Lunch Wrap: ASX jumps early as iron ore, coal and lithium miners all catch a bid

The ASX jumped early as miners rallied. Picture via Getty Images

- Miners muscle ASX up, lithium glows again

- Reece pipes burst on profit alert

- Wall St inches to record, Nvidia flirts with $3.8 trillion

The ASX came out swinging this morning, jumping a lively 0.6% out of the gates before easing off to a 0.1% gain by eastern lunch time.

Wall Street set the stage overnight with a solid session. The S&P 500 closed just three points shy of its all-time high, and the Nasdaq rallied 1%.

Nvidia briefly flirted with an outrageous US$3.8 trillion valuation before pulling back.

Over at Tesla HQ, yet another Musk confidant has left the building. Omead Afshar, who was overseeing major ops and considered one of Elon’s inner circle, has departed. No word yet on why.

Back to the ASX where miners had a field day this morning.

BHP (ASX:BHP) surged 3.5%, Rio Tinto (ASX:RIO) rocketed up 4%, and Fortescue (ASX:FMG) flexed 3% as iron ore futures rebounded thanks to demand hopes in China.

Elsewhere, coal stocks got a warm lift as Beijing’s heatwave, nudging 40 degrees, gave prices a gentle shove off the floor.

Lithium stocks also lit up again, building on Thursday’s jolt after Vanguard was revealed as a major new holder in Pilbara Minerals (ASX:PLS). PLS rose another 7% this morning, and IGO (ASX:IGO) lifted 5%.

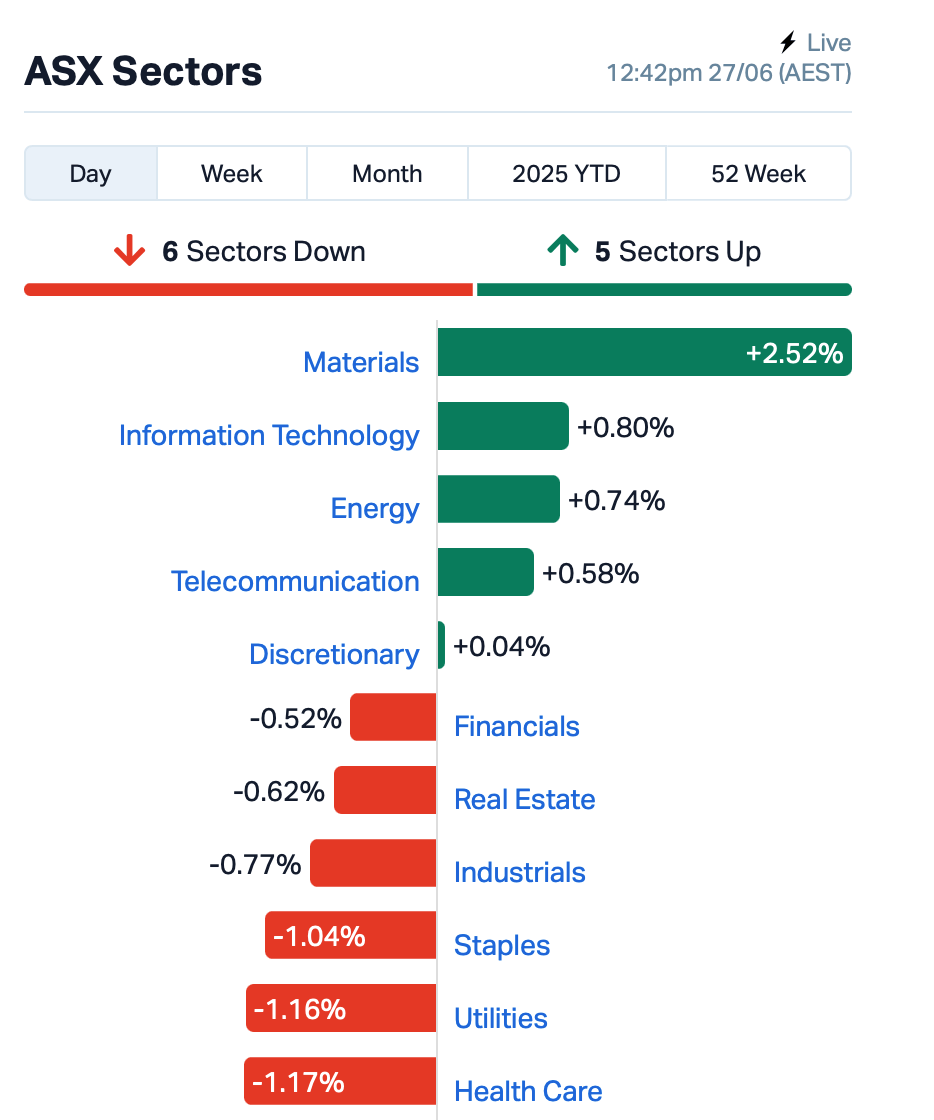

This where things stood at about 12:40pm AEST:

In other large caps news, giant plumbing supplier Reece (ASX:REH) was hammered more than 14% after warning that earnings will fall to around $548-558 million for FY25, down from $681 million last year.

Blame soft volumes in Aussie and Kiwi housing markets, and a flat US construction scene where interest rates and affordability are squeezing new builds.

Wesfarmers (ASX:WES) made a big move with its Bunnings landlord, BWP Trust. It’s selling its 100% stake in BWP Management for $142.6 million, a deal that also resets a bunch of Bunnings leases. WES’ shares were up 0.5%.

ASX SMALL CAP WINNERS

Here are the best performing ASX small cap stocks for June 27 [intraday]:

| Security | Description | Last | % | Volume | MktCap |

|---|---|---|---|---|---|

| TD1 | Tali Digital Limited | 0.002 | 100% | 13,897,807 | $4,095,156 |

| WEL | Winchester Energy | 0.002 | 100% | 165,600 | $1,363,019 |

| LSR | Lodestar Minerals | 0.009 | 50% | 30,067,490 | $1,910,543 |

| ADD | Adavale Resource Ltd | 0.002 | 50% | 8,325,802 | $2,287,279 |

| ADY | Admiralty Resources. | 0.006 | 50% | 1,690,337 | $10,517,918 |

| EEL | Enrg Elements Ltd | 0.002 | 50% | 854,101 | $3,253,779 |

| ALM | Alma Metals Ltd | 0.004 | 33% | 387,947 | $5,261,182 |

| EMT | Emetals Limited | 0.004 | 33% | 50,000 | $2,550,000 |

| FHS | Freehill Mining Ltd. | 0.004 | 33% | 628,446 | $10,241,561 |

| GTR | Gti Energy Ltd | 0.004 | 33% | 2,603,885 | $8,996,849 |

| LCL | LCL Resources Ltd | 0.008 | 33% | 5,356,812 | $7,195,543 |

| M2R | Miramar | 0.004 | 33% | 6,250,614 | $2,990,470 |

| MPR | Mpower Group Limited | 0.009 | 29% | 4,162,897 | $2,405,923 |

| RPG | Raptis Group Limited | 0.066 | 27% | 177,393 | $18,235,612 |

| RCM | Rapid Critical | 0.003 | 25% | 500,000 | $2,831,556 |

| ROG | Red Sky Energy. | 0.005 | 25% | 120,000 | $21,688,909 |

| VR1 | Vection Technologies | 0.036 | 24% | 30,049,768 | $51,255,235 |

| GBZ | GBM Rsources Ltd | 0.016 | 23% | 3,064,593 | $18,406,194 |

| LRK | Lark Distilling Co. | 0.840 | 23% | 485,122 | $72,333,777 |

| PUA | Peak Minerals Ltd | 0.033 | 22% | 42,337,208 | $75,797,675 |

| SDV | Scidev Ltd | 0.365 | 22% | 112,163 | $57,026,459 |

| AS2 | Askarimetalslimited | 0.006 | 20% | 3,057,649 | $2,020,853 |

| BNL | Blue Star Helium Ltd | 0.006 | 20% | 187,807 | $13,474,426 |

| C7A | Clara Resources | 0.003 | 20% | 513,147 | $1,470,677 |

| ICR | Intelicare Holdings | 0.006 | 20% | 198,537 | $2,430,941 |

Shares in plastic pallets specialist Range International (ASX:RAN) doubled after it won appeals in the Indonesian Tax Court, wiping out tax bills from 2018 related to withholding and VAT issues. The court ruled in full favour of Range’s local subsidiary, bringing the payable amount down to zero. The board said it’s a big win that brings much-needed certainty as it focuses on growing the business.

Argosy Minerals (ASX:AGY) has locked in a spot sales deal to sell 60 tonnes of high-grade lithium carbonate from its Rincon Project in Argentina. The sale price is pegged to SMM battery-grade pricing, with 30% paid upfront and the rest before shipping from Buenos Aires. Argosy says it’s stoked with the strong demand, and reckons it’s in a solid spot to benefit from the EV sector’s comeback, especially given how few producers are hitting this level of purity.

Sunrise Energy Metals (ASX:SRL) has struck more high-grade scandium at its Syerston project in NSW, following a 125-hole drilling campaign across April and May. Early results from 49 of those holes show strong, continuous hits, with grades up to 1123ppm. The new zones remain open in multiple directions and are expected to feed into a fresh resource upgrade for the company’s upcoming feasibility study. With China recently clamping down on scandium exports, Sunrise reckons it’s sitting on one of the biggest and highest-grade scandium resources in the world.

ASX SMALL CAP LOSERS

Here are the worst performing ASX small cap stocks for June 27 [intraday]:

| Code | Name | Price | % Change | Volume | Market Cap |

|---|---|---|---|---|---|

| GMN | Gold Mountain Ltd | 0.001 | -50% | 1,560,215 | $11,239,518 |

| IS3 | I Synergy Group Ltd | 0.002 | -50% | 3,892,995 | $2,002,920 |

| VEN | Vintage Energy | 0.003 | -40% | 343,075 | $10,434,568 |

| L1M | Lightning Minerals | 0.040 | -33% | 1,076,495 | $6,199,699 |

| CCO | The Calmer Co Int | 0.002 | -33% | 142,635 | $9,034,060 |

| TKL | Traka Resources | 0.001 | -33% | 135,263 | $3,188,685 |

| TMK | TMK Energy Limited | 0.002 | -33% | 35,626,606 | $30,667,149 |

| FIN | FIN Resources Ltd | 0.003 | -25% | 557,800 | $2,779,554 |

| HLX | Helix Resources | 0.002 | -25% | 248,732 | $6,728,387 |

| SFG | Seafarms Group Ltd | 0.002 | -25% | 72,209 | $9,673,198 |

| SRN | Surefire Rescs NL | 0.002 | -25% | 190,144 | $4,972,891 |

| T3D | 333D Limited | 0.007 | -22% | 195 | $1,585,651 |

| SRL | Sunrise | 0.775 | -22% | 490,344 | $109,125,223 |

| UCM | Uscom Limited | 0.015 | -21% | 80,000 | $4,759,063 |

| AUK | Aumake Limited | 0.002 | -20% | 326,886 | $7,558,397 |

| PPG | Pro-Pac Packaging | 0.016 | -20% | 77,661 | $3,633,754 |

| SKK | Stakk Limited | 0.004 | -20% | 1,165,197 | $10,375,398 |

| SRJ | SRJ Technologies | 0.004 | -20% | 528,849 | $3,027,890 |

| EM2 | Eagle Mountain | 0.005 | -17% | 156,132 | $6,810,224 |

| MKL | Mighty Kingdom Ltd | 0.017 | -15% | 480,524 | $10,326,928 |

| OVT | Ovanti Limited | 0.006 | -14% | 21,838,756 | $21,038,605 |

| PLG | Pearlgullironlimited | 0.006 | -14% | 705,981 | $1,431,793 |

| SSH | Sshgroupltd | 0.120 | -14% | 30,823 | $10,407,640 |

| YAR | Yari Minerals Ltd | 0.013 | -13% | 2,283,074 | $8,320,672 |

| EQS | Equitystorygroupltd | 0.020 | -13% | 61,331 | $3,836,869 |

IN CASE YOU MISSED IT

Spartan Resources (ASX:SPR) is targeting resource growth at the Dalgaranga project as drilling produces gold up to 163.67g/t from a hanging wall zone 193.7m deep.

Uvre (ASX:UVA) has unearthed rock chips up to 18.4g/t gold at the Waitekauri project, a flagship asset UVA is acquiring through the purchase of Otagold.

LAST ORDERS

New World Resources (ASX:NWC) is enjoying somewhat of a bidding war over its shares, with Central Asia Metals Plc countering Kinterra Capital’s takeover offer at A$0.057 per share with its own revised bid at $0.062 each.

Management says neither company has declared its offer to be best and final as of yet, meaning shareholders are not required to take any action at present.

Aura Energy (ASX:AEE) is a step closer to securing funding after the publication of an Environmental and Social Impact Assessment (ESIA) for the Tiris uranium project on the US International Development Finance Corporation’s website.

MD and CEO Andrew Grove said it was a reflection of the company’s efforts to align the project’s development plans with international best practices and the expectations of global financiers as Tiris moves toward a final investment decision.

At Stockhead, we tell it like it is. While New World Resources and Aura Energy are Stockhead advertisers, they did not sponsor this article.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.