’s wild ride saw the stock rocket nearly 9000% intraday before closing up 2900%. The explorer swears it’s got no secret sauce beyond a green light to drill in South Australia, though the ASX has already slapped it with two speeding tickets. A fresh chairman, Jianzhong Yang, has also popped up on the register with a chunky stake via Treasure Unicorn.

ASX LAGGARDS

Today’s worst performing stocks (including small caps) intraday:

| Code | Name | Price | % Change | Volume | Market Cap |

|---|---|---|---|---|---|

| SRN | Surefire Rescs NL | 0.001 | -33% | 1,210,000 | $5,822,789 |

| CR9 | Corellares | 0.003 | -25% | 296,010 | $4,029,079 |

| M2R | Miramar | 0.003 | -25% | 2,850,000 | $3,987,293 |

| EGY | Energy Tech Ltd | 0.023 | -18% | 801,165 | $13,998,672 |

| FL1 | First Lithium Ltd | 0.100 | -17% | 179,827 | $9,558,432 |

| JAV | Javelin Minerals Ltd | 0.003 | -17% | 10,537,367 | $18,756,675 |

| MTB | Mount Burgess Mining | 0.010 | -17% | 9,568,736 | $5,107,660 |

| PIL | Peppermint Inv Ltd | 0.003 | -17% | 1,435,000 | $6,994,230 |

| NME | Nex Metals Explorat | 0.022 | -15% | 9,013 | $8,717,339 |

| ANX | Anax Metals Ltd | 0.006 | -14% | 218,880 | $6,179,653 |

| AVE | Avecho Biotech Ltd | 0.006 | -14% | 21,993 | $22,214,246 |

| MRQ | Mrg Metals Limited | 0.003 | -14% | 54,000 | $9,542,815 |

| RNX | Renegade Exploration | 0.003 | -14% | 5,180,000 | $5,608,272 |

| SMS | Starmineralslimited | 0.038 | -14% | 5,692,105 | $8,232,693 |

| 1TT | Thrive Tribe Tech | 0.007 | -13% | 3,818,252 | $1,250,950 |

| CHM | Chimeric Therapeutic | 0.004 | -13% | 420,000 | $13,018,235 |

| MMR | Mec Resources | 0.007 | -13% | 1,208,357 | $14,798,127 |

| ODE | Odessa Minerals Ltd | 0.007 | -13% | 3,248,509 | $12,796,260 |

IN CASE YOU MISSED IT

Rhythm Biosciences (ASX:RHY) has undertaken a capital raise of up to $3.75m to advance development of its products, including a simple blood test to detect colorectal cancer.

Challenger Gold (ASX:CEL) has secured an explosives permit from the Argentine Ministry of National Security allowing the company to start drill and blast operations.

Audeara (ASX:AUA) has tuned into strong growth for Q1 FY26, with unaudited revenue reaching $1.05m – a 46% increase on the prior quarter.

Lumos Diagnostics (ASX:LDX) has submitted a FDA CLIA waiver approval for FebriDx, a diagnostic test for bacterial and non-bacterial infections.

Resolution Minerals (ASX:RML) is testing for gold-antimony mineralisation at depth, kicking off the first phase of drilling at the Horse Heaven project in the US.

iTech Minerals’ (ASX:ITM) latest rock chip sampling program has yielded high-grade antimony results at Reynolds Range.

Argent BioPharma (ASX:RGT) has signed a binding term sheet to acquire the key assets and intellectual property of AusCann Group in a deal worth around US$15 million.

LAST ORDERS

Locksley Resources (ASX:LKY) is moving to the second stage of mapping and targeting at the Mojave rare earths project, deploying a structural geology team to site.

The company is also progressing an application to join the Critical Materials Institute and scheduled engagements with the EXIM Bank and the US Department of the Interior to advance financing and permitting pathways.

Anson Resources (ASX:ASN) has added $5m to the coffers in an oversubscribed share placement, with funding to support an engineering study, re-entry program, JORC estimate upgrade and tenement acquisitions at the Green River lithium project in Utah, US.

AnteoTech (ASX:ADO) has officially welcomed Merrill Gray to the position of managing director and CEO after serving as interim MD and CEO over the last four months.

Gray is an experienced scientist, engineer and business leader, having begun her career in the Western Australian Goldfields more than ten years ago. She’s since worked in battery technologies with a focus on decarbonisation, working with several active cathode and battery recycling companies in Australia and in Europe.

“EBITDA, EBITDA, EBITDA, that’s all folks.” Until we wrap up the afternoon session in Closing Bell, that is.

At Stockhead, we tell it like it is. While Locksley Resources, Anson Resources and AnteoTech are Stockhead advertisers, they did not sponsor this article.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.