Lunch Wrap: ASX wobbles; Trump-Xi phone call lifts iron ore but sinks lithium

The Trump–Xi phone call walloped lithium and rare earths stocks. Picture via Getty Images

- ASX wobbles at lunch but miners rallied early on Trump-Xi call

- Critical minerals sink while Tesla crashes 14pc

- Worley wins job in Alaska, Ora Banda dips

The ASX edged higher in early trade on Friday as the index brushed right up against record territory.

But… it hasn’t sustained, wobbling back down again to -0.15% intraday so far.

Miners and energy names did the heavy lifting early, though, after Donald Trump and Xi Jinping finally picked up the phone and agreed to resume trade talks.

Trump called it a “very good call”, and markets took that as a sign that China might keep buying iron ore and crude by the boatload.

Iron ore jumped to nearly US$96.50 a tonne, and Brent oil climbed, too.

But here’s the twist.

The Trump–Xi thaw, while good for iron ore, actually walloped lithium and rare earths stocks. If China-US trade cools down, then maybe pressure on critical mineral supply eases, too. And that means less panic buying.

Local stocks like Pilbara Minerals (ASX:PLS) and IGO (ASX:IGO) got hammered by 5-6% this morning on the news.

Meanwhile, Tesla plunged by 14%, the biggest single-day hit to its market cap, ever.

Investors scrambled for the exits after Trump threatened to rip up Elon’s government contracts, claiming the world’s richest man had “gone crazy” since finishing his post at the so-called Department of Government Efficiency.

Musk didn’t exactly go quiet into the night.

He lit up X with claims he was the one who got Trump elected, suggested Trump’s name appears in the Epstein files, and all but challenged him to a cage fight.

Even Bitcoin felt the fallout, sliding 3% to just above US$100k as traders cringed at the chaos.

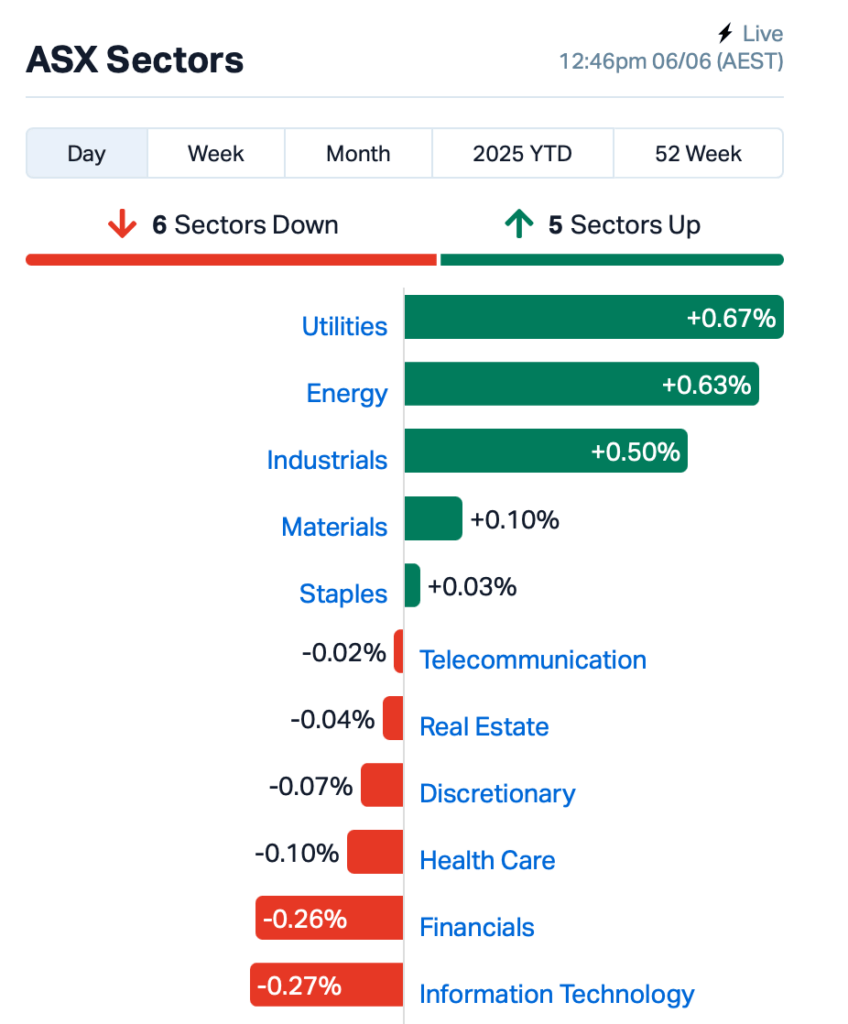

Back on home soil, Utilities and Energy were the two best sectors this morning:

In the large caps space, Worley (ASX:WOR) booked itself a big job, landing a contract with Glenfarne to support engineering works on Alaska’s LNG pipeline. WOR’s shares were flat.

Ora Banda (ASX:OBM) got whacked 9% after admitting its full-year gold output is going to fall short due to extended downtime at the Davyhurst project.

SkyCity Entertainment Group (ASX:SKC) jumped 1% after launching a $330 million lawsuit against Fletcher Building (ASX:FBU) over what it claims was “gross negligence” during construction of a New Zealand convention centre. Fletcher slid 3%, presumably with a team of lawyers now sleeping in the office.

ASX SMALL CAP WINNERS

Here are the best performing ASX small cap stocks for June 6 [intraday]:

Security Description Last % Volume MktCap BMO Bastion Minerals 0.003 100% 124,237,975 $1,355,441 CZN Corazon Ltd 0.003 100% 21,386,226 $1,776,858 WC1 West Cobar Metals 0.024 60% 39,757,383 $3,110,692 AXI Axiom Properties 0.028 56% 30,000 $7,788,846 EM2 Eagle Mountain 0.006 50% 1,927,601 $4,540,149 MGU Magnum Mining & Exp 0.005 43% 498,430 $3,925,778 GMN Gold Mountain Ltd 0.002 33% 926,889 $8,429,639 QXR Qx Resources Limited 0.004 33% 1,583,144 $3,930,987 SRN Surefire Rescs NL 0.002 33% 1,042,535 $3,729,668 MEM Memphasys Ltd 0.006 33% 778,755 $8,926,191 IS3 I Synergy Group Ltd 0.004 33% 154,270 $1,502,290 LOC Locatetechnologies 0.145 32% 1,351,777 $24,886,036 NWM Norwest Minerals 0.013 30% 6,600,901 $9,683,586 ASM Ausstratmaterials 0.640 26% 1,276,645 $92,030,396 EDE Eden Inv Ltd 0.003 25% 610,676 $8,219,762 EVR Ev Resources Ltd 0.005 25% 58,315 $7,943,347 PIL Peppermint Inv Ltd 0.003 25% 534,955 $4,552,180 MRR Minrex Resources Ltd 0.011 22% 2,001,273 $9,763,808 ATG Articore Group Ltd 0.225 22% 234,067 $52,676,230 OLI Oliver'S Real Food 0.006 20% 100,000 $2,703,660 BDM Burgundy D Mines Ltd 0.025 19% 974,970 $29,847,978 HPR High Peak Royalties 0.059 18% 4,763 $10,402,986

West Cobar Metals (ASX:WC1) has completed the 100% acquisition of the Mystique Gold Project from IGO in WA’s Fraser Range. The project sits just south of Rumble’s Themis prospect, where standout gold hits include 4m at 22.2g/t. Drilling is now being planned at two key targets – Themis South and Torquata – to test for saprolite and basement gold.

Australian Strategic Materials (ASX:ASM) is gaining momentum at its Korean Metals Plant, locking in new sales of rare earth metals and alloys as global buyers look for supply outside China. ASM has confirmed orders for NdFeB alloy to Noveon Magnetics in the US (15 tonnes) and Germany’s Vacuumschmelze (7.2 tonnes), with first shipments kicking off in June.

ASX SMALL CAP LOSERS

Here are the worst performing ASX small cap stocks for June 6 [intraday]:

Code Name Price % Change Volume Market Cap JAY Jayride Group 0.001 -50% 907,361 $2,855,778 LNR Lanthanein Resources 0.001 -50% 2,934,969 $4,887,272 CCO The Calmer Co Int 0.002 -33% 656,778 $9,034,060 JAV Javelin Minerals Ltd 0.002 -33% 868,000 $18,378,447 OB1 Orbminco Limited 0.001 -33% 100,000 $4,796,352 SKN Skin Elements Ltd 0.002 -33% 158,639 $3,225,642 LU7 Lithium Universe Ltd 0.005 -29% 3,039,537 $5,501,857 KNB Koonenberrygold 0.045 -27% 49,922,090 $63,530,934 HLX Helix Resources 0.002 -25% 594,904 $6,728,387 VML Vital Metals Limited 0.002 -25% 4,399,659 $11,790,134 HMD Heramed Limited 0.009 -25% 5,851,655 $10,507,233 ENT Enterprise Metals 0.002 -20% 1 $2,945,793 OVT Ovanti Limited 0.002 -20% 1,809,635 $6,983,788 VRC Volt Resources Ltd 0.004 -20% 456,393 $23,423,890 RMI Resource Mining Corp 0.017 -19% 3,783,064 $15,423,520 SNX Sierra Nevada Gold 0.025 -17% 80,974 $4,939,774 FBR FBR Ltd 0.005 -17% 1,613,165 $34,136,713 TON Triton Min Ltd 0.005 -17% 182,233 $9,410,332 ZEU Zeus Resources Ltd 0.010 -17% 1,048,831 $7,688,078 EMT Emetals Limited 0.003 -14% 750,000 $2,975,000 HHR Hartshead Resources 0.006 -14% 947,158 $19,660,775 LSR Lodestar Minerals 0.006 -14% 50,000 $2,228,967 TMS Tennant Minerals Ltd 0.006 -14% 2,359,434 $6,691,233

IN CASE YOU MISSED IT

Vertex Minerals (ASX:VTX) is on track to mine the first gold from the Reward underground gold mine this quarter.

Internationally renowned engineering firm Ausenco has been engaged by RareX (ASX:REE) to conduct initial infrastructure and development studies at the Mrima Hill project.

LAST ORDERS

Locksley Resources (ASX:LKY) will soon list to the OTCQB Venture Markets in the US, after engaging advisory group Viriathus Capital LLC to assist in securing quotation. The company reckons the over-the-counter market listing will increase its visibility, liquidity and access for North American investors, while also supporting the company’s US-based critical mineral strategy.

Neurotech (ASX:NTI) will present its lead product NTI164 at the upcoming International Rett Syndrome Foundation (IRSF) Scientific Meeting. The company will present on its novel full-spectrum medicinal cannabis pharmaceutical, designed to improve symptoms of Rett syndrome, a rare genetic neurodevelopmental disorder.

At Stockhead, we tell it like it is. While Locksley Resources is a Stockhead advertiser, it did not sponsor this article.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.