Lunch Wrap: ASX hangs in there as new tariff threats sink in

The ASX has clawed its way back to positively flat territory despite some strong tariff-borne headwinds. Pic: Getty Images

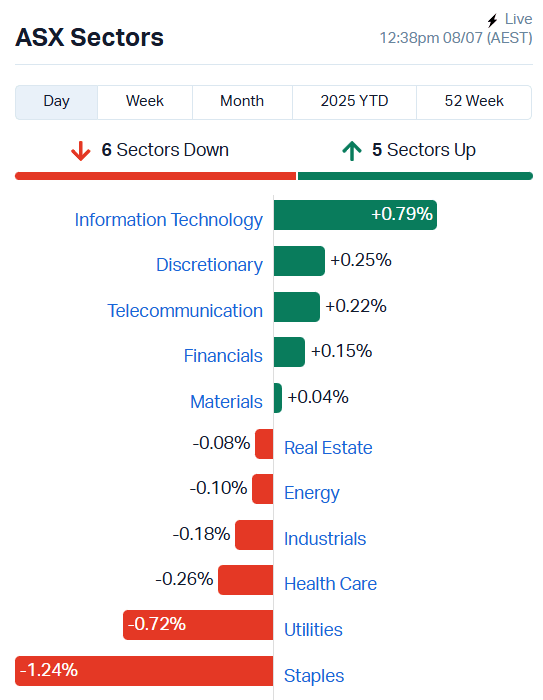

- ASX 200 struggles back into green by lunchtime

- Info tech and gold stocks prop up struggling market

- Trump sends out dozens of tariff threats ahead of extended deadline

ASX crawls along

After a rough start to the morning saw the ASX 200 slice 0.25% off the top, the Aussie bourse has staged a recovery to tip back into the green. Although… hang on… the grip is loosening as we type.

It’s now about flat and seemingly just clinging on as of about 1.15pm AEST, which is actually nothing to sniff at considering Wall Street’s abysmal performance overnight.

Retreating from all-time highs, the Nasdaq, S&P500 and Dow all lost about 0.8-0.9% overnight.

The mood turned decidedly sour as Trump let rip with the tariff rhetoric once again, pushing nine of the S&P 500’s 11 sectors lower.

And the drama ramped up further as Elon Musk announced the formation of the new “American Party” in direct response to the passing of Trump’s latest tax bill. Tesla shares tumbled 6.8%.

While US tech stocks languished overnight – Nvidia, Apple, Alphabet and AMD all sank – it’s the info tech sector providing a lot of the supporting strength for the ASX today.

Gold stocks are also flying as the tariffs push investors back into gold – the All Ords Gold index has surged 3% so far in trade today.

Taking a look at our big cap movers for the middle of the day, Commonwealth Bank (ASX:CBA) has added 0.42%, ANZ (ASX:ANZ) is up 0.53% and NAB (ASX:NAB) has gained 0.54%.

BHP Group (ASX:BHP) has shed 1.15%, CSL (ASX:CSL) is down 0.54% and Westpac (ASX:WBC) is trending against the other banks, losing 0.34%.

Trump ramps up tariff threats after deadline extension

US markets had reached new all-time highs in the brief reprieve from tariff chaos over the last few months, but major indices fell almost a full percentage point each overnight as Trump turned the heat back up.

Writing to the leaders of dozens of countries, US President Donald Trump has threatened to impose new tariffs of between 25% and 40%.

South Korea, Malaysia, Japan, Kazakhstan and Tunisia are all staring down the barrel of unilateral 25% trade taxes.

It gets worse from there. South Africa, Bosnia and Herzegovina, Indonesia, Serbia, Bangladesh and Cambodia will be slapped with tariffs of 30% to 36%, while goods from Laos and Myanmar will carry a 40% tariff.

“Please understand that the 25% number is far less than what is needed to eliminate the Trade Deficit disparity we have with your Country,” Trump wrote in letters to Japan and South Korea, with similar language in other communications.

He also explicitly threatened to one-up any retaliation, stating any changes to tariffs on US goods would see the same percentage added to US trade taxes.

JP Morgan research predicts the average tariff rate will be a good bit lower than levels currently being threatened.

“Tariffs are a central pillar of this administration’s economic agenda,” JP Morgan chief global economist Bruce Kasman said in June.

“The path and the distribution across countries and sectors are uncertain, but we continue to believe that the average effective tariff rate should eventually settle around 15-18%.”

ASX SMALL CAP WINNERS

Here are the best performing ASX small cap stocks for July 8 [intraday]:

| Security | Description | Last | % | Volume | MktCap |

|---|---|---|---|---|---|

| AQC | Auspaccoal Ltd | 0.023 | 360% | 26455906 | $3,502,338 |

| LNR | Lanthanein Resources | 0.002 | 167% | 3084720 | $3,161,454 |

| HLX | Helix Resources | 0.002 | 100% | 400100 | $3,364,194 |

| ATV | Activeportgroupltd | 0.015 | 67% | 13925144 | $6,182,794 |

| ALR | Altairminerals | 0.003 | 50% | 166733 | $8,593,488 |

| AXP | AXP Energy Ltd | 0.0015 | 50% | 250000 | $6,684,681 |

| AM7 | Arcadia Minerals | 0.025 | 39% | 40120 | $2,112,902 |

| AMS | Atomos | 0.004 | 33% | 2561337 | $3,645,055 |

| QXR | Qx Resources Limited | 0.004 | 33% | 2947669 | $3,930,987 |

| RDG | Res Dev Group Ltd | 0.009 | 29% | 118403 | $20,656,007 |

| GT1 | Greentechnology | 0.027 | 29% | 2302359 | $9,978,571 |

| SCP | Scalare Partners | 0.165 | 27% | 43422 | $5,438,553 |

| RMI | Resource Mining Corp | 0.015 | 25% | 93140 | $8,813,440 |

| 1AD | Adalta Limited | 0.0025 | 25% | 667400 | $2,142,633 |

| RLG | Roolife Group Ltd | 0.005 | 25% | 911660 | $6,371,125 |

| TMK | TMK Energy Limited | 0.0025 | 25% | 4176969 | $20,444,766 |

| VEN | Vintage Energy | 0.005 | 25% | 2207274 | $8,347,655 |

| PIQ | Proteomics Int Lab | 0.49 | 24% | 1285414 | $64,590,968 |

| AGY | Argosy Minerals Ltd | 0.031 | 19% | 11634924 | $37,853,944 |

| SVY | Stavely Minerals Ltd | 0.013 | 18% | 2260181 | $5,984,463 |

| ENX | Enegex Limited | 0.021 | 17% | 25508 | $6,856,597 |

| CRR | Critical Resources | 0.0035 | 17% | 1115050 | $8,310,256 |

| IPT | Impact Minerals | 0.007 | 17% | 1120792 | $23,959,980 |

| GCM | Green Critical Min | 0.022 | 16% | 20614126 | $46,634,138 |

| SUM | Summitminerals | 0.046 | 15% | 2359785 | $3,543,043 |

In the news…

Activeport (ASX:ATV) is preparing to roll out its network operations centre module at-scale for the first time after locking in a contract with India-based Ishan Netsol Pvt Ltd to provide network infrastructure automations.

The $375k deal will see ATV deploy its Fibre-to-the-Node orchestration to more than 12,000 buildings and 40+ data centres across India, tapping into a network across 100 locations and 85,000 customers in the country.

TMK Energy (ASX:TMK) has locked in a drilling contractor for the LF-07 production well at the Pilot Well project in Mongolia, contracting a larger, more powerful TXD200 drilling rig for the first time.

TMK intends to spud the LF-07 well in the second half of July, once Mongolia’s annual holiday celebration, the Naadam festival, has ended.

Stavely Minerals (ASX:SVY) is taking a magnifying glass to its Western Victorian tenure in a fresh hunt for gold, taking advantage of the lucrative gold pricing environment to pivot from its usual copper targets.

The company has already put drill bit to ground at the Fairview North and South gold prospects, with an eye to investigate some breccia-hosted gold targets at the S41 prospect as well.

Green Critical Minerals (ASX:GCM) is looking to jump on the data centre bandwagon with its VHD graphite heatsink technology, which handily outperformed traditional materials in recent modelling.

With data centre microchips now requiring up to 300W of power, GCM’s heat sink can maintain temperatures of 70-85 degrees Celsius at power loads of 300 to 400 watts.

ASX SMALL CAP LAGGARDS

Here are the worst performing ASX small cap stocks for July 8 [intraday]:

| Code | Name | Price | % Change | Volume | Market Cap |

|---|---|---|---|---|---|

| VFX | Visionflex Group Ltd | 0.001 | -50% | 447757 | $6,735,721 |

| EEL | Enrg Elements Ltd | 0.001 | -33% | 250101 | $4,880,668 |

| GMN | Gold Mountain Ltd | 0.002 | -20% | 884391 | $14,049,398 |

| MRD | Mount Ridley Mines | 0.002 | -20% | 1071190 | $1,946,223 |

| DGR | DGR Global Ltd | 0.005 | -17% | 423719 | $6,262,176 |

| TON | Triton Min Ltd | 0.005 | -17% | 180000 | $9,410,332 |

| ZMI | Zinc of Ireland NL | 0.008 | -16% | 4792390 | $5,529,102 |

| HPC | Thehydration | 0.011 | -15% | 856893 | $5,021,912 |

| LML | Lincoln Minerals | 0.006 | -14% | 2418211 | $14,717,988 |

| LU7 | Lithium Universe Ltd | 0.006 | -14% | 43962 | $6,551,857 |

| WMG | Western Mines | 0.24 | -14% | 80634 | $27,100,736 |

| BPH | BPH Energy Ltd | 0.007 | -13% | 500000 | $9,745,863 |

| RNX | Renegade Exploration | 0.0035 | -13% | 157488 | $5,153,454 |

| WBE | Whitebark Energy | 0.0035 | -13% | 882608 | $2,749,334 |

| NUC | Nuchev Limited | 0.14 | -13% | 5263 | $23,467,622 |

| TOU | Tlou Energy Ltd | 0.021 | -13% | 479382 | $31,166,024 |

| MCE | Matrix C & E Ltd | 0.255 | -12% | 1305836 | $64,905,242 |

| RML | Resolution Minerals | 0.044 | -12% | 9997065 | $32,910,914 |

| DXN | DXN Limited | 0.059 | -12% | 696899 | $20,013,144 |

| ILT | Iltani Resources Lim | 0.19 | -12% | 222980 | $14,177,272 |

| LOC | Locatetechnologies | 0.155 | -11% | 740100 | $40,657,564 |

| SKY | SKY Metals Ltd | 0.056 | -11% | 356254 | $44,774,299 |

| MEM | Memphasys Ltd | 0.004 | -11% | 2181 | $8,926,191 |

| ADO | Anteotech Ltd | 0.0125 | -11% | 1057680 | $37,874,205 |

| BOA | BOA Resources Ltd | 0.018 | -10% | 55555 | $2,467,057 |

IN CASE YOU MISSED IT

Argent BioPharma (ASX:RGT) has initiated supply of EU-GMP Cannabinoid API for epilepsy treatment at Slovenia’s largest hospital.

Brookside Energy (ASX:BRK )is preparing to commence a ~$1.92 million on-market share buy-back to support its upcoming New York Stock Exchange ADR listing.

Pure Hydrogen (ASX:PH2) is expecting a $1.1m R&D refund for FY25, which will assist in funding its goal of driving uptake of hydrogen and electric commercial vehicles.

Koonenberry Gold (ASX:KNB) has inked a 160% gain year to date on thick, high-grade gold hits at its Sunnyside prospect in New South Wales. But could it be sitting on another potential monster find?

StockTake: Buxton Resources (ASX:BUX) has kicked off its maiden drilling program at Centurion, testing gravity and magnetic anomalies.

Break it Down: Western Yilgarn (ASX:WYX) has announced a 16.5-million-tonne bauxite resource estimate for its Cardea-3 deposit in Western Australia.

LAST ORDERS

Star Minerals (ASX:SMS) has polished off a 2033-metre, 38-hole drilling program at the Tumbelgum South gold project, on time and within budget.

The infill drilling data from the program will be used for a resource estimate upgrade, and will also provide insights on structural targets to the northwest with potential to hold more gold mineralisation.

At Stockhead, we tell it like it is. While Star Minerals and Green Critical Minerals are Stockhead advertisers, they did not sponsor this article.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.