Lunch Wrap: ASX 200 sits pretty at record 8,800, as bourse makes a blunder

ASX sits pretty at lunchtime Wednesday. Picture via Getty Images

- ASX touches new record as gold glows

- TPG Telecom plunges $440m after name mix-up

- Justin Langer to quit MinRes

The ASX was sitting pretty by Wednesday lunchtime in the east, up a solid 0.5% and punching through the 8,800 mark for the first time ever.

Gold miners in particular are loving life as bullion edges closer to US$3,400 an ounce, with punters increasingly betting on a Fed rate cut next month.

On the real estate side, the interest-rate-sensitive sector is also back in fashion as bond yields soften.

Even the comms sector joined the rally this morning, helped along by a red-hot 7% leap from REA Group (ASX:REA), which handed down a record $1.38 dividend and some juicy earnings growth.

Across the ditch, however, the Kiwis are getting twitchy.

New Zealand’s unemployment rate crept up to 5%, the highest in nearly five years. Jobs dropped 0.1%, and the economy’s looking a bit wobbly.

The NZD oddly edged higher after the data, but markets reckon the RBNZ might soon have to throw in the towel and cut rates.

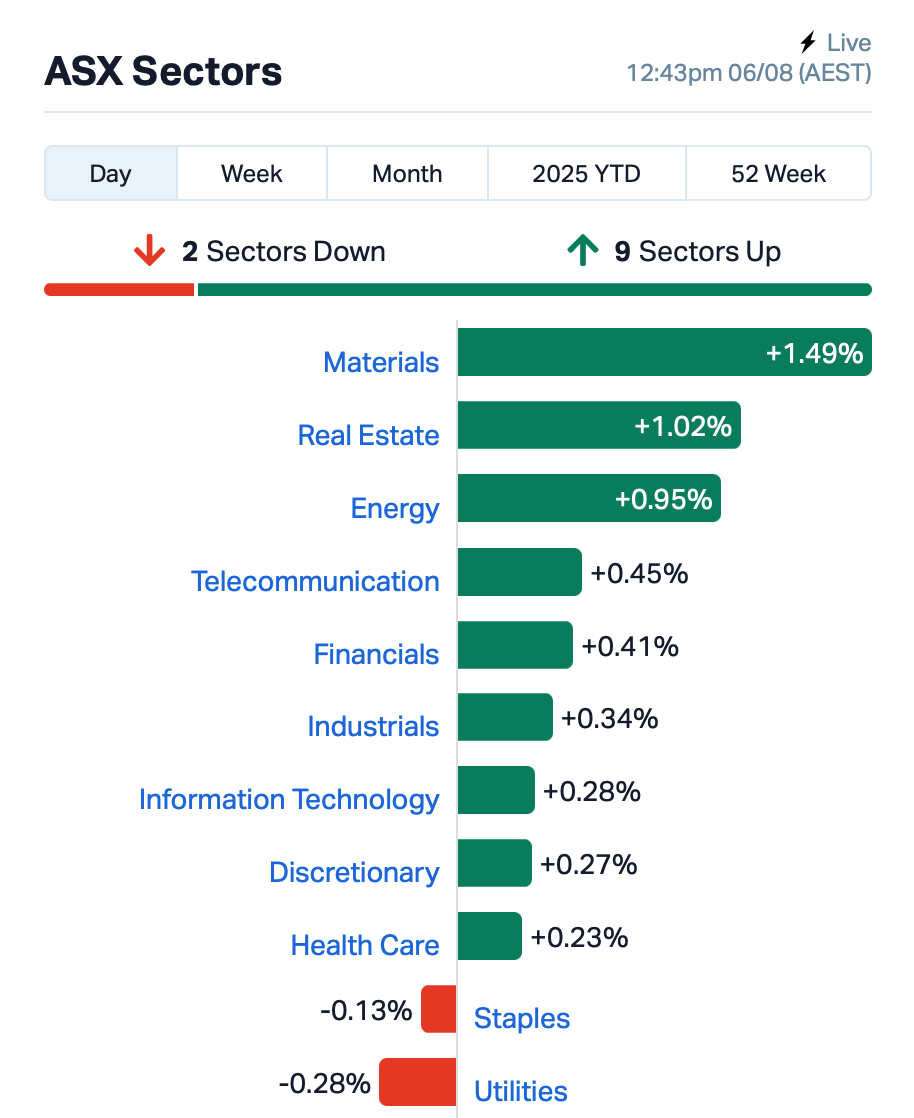

Back home, this is where things stood at about 12:40pm AEST:

Now, onto the real headline for the morning: the ASX (ASX:ASX).

TPG Telecom (ASX:TPG)’s shares tanked as much as 4% after a massive blunder saw it mistakenly tied by the ASX to a $651 million takeover deal meant for a completely different TPG – the unlisted private equity mob, TPG Capital.

ASX had to issue a mea culpa, halt trading, and now plans to cancel every pre-market trade made before the 10:15am freeze.

That’s $437 million in market cap wiped off in a blink, all because someone couldn’t tell their TPGs apart.

Meanwhile, the actual target of the takeover, Infomedia (ASX:IFM), went bananas, up nearly 40% in the first hour of trade.

News Corp (ASX:NWS) also put in a solid showing, up 7% after reporting $13.1 billion in revenue for FY25 and a 14% jump in EBITDA.

And finally, former star Test cricket opener Justin Langer has stepped down from the board of Mineral Resources (ASX:MIN).

Langer said his growing media and coaching duties overseas mean he can’t give the role the time it deserves. MIN’s shares were up 2%.

ASX LEADERS

Today’s best performing stocks (including small caps) intraday:

| Security | Description | Last | % | Volume | MktCap |

|---|---|---|---|---|---|

| RLG | Roolife Group Ltd | 0.010 | 150% | 118,345,023 | $6,371,125 |

| RHY | Rhythm Biosciences | 0.180 | 89% | 3,611,935 | $26,987,659 |

| ROG | Red Sky Energy. | 0.004 | 33% | 135,896 | $16,266,682 |

| LIN | Lindian Resources | 0.125 | 33% | 24,960,593 | $111,241,690 |

| PR2 | Piche Resources | 0.130 | 30% | 211,414 | $8,348,930 |

| IFM | Infomedia Ltd | 1.683 | 27% | 9,030,269 | $499,513,991 |

| WTM | Waratah Minerals Ltd | 0.580 | 26% | 4,705,983 | $107,415,642 |

| AVE | Avecho Biotech Ltd | 0.005 | 25% | 826,442 | $12,693,855 |

| BMG | BMG Resources Ltd | 0.010 | 25% | 14,881,111 | $6,755,177 |

| ERA | Energy Resources | 0.003 | 25% | 483,246 | $810,792,482 |

| TKL | Traka Resources | 0.003 | 25% | 9,357,133 | $4,251,580 |

| TMX | Terrain Minerals | 0.003 | 25% | 500,000 | $5,063,629 |

| WBE | Whitebark Energy | 0.005 | 25% | 100,200 | $2,802,231 |

| SHO | Sportshero Ltd | 0.033 | 22% | 2,159,848 | $21,686,238 |

| LMS | Litchfield Minerals | 0.120 | 20% | 15,390 | $2,904,606 |

| AJX | Alexium Int Group | 0.006 | 20% | 408,907 | $7,932,143 |

| ALM | Alma Metals Ltd | 0.006 | 20% | 100,000 | $9,253,686 |

| AN1 | Anagenics Limited | 0.006 | 20% | 209,032 | $2,481,602 |

| CZN | Corazon Ltd | 0.003 | 20% | 72,094,438 | $2,961,431 |

| TEG | Triangle Energy Ltd | 0.003 | 20% | 2,662,427 | $5,223,085 |

| H2G | Greenhy2 Limited | 0.019 | 19% | 792,432 | $11,006,589 |

| ATT | Altitude Minerals | 0.020 | 18% | 339,853 | $3,169,831 |

| ORD | Ordell Minerals Ltd | 0.400 | 18% | 427,208 | $18,904,408 |

RooLife Group (ASX:RLG) has signed a two-year supply deal with Eternal Asia, one of China’s biggest distribution giants, covering over 1 million retail outlets and servicing 100+ Fortune 500 firms. Under the deal, RLG will source and supply health, wellness, and food and beverage products into China’s massive general trade market, with potential annual orders worth up to CNY 500 million (~$110m), subject to confirmed purchase volumes.

Lindian Resources (ASX:LIN) has locked in a 15-year strategic offtake deal with Iluka Resources (ASX:ILU), along with a binding US$20 million construction loan to support its Kangankunde rare earths project. Under the agreement, Lindian will supply 6,000 tonnes of rare earth monazite concentrate per year to feed Iluka’s Eneabba refinery in WA, with pricing linked to NdPr oxide sales and downside protection via a floor price. Iluka also gets first dibs on any Phase 2 expansion, potentially adding another 375,000 tonnes over 15 years, if it agrees to fund half the capital cost.

BMG Resources (ASX:BMG) has raised $600,000 via a share placement at 0.8 cents, with strong backing from institutional and sophisticated investors. It will use the cash to push ahead at its 100%-owned WA gold projects, with a scoping study underway at Abercromby (home to a 518,000oz resource including 208,000oz at 4.09g/t) and fresh drilling at Bullabulling, where assays are due this month.

And, Nanosonics (ASX:NAN) has scored US FDA clearance to launch its next-gen disinfection tech – trophon3 and the trophon2 Plus upgrade – across the US. NAN said it expected to unlock major growth, with around 30,000 new device opportunities in the US, plus global upgrade potential across 10,000 first-gen and 20,000 trophon2 units.

ASX LAGGARDS

Today’s worst performing stocks (including small caps) intraday:

| Code | Name | Price | % Change | Volume | Market Cap |

|---|---|---|---|---|---|

| JAV | Javelin Minerals Ltd | 0.002 | -33% | 861,666 | $18,756,675 |

| MEL | Metgasco Ltd | 0.002 | -33% | 23,170 | $5,511,260 |

| ASE | Astute Metals NL | 0.015 | -32% | 6,375,628 | $13,599,294 |

| AUK | Aumake Limited | 0.003 | -25% | 170,000 | $12,093,435 |

| CR9 | Corellares | 0.003 | -25% | 61,335 | $4,029,079 |

| CT1 | Constellation Tech | 0.002 | -25% | 33,229 | $2,949,467 |

| RML | Resolution Minerals | 0.060 | -21% | 75,122,211 | $93,921,549 |

| CF1 | Complii Fintech Ltd | 0.020 | -20% | 148,123 | $14,289,450 |

| ARV | Artemis Resources | 0.004 | -20% | 69,177 | $14,328,361 |

| DDT | DataDot Technology | 0.004 | -20% | 1 | $6,054,764 |

| TMK | TMK Energy Limited | 0.002 | -20% | 31,668 | $25,555,958 |

| EVR | Ev Resources Ltd | 0.009 | -18% | 323,866 | $24,502,537 |

| WCN | White Cliff Min Ltd | 0.023 | -18% | 25,969,976 | $68,274,812 |

| ATX | Amplia Therapeutics | 0.200 | -17% | 21,190,746 | $116,754,486 |

| CUL | Cullen Resources | 0.005 | -17% | 100,000 | $4,160,411 |

| DGR | DGR Global Ltd | 0.010 | -17% | 3,110,615 | $12,524,352 |

| DTM | Dart Mining NL | 0.003 | -17% | 365 | $3,594,167 |

| PL3 | Patagonia Lithium | 0.034 | -15% | 515 | $4,776,414 |

| CR3 | Core Energy Minerals | 0.012 | -14% | 375,000 | $5,601,544 |

| LCL | LCL Resources Ltd | 0.006 | -14% | 1,000,000 | $8,394,800 |

| LU7 | Lithium Universe Ltd | 0.006 | -14% | 232,830 | $6,551,857 |

| AUA | Audeara | 0.019 | -14% | 163,677 | $3,958,556 |

IN CASE YOU MISSED IT

Hearing health company Audeara (ASX: AUA) has partnered with Ear Science Institute Australia to advance bone-conduction hearing solutions for in-need Australian communities.

Norwest Minerals (ASX:NWM) is targeting two distinct mineralised zones with a SkyTEM survey at the Marymia East project as it hunts for gold and base metals.

The US Centers for Medicare & Medicaid Services has approved EBR Systems’ (ASX:EBR) WiSE CRT System for Medicare inpatients under a new technology add-on payment.

European Lithium (ASX:EUR) has assayed 2010 drill holes at the Tanbreez project in Greenland, returning high-grade gallium and rare earth results.

White Cliff Minerals (ASX:WCN) continues to build drilling momentum at its Danvers copper project in Canada, more than doubling strike length.

LAST ORDERS

Besra Gold’s (ASX:BEZ) newly appointed board of directors have made a collective site visit to the flagship Bau gold project in Sarawak, Malaysia, marking the first time the full board has made the trip.

The directors took the opportunity to review all aspects of the company’s business, meeting with a range of stakeholders including site-based employees, government representatives and BEZ’s major shareholder.

Argenica Therapeutics (ASX:AGN) has tapped Sharon Hanegraaf as as vice president of regulatory affairs, positioning her to manage all related activities, including investigational new drug applications to the Food and Drug Administration.

The appointment comes ahead of AGN’s plans to begin later-stage clinical trials in acute ischaemic stroke.

At Stockhead, we tell it like it is. While Argenica Therapeutics and Besra Gold are Stockhead advertisers, they did not sponsor this article.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.