Lunch Wrap: ASX bounces back toward August highs despite Trump’s China comments

Aussie investors are shrugging off more hostility toward China from Trump, with the market bouncing higher on broad strength. Pic: Getty Images

- Broad strength as ASX shrugs off US-China trade concerns

- Gold reaches new high, approaching US$4200 an ounce

- Defence-related stocks retreat as ceasefire comes into effect in Gaza

Wall Street wasn’t sure which way to jump after US President Trump had another go at China overnight.

This time his beef was with agricultural imports.

With Trump-era tariffs in place, China has slashed its soybean imports from the US, sourcing them from America’s cheaper neighbours to the south.

Trump called the switch an “Economically Hostile Act” and threatened to cut off new elements of US-Chinese trade.

The S&P500 closed 0.2% lower, and gold futures hit yet another all-time high. They’re hovering at around US$4195.75 an ounce at time of writing.

Aussie traders digested Trump’s comments… and promptly ignored them.

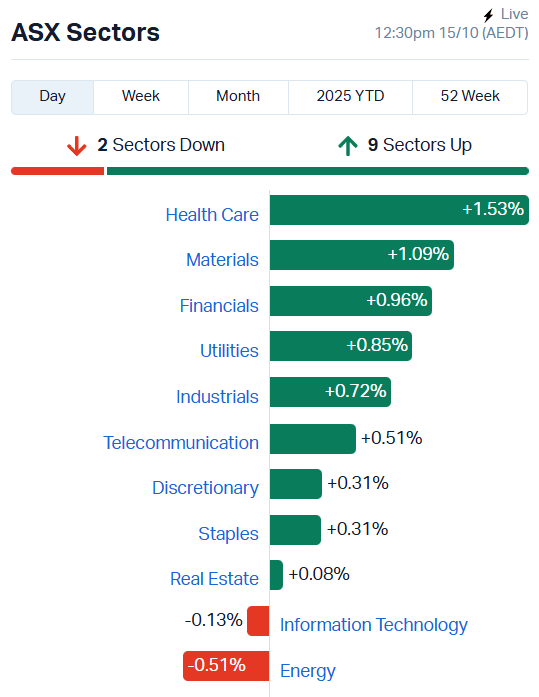

The ASX 200 has bounced 0.78% as of about 12:30 AEDT, showing powerful momentum with nine of 11 sectors higher.

Lithium, gold, copper and mineral processing stocks are still dominating our top gainers at present, but a few other names have snuck into the mix.

Telix Pharma (ASX:TLX) surged 14% intraday after upgrading its revenue guidance and delivering a 53% year-on-year uptick in unaudited group revenue for the September quarter.

Sales of its prostate cancer cell imaging agents Gozellix and Illuccix were on the up, contributing to upgraded FY25 guidance of between US$800m and US$820 million.

Fellow biotech Paragon Care (ASX:PGC), a medical equipment and device manufacturer and distributor, climbed 11.32% on no fresh news.

Lottery specialist Jumbo Interactive (ASX:JIN) jumped 10% after acquiring Dream Car Giveaways, a UK competition platform.

Asset management firm Pacific Current (ASX:PAC) added 8.32% after announcing a share buy back plan. PAC intends to buy back up to 2 million shares, representing about 6.8% of shares on issue.

Defence stocks pull back as global tensions ease

The tentative ceasefire in Gaza has hit the breaks on a strong defence-sector rally, with several ASX-listers retreating after weeks of gains.

Electro Optic Systems (ASX:EOS) shed 11.39%, Elsight (ASX:ELS) 7.05% and Droneshield (ASX:DRO) 5.59%.

With the war in Ukraine still raging and the peace in the Middle East uncertain at best, there’s a good chance those stocks won’t be looking bearish for long.

All three stocks have experienced startling growth over the last six months, adding more than 300% across the board.

They’re not alone – the VanEck Global Defence ETF, a basket of the top global military or defence-related companies, is up 39% over the past six months itself and military spending shows little sign of slowing.

ASX LEADERS

Today’s best performing stocks (including small caps) intraday:

| Security | Description | Last | % | Volume | MktCap |

|---|---|---|---|---|---|

| SKN | Skin Elements Ltd | 0.012 | 300% | 27376291 | $3,225,642 |

| AYM | Australia United Min | 0.01 | 150% | 2205380 | $7,370,310 |

| NVA | Nova Minerals Ltd | 1.6 | 78% | 10621671 | $361,952,025 |

| RAU | Resouro Strategic | 0.33 | 65% | 832473 | $9,724,918 |

| PIL | Peppermint Inv Ltd | 0.003 | 50% | 3987815 | $5,018,042 |

| ADD | Adavale Resource Ltd | 0.058 | 45% | 14210603 | $10,747,398 |

| BIT | Biotron Limited | 0.005 | 43% | 35477394 | $4,645,360 |

| CUF | Cufe Ltd | 0.023 | 35% | 35791063 | $22,891,773 |

| CT1 | Constellation Tech | 0.002 | 33% | 40334 | $2,212,101 |

| MOM | Moab Minerals Ltd | 0.002 | 33% | 17141105 | $2,811,999 |

| PRM | Prominence Energy | 0.004 | 33% | 249215 | $2,667,529 |

| AUA | Audeara | 0.036 | 33% | 3347329 | $4,858,228 |

| AXPDD | AXP Energy Ltd | 0.021 | 31% | 1664055 | $5,347,745 |

| LMS | Litchfield Minerals | 0.74 | 31% | 1066509 | $24,963,711 |

| AAJ | Aruma Resources Ltd | 0.017 | 31% | 28229382 | $4,263,227 |

| ATG | Articore Group Ltd | 0.31 | 29% | 410792 | $70,528,530 |

| ALM | Alma Metals Ltd | 0.009 | 29% | 9201593 | $13,000,660 |

| ADC | Acdc Metals Ltd | 0.115 | 28% | 526103 | $6,743,768 |

| CYC | Cyclopharm Limited | 0.74 | 28% | 113837 | $64,459,373 |

| EMN | Euromanganese | 0.195 | 26% | 487714 | $7,835,551 |

| AMX | Aerometrex Limited | 0.245 | 26% | 138334 | $18,523,175 |

| APL | Associate Global | 0.15 | 25% | 20000 | $6,893,091 |

| BP8 | Bph Global Ltd | 0.0025 | 25% | 1506000 | $2,599,469 |

| CR9 | Corellares | 0.005 | 25% | 1974378 | $4,030,279 |

| CTN | Catalina Resources | 0.005 | 25% | 2348009 | $9,704,076 |

In the news…

Skin Elements (ASX:SKN) has secured binding commitments to raise $2.5 million in a two-tranche placement. The funds from the placement will go to its development program for its SE Formula biotechnology.

SKN is developing a plant-based portfolio of formulations including hospital-grade disinfectants, natural and organic sunscreen, skincare products and the Elizabeth Jane Natural Cosmetics brand.

Biotron (ASX:BIT) is also set to raise $2.5 million in a placement, to support the acquisition of Sedarex, which holds global patents for SedRx, a safer, next-generation general anaesthetic.

Management says it’s a late-stage, largely de-risked clinical asset with additional upside in new indications, enjoying FDA backing for a streamlined approval process (505(b)(2) pathway) and potential EMA abridged approval.

Capital raises are flying thick and fast today. CuFe (ASX:CUF) is also hitting the placement drum, targeting $5.4 million at a 9% premium to its last 5-day VWAP.

The strategic placement includes only 4 participants led by Critical Minerals and Strategic Defence Department sector focused investor Mr. Mathew August. The funding will be channelled to feasibility and exploration at the flagship Tennant Creek copper-gold project.

Audeara (ASX:AUA) has locked in an initial 1,000-piece order for its hearing aid technology licence keys from Eastech (Huizhou), a wholly owned subsidiary of Eastech Holding Limited.

The milestone is another step forward in AUA’s global expansion strategy, coming off the back of a distribution agreement that opens pathways to the Japanese market inked yesterday.

ASX LAGGARDS

Today’s worst performing stocks (including small caps) intraday:

| Code | Name | Price | % Change | Volume | Market Cap |

|---|---|---|---|---|---|

| BMO | Bastion Minerals | 0.001 | -50% | 631347 | $4,445,190 |

| PLCR | Premier1 Lithium - Rights | 0.001 | -50% | 1221719 | $736,121 |

| HAL | Halo Technologies | 0.04 | -32% | 383749 | $17,224,433 |

| NTU | Northern Min Ltd | 0.054 | -24% | 1.13E+08 | $593,358,063 |

| SLM | Solismineralsltd | 0.06 | -21% | 4202948 | $10,722,094 |

| OM1 | Omnia Metals Group | 0.019 | -21% | 724021 | $5,210,201 |

| OEL | Otto Energy Limited | 0.004 | -20% | 3144177 | $23,975,049 |

| 29M | 29Metalslimited | 0.4325 | -18% | 6900155 | $726,808,311 |

| SFX | Sheffield Res Ltd | 0.135 | -18% | 1723795 | $65,262,005 |

| ASM | Ausstratmaterials | 1.635 | -18% | 5363335 | $450,355,021 |

| HMI | Hiremii | 0.05 | -17% | 150000 | $9,064,345 |

| OVT | Ovanti Limited | 0.005 | -17% | 63647743 | $33,094,738 |

| SP8 | Streamplay Studio | 0.01 | -17% | 6506674 | $15,376,374 |

| M2M | Mtmalcolmminesnl | 0.022 | -15% | 533575 | $8,077,683 |

| VML | Vital Metals Limited | 0.33 | -14% | 1731818 | $56,400,222 |

| APC | APC Minerals | 0.014 | -13% | 573613 | $4,686,934 |

| ASP | Aspermont Limited | 0.007 | -13% | 117646 | $21,123,941 |

| TSL | Titanium Sands Ltd | 0.007 | -13% | 975578 | $18,757,978 |

| IG6 | Internationalgraphit | 0.105 | -13% | 1971801 | $23,590,054 |

| SPG | Spc Global Holdings | 0.355 | -11% | 224513 | $77,192,753 |

| C1X | Cosmosexploration | 0.06 | -11% | 173455 | $7,321,496 |

| LCY | Legacy Iron Ore | 0.008 | -11% | 62500 | $87,858,383 |

| PPY | Papyrus Australia | 0.008 | -11% | 3239840 | $5,425,936 |

| RNX | Renegade Exploration | 0.008 | -11% | 3478805 | $18,468,271 |

| ARU | Arafura Rare Earths | 0.3975 | -11% | 35674794 | $1,307,020,720 |

IN CASE YOU MISSED IT

Pinnacle Minerals (ASX:PIM) has option to acquire eight US projects including six that surround Perpetua Resources’ highly prospective Stibnite project in Idaho.

Nimy Resources (ASX:NIM) has initiated extensive surface geochemical sampling at the Mons critical minerals project in WA.

Patronus Resources (ASX:PTN) has demonstrated the scale potential of the Thunderball deposit in the Pine Creek project with high-grade uranium intersections.

Surging investor demand has seen Flynn Gold (ASX:FG1) increase its capital raise to $5m as it looks to accelerate exploration across its Tasmanian gold, silver and critical metals projects.

Waratah Minerals’ (ASX:WTM) drilling has identified high grade gold 150m below previous drilling at the Spur Zone in NSW.

Everest Metals (ASX:EMC) has secured strategic backing for its Mt Edon project, signing an MoU with Arlington Innovation Partners in the US.

LAST ORDERS

Buxton Resources (ASX:BUX) has promoted CEO Martin Moloney to the role of managing director, effective immediately. The company says his promotion reflects his leadership, technical expertise and commitment to driving BUX’s strategic growth initiatives.

St George Mining (ASX:SGQ) has hit a very wide interval of rare earth and niobium mineralisation outside the current JORC resource boundary at the Araxa project.

SGQ hit an interval of 98.4m at 3.07% total rare earth oxides and 0.43% niobium from surface, which contained 10.4m at 5.48% TREO and 0.48% niobium and 12m at 4.04% TREO.

Hillgrove Resources (ASX:HGO) has produced first ore from its Nugent deposit ahead of schedule. The milestone marks a key transition from development to production at the Kanmantoo underground mine.

HGO expects to produce 1.7 to 1.8 million tonnes of copper per year by the first half of 2026.

At Stockhead, we tell it like it is. While Audeara, Cufe, Buxton Resources, St George Mining and Hillgrove Resources are Stockhead advertisers, they did not sponsor this article.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.