Lunch Wrap: ASX ruffled by hot CPI surprise, CSL dumps again

Clucking madness: Traders were ruffled as CPI shock sent the ASX lower. Pic: Getty Images

- ASX sinks as CPI shock kills the mood

- Boss Energy and Nick Scali steal the spotlight

- CSL slides again, while SiteMinder books a win

The ASX was coasting along nicely early doors today … before the inflation numbers hit like a brick through a windscreen.

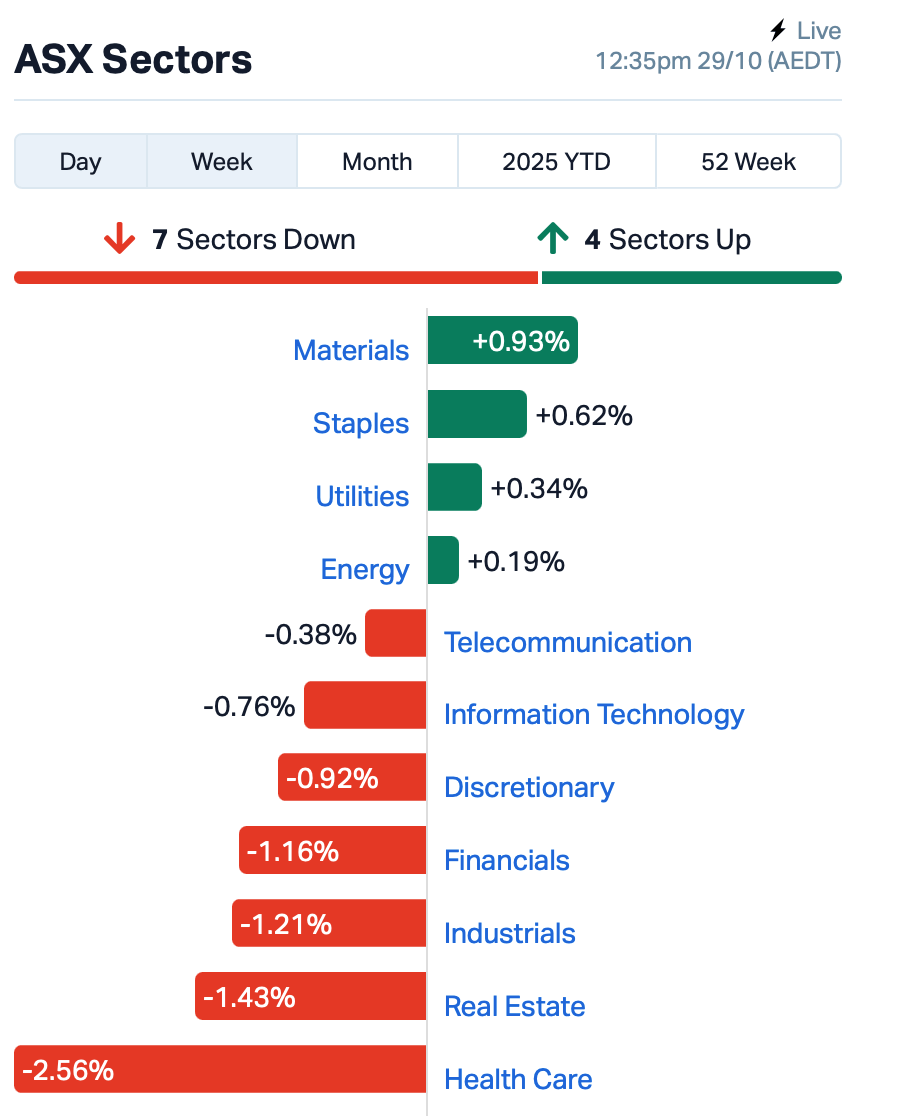

By around chow time in the east, the market had slipped by roughly 0.77%.

Overnight, Wall Street was in party mode, however, with the Dow, S&P and Nasdaq all touching new highs.

But back to Sydney, where the ABS dropped its September-quarter inflation bombshell this morning.

Headline inflation jumped 1.3% for the quarter and 3.2% year-on-year – both hotter than expected. Core inflation, the RBA’s favourite measure, hit 1% quarter-on-quarter and 3% annually, comfortably above forecasts.

For context, Governor Michele Bullock said earlier this week that 0.9% would be “a big miss.” Well, she got her big miss.

Markets are now shelving any talk of near-term cuts, with “higher for longer” back on the betting slip.

But before the data landed, the morning looked promising.

Iron ore stocks nudged higher, uranium names were on fire, and the mining sector led the early charge.

In large cap news, Woolworths (ASX:WOW) edged up 2% after posting $18.5 billion in quarterly sales, a touch light versus consensus, but enough to keep investors calm.

Over at Nick Scali (ASX:NCK), things were firing on all cylinders.

The furniture maker rocketed 11% after revealing an 11.6% lift in written orders and a forecast half-year profit of up to $35 million.

Even its UK division, long a headache, seems to be finally sitting on a comfortable couch, with losses narrowing and margins fattening.

Data#3 (ASX:DTL) jumped 5% after guiding to a first-half profit slightly ahead of forecasts. Not huge, but in this market, beating consensus is practically a party.

CSL (ASX:CSL), meanwhile, copped another beating, down 5% this morning after Tuesday’s AGM spooked investors with softer guidance and a paused Seqirus demerger. The stock dragged down the whole Healthcare index again today.

ASX LEADERS

Today’s best performing stocks (including small caps) intraday:

| Security | Description | Last | % | Volume | MktCap |

|---|---|---|---|---|---|

| FRX | Flexiroam Limited | 0.010 | 43% | 20,040,392 | $10,621,790 |

| AUH | Austchina Holdings | 0.002 | 33% | 3,913,474 | $4,538,075 |

| MRD | Mount Ridley Mines | 0.016 | 33% | 45,740,800 | $14,324,180 |

| AAJ | Aruma Resources Ltd | 0.022 | 29% | 4,256,777 | $6,967,289 |

| WBE | Whitebark Energy | 0.009 | 29% | 63,140,431 | $4,924,589 |

| DOC | Doctor Care Anywhere | 0.160 | 23% | 463,211 | $47,663,492 |

| FIN | FIN Resources Ltd | 0.011 | 22% | 40,491,306 | $6,253,996 |

| KEY | KEY Petroleum | 0.050 | 22% | 36,710 | $1,387,557 |

| AGD | Austral Gold | 0.082 | 21% | 261,724 | $41,637,172 |

| WAG | Theaustralianwealth | 0.600 | 20% | 16,393 | $37,182,500 |

| EMT | Emetals Limited | 0.006 | 20% | 7,780,927 | $4,250,000 |

| LIB | Liberty Metals | 0.003 | 20% | 16,162,574 | $14,957,333 |

| VRC | Volt Resources Ltd | 0.006 | 20% | 1,580,728 | $23,424,247 |

| NC1 | Nicoresourceslimited | 0.185 | 19% | 5,776 | $19,134,839 |

| BOE | Boss Energy Ltd | 1.858 | 17% | 17,095,074 | $659,725,202 |

| TM1 | Terra Metals Limited | 0.180 | 16% | 6,543,046 | $104,225,220 |

| POD | Podium Minerals | 0.075 | 15% | 1,802,040 | $64,195,725 |

| MFD | Mayfield Childcr Ltd | 0.460 | 15% | 206,977 | $30,169,844 |

| FML | Focus Minerals Ltd | 2.550 | 15% | 1,175,545 | $636,160,192 |

| AEV | Avenira Limited | 0.008 | 14% | 1,313,394 | $29,810,508 |

| MGU | Magnum Mining & Exp | 0.008 | 14% | 3,397,716 | $19,628,890 |

| CNQ | Clean Teq Water | 0.560 | 14% | 160,380 | $35,398,728 |

| BM8 | Battery Age Minerals | 0.165 | 14% | 291,033 | $26,410,564 |

Boss Energy (ASX:BOE) surged 16% after clocking record quarterly production at its Honeymoon project, with costs below FY26 guidance and plenty of free cash to boot.

Flexiroam (ASX:FRX), a global connectivity platform, has posted record operating cash flow of $1.3 million for Q1 FY26, its best result since listing. The strong turnaround follows the completion of legacy payables and reflects solid underlying profitability, with EBITDA of $1.1 million and NPAT of $1 million. Revenue held steady at around $3 million, supported by stable recurring business and improving margins.

Whitebark Energy (ASX:WBE) has uncovered new dry gas zones at its 100%-owned Warro Gas Field after a major technical review confirmed thick, gas-bearing intervals with minimal water. The independent study by global specialist Steve Adams found that earlier drilling had accidentally hit water zones, masking the field’s true potential. The new analysis points to strong targets in the Yarragadee Lower Formation and reaffirms Warro’s 4.4–11.6 TCF gas-in-place, potentially the largest onshore gas resource in WA.

Fin Resources (ASX:FIN) has snapped up 100% of the Cabin Lake Gold Project in Canada’s Northwest Territories. This is a fully permitted, drill-ready asset sitting in a Tier-1 gold province with over 14Moz of historic production. Early drilling has hit thick, high-grade zones such as 31.9m at 13.66g/t gold, defining clear open-pit targets at the Arrow Zone. The project lies within the same geology as the 3.3Moz Lupin Mine and hosts eight priority drill sites along a 15km strike.

ASX LAGGARDS

Today’s worst performing stocks (including small caps) intraday:

| Code | Name | Price | % Change | Volume | Market Cap |

|---|---|---|---|---|---|

| LNU | Linius Tech Limited | 0.001 | -50% | 2,300,000 | $14,254,387 |

| BMO | Bastion Minerals | 0.001 | -33% | 415,000 | $3,354,675 |

| RBR | RBR Group Ltd | 0.002 | -25% | 1,500,000 | $6,882,570 |

| SPX | Spenda Limited | 0.003 | -25% | 627,040 | $18,910,862 |

| ARU | Arafura Rare Earths | 0.300 | -20% | 64,678,099 | $1,101,421,955 |

| PIL | Peppermint Inv Ltd | 0.004 | -20% | 500,000 | $12,545,104 |

| RFT | Rectifier Technolog | 0.004 | -20% | 28,963 | $6,909,920 |

| RR1 | Reach Resources Ltd | 0.008 | -20% | 1,803,065 | $8,744,313 |

| SRN | Surefire Rescs NL | 0.002 | -20% | 3,367,392 | $10,064,023 |

| DTZ | Dotz Nano Ltd | 0.050 | -19% | 372,912 | $39,946,677 |

| SCN | Scorpion Minerals | 0.030 | -19% | 4,152,143 | $19,399,329 |

| CMG | Criticalmineralgrp | 0.180 | -16% | 59,782 | $19,467,038 |

| PRM | Prominence Energy | 0.003 | -14% | 4,546 | $3,112,117 |

| MGL | Magontec Limited | 0.200 | -13% | 132,828 | $13,101,220 |

| 1MC | Morella Corporation | 0.041 | -13% | 738,566 | $17,316,162 |

| HWK | Hawk Resources. | 0.035 | -13% | 1,674,749 | $13,546,472 |

| RRE | Right Resources | 0.175 | -13% | 1,296,773 | $17,687,469 |

| WMG | Western Mines | 0.175 | -13% | 55,000 | $22,749,669 |

| WLD | Wellard Limited | 0.030 | -12% | 3,137,564 | $18,062,511 |

| EDE | Eden Inv Ltd | 0.053 | -12% | 1,845,040 | $22,155,213 |

| AVR | Anteris Technologies | 7.500 | -12% | 11,060 | $120,681,563 |

| RWD | Reward Minerals Ltd | 0.040 | -11% | 115,011 | $12,249,881 |

| WNX | Wellnex Life Ltd | 0.200 | -11% | 86,498 | $15,739,982 |

IN CASE YOU MISSED IT

Aussie medtech and wellness innovators like EZZ Life Science (ASX:EZZ) are cashing in on ageing populations across Asia.

ADX Energy (ASX:ADX) is resuming operations at Welchau-1, drilling shallow gas wells and an oil appraisal at Anshof in 2026.

Pure Hydrogen (ASX:PH2) is on the road to assembling zero-emission vehicles in Australia on the back of a new term sheet with Advanced Manufacturing Queensland.

RareX’s (ASX:REE) Cummins Range project is shaping as one of the most consistent and high-grade gallium plays in Australia.

CONNEQT Health (ASX:CQT) has secured a $1.1m contract to supply its vascular monitoring systems for a Phase 2b hypertension trial in the US.

Lodestar Minerals (ASX:LSR) is acquiring the Virgin Mountain REE project in Arizona, near America’s only producing rare earths mine, Mountain Pass.

An intersection of pyrite and copper sulphides proves there’s plenty of unmined mineralisation at Highway Reward for Loyal (ASX:LLM).

Terra Metals (ASX:TM1) has spotted evidence of copper-nickel-PGM-cobalt sulphide mineralisation at the Southwest prospect of its Dante project in WA.

Fin Resources (ASX:FIN) is moving into Canada’s Northwest Territories after executing a sale and purchase agreement with Stockworks Gold for the Cabin Lake project.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.