Lunch Wrap: ASX dips after record high; banks take hit on thinning margins

ASX dips after record high, banks take a hit. Picture via Getty Images

- ASX drops following record peak, with banks taking a hit

- RBA rate cut expected, but no flood of cuts ahead

- BlueScope and A2 milk shine, while insurers slump

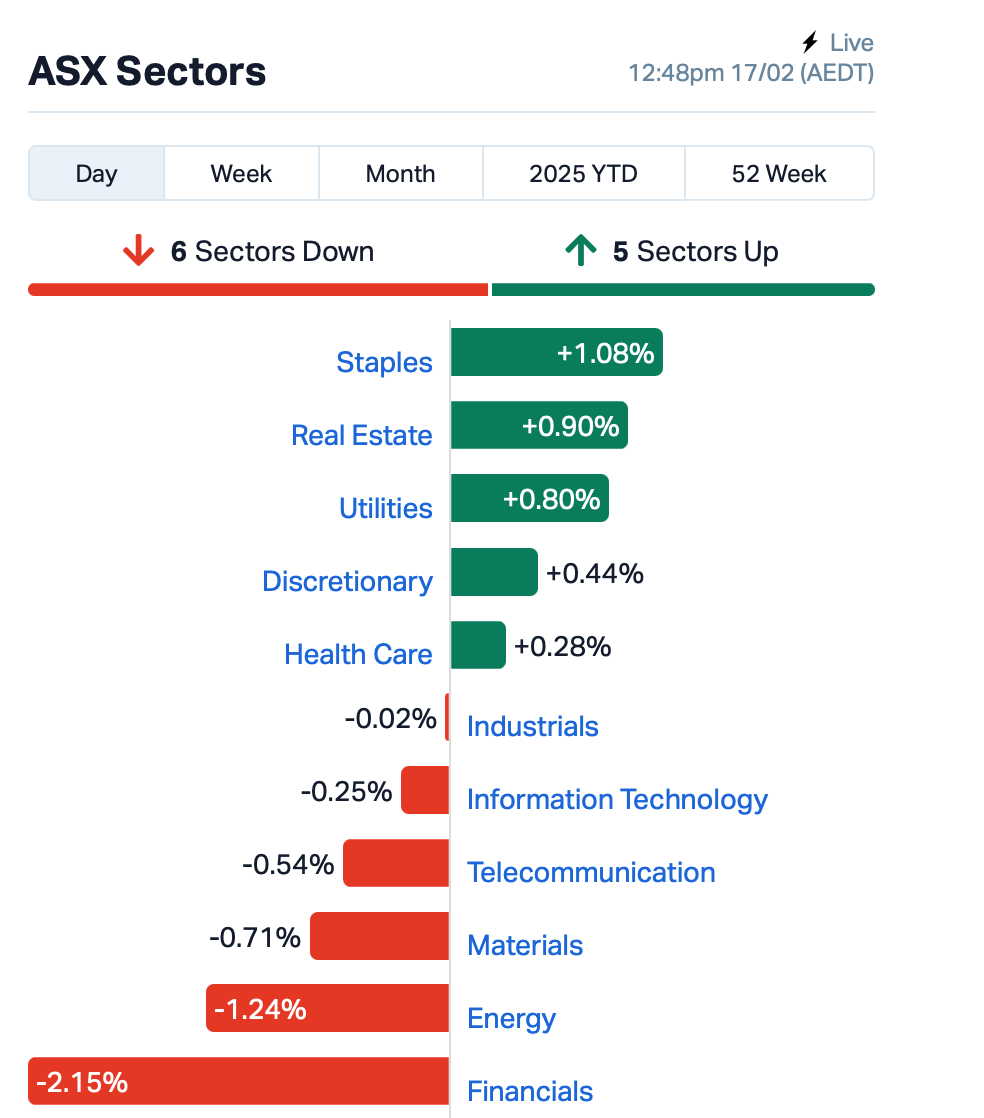

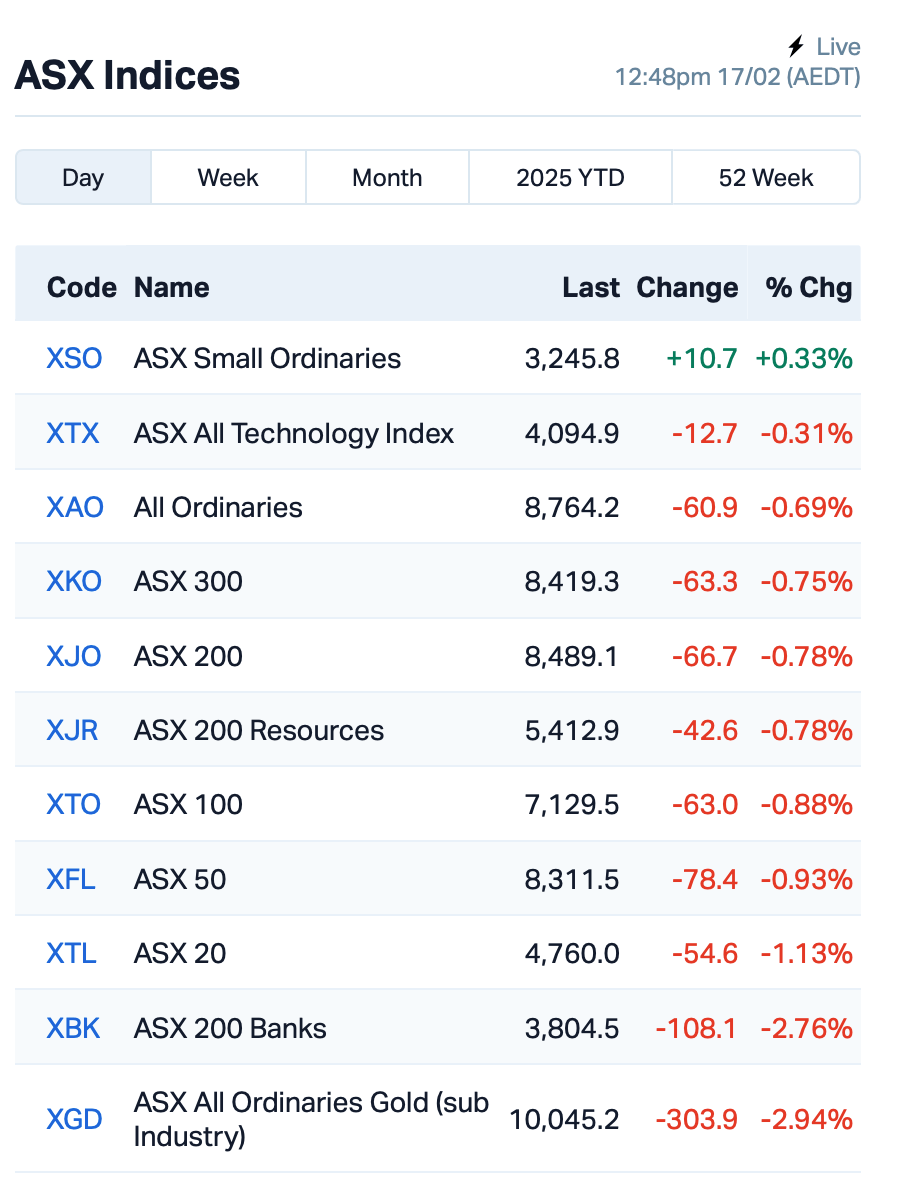

The ASX was down by 0.8% at 12:30pm AEDT following a record-high close last Friday.

On Wall street, markets were mixed after rising US-EU tensions over how to handle peace talks with Russia on Ukraine.

Investor attention, however, will stay on macroeconomic data for now, with key policy decisions expected this week.

This includes the RBA kicking off its long-awaited rate cut on Tuesday, and New Zealand’s central bank likely to keep easing to boost its weak economy on Wednesday.

But experts reckon it won’t be a flood of cuts, with inflation and Trump’s tariffs still causing uncertainties.

“Unknown outcomes from recent US policy shifts and persistent weakness in China will certainly be on the Bank’s radar, and it wouldn’t be outside of the realm of possibility that the RBA will wait until March for the dust to settle,” said Webull’s Rob Talevski.

Back to the ASX, banks led the charge down this morning.

This came as Bendigo and Adelaide Bank (ASX:BEN) plunged by 17% after the bank’s net profit for the first half of FY25 came in almost 10% lower compared to the previous six months.

But the main reason for the dip in share price was the drop in BEN’s net interest margin (NIM), which shrank by 6 basis points to 1.88% due to rising deposit costs.

Westpac’s (ASX:WBC) shares also dropped 5% after a Q1 update showed weaker-than-expected results. Net interest income dropped 6%, while its NIM was slashed by 2 bp to 1.81%.

Insurance companies also took a tumble this morning, following threats from opposition leader Peter Dutton to break them up ahead of the federal election.

And goldies were also hit hard, as bullion prices retreated below the US2,900/oz level.

Still in the large caps space, Bluescope Steel (ASX:BSL) jumped 10% after upping its dividend despite a huge profit drop of 59% in the half.

A2 Milk (ASX:A2M) surged by 18% after upgrading its revenue forecast and announcing its first dividend.

Meanwhile, Woodside Energy Group (ASX:WDS) saw its proved reserves shrink, reporting a drop in oil and gas reserves from the previous year. WDS’s shares slipped 3%.

ASX SMALL CAP WINNERS

Here are the best performing ASX small cap stocks for February 17 [intraday]:

| Security | Description | Last | % | Volume | MktCap |

|---|---|---|---|---|---|

| EVR | Ev Resources Ltd | 0.006 | 100% | 16,785,094 | $5,797,510 |

| AS2 | Askari Metals | 0.016 | 52% | 40,048,911 | $2,795,420 |

| AOK | Australian Oil. | 0.003 | 50% | 199,506 | $2,003,566 |

| TX3 | Trinex Minerals Ltd | 0.002 | 50% | 1,000,000 | $1,878,652 |

| E79 | E79Goldmineslimited | 0.048 | 45% | 17,625,427 | $3,371,367 |

| MAT | Matsa Resources | 0.065 | 38% | 12,677,105 | $34,432,229 |

| MMR | Mec Resources | 0.004 | 33% | 369,923 | $5,549,298 |

| RGL | Riversgold | 0.004 | 33% | 14,502,272 | $5,051,138 |

| RNX | Renegade Exploration | 0.008 | 33% | 5,655,795 | $7,704,021 |

| RCR | Rincon | 0.017 | 31% | 7,945,218 | $3,803,312 |

| SLM | Solismineralsltd | 0.082 | 30% | 402,460 | $4,850,927 |

| GMN | Gold Mountain Ltd | 0.003 | 25% | 87,234 | $9,158,446 |

| C29 | C29Metalslimited | 0.058 | 23% | 136,725 | $8,186,847 |

| M2M | Mtmalcolmminesnl | 0.018 | 20% | 134,198 | $3,397,134 |

| EPM | Eclipse Metals | 0.006 | 20% | 83,333 | $14,299,095 |

| TMK | TMK Energy Limited | 0.003 | 20% | 200,000 | $23,313,913 |

| PV1 | Provaris Energy Ltd | 0.020 | 18% | 50,735 | $11,677,022 |

| CRI | Criticalim | 0.021 | 17% | 9,124,130 | $48,392,075 |

| VMC | Venus Metals Cor Ltd | 0.088 | 16% | 413,344 | $14,905,780 |

| TFL | Tasfoods Ltd | 0.015 | 15% | 260,929 | $5,682,242 |

Eden Innovations (ASX:EDE) has scored a second order from Holcim Ecuador worth about $353,266 for EdenCrete Pz7, set for use across multiple concrete plants. This comes after an initial order back in May 2024, bringing the total from Holcim Ecuador to around $473,666. Holcim, a global cement giant, has been trialling EdenCrete Pz7 in places like the US, UK, Canada, and Ecuador, with ongoing trials in Canada and the UK showing promise.

Chalice Mining (ASX:CHN) said it has made a major breakthrough at Gonneville, producing saleable copper and nickel concentrates without the need for expensive hydrometallurgical processes. This simplifies operations, cuts costs, and reduces risks. The project’s margins are expected to improve significantly with new optimisations, and the Pre-Feasibility Study (PFS) is set for mid-2025.

IperionX (ASX:IPX), a US-based metals producer which specialises in advanced titanium and rare earth materials, has just scored a $74.1 million deal with the US Department of Defence. This partnership is part of a two-phase, two-year project to enhance the US’s industrial base by strengthening the domestic supply of titanium. IperionX said the cash will fund a two-year project to ramp up US titanium production, boosting both national security and economic strength.

Audio tech company Audinate’s (ASX:AD8) 1H25 results came in above market expectations, with moderate growth expected in 2H25. Key highlights include a gross profit of US$16 million (down 29% from 1H24), but a strong gross margin of 82%, thanks to a shift toward higher-margin software. Despite a dip in EBITDA and cash flow, the company said it remains in a solid financial position with $111 million in cash.

Drilling has started at FMR Resources’ (ASX:FMR) Fairfield Copper Project in Canada, focusing on targets at Demoiselle identified in past drilling and a recent airborne EM survey. Previous drilling at Demoiselle hit impressive intersections, including 8.1m at 0.9% Cu & 7 g/t Ag. The 1,500m RC drill program is expected to wrap up in about a month, with results to follow shortly.

ASX SMALL CAP LOSERS

Here are the worst performing ASX small cap stocks for February 17 [intraday]:

| Code | Name | Price | % Change | Volume | Market Cap |

|---|---|---|---|---|---|

| FBR | FBR Ltd | 0.0225 | -39% | 96,656,781 | $187,214,774 |

| ASR | Asra Minerals Ltd | 0.002 | -33% | 515 | $6,937,890 |

| MOM | Moab Minerals Ltd | 0.0015 | -25% | 92,504 | $3,133,999 |

| MRQ | MRG Metals Limited | 0.003 | -25% | 714,245 | $10,906,075 |

| RDN | Raiden Resources Ltd | 0.006 | -25% | 17,972,852 | $27,607,132 |

| SFG | Seafarms Group Ltd | 0.0015 | -25% | 164,569 | $9,673,198 |

| WR1 | Winsome Resources | 0.325 | -24% | 2,680,973 | $94,301,411 |

| MSG | Mcs Services Limited | 0.004 | -20% | 220,000 | $990,498 |

| PRM | Prominence Energy | 0.004 | -20% | 519,300 | $1,945,882 |

| RLG | Roolife Group Ltd | 0.004 | -20% | 887,500 | $7,105,156 |

| TMX | Terrain Minerals | 0.004 | -20% | 1,161,236 | $10,017,783 |

| FRS | Forrestaniaresources | 0.021 | -19% | 3,340,651 | $6,343,050 |

| BEN | Bendigo and Adelaide | 11.09 | -17% | 4,473,154 | $7,622,211,993 |

| SRJ | SRJ Technologies | 0.03 | -17% | 845,761 | $21,786,918 |

| CDT | Castle Minerals | 0.0025 | -17% | 18,279,881 | $5,690,442 |

| ERA | Energy Resources | 0.0025 | -17% | 1,587,024 | $1,216,188,722 |

| AVE | Avecho Biotech Ltd | 0.006 | -14% | 8,963,296 | $22,185,079 |

| HLX | Helix Resources | 0.003 | -14% | 75,352 | $11,774,678 |

| MGU | Magnum Mining & Exp | 0.006 | -14% | 739,924 | $5,665,530 |

| ODE | Odessa Minerals Ltd | 0.006 | -14% | 305,406 | $11,196,728 |

| OVT | Ovanti Limited | 0.013 | -13% | 110,356,214 | $34,973,218 |

| SRK | Strike Resources | 0.026 | -13% | 38,862 | $8,512,500 |

| BLZ | Blaze Minerals Ltd | 0.0035 | -13% | 775,000 | $6,267,791 |

| FFF | Forbidden Foods | 0.007 | -13% | 3,442,857 | $4,577,788 |

| HHR | Hartshead Resources | 0.007 | -13% | 500,000 | $22,469,457 |

IN CASE YOU MISSED IT

Northern Territory gold explorer Prodigy Gold (ASX:PRX) has outlined to the market today its plans for the 2025 field season. Notably, the company will drill at its Hyperion deposit to test the down-dip extension of previously reported mineralisation – which measured at 10m at 15.9g/t gold from 177m.

Other catalysts for the company include surface sampling near Hyperion, metallurgical samples on 2024 drill samples from Hyperion and assessing a potential near-term mining opportunity at the historical Old Pirate mine.

White Cliff Minerals (ASX:WCN) is locked and loaded to drill at its Rae copper project in Nunavut after tapping Northspan Explorations to undertake the work. Northspan holds under its belt more than 40 years of experience drilling in Northern Canada, including at projects near Rae. The maiden campaign at Rae will burrow roughly 4000m at the Hulk Sedimentary target and Danvers project area.

The market has a new kind of hunger for gold projects in Western Australia’s Pilbara region, and Raiden Resources (ASX:RDN) is hot on the tail of chasing a discovery. The company completed 79 aircore drill holes in November at its Arrow gold project – spanning more than 3000m.

Raiden shared with the market that today several gold in soil trends correlate with elevated gold anomalism from November’s drilling. Follow up work is now being planned by the company’s JV partner, Mallina Co.

Legacy Minerals’ (ASX:LGM) sights are set on an untested copper-gold anomaly at its Glenlogan project in New South Wales following geophysical testing by earn-in partner, S2 Resources (ASX:S2R). LGM management believes the anomaly points towards a potential mineralised porphyry intrusion, which will be the focus of future work.

At Stockhead, we tell it like it is. While Legacy Minerals, Prodigy Gold, White Cliff Minerals and Raiden Resources are Stockhead advertisers, they did not sponsor this article.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.